Good morning all, today's Agenda is now complete. It's a great day if you're interested in resource and energy stocks, but otherwise it's slim pickings!

All done for today, thanks everyone! Spreadsheet accompanying this report: link.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

BAE Systems (LON:BA.) (£61bn | SR73) | Revenue up 8% to £28.3bn with operating profit up 9% to £2.9bn. Adj EPS +12% to 75.2p, slightly ahead of 74.1p consensus. Record order backlog at £83.6bn. Outlook guidance: 2026 adj EPS +9 to +11%. | AMBER/GREEN = (Roland) These results are strong and appear to be marginally ahead of FY25 consensus estimates. Earnings growth guidance for 2026 has also been tweaked higher, although my impression is that this was already reflected in consensus estimates. Looking at the results, profitability was stable last year, supporting good cash generation. While the valuation is arguably up with events, it is not outlandish given the macro backdrop and strong order book. On balance, I think there’s enough evidence of positive momentum here to justify leaving my view unchanged today. | |

Glencore (LON:GLEN) (£57bn | SR36) | Preliminary Results & Glencore agreement w Gécamines for KCC land access | Revenue +7% to $247.5bn, adj EBIT -14% to $6.0bn. Net debt $11.2bn. (0.83x EBITDA). Reports “illustrative annualised free cash flow” of c.$7.0bn. | |

Pan African Resources (LON:PAF) (£3.0bn | SR67) | Gold production +51.5% to 128,296oz - on track for FY production guidance of 275-292koz. H1 revenue +157.3% to $487m, net profit +211.9% to $147.8m. Interim dividend of 0.55pps. Expects to reach net cash position by end Feb 26. | AMBER = (Roland) These results look to be in line with expectations to me. My simple modelling produces an FY26 profit estimate that’s very close to consensus. I’m encouraged by the initiation of dividends and near-elimination of debt, but I note that capex is expected to rise by c.70% next year. Pan African shares have tripled since my last look at this stock one year ago, but I’m maintaining my neutral view. I explain why below, but in short I think the shares are now a pure play on the gold price, rather than a fundamental investment. | |

PPHE Hotel (LON:PPH) (£862m | SR42) | Sold NY development site for $33.5m. This site was purchased in 2019 but is no longer considered suitable for hotel development due to regulatory changes. Proceeds will be used to repay $8.3m debt, with the balance deployed according to capital allocation strategy. | ||

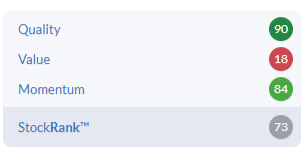

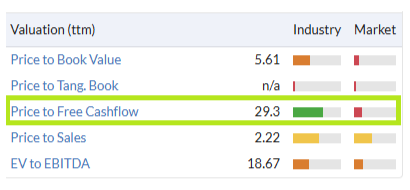

Conduit Holdings (LON:CRE) (£654m | SR59) | GWP +6.9% to $1,243m, comprehensive (net) income -7% to $116.8m. Achieved return on equity of 11.1% in a “high catastrophe year”. Total dividend c.26pps, tangible net asset value 530pps. Outlook: market conditions “adequate” in most lines. | AMBER/GREEN ↑ (Roland) Last year’s net profit was c.40% ahead of (reduced) expectations, after a benign H2 for losses and strong investment returns. Brokers have trimmed forecasts for 2026 and 2027 to reflect softening industry conditions, but if Conduit can continue to generate double-digit returns on equity then I think the stock’s 27% discount to book value could offer an opportunity. The main risk is that it’s too early in the downcycle to back this relatively unproven business. However, I’m going to take a chance on the experienced new leadership team and move our view up by one notch today. | |

Galliford Try Holdings (LON:GFRD) (£568m | SR95) | Building division appointed to £15.4bn Dept for Education framework (CF25). GFRD has secured places on high value lots for projects of >£12bn. This is a six-year framework. | ||

Griffin Mining (LON:GFM) (£562m | SR60) | Assay results reported on 12 Feb were correct, but the high-grade interval previously described as 15.7m@34.6g/t was not correct. See announcement for details. | ||

Amaroq (LON:AMRQ) (£514m | SR23) | This Greenland-focused company will delist from TSX due to low volumes on 19 Mar 26 and plans to move its UK AIM listing to the Main Market during 2026. | ||

Gulf Keystone Petroleum (LON:GKP) (£444m | SR56) | Shares begin trading in Oslo today. Company welcomes c.700 investors who purchased shares in the €1m retail offering. London listing is unchanged. | ||

