Good morning!

I recorded a cracking (long!) audiocast last night with corporate financier, and accomplished investor, Edward Roskill. He's a man worth listening to, as his favourite three share ideas in our Oct 2014 audiocast have since risen 70% (FIF), 150% (QTX), and 180% (TRAK)! We recap on these stocks, and others, and Edward introduces some of his current micro cap share ideas (NB these are highly illiquid, so come with larger than usual wealth warnings).

I've started typing up a transcript for deaf followers and anyone else who prefers this format, but please bear with me, as it's a lot of typing, so have only done about a quarter of it so far. It should be complete within a few days, so if interested just bookmark that link & revisit later this week perhaps.

Cloudbuy (LON:CBUY)

Share price: 13.9p (down 26% today)

No. shares: 128.4m

Market cap: £17.8m

NOMAD appointed & shares restored - this is an interesting one. Cloudbuy shares were abruptly suspended on 11 Sep 2015, which I reported on here. The reason was that the NOMAD, Westhouse Securities, resigned with immediate effect, giving no reason. The company only had one month to find a replacement NOMAD, otherwise the shares would have de-listed.

So here we are, just six days before Cloudbuy shares would have seen the AIM listing cancelled, the company has managed to find another NOMAD to take them on - Arden Partners.

EFH Director dealing - Ronald Duncan, Cloudbuy's Chairman, was one of several listed company Directors who unwisely got involved in a scandal last year, where Directors purported to take out loans with Equities First Holding LLC (EFH), using shares in their companies as collateral.

Tom Winnifrith exposed these arrangements as actually being sale & optional re-purchase agreements. As the loans were non-recourse, and there was no obligation to re-purchase the stock signed away to EFH, then the commercial reality of these transactions was that they were disposals of shares by Directors. EFH sold the stock into the market once they received it as collateral. Whether Directors were aware this was their intention or not, is unclear. However, on looking at the terms of the loans offered by EFH, any idiot could have worked out that EFH would have to sell the shares immediately, in order to be able to offer such attractive terms on their non-recourse "loans".

The announcement today from Cloudbuy says that Ronald Duncan "has terminated and settled with immediate effect" his arrangement with EFH. So that sounds as if he has re-purchased the shares he signed over to them. However, I think the wording is misleading, as it then goes on to say that he no longer holds the 2.25m shares concerned, and his holding has reduced to 18.4m shares (still significant at 14.9% of the company).

So a more accurate wording should have said that he has disposed of 2.25m shares, and has decided not to re-purchase them. Of course he wouldn't re-purchase them at the original price, as it's far higher than the current market price. It draws a line under a grubby deal anyway.

Token Director buys - to make matters worse, Duncan has bought just 50,000 shares (just £7,700 worth!) in what is presumably supposed to reassure people! Token gesture share purchases like this, immediately after bad news, are counter-productive in my view. It doesn't show any real commitment to the company, it's meaningless. In fact, I see it as a negative - if he could only scrape up £7,700 to buy 50k shares, having sold 2.25m by the back door, then it's not telling me he has confidence in the business, but rather the opposite.

NED buys shares - a NED has bought 100k shares, costing £14,750. Whoopie doo! Again, just a PR exercise to reassure shareholders. So if it's done for the wrong reasons, after bad news, then Director buying like this is actually a negative.

Maybe the Directors are saving their money for the inevitable next Placing, which is imminent I reckon.

Cash position - as I reported on here, Cloudbuy is almost out of cash. I reckon it has enough to last just into the new year, and if it can't raise more cash before then, then it will have to drastically cut costs, or go bust.

Any fundraising is likely to be at a deep discount, as this is a stale story, and the results to date have been lamentable. So existing holders are almost certainly going to be savagely diluted, and the share price is likely to continue falling precipitously in my opinion.

My opinion - whilst Cloudbuy may have saved the day (for now) by finding a new NOMAD, I suspect that many (possibly even hundreds) of rubbish companies will be leaving AIM over the next couple of years through NOMAD resignations. It's already becoming the de facto method of de-listing, where the NOMAD finally tires of the reputational damage & hassle of supporting hopeless companies. There are loads of washed-up resources exploration companies that no longer have a hope in hell of surviving, that are likely to disappear in this way. Plus the last of the Chinese AIM junk that still remains.

