Good morning!

Well, here's my last SCVR of the year - making it a grand total of 251 reports in 2015!

I did a year-end recap on my own portfolio(s) results this year here, in my 24 Dec report, for anyone who hasn't already seen that.

2016 Charity Challenge

I like to do something worthwhile for charity each year, so have come up with a dual-purpose challenge for 2016.

1) Total abstention from alcohol for the whole month of January 2016. I usually do this anyway, so thought I'd add a twist this year, namely;

2) Instead of having fun nights out at the weekends, I will spend my weekends in Jan 2016 writing a report analysing small cap profit warnings from 2015. I've been meaning to do this for years, but never had time, as it's a big project, so have decided to make some time in 2016.

The idea is this - as I already report on most (nearly all) significant profit warnings in small caps in my SCVRs, then I'm going to re-read all 251 SCVRs from 2015, pick out the profit warnings, and prepare both some data, and summarised commentary on each one, then analyse what happened next.

The key themes will be - what percentage of shares recovered from profit warnings, over what timescale? Do profit warnings really come in threes? Is there an optimum time to buy x days/weeks after a profit warning? Are there any patterns from various sectors? Could profit warnings have been foreseen & therefore avoided? If so, what were the best signals in advance that something was going wrong? Should we sell on the opening bell when a profit warning occurs, or sit tight and ride it out? Should we average down on a profit warning?

It might prove too much work to cover all 2015 profit warnings, but I'll make a good stab at it anyway, and will aim to complete my report by the end of Feb 2016.

Ed mentioned that he would allocate me some time from a researcher to do more statistical analysis of profit warnings over the summer of 2016, so we might then be able to use my report as the starting point for a deeper mathematical approach, mining the data properly (whereas my approach will be more high level, as I'm not a statistician).

So the charity sponsorship will be to help motivate me to have a boring month with no boozing, and spending my spare time writing the profit warnings report. Feel free to sponsor in advance, or to wait until it's done. I'll set up the charity donations page shortly.

On to today's results. Well, there aren't any interesting ones - just a handful of junior resource stocks rushing to get 30 Jun 2015 accounts filed before their shares are suspended. Late accounts is a major bugbear of mine - and it's usually companies with the smallest, simplest accounts that take the longest to file them too. It shows contempt for shareholders, disorganisation, incompetence, and usually financial distress - as late accounts can often be due to auditors refusing to sign off re going concern.

Looking at results for 2015 overall, I find that a lot of people benchmark themselves against FTSE 100 Index (FTSE:UKX) - but unless your portfolio is focussed on the largest companies, it's a meaningless comparison, because the index is so overweight with oil/gas and mining shares, banks, etc. Obviously it's been a terrible year for the resources sector, so that has pulled down FTSE 100.