Anglo Asian Mining (LON:AAZ) (£317m | SR53) | The Company anticipates approximately tripling its copper production in 2026. Gold and silver production is anticipated to increase year-on-year. Costs at all operations to remain competitive. | ||

NextEnergy Solar Fund (LON:NESF) (£290m | SR44) | Nav per share 84.9p (Sep 2025: 88.8p), “primarily driven by a reduction in power price forecasts from third-party consultants”. Including the post period impact of the government's change to inflation indexation, NAV per share would be 82.9p. Strategic review is progressing. | ||

Seeing Machines (LON:SEE) (£206m | SR24) | SP down 27% Revenue for H1 FY2026 to be in the range US$23.4m - US$24.0m (H1 FY2025: US$25.3m). Adjusted EBITDA loss in the range US$13.1m - $13.7m (H1 FY2025: US$17.7m). Cash US$3.4m, with an accelerated lump sum payment of $14.1m received post period end. “The Company continues to trade in line with market expectations… Adjusted EBITDA is expected to be positive in Q3 and the second half of FY2026.” | RED ↓ (Graham) Downgrading this to RED for two main reasons. Firstly, the cash burn and my lack of faith in their ability to conserve their cash. Secondly, the mismatch between official estimates and what seems to be the most plausible outcome over the next six months. They are supposedly at an inflection point, so my negativity could be ill-founded. But I'd prefer to be overly sceptical rather than overly optimistic, given the history here. | |

Keystone Law (LON:KEYS) (£185m | SR74) | FY January 2026 revenue and adjusted PBT to be marginally ahead of current market expectations. “Keystone's lawyers performed strongly across the business, with buoyant trading conditions… underpinned by ongoing client demand delivering an increase of just under 10% on FY 2025 revenue per Principal and an improved financial performance.” | AMBER/GREEN = (Graham) I hold this one in high regard, both for its major tech focus and also for its ability to meet and exceed forecasts. But the valuation is still quite rich, even after softening in recent months, given that it's a professional services business. So I continue to refrain from taking a fully positive stance. | |

AFC Energy (LON:AFC) (£139m | SR17) | Agreement by the UK Environment Agency to revise AFC Energy's Research and Development permit for the export and sale of low carbon hydrogen. This accelerates revenue generation by AFC Energy from low carbon hydrogen production by a number of months. | ||

Centaur Media (LON:CAU) (£66m | SR61) | New strategic partnership with Smartzer. Will introduce a new product that enables influencers to efficiently transform their content into fully integrated, shoppable video landing pages. | ||

Celsius Resources (LON:CLA) (£36m | SR32) | A long-standing NED and former MD has been appointed interim non-Exec Chair. CLA is progressing three non-binding offers for the Opuwo project, and implementing a revised ownership structure for Makilala Mining in the Philippines. | ||

Kr1 (LON:KR1) (£34m | SR27) | Commencement of a new infrastructure income stream through the Nexus Mutual protocol. Phase one is now operational, with further NXM allocations expected during the first half of 2026. | ||

Petro Matad (LON:MATD) (£20m | SR12) | All production revenue withheld by PetroChina during 2025 has been paid ($1.03 million). Wording is now being finalised for the 2026 Oil Sales Agreement. Block XX production continues in line with expectations. |

Graham's Section

Seeing Machines (LON:SEE)

Down 27% to 3.08p (£153m) - Trading Update - H1 FY2026 - Graham - RED ↓

It has been very tempting to upgrade this one, but I stuck to my guns in January with a moderately negative stance.

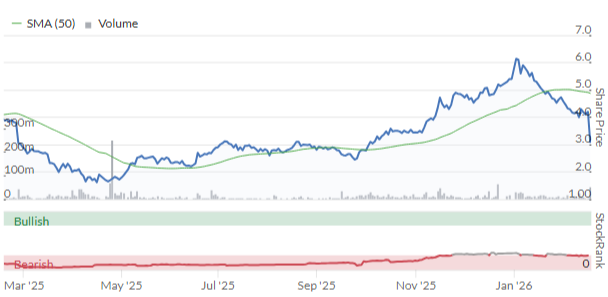

The share price now is still double last year’s low, but it’s a far cry from the 6p seen in early January:

Let’s review today’s trading update for the six months to December. A key deadline is approaching:

The Company is entering a key phase as it prepares for the 7 July 2026 EU General Safety Regulation (GSR) deadline, which mandates camera-based Driver Monitoring System ("DMS") technology for all newly registered vehicles.

Unfortunately, that deadline has not come quickly enough to generate a quality financial performance in H1.