The problem with a company de-listing is obviously that there is no longer a ready market in its shares. Sometimes companies put in place informal dealing arrangements, e.g. you can contact the Co.Sec. to seek out a buyer or seller. However, holding shares in a private company often means that you are high & dry - marooned in the shares, which probably have very little (if any) resale value.

So de-listings are usually a total disaster. Anyone holding the shares through a spread bet or CFD would usually be forced to close out, or at least stump up 100% margin to cover the likely losses. Similar problems are likely if they are held in a SIPP or ISA.

There's a chance that Cloudbuy might be able to convince a fresh wave of investors that it's worth supporting. However, if I held these shares, I would have taken advantage of today's resumption in trading to dump the lot. There is no evidence that Cloudbuy is, or will ever become, a viable business.

Trinity Mirror (LON:TNI)

Share price: 155p (up 2.5% today)

No. shares: 257.7m

Market cap: £399.4m

Trading update - the company confirms that it is trading in line with expectations today, for the current year (ending 28 Dec 2015). What they define as underlying revenue, which was falling at a steep rate of 10% in Q2, has slowed somewhat to a fall of 7% in Q3. This still very much reinforces the reality that newspapers are on their way out, or might only survive on a niche, or given-away-free basis in future.

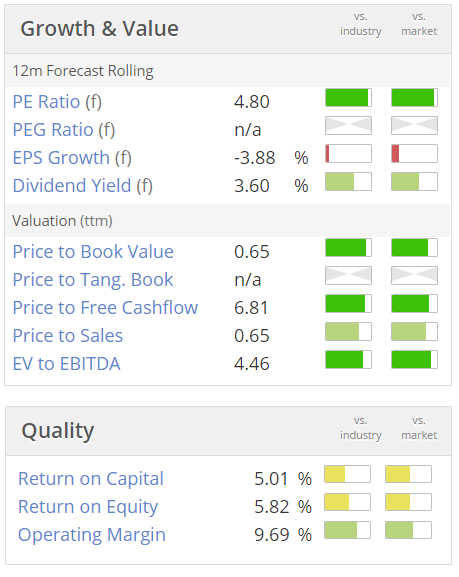

Valuation - this looks superficially attractive, but a PER as low as 4.8 is telling you that the earnings are not sustainable for long. So very much a last gasp type of share.

My opinion - personally I only ever buy the occasional copy of the FT, mainly because their online pricing is far too high, and other than that the only physical newspapers I read are the free ones in London, e.g. Metro & Evening Standard, just to kill time on the train, or as a prop to avoid eye contact with a person I am forced to sit directly opposite on the tube or train. So really, what future do TNI's titles have?

For now, TNI is cutting costs sufficiently fast, to maintain cashflow, but obviously that can't continue forever. There's the pension deficit to think about too, as this restricts the divis the company is able to pay. It is actually paying divis now though. Plus you have the escalating cost of phone hacking as a further downside risk.

At this level, this share looks a value trap to me. You can't value it on a PER basis, as profits are not sustainable. Its digital strategy hasn't worked, and it's probably too late now, as the advertising bucks are leaking away to Google and Facebook. On the upside, if they can come up with a credible digital strategy, and there was an impressive recent appointment of a NED who works at Facebook, then who knows? There's also a decent amount of freehold property on the balance sheet, so the company still has a number of options. The mkt cap of nearly £400m just seems to high, given that earnings are likely to disappear over the next say 5 years.

Hargreaves Services (LON:HSP)

Share price: 295p (down 15% today)

No. shares: 31.9p

Market cap: £94.1m

Trading update - a strange muted initial reaction from the market, but as the morning has gone on, sellers have pushed the price of this coal/coke distributor further down.

Today's update mentions the closure of the SSI steelmaking site at Redcar, and that this will probably hit Hargreave's profit to the tune of £4m p.a. That's material, in the context of current year forecast of £13.6m profit. Thankfully there don't seem to be any other particularly onerous costs, such as bad debts, with only £1.5m in additional costs. It sounds like Hargreaves wisely maintained title to the stocks of coal used at Redcar, and says it will liquidate these £14m of stocks (in what could otherwise have been a bad debt, but isn't).

