Good morning! I'm afraid there are several profit warnings sprinkled among today's updates.

Today's Agenda is complete!

Spreadsheet accompanying this report: link.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Severn Trent (LON:SVT) (£9.1bn | SR61) | On track to meet environmental and operational targets. Financial performance in line with expectations. Expecting to deliver towards the top end of capital investment guidance range of £1.7 billion - £1.9 billion. | ||

Barratt Redrow (LON:BTRW) (£5.5bn | SR46) | A resilient performance in a subdued market. Adjusted operating profit, before “purchase price allocation” adjustments, at £210.2m down 0.3%. Net cash £174m. Full year adjusted profit before tax (very particularly defined) is expected to be within the current range of consensus estimates. | ||

Fermi (LON:FRMI) (£4.2bn | SR0) | $500 million financing commitment from MUFG Bank. Further strengthens Fermi’s ability to deliver the first 2.3 of 11 gigawatts of long-duration, reliable power at scale. | ||

Pan African Resources (LON:PAF) (£2.8bn | SR66) | EPS is expected to be between US 7.18 cents per share and US 7.43 cents per share, compared to EPS of US 2.50 cents per share for the six-month period ended 31 December 2024. 61.6% increase in the gold price received, 51.5% increase in gold produced. Group production is expected to increase further in H2. | ||

Renishaw (LON:RSW) (£2.8bn | SR72) | “We enter H2 with momentum and we expect to achieve strong revenue and profit growth in the remainder of the year." Likely to see a normal H2 weighting. FY26 guidance: revenue £740m to £780m, adjusted profit before tax £132m to £157m. | ||

Edinburgh Worldwide Investment Trust (LON:EWI) (£816m | SR N/A) | Recommends shareholders take no action. "For the third time, Saba is seeking to replace the entire independent Board with its own nominees in order to take control of the Company. Saba's basis for its latest attack has not changed since shareholders rejected its resolutions on 20 January 2026, just three weeks ago.” | ||

PZ Cussons (LON:PZC) (£344m | SR77) | LfL revenue +9.5%. Cost savings on track. Trading to the end of January has been in line with expectations. FY26 Outlook: adjusted operating profit: £53-57 million (£50-55 million previously). | ||

RWS Holdings (LON:RWS) (£292m | SR80) | "Trading in the early months of FY26 has been encouraging. We have returned to organic constant currency growth… for FY26 we expect to deliver in line with our existing guidance.” | GREEN = (Roland - I hold) [no section below] Today’s update is brief but positive, confirming a return to organic revenue growth driven by “increasing adoption” of AI-related services. Full-year expectations are unchanged today. | |

Enquest (LON:ENQ) (£257m | SR68) | Enquest’s Malaysia affiliate has received a Letter of Award as a Partner in the Cendramas Production Sharing Contract. | ||

MJ GLEESON (LON:GLE) (£231m | SR57) | “A robust performance in a subdued market environment.” Outlook: “...whilst current market expectations remain achievable, a strong Spring selling season remains fundamental to our assumptions in delivering on those expectations and we need to see the recovery gain further momentum.” | AMBER = (Roland) Today’s commentary stops short of a downgrade to guidance, but my sums suggest that to meet forecasts, the H2 weighting to profits needs to increase from 84% in FY25 to 92% in FY26. This isn’t necessarily as improbable as it might sound, due to the expected contribution from Land transactions currently in progress. In Homes, I think it’s fair to expect an improvement in volumes in H2. My main concern is that the cost pressures described in today’s results are mostly unit costs that won’t ease with higher volumes. That could put pressure on full-year margins, leading to a result below current guidance even if sales targets are hit. On balance I do expect FY26 profits to be slightly lower than current forecasts. However, with the stock now trading at a 30% discount to NAV, I think there’s enough value on offer here to justify leaving our neutral view unchanged at this time. | |

Tufton Assets (LON:SHPP) (£223m | SR94) | Agreement to acquire two high-specification, eco-design, Japanese-built Handysize Bulkers for $33m en-bloc. Expected net yield of 12% or more. | ||

VP (LON:VP.) (£222m | SR68) | “Current market headwinds, particularly in construction and water… have resulted in a disappointingly muted January… Therefore Vp now expects to report a profit for the current financial year within the range of £26-29m.” Expectations at the interim results: £37.3m. | BLACK (AMBER ↓) (Graham) | |