Revenue $23.4- 24.0m, down from $25.3m in H1 the previous year.

Comment: “The decrease reflects lower non‑recurring engineering ("NRE") activity as major automotive programs mature and transition into production phases, as well as the absence of license revenue associated with prior exclusivity arrangements.”

ARR increases slightly from $13.5m to $14m

Adjusted EBITDA loss $13.1-13.7m (H1 last year: $17.7m)

The loss is at least a little smaller, with the company highlighting reduced operating expenses.

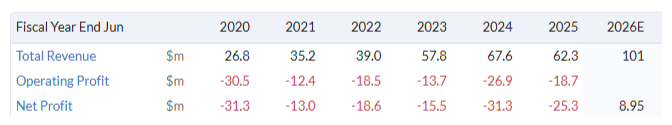

However, I have found that being very cautious on companies that are loss-making at the EBITDA level has served me well. In January I said the same thing. An adjusted EBITDA loss doesn’t mean that a company is uninvestable, but it does say something very serious to me about its current level of performance. And Seeing Machines has been this way for a long time:

Cash falls from $22.6m (June 2025) to $3.4m (December 2025). That’s a $19m outflow, significantly larger even than the EBITDA loss.

The company explains that $13m of the outflows was due to operating performance, $5m was working capital movements (higher inventor), and $1m was defcon for a 2024 acquisition.

At this point I would expect the company to fundraise, if not for the following:

Post period end, an accelerated lump sum royalty payment of approximately US$14.1 million was received from a Tier 1 automotive customer under an existing Automotive Program Guarantee

Operational highlights are more promising:

67% year-on-year growth in cards on the road using SEE’s Driver/Occupant Monitoring Systems (DMS/OMS).

62% growth in production volumes

Expansion of an existing program with expected $10m in lifetime value

$1.8m order received from North American autonomous vehicle operator

Various other bits of news: orders, collaboration etc.

Outlook is in line and says adjusted EBITDA will turn positive:

With GSR implementation imminent, automotive production volumes are expected to increase materially over the coming quarters. Seeing Machines is positioned to benefit from accelerating royalty volume, expanding recurring revenues and improved operating leverage as OEM compliance strategies move into production. The Company continues to trade in line with market expectations and is pleased with the continued recent momentum. Adjusted EBITDA is expected to be positive in Q3 and the second half of FY2026.

Estimates: I’m not sure what Singers and Stifel are saying today. Based on the text of the RNS, no change in estimates should have occurred. Estimates suggest:

Full year revenues $101m

Full year net profit $8.95m

It looks to me as if the company is supposed to earn positive EBITDA of $30m in H2, in order to hit its existing full-year targets.

Now anything is possible, but the company’s outlook statement today merely promises that EBITDA will be “positive” in Q3 and H2. Whereas the forecasts suggest that they are about to print money over the next 5 months.

Graham’s view

I don’t think this update is technically a profit warning. At the same time, it leaves me with zero confidence that full-year estimates are going to be achieved.

I also note the very high rate of cash burn. Hopefully this will unwind as inventory is delivered. But this cash burn did still leave them vulnerable, until the accelerated royalty payment bailed them out.

The accelerated payment was announced on 6th January, and it was not described as a necessary step to prevent the need for an equity refinancing. This is what they said:

The payment, which will be received this month, relates to a material change to a production program which has enabled a renegotiation of the royalty payment terms, under guarantee. The accelerated payment is being made in lieu of future royalty payments that would otherwise have been received over the next four years.

Putting it all together, I don’t see how I can be anything but RED on this.

It’s possible that the legal inflection point is about to result in a turbo-charged financial performance.

But I’m going to do what I normally do: stay negative on companies with negative adjusted EBITDA.

And a downgrade to RED is necessary since a) I don’t have complete faith that the company will be able to protect its cash balance and avoid a refinancing, b) there seems to be a profound mismatch between official estimates and what the company is likely to achieve by June.

The StockRanks are in agreement with scepticism, calling it a “Momentum Trap” (although I doubt it will have much momentum left after today’s crash).

Keystone Law (LON:KEYS)

Unch. at 583p (£185m) - Full Year Trading Update and Notice of Results - Graham - AMBER/GREEN =

Keystone calls itself “the tech-enabled platform law firm”.

Today it gives us a little update on FY January 2026.

And it’s a strong one:

Keystone's lawyers performed strongly across the business, with buoyant trading conditions during the Period underpinned by ongoing client demand delivering an increase of just under 10% on FY 2025 revenue per Principal and an improved financial performance.