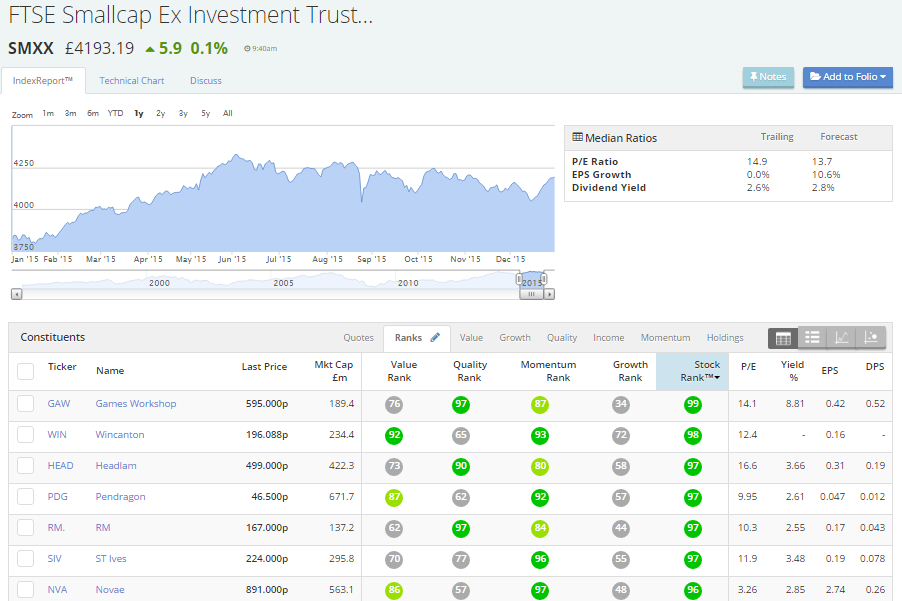

FTSE Smallcap Ex Investment Trusts Index (FTSE:SMXX)

I prefer to focus on SMXX and AXX as my two comparator indices, and they've both had an OK year overall.

If you're a Stockopedia subscriber (it really is worth every penny - and is my main tool for researching stocks & searching for ideas), then just put in SMXX into the search box, and that will bring up a very useful page showing not only charts, and stats on the small caps index (excl. investment trusts), but also shows all its constituents with customisable displays of data, that you can sort on any criteria you wish to. Here's a screen shot (which I have sorted by Stockopedia StockRank);

I'm surprised that the median forecast PER is only 13.7, so maybe there is more value in this index than I realised? That has prompted me to have a rummage and look for some bargains.

Note that good gains in small caps happened in a very strong patch from Feb-May 2015, but since then the index has drifted down gently, although a good Santa Claus rally has happened since 14 Dec 2015.

Overall then SMXX is up about 9.8% in 2015 at the time of writing (10:00 on 31 Dec), a respectable performance. With divis on top of that of course, so a total return of c. 12-13% - pretty good.

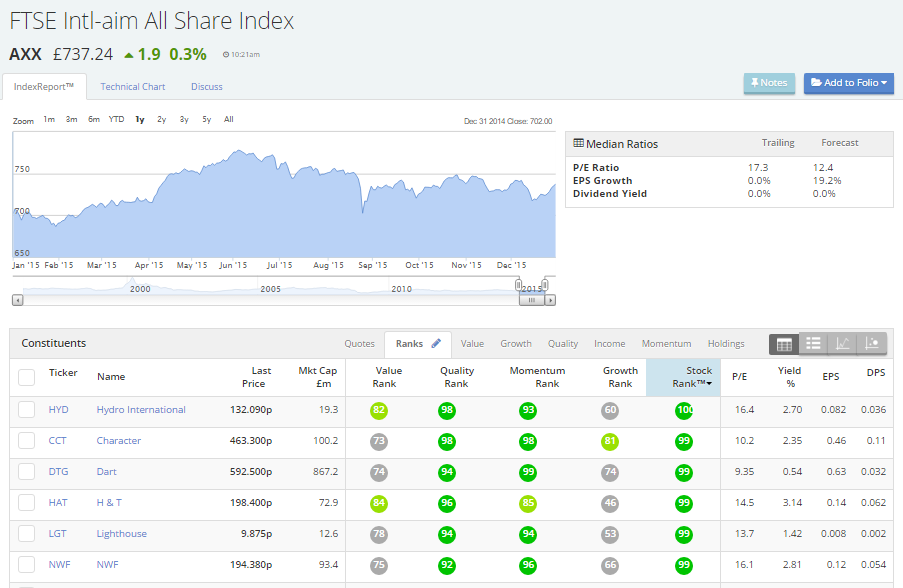

AIM All-Share Index (LON:AXX)

Turning our attention next to the controversial junior market, characterised sadly by its lax regulation, and where I would say that about two thirds of the companies on this market are complete junk, by my investing criteria. Some of them are worse then junk actually - as we saw very clearly in 2015, AIM has become a magnet for frauds from all over the world, particularly China. Some City firms willingly participate in and promote these frauds (or at the very least turn a blind eye), in return for lucrative fees. Shame on them, and of course such firms will inevitably go out of business in the long run, because after a while nobody will trust them, or any of the companies that they represent. It's amazing that this clear-out of dodgy advisers hasn't already happened. Investors are too forgiving, and should instead boycott firms which have consistently tried to sell them pups in the past.