Seeing Machines (LON:SEE) (£206m | SR24) | Cars on the road with Seeing Machines’ tech +67% year-on-year. Quarterly production +13%. CEO: “We still expect to achieve positive adjusted EBITDA in Q3 and for the second half of FY2026 (excluding the impact of the recently announced up-front royalty payment)." | ||

KEFI Gold and Copper (LON:KEFI) (£160m | SR35) | Subsidiary Tulu Kapi Gold Mines signs a US$20 million equity-ranking-royalty with Chancery Royalty Limited. A “key final part” of the US$340m financing package for the Tulu Kapi Gold Project. “As a separate and optional matter, consideration continues to be given to the raising of capital in excess of the Project development requirements in the form of Ethiopian BIRR-denominated non-convertible, redeemable preference shares.” | ||

Quartix Technologies (LON:QTX) (£143m | SR80) | Revised accounting policy is expected to result in a moderate increase in reported profit. FY December 2025 results expected to be released by the end of March. | ||

accesso Technology (LON:ACSO) (£105m | SR75) | Proposing to return up to £14.5m to Shareholders by a Tender Offer at £3 per share. 8.7% premium to yesterday’s close, 15.4% premium price prior to the recent trading update. | ||

Severfield (LON:SFR) (£89m | SR50) | Appoints new CFO from next week. Most recently, he was Interim Chief Financial Officer at privately-owned construction and engineering group, ISG. | ||

IG Design (LON:IGR) (£47m | SR37) | For FY26, the Board now expects to be “at the upper end” of previous guidance with revenue of c.$280-285m and y/e net cash of c.$55-60m. This is ahead of current market consensus for revenue $275m, adj op profit $9.7m, net cash $42m. FY27 expectations unchanged. | ||

Ultimate Products (LON:ULTP) (£46m | SR94) | H1 revenue -6% to £74.5m, adj EBITDA to be “around £5.0m”. “Current trading remains in line with market expectations”. H1 results on 24 Mar 26. | ||

Gelion (LON:GELN) (£42m | SR5) | Supplied samples to TDK in Japan, initial pouch cells have been successfully manufactured by TDK. Active discussions progressing with other potential partners. ARENA funding (Australian govt) increased from c.£4.8m to c.£5.3m. Interim results due on 2 Mar 26. | ||

Manx Financial (LON:MFX) (£39m | SR51) | Conister Loan book +2.1%, deposits +7.3% in quarter. Loan book +11.6% for the full year, with deposits +11.7%. Entry into consumer overdraft market now approved, scheduled for Q2 2026. Results of FCA’s DCA consultation are due in March 2026, management expects an additional provision will be required. | ||

Gattaca (LON:GATC) (£38m | SR97) | H1 trading ahead of expectations. H1 26 group net fee income to be £21.2m (H1 25: £18.9m). FY26 adj pre-tax profit expected to be £4.5m (+12% vs previous PanLib forecast of £4.0m). | ||

Tpximpact Holdings (LON:TPX) (£25m | SR97) | £22m, 2yr “digital transformation award” under Digital Outcomes 6 framework. Will deliver services across Maternity, Neonatal and School-Age Vaccinations. Broker Cavendish: no change to forecasts, “supports our existing revenue expectations for FY27 and FY28”. | ||

Renalytix (LON:RENX) (£25m | SR5) | H1 revenue of $1.6m and FY26 revenue guidance of $4m. Three new integrations in H1, but “slower than expected” ramp-up of revenue due to longer lead times and complexities with larger healthcare system implementations. (Stocko consensus shows FY26 revenue exps of $19.6m previously, not able to corroborate this w/ broker forecasts). | BLACK | |

iomart (LON:IOM) (£22m | SR55) | PW: trading softened in Dec/Jan, with an increase in customer churn in certain high margin areas. Board now expects revenue “broadly in line” and EBITDA “just below” current market expectations. (Consensus: revenue £157.6m-£159.1m, adj EBITDA £27.7m-£28.5m). CFO resigned to pursue a new opportunity. Will leave in June 2026. | BLACK | |