There are 61 new Principals and 36 new “Pod members” (junior lawyers). Total fee earners are up 13.5% to 654.

Results: FY 2026 revenue and adjusted PBT will be “marginally ahead of current market expectations”.

These expectations are for £108.9m of revenue and £14.4m of adjusted PBT.

CEO comment:

"I am delighted that Keystone has delivered such an impressive performance across 2026, beating market expectations.

These financial results, supported by a strong operational performance across the business, are testament to the broad appeal of Keystone's brand and our ongoing ability to attract and retain highly successful lawyers…”

Graham’s view

The share price has dropped back since I reviewed Keystone last, in September.

I see that back then, market expectations were for FY26 revenue of £103.6m and adjusted PBT of £12.9m.

They told us at the time that those expectations would be beaten.

There has indeed been a pleasant trend in EPS forecasts:

This progression has been organic: no acquisitions needed to drive expectations higher, only the profitable hiring of additional lawyers.

I did say in September that I thought Keystone was “certainly very expensive for a law firm” (in terms of its market cap, not fees!).

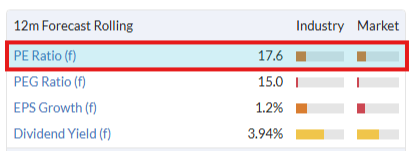

That remains true today, although less so. The earnings multiple has softened from 20x:

On balance, I think a moderately positive stance continues to make sense here. While the company’s references to tech and AI might seem unconvincing, they’ve given enough detail in the past to make me think that they are using tech in a manner that might give them a competitive advantage.

And I appreciate their ability to hit and exceed expectations.

At the same time, I would hesitate being outright positive on a law firm trading at an earnings multiple like this. Professional services businesses, especially the likes of accountancy firms and law firms, tend not to be investments of the very highest quality (as they are fundamentally people businesses), and in general they should trade at modest earnings multiples. So I must continue to hold back from a fully GREEN colouring.

Roland's Section

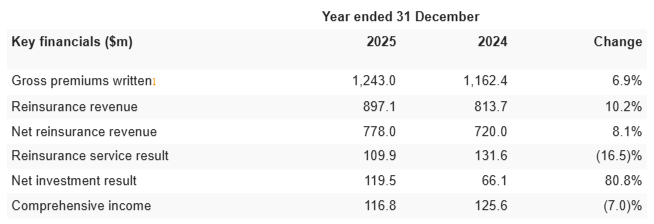

Pan African Resources (LON:PAF)

Up 3.7% at 151p (£3.0bn) - Interim Results - Roland - AMBER =

Mining companies are essentially leveraged plays on the price of the underlying commodity. The majority of their costs are fixed, so profits can swing wildly depending on whether commodity prices are rising or falling.

Gold has staged an impressive rally over the last year. This has had an inevitable effect on the share prices of profitable miners like Pan African Resources.

This creates exciting opportunities (and risks) for investors.

For example, the gold price has risen by around 75% over the last year:

Source: Tradingeconomics.com

But Pan African’s share price has risen by 320% over the same period:

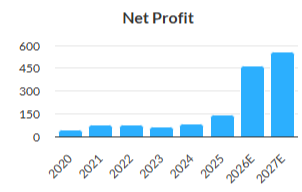

This share price growth largely reflects the miner’s profits, which doubled in FY25 (y/e June) and, as we learn today, rose by 212% during the first half of FY26 (Jul-Dec 25).

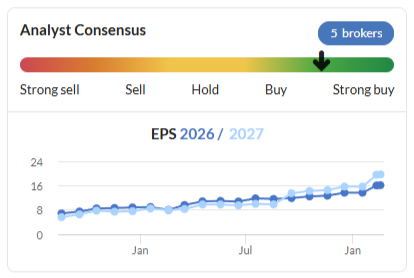

Further significant gains are pencilled in for FY26 and FY27 – assuming gold remains at current levels:

H1 results summary

Today’s results add credibility to these forecasts, in my view. Revenue rose by 157% to $487.1m during the half year, while net profit rose by 211.9% to $147.8m.

Half-year gold production rose by 51.5% to 128,296oz, primarily driven by an 87% increase in the output from Evander Mines, to 21,640oz. A further increase is expected at Evander in H2.

Pan African’s All-In Sustaining Costs (AISC) rose by 11.9% to $1,874/oz in H1. This was well above previous FY26 guidance for AISC of $1,525-1,575/oz. Management says this was due to adverse USD/ZAR exchange rate movements, higher employee share-based payment costs and a volume-related increase in costs and royalty payments at Evander.