Management at Hargreaves seem very shrewd, and are managing the decline of the business/sector very well I think. The CEO owns 7.1% of the business, which no doubt helps focus his mind on preserving what shareholder value there is.

A broker note today has reduced forecast earnings by 30% to 30p EPS. Bear in mind this company was delivering 90-149p EPS p.a. between 2011-2015, and you can see how its profits have really collapsed due to lower coal prices, and reduced demand due to closure of heavy users, such as coal-fired power stations - no longer wanted, as they are so dirty.

My opinion - it's a special situation now - you can't meaningfully value it on a PER basis any more, as earnings are collapsing. Therefore it's all about what assets the company has (including some valuable property), re-sale value of plant & equipment, and any other profit sources it can eke out.

I have no idea how to value it. You would have to do a detailed sum of the parts type of valuation, then apply a discount, etc. At some point I think it could get interesting, but am not sure we're quite there yet. You would have to be quite brave to call the bottom on a share price chart like the one above.

Waterman (LON:WTM)

Share price: 78.75p (up 7.5% today)

No. shares: 30.8m

Market cap: £24.3m

(at the time of writing, I hold shares in this company)

Results y/e 30 Jun 2015 - this is a multi-disciplinary group of consultants to the property & infrastructure sectors. The main activity seems to be essentially being architects, quantity surveyors, and engineers, from what I can make out.

EDIT: Sorry, I got this wrong. It's not an architects! The CEO corrected me on this, on a conference call. Waterman is better described as a group of engineers and consultants, involved in structural engineering, building services (i.e. design of aircon, lighting, fire, drains), environmental consultants (checking for site contamination, impact on adjoining properties), civil transportation consultants (e.g. impact on surrounding roads, utilities, etc, from new build property), highways & outsourcing - seconding engineers into local authorities in particular.

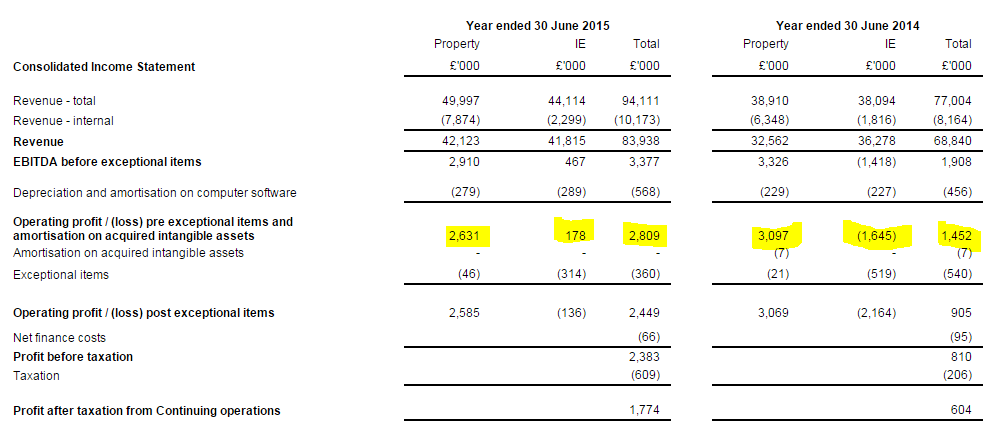

The numbers today look excellent;

- Turnover up 22% to £83.9m

- Adjusted profit before tax up 93% to £2.7m (great, but margin still low, at 3.2%)

- Adj EPS at 5.4p, slightly above consensus forecast of 5.38p

- Total divis for the year doubled to 2.0p (as expected)

- Order book "solid" at £130m (2014: £120m)

- Focus on core UK market - now 89% of revenue

- Australia is main overseas market at 8% of revenue (balance of 3% is Ireland & Poland)

Divisional performance - further potential upside to future profits should come from the reduced losses at the UK Civil & Transportation Consulting business, which recorded a loss of £1.2m (£0.5m improvement from prior year) on £11.8m turnover. Problems "substantially resolved" by year end. So this gives a potential £1.2m additional group profit if this division just reaches breakeven this year.