Eco Buildings (LON:ECOB) (£20m | SR14) | Signed MOU with experienced local construction and financing group (MCA) “to address major modular housing demand in Indonesia”. MCA will invest $5m for a 49% equity stake. | ||

RTC (LON:RTC) (£13m | SR97) | Subsidiary Ganymede has won two new/extended contracts with UK infrastructure/utility customers: Southern Renewals Enterprise (8yr labour contract) and E.ON Smart Meter Engineers Contract Extension (12 months). These are framework contracts with no guaranteed volume or value. | ||

Fulcrum Metals (LON:FMET) (£12m | SR12) | Begun pilot study at Kirkland Lake Ontario, working with partners to study the best way to move from laboratory tests to a pilot-scale operation. Expect study to be completed in c.10 weeks. | ||

Jangada Mines (LON:JAN) (£11m | SR26) | Raising £1.2m before expenses at 1.4p per share (12.5% discount to 10/2 close of 1.6p) to help fund the Molly and Paranaita Gold Projects in Brazil. Also issuing one warrant for each new share, exercisable at 2.25p in two years’ time. | ||

Zinc Media (LON:ZIN) (£11m | SR32) | 2025 revenue up 27% to £41m, adj EBITDA +27% to £1.9m. Positive start to FY26, with £21m secured or “highly advanced in the pipeline” following a recent £3m win. Trading in line with expectations, on track to deliver medium-term target of £5m EBITDA. | ||

Nexus Infrastructure (LON:NEXS) (£11m | SR53) | Results for y/e 30 Sept 25 were previously scheduled for 12 Feb 26. They are now due “no later than the end of February” to allow additional time for auditing. |

Graham's Section

VP (LON:VP.).

Down 11% to 493p (£201m) - Trading Update - Graham - BLACK (AMBER ↓)

Vp plc, the specialist equipment rental business, today provides a trading update for the ten months ended 31 January 2026.

This trading update strikes a reassuring tone without sugarcoating the bad news too much.

The Board remains confident that the Group, aided by its robust balance sheet and transformation of Brandon Hire Station, and underpinned by a focused strategy targeted at core sectors, is well positioned to take advantage of future market opportunities. However, current market headwinds, particularly in construction and water, where we have seen a slower than expected impact from AMP8, have resulted in a disappointingly muted January 'return to work' and a correspondingly slow fourth quarter ramp-up in activity volumes. Therefore Vp now expects to report a profit* for the current financial year within the range of £26-29m.

AMP is the water industry’s “asset management plan”, with the current plan from Ofwat running from 2025 to 2030.

With capital spending being dictated by Ofwat, I would have expected a high degree of predictability, but VP has been caught off guard in the short term. They now expect “meaningful increases in water revenues in FY27 rather than the current financial year”.

The good news is that FY27 starts at the end of March 2026, so perhaps we are only talking about a delay of a few months until spending ramps up as expected?

Other relevant industries:

Energy transmission: growth and strong demand continuing

Housebuilding: overall activity levels subdued

CEO comment:

Vp remains committed to its strategy of offering a diversified range of specialist equipment and expertise to clients across a portfolio of critical market sectors. While this diversity and breadth gives our business market-leading resilience and opportunity, it is not immune to general trading conditions in construction and delays to major infrastructure programme spend in key sectors

Estimates: I appreciate VP including their new profit forecast for FY26 in the RNS (adjusted PBT of £26-29m).

Going back to the interim results, published in November, I see that they were still expecting an in-line result of £37.3m.

That’s a very significant miss, and the fact that it has come so late in the financial year increases its seriousness - it implies a lack of visibility and/or a high degree of reliance on the timing of certain projects.

At the midpoint, it’s a miss against expectations of 26%.

Graham’s view

I should note in passing that the former CEO announced her intention to step down in September, and she was replaced only last week. I wonder what the connection might be between the CEO change and the profit warning: might the leadership transition have resulted in the company missing out on some work? Might the former CEO have had a suspicion that it would be difficult to hit forecasts?

That’s purely speculation, but it’s not unusual for management changes and profit warnings to go hand-in-hand. That might not be the case here, but it’s an interesting coincidence. The new CEO officially started only nine days ago!