FY26 AISC guidance has now been increased to $1,820-1,870/oz, suggesting costs are expected to remain broadly stable in H2, with some benefit to unit costs from higher production volumes.

Fortunately, the increase in costs was comfortably outweighed by a 61.6% increase in the average gold selling price, which rose to $3,812/oz.

The resulting increase in cash generation allowed Pan African to reduce net debt by over $100m in six months, to just $46.2m. Management expects the business to be in a net cash position by the end of this month (Feb 26).

To reflect this new balance sheet strength, Pan African has initiated dividend payments with an interim payout of ZAR 12.0 cents per share (0.5475p per share).

FY26 profit estimate: what’s interesting about these numbers is that Pan African’s average selling price in H1 was still c.$1,100/oz below the current gold price of c.$4,920/oz.

Assuming gold prices remain stable, we should be able to expect a significant step up in profit in H2.

The information provided in today’s report makes it easy to estimate what steady-state FY26 profits might be:

H1 gold production was 129koz

The company confirms today that it’s on track to meet full-year production guidance for gold production of 275-292koz;

This implies H2 production of around 155koz, at the mid-point;

Assuming an average selling price of $4,600/oz and AISC of $1,825/oz in H2, operating profit could be c.$2,775/oz

My sums suggest this could equate to c.$430m of H2 operating profit

Finance costs should be minimal/positive as the business moves into net cash

Subtracting tax at the same rate as H1 gives an estimated H2 net profit of c.$305m

Adding this to H1 profit gives me a FY26 estimate of $453m.

For context, broker consensus on Stockopedia prior to today was $462m – it just goes to show that calculating these forecast estimates is not always that complicated!

There are a few points to note here:

The method I’ve used above gives me a near-exact match with H1 comprehensive income of $185m (including $38m of FX gains);

ZAR/USD currency risks is significant and could influence the result either way;

These estimates all assume the gold price will remain largely unchanged during the period concerned.

This analysis also suggests to me that today’s results are in line with expectations – a view supported by the lack of share price movement.

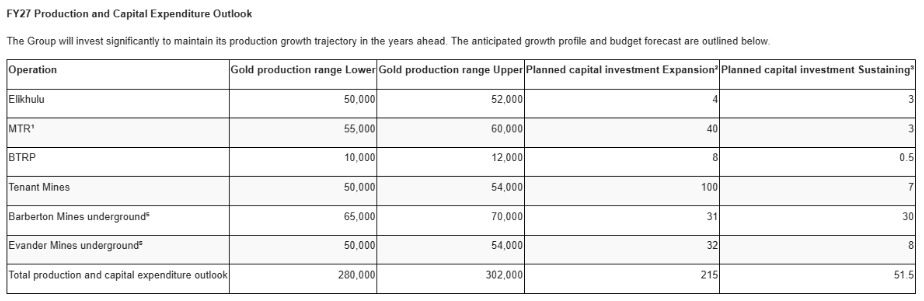

FY27 outlook: while the direction of the gold price will remain a mystery, Pan African has provided quite detailed guidance on spending and production plans for the FY27 financial year today.

I have reproduced this below for those who are interested:

What’s notable to me is that while production growth is expected to be modest next year, capital expenditure is expected to rise by 70% to $267m (FY26 guidance $156m). This rapid growth in spending on growth and future production is (arguably) classic late cycle mining behaviour.

Roland’s view

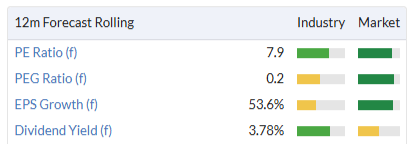

Current forecasts mean that Pan African trades on 32x FY25 trailing earnings but a much more modest 8x 1y rolling forecast earnings:

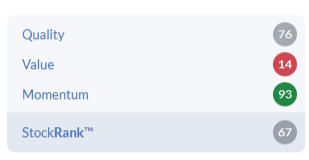

This makes it quite difficult to value – in effect, this has become a pure momentum play, something that’s somewhat reflected in the StockRank and High Flyer styling:

I don’t have a view on the outlook for the gold price. For those who are interested in understanding this better, there’s an interesting Edison note available free on Research Tree (and probably elsewhere) from 29 Jan 26 which discusses various ways of looking at the gold market.

As I’ve illustrated above, if the gold price stays at current levels for the next 18 months, Pan African’s profits could rise much further. In the absence of debt, this could support attractive shareholder returns. The shares could have further to run – and of course gold could rise further still.