Perhaps the highest profile fraud this year occurred at Quindell - where Rob Terry (and almost certainly others) were exposed for having cooked the books. The SFO are currently investigating, and Quindell was forced to admit wrongdoing, and restate its accounts, so let's hope that particular serial conman ends up spending some time at Her Majesty's pleasure. Otherwise, what's the point in having laws at all, if there are no consequences for breaking them? This country is ridiculously lax on punishing white collar crime. Well done to Tom Winnifrith for his astonishingly detailed investigative work on Quindell.

It is this failure to punish white collar crime in the UK which led one ex-banker to cheerfully comment on CNBC a while ago that US firms weren't worried about dodgy dealings, because "we just outsourced our fraud to London". What a state of affairs where the UK is becoming known as the place to commit fraud with impunity. A whole new regulatory/legal approach is needed, with a major clampdown on wrongdoing of all kinds. From what I can gather, UK regulations seem to just heap administrative burdens onto the honest.

Another significant fraud on AIM was of course Globo (GBO). Some investors chose to ignore a sea of red flags, and numerous warnings, including the 29 articles I wrote here, over 3 years, warning of the dangers lurking at this company. My articles are available here. One of my goals for 2016 is to produce a video, demonstrating all the warning signs at Globo - there were at least 13 significant red flags.

One or two red flags can maybe be forgiven, or explained, but in my experience where you have many red flags in combination, then the risk of it being fraudulent in some way rises exponentially.

It simply amazes me to see the capacity for self-delusion that so many investors have. Once they buy a stock, they simply cease to think. They instead reprogram their mind into blind faith, and shouting down criticism of the company. This is a natural urge in all of us, indeed I find it welling up within me too, far too often. Whenever that particular monster raises its ugly head, I actively force it back into hibernation, by engaging with bears, and listening to what they have to say. That has saved me a lot of money in the last two years - being one of the first into the lifeboats means you can escape the sinking ship relatively safely.

Stockopedia readers are often the first to hear about dodgy accounts, as my track record in the last couple of years shows that I can usually sniff out accounting problems from a hundred yards!

The absolutely key figures to look for, are inflated debtors. That is nearly always the giveaway. After that, you look for excessive capitalisation of costs into intangibles. Artificial profits require assets on the balance sheet to be over-stated, or liabilities under-stated. So it's the balance sheet which is where the bodies are buried. If anything looks wrong on the balance sheet, then don't touch the shares. That applies to quite a lot of overseas AIM stocks, so I don't touch any of them, with perhaps just a handful of exceptions, and exercising great care even then (i.e. only very small position size).

With AIM, it is important to remember that there are perhaps 300-400 good companies (some excellent ones) on AIM, which are profitable, do pay divis, and in some cases will be the stars of the future. So I feel it's wrong to rubbish the whole market. Part of it is good, and of course there are excellent tax breaks, in particular the Inheritance Tax loophole, which you could argue makes IHT essentially an optional tax - or payable only due to overlooking the need for tax planning perhaps?

Here's the same Stockopedia index page for AXX, sorted again by highest StockRank;

Note that the forecast median PER is only 12.4 on AIM, indicating that again there might be some decent, overlooked value, still lurking undiscovered. I'll have a good rummage here too. Mind you, one does have to be careful with forecast earnings, as often a huge leap in EPS is forecast, but doesn't materialise. So the actual PER might turn out to be higher.

Overall, AIM rose about 5% in 2015, which isn't a bad result considering how much rubbish there is in this market - although the junk is mostly smaller market caps, so has a lower weighting.

There's an article in Investors Chronicle today from one of the smartest investors I know, Mark Lauber, which is well worth a read if you subscribe, it's here. Coincidentally, Mark has covered a lot of the issues which I mention above, and gives common sense rules for how to avoid heave losses, or worse still frauds.

Well worth a read, and one of the best articles in IC for a long time. I'll see if I can persuade him to do an audio interview with me in the new year!

(this article is being updated in stages between 10am & 1pm)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.