As for the merits of this stock, we’ve generally considered VP to be a pretty good business, with some caveats. See coverage by Mark here and by Roland here.

Financial net debt was £156m at the interim results, which is of course a substantial figure, but it’s standard in the equipment rental industry. Rather like banking, it’s not possible to earn an acceptable ROCE without carrying substantial debts.

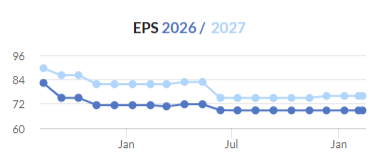

The problem with VP is pretty basic: a gradual downward trend in earnings estimates.

A slow start to Network Rail spending was previously blamed, and a subdued construction sector is understandable. But now we have a major profit warning from unexpectedly slow water spending. Every sector seems capable of disappointing - no sector is "safe".

But as the company is still profitable (depending on the heaviness of adjustments), and is arguably somewhat “cheap” (£200m market cap against adj. PBT of £26m+), with prospects for water spending to pick up in a few short months, I’m not inclined to take a very negative stance on it today. We were AMBER/GREEN before and I’ll just go down to AMBER for now. I think that does a good job of balancing the vulnerability of earnings estimates against its apparent cheapness.

Roland's Section

MJ GLEESON (LON:GLE)

Down 10% at 357p (£208m) - Results for Title - Roland - AMBER =

Gleeson’s focus on building affordable housing should be an asset in a market that’s being constrained by affordability.

Graham upgraded our view to neutral following January’s in line update. He noted that Gleeson warned on profits twice last year but could be cheap if the business was able to hit FY27 and FY28 earnings forecasts.

Unfortunately, the situation isn’t quite that simple. Today’s half-year results flag up a subdued performance in Q2 and warn that “a strong Spring selling season remains fundamental” to the company’s ability to meet full-year forecasts. A further update is promised in April.

The market has understandably interpreted today’s commentary as the precursor to a profit warning.

Here are the key points from today’s H1 results, which cover the six months to 31 December 2025:

Revenue up 9.6% to £173.1m

Operating profit down 17.6% to £4.2m

Pre-tax profit down 52.8% to £1.7m

Adjusted EPS down 43.8p to 2.7p

Interim dividend held at 4.0p

Return on Capital Employed: 7.6% (H1 25: 8.0%)

Stepping through the income statement, the first takeaway from these numbers is that profitability fell despite an increase in both selling prices and volumes:

Home sales up 6% to 848

Average selling price up 2.5% to £198,800

Unfortunately, costs rose more quickly than pricing which remains under pressure. Today’s commentary notes several cost headwinds:

Build cost inflation of 2.6%, mainly due to labour rates;

A higher proportion of (lower margin) bulk sales;

Sales incentives “remained elevated at c.4.5%”.

Group overheads also increased, with administrative expenses rising by 14.7% to £26.5m. This was primarily due to higher staff costs.

Together, these factors reflect the fall in operating profit and the reduction in operating margin to 4.1% (H1 25: 5.8%).

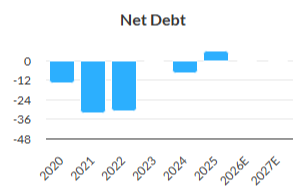

Balance sheet/debt: the much larger fall in pre-tax profit mainly reflects an unfortunate side effect of lower H1 sales – debt levels rose as the company ramped up activity:

We ended the period with net debt of £22.5m (31 December 2024: £18.1m) which reflects the opening of nine new build sites and investment in build activity on established sites ahead of the important Spring selling season.

This is a 24% increase in H1 net debt, but it led to a 47% increase in H1 finance costs, to £2,270k.

One reason for this may be that Gleeson started the comparative period in June 2024 with a sizeable net cash position. In June 2025, net cash was close to zero, so I would speculate that the group may have traded for longer with a net debt position this year.

This level of borrowing doesn’t seem too alarming to me when set against forecast net profit of c.£18m for the current year. But the trend is worsening:

Gleeson shares also continue to trade well below their tangible net asset value. Today’s share price of 356p represents a c.30% discount to TNAV of 522p per share. If profits do start to recover, that could represent significant value.

FY26 outlook

Housebuilders traditionally depend on a strong calendar Q1, so the idea of an H2 weighting isn’t automatically alarming.