Of course, if the gold price were to fall sharply for any length of time, Pan African’s (mostly) fixed costs would cause profits to plummet. It would be reasonable to expect the share price to fall far in excess of the reduction in the price of gold.

I was AMBER on Pan African in February 2025, noting that the “valuation looks about right”. The market cap was £763m at the time, compared to £3bn today.

It’s easy to chuckle about how wrong I was now, but the reality is that I have no more chance of predicting the market cap in February 2027 than I did of guessing correctly one year ago.

Pan African seems a decent enough operator, with stable near-term production and a strengthened balance sheet. But in my view, this is now a pure-play on the price of gold. For this reason, I am going to stay neutral today.

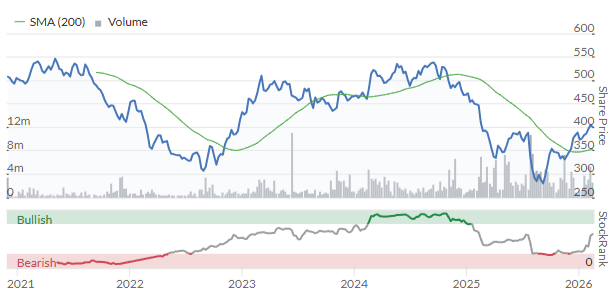

BAE Systems (LON:BA.)

Up 3% at 2,106p (£63bn) - Preliminary Results - Roland - AMBER/GREEN =

In a new era of defence spending, driven by escalating security challenges, we're well positioned to provide both the advanced conventional systems and disruptive technologies needed to protect the nations we serve now and into the future. With a record order backlog and continuing investment in our business to enhance agility, efficiency and capacity, we're confident in our ability to keep delivering growth over the coming years.

Today’s 2025 results from FTSE 100 defence group BAE Systems were always going to be strong, but have turned out to be slightly ahead of expectations. Today’s guidance also includes a modest upgrade to the outlook for 2026.

2025 highlights

Sales* up 10% to £30,662m

Revenue up 12% to £28,336m

Adjusted EBIT up 12% to £3,322m

Reported operating profit up 9% to £2,925m

Adjusted EPS up 12% to 75.2p (ahead of 74.1p consensus)

Dividend up 10% to 36.3p per share

*Sales includes BAE’s net share of sales by its equity-accounted investments.

Operationally, progress was also good with strong order intake:

Order intake up 9.2% to £36.8bn

Order backlog up 7.5% to £83.6bn (including equity accounted investments)

Order book up 5% to £63.1bn (this is a statutory measure excluding equity accounted investments)

Book-to-bill ratio of 1.2x (a number >1 indicates growth)

BAE operates in a wide range of sub-sectors, including traditional big ticket items such as aircraft and ships. One concern that periodically raises its head is that the order pipeline for these long cycle items could dry up, endangering high numbers of jobs and future revenue.

This doesn’t seem to be a concern at the moment, though. New orders last year included:

An agreement to supply 20 Typhoon aircraft to Turkey, worth £4.6bn and “helping to sustain 20,000 jobs across the UK”;

Launched Edgewing JV with partners in Italy and Japan to design a next-generation combat aircraft;

Norway selected BAE’s Type 26 frigate for its future warship programme. This £10bn government-backed agreement is set to be “the UK’s largest ever warship export deal by value”;

Signed $1.2bn contract to provide US Space Force with space-based missile tracking capabilities;

Armored MPV programme celebrated 500th delivery and is “under full-rate production” to meet the US Army’s plan to have nearly 3,000 AMPVs;

Laid the keep of HMS Dreadnought, the first of four new submarines being built for the Royal Navy at Barrow-in-Furness.

Alongside this, BAE opened a number of new manufacturing, repair and training facilities in the UK to support future growth.

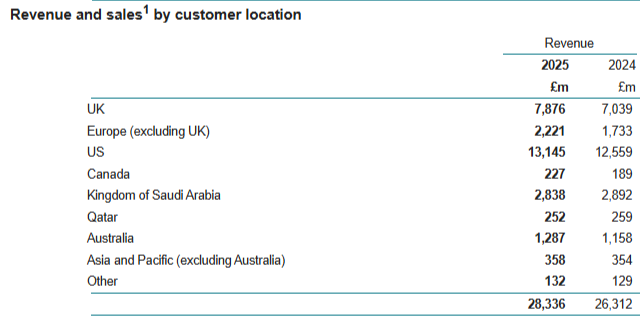

The geographic split of profits is interesting and potentially worth repeating here. The US contributed 46% of revenue last year, notwithstanding BAE’s deep roots as a supplier to the UK armed forces:

Whether the heavy dependence on the US is a risk or an opportunity is probably a subject for another day. But I think it’s worth noting.