Waterman had previously set itself a target of tripling adj. profit before tax to £3.3m by y/e 30 Jun 2016. That sounds great, but it was a fairly easy target - all they had to do was eliminate losses in some divisions. Anyway, today it says this target will be exceeded. A ROCE target of 20% has already been exceeded.

A new target has been set, to increase the adj. operating profit margin from 3.3% to 6.0% over the four years to Jun 2019. That would take adj. EPS from 5.4p to 9.8p, so sounds a very positive thing. Again, it's not actually a tough target, since there are still losses in some divisions. The property segment (half of group turnover) is already achieving a 6.2% operating margin (down from 9.5% prior year).

The Structures segment (about a quarter of turnover) also saw a reduced operating margin, down from 9.7% last year, to 5.3% this year. So again, quite a sharp deterioration in performance there.

The operating margin in Building Services also fell, from 7.4% to 4.2%, on £11.8m of turnover.

So how come profits rose then, if the main activities seem to have actually gone backwards, in terms of profitability? The reason seems to be that losses at the Infrastructure & Environment division have improved from a £1.6m loss last time, to a £0.2m profit this time. This reversal of losses into a small profit has more than offset the £0.5m deterioration in performance in the Property division.

So in simple terms, the doubling of profit is due to losses being eliminated at a problem part of the business. The core business actually went backwards in terms of profits. I've highlighted the key figures below:

Balance sheet - this is really good;

- Net assets of £27.5m reduces to £11.7m after intangibles are written off.

- Current ratio is reasonable at 1.17

- Net cash of £3.8m looks healthy

- Debtors look a little high at £31.5m, so I'd like to see them improve cash collection.

- Long-term contracts shown in note 13 shows an enormous size of work-in-progress, of £101m, less £107.5m paid on account by customers. So there is the risk of large adjustments being made to final accounts on these big projects. (EDIT: I asked management about this on a conf call, and they assured me that this isn't an issue - disputes are not opened up about previously billed work).

Long-term Incentive Plan

Director greed is a hot current topic, so LTIPs are coming under more scrutiny. Note 19 sets out the details of an LTIP that was approved by shareholders at the last AGM, in Dec 2014. The key terms seem to be the award of up to 3m nil cost new shares (so just under the key 10% dilution level which investors should see as sacrosanct) based on a range of share price targets between 100-150p.

I would expect the share price to at least double over the next 5 years anyway, so I don't really see why the Directors & staff should be given 10% of the company just for doing their jobs! Isn't this paying them twice for the same thing?

Anyway, it's been approved by shareholders, so I suppose is a done deal. You could argue that, in a people business like this, locking in key senior management is important, as they could just as easily walk out & set up their own competing firm. Dilution is just below the crucial 10% dilution level, and this is a 5-10 year scheme, so on reflection maybe it's alright. Yes, I think I can live with this.

My opinion - the headline figures look great, but on deeper digging, the core businesses actually went backwards. Stemming the heavy losses in other parts of the group actually drove the overall much better performance. So there remains work to be done here.

EDIT: Management explained to me that the margins achieved in some divisions in 2014 were unsustainable, as staff resources had been stretched in an unsustainable way. So the 2015 figures reflected costs of recruiting new people. Margins should rise somewhat in 2016.

Broker consensus is for 7.26p EPS this year, and I reckon it's heading for about 10p EPS the year after. So a share price of say 100-150p looks achievable over the next couple of years. There's a commercial property building boom going on at the moment, plus a lot of infrastructure renewal, so Waterman is in a sweetspot, and should do well over the next few years.

Management are incentivised to achieve share price targets of 100-150p too, which confirms my valuation targets. So it's all pointing towards good further upside on this share for the next couple of years, and reasonable divis along the way, whilst we wait. Overall then, I like it, and will remain a shareholder probably for another 1-2 years. I don't want to hold it forever, as it's cyclical, so the trick is to judge the cycle correctly, and sell before business dries up in the next recession!

Stockopedia likes it too, with a StockRank of 96.

The chart suggests there's plenty to go for as well (the number of shares in issue has remained largely unchanged over this period, so it's a valid comparison):

All done for today, see you in the morning!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in WTM, and no short positions.

A fund management company with which Paul is associated may also hold positions in companies mentioned.

These reports are just Paul's personal opinions, which may turn out to be wrong or right).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.