Today’s results include operational metrics suggesting performance has already started to improve, albeit sales have remained below the levels seen during the comparable period last year:

We are cautiously encouraged by early signs of a recovery in open market demand. Net reservation rates on open-market sales of 0.55 in the five weeks to 6 February 2026 are up 38% on the 3 months to December 2025 albeit not yet at the levels experienced during the same five-week period last year.

Looking at the order book, there is a marked improvement over the same point one year ago. However, checking back to last year’s FY25 results (June 2025) shows that most of this improvement actually took place in H2 25, not during the H1 just ended:

December 2025: 978 plots

June 2025: 845 plots

December 2024: 597 plots

June 2024: 559 plots

Gleeson Land: so far, I’ve only really talked about the Homes business. However, there is a possible wildcard that could help support FY profits – Glesson’s Land business. This buys land and secures planning, then sells the permissioned land to other developers.

It’s an inherently lumpy business. While Land contributed nearly 25% of group operating profit last year, it was entirely skewed to the second half of the year.

Based on the commentary in today’s results, I think it’s possible that something similar could happen this year:

H1 26: revenue £4.5m, op loss £(0.6)m;

H1 26: three land sale transactions;

Planning secured on five sites expected to sell in FY26

One site represents 50% of total plots forecast to sell in FY26. Completion is dependent on “finalising an agreed position on highways design”.

I have no idea what the likely timescale or uncertainty involved in the highways design issue might be. But it’s clear that a big chunk of expected Land revenue and profit is tied up in a single transaction. This could go either way, but I think it’s fair to suggest that the Land business may yet help Gleeson meet full-year profit forecasts.

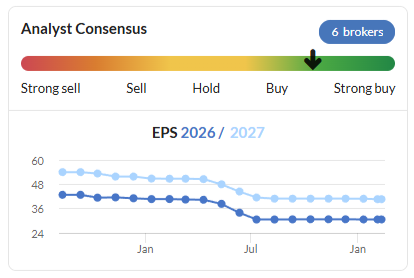

Broker estimates: are forecasts still realistic?

In FY25, Gleeson generated c.84% of adjusted pre-tax profit during the second half of the year.

If the company is to meet current FY26 consensus forecasts for adjusted pre-tax profit of £24.3m, then this H2 weighting will need to increase to c.92%.

Based on the prospect of improved sales and a successful half year for the Land business, I think it’s fair to say that this remains possible.

However, I am not sure how likely it is, for three reasons.

Firstly, there’s always a risk that expected Land transactions could slip into FY27.

Secondly, my impression is that the company’s pricing power remains limited. Today’s H1 results show that Gleeson hasn’t been able to increase prices by enough to offset cost inflation. Many of these cost increases are per unit and won’t ease with higher volumes. For this reason, I suspect margin pressures may persist during the second half of the year, even if volumes do meet expectations.

Finally, higher debt costs could persist into H2 as well, placing additional pressure on pre-tax profits and net earnings.

Broker Cavendish has issued a Flash note on Gleeson today and notes similar concerns on pricing and costs. While FY26 estimates are unchanged today, Cavendish says “we will be reviewing our forecasts shortly”.

Roland’s view

On balance, I think it’s probably prudent to price in a 5%-10% reduction to FY26 profit expectations after today’s results. While the company could still potentially avoid a downgrade, it’s not something I’d want to bet on.

A further concern for me is the weakness in the build-to-rent market, where volumes have slumped over the last couple of years. This is also likely to mean that Gleeson has to price very competitively to continue securing bulk sales.

Consensus forecasts were left unchanged after January’s HY update, but I would not be surprised to see consensus edge lower in the coming weeks:

The key question for me today is whether I need to reverse Graham’s January upgrade and revert to a more neutral view.

While I probably could justify a shift to AMBER/RED, I think there’s probably enough value here to justify remaining neutral.

Gleeson’s balance sheet doesn’t look too stretched to me and the stock’s 30% discount to book value is at a level where I might start to take an interest in a profitable housebuilder. I also think it’s fair to expect a much stronger H2 result, even if it does fall below current expectations.

For these reasons, I’m going to take a chance and leave our view unchanged at AMBER today.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.