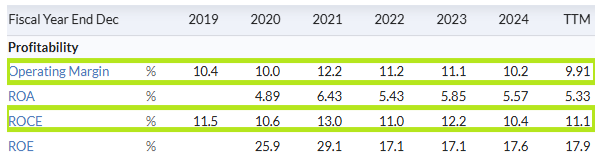

Profitability: there are adjustments here, but nothing that gives me any cause for concern.

Margins and returns in 2025 were consistent with recent years, with an operating margin of 10.3% and return on capital employed of 11.5%.

These figures highlight the relatively capital-intensive nature of this business, but are respectable all the same. When combined with modest debt leverage, this result supported an 18% return on equity – a good result for shareholders, in my view.

Cash flow: while free cash flow fell by 14% to £2,158m last year, my impression is that this simply reflects the normal lumpiness of BAE’s big ticket sales. It’s also worth noting that this gives 100% cash conversion from net profit of £2,151m – an excellent result.

Incidentally, I’m also happy that BAE’s calculation of free cash flow is within a few £m of my own calculation. This doesn’t always happen, but when it does I tend to see it as a sign of good quality reporting.

2026 outlook

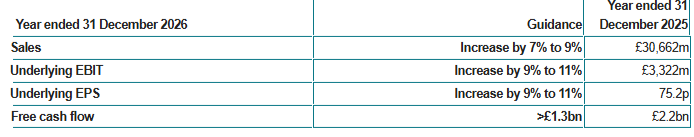

I don’t have access to broker notes for BAE, but the company helpfully provides detailed guidance on expectations versus 2025 results:

Sales growth is unchanged from previous guidance, but EPS growth was previously expected to be 8%-10%, so today’s guidance is a modest upgrade.

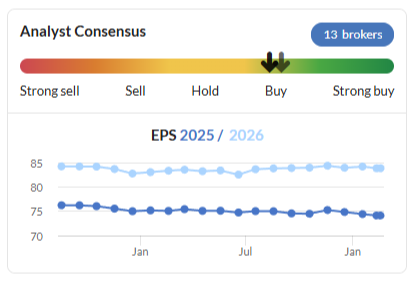

The StockReport shows a FY26 consensus EPS estimate of 83.8p per share prior to today. This equates to an 11.4% increase versus 2025’s 75.2p per share figure, suggesting to me that brokers were already pricing in a stronger outlook here:

Roland’s view

These forecasts leave BAE shares trading on a forecast P/E of 25x, with a dividend yield of 1.9%.

For investors comfortable with US-style valuations, this isn’t excessive. However, I think the stock’s High Flyer styling is probably well deserved:

Profitability here is respectable rather than outstanding.

Moreover, my sums suggest BAE shares are now trading with a trailing free cash flow yield of just 3.5%. Guidance is for cumulative free cash flow “in excess of £6.0bn” from 2026 to 2028, suggesting only modest growth in cash generation over the next few years:

I may be old fashioned about these things, but the current valuation seems high enough to me, relative to expected cash generation.

The market may yet prove me wrong, though. BAE’s share price has already risen by 20% this year.

There’s also the possibility – quite real – that the company may outperform these forecasts.

Capital expenditure has increased and is currently running at c.£1bn. It’s possible that this outlay will support a materially higher earnings capacity in the future.

BAE shares are too expensive for me personally at current levels. But the valuation isn’t necessarily unreasonable and I think there’s enough evidence of momentum for me to leave my previous AMBER/GREEN view unchanged today.

Conduit Holdings (LON:CRE)

Down 4% at 387p (£626m) - Preliminary Results - Roland - AMBER/GREEN ↑

Bermuda-based reinsurer Conduit was only founded in 2020 and has had a mixed track record so far:

The group was forced to make some changes to its reinsurance strategy and to key personnel last year after suffering a c.$120m loss in the California wildfires.

This setback cast some doubt on the quality of Conduit’s underwriting – more established rival Lancashire Holdings (disc: I hold) did not suffer in the same way.

The resulting profit warnings saw 2025 estimates drop by c.50%:

The good news is that changes have been made and the resulting business should be more resilient – in theory at least – and today’s 2025 results are significantly ahead of expectations.

Conduit shares are down today though, perhaps suggesting some caution about the outlook in a weakening market.

2025 results highlights

Insurance is a complex business and I don’t claim to be an expert. But in essence Conduit’s profits can come from two sources – insurance activities and investment returns from premium income.

In this section I’ve attempted to step through the headline figures in today’s results to show how the business has generated positive returns and consider its balance sheet and valuation.

Today’s results provide a useful breakdown of revenue and segmental profit. Comprehensive income is the group’s net profit after all expenses:

Comprehensive income of $116.8m is 41% above the consensus estimate of $82.9m shown on the StockReport. An updated note from broker Panmure Liberum today on Research Tree confirms that this is an appropriate comparison, with PanLib’s analyst reporting a 38% beat against his expectations.

This result has allowed Conduit to leave its dividend unchanged this year, while maintaining a comfortable level of earnings cover:

Earnings per share down 6.3% to $0.74

Dividend per share unchanged at $0.36

One reason for this improved performance appears to be that the second half of 2025 was relatively quiet, in terms of major losses. Investment returns also improved.

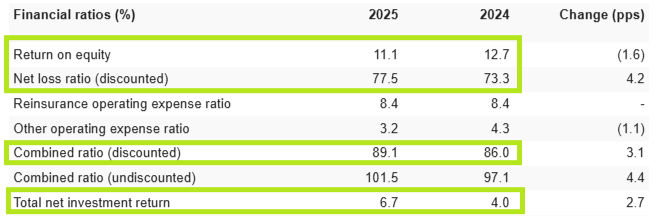

This enabled Conduit to deliver a strong result for the year than expected, maintaining a respectable level of profitability. I’ve highlighted what I view as the main metrics here:

The end result is that the damage to Conduit’s capital from the California wildfire losses was more limited than expected:

Tangible capital rose by 4.8% to $1.10bn in 2025

Tangible net assets per share fell by 1% to 530p, due to the impact of dividend payments

Excluding dividends, tangible net assets rose by 11.9%

Trading commentary

It’s generally accepted that the specialty insurance market is softening somewhat after a very strong period of growth. Sure enough, today’s outlook statement contains this rather subdued comment:

Market conditions remain adequate in most lines of business, although continued softening could lead to moderating premium growth rates over the course of the year, particularly in Property and Specialty segments

While the January renewal season is described as “successful” I think it’s fair to assume that there’s some pressure on pricing in a range of areas. There’s also the potential for rates to fall as the year passes, especially if there are no further exceptional loss events.

Outlook & Updated Estimates – a cut!

Conduit’s share price is down today despite what appear to be a much stronger set of results than expected. In such scenarios I usually check to see if earnings forecasts have been cut – sure enough, they have been!

With thanks to Panmure Librum, we have updated estimates today:

FY26 EPS: 91.9c cents (-4% vs 95.2c previously)

FY27E EPS: 90.5 cents (-19% vs 100.9c previously)

These results put Conduit on a forward P/E of around 5.8x, with a possible dividend yield of 7%.

Roland’s view

Confidence is hard won and easily lost and I think Conduit is suffering from its previous misjudgements and short track record.

We won’t know if the changes made following last year’s wildfire losses have delivered the intended results until at least another year has passed.

In addition, many of the markets in which Conduit competes are softening, potentially creating difficult choices between profitability and volume. Unlike Lancashire, Conduit doesn’t have a proven track record of navigating market cycles successfully.

Finally, the changing nature of both the climate and global geopolitics adds an extra level of uncertainty to long-term results.

So there’s definitely a case for caution here.

However, I can see some potential value here as well.

Conduit did not have to raise capital last year and has been able to maintain its dividend, while also maintaining a stable capital base.

At 387p, the shares are trading around 27% below their tangible net asset value. Broker forecasts suggest return on equity could be maintained at c.11% over the next couple of years, in which case the shares could prove cheap at current levels, providing an attractive income.

When we last looked at Conduit in May, I took a neutral view following the appointment of an experienced new CEO. I would also note that CFO Elaine Whelan was previously the long-term CFO at Lancashire, so does have a strong pedigree in this specialist sector.

My choice today is between staying neutral and upgrading to AMBER/GREEN.

The main factor encouraging me to be cautious is today’s cut to earnings forecasts and the expected earnings decline in FY27. However, I think this reflects cyclical sector conditions rather than any downgrade to expected performance from Conduit.

With the stock trading comfortably below book value and expected to continue generating a double-digit return on equity, I think there’s a case to be made for considering this as a value play.

The risk is that I’m too early in the cycle to back this relatively unproven business. However, I’m going to take a chance today and move my view up by one notch to AMBER/GREEN.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.