Good morning!

Things are getting jittery again, at least for large caps. At the time of writing, the FTSE 100 Index (FTSE:UKX) is down 2.7% to 5,903, and the US Futures are also down nearly as much. Various problems seem to be causing this;

Oil - this has really dropped sharply again, with the US Daily Crude price that I monitor on IG having dropped from about $38 to $32 in the last 3 days. That causes all sorts of problems, not just for oil producers, but for Governments in oil-producing countries, which as we all know are often not the most stable countries in the best of times, let alone when facing severe budget deficits, currency issues, etc.

However, cheaper oil is a nice tax cut for companies and consumers in oil-importing countries, so my personal strategy of sticking to UK consumer cyclicals mainly, looks safe for the time being.

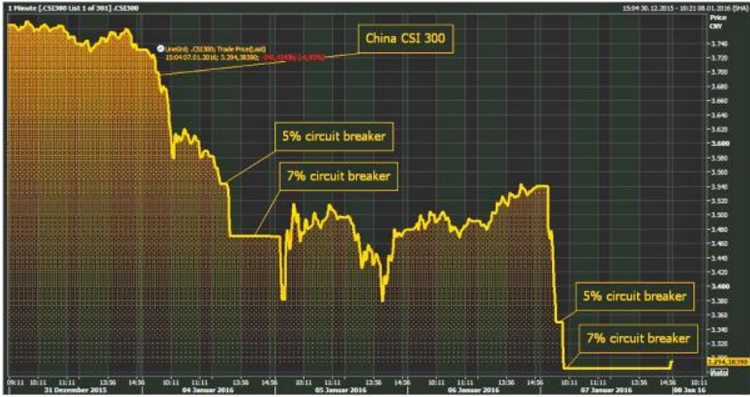

China - yes, this has reared its ugly head again, and is a similar situation to what we saw in Aug 2015. The Chinese stock market is trying to crash, but that is being prevented by the circuit breakers, which close the market once it's down 7%. This has happened twice this week now, and appears to be causing panic selling - since punters realise they only have a brief window after market opening to get their selling done.

Also the Chinese currency is devaluing apparently.

Chart courtesy of zerohedge;

** BREAKING NEWS - China has suspended the circuit-breakers on its stock market. (14:41, 7-Jan-2016) **

US economy - I'm reading things on the internet saying that there is an increased chance of a (probably short & shallow) US Recession. I'm no expert on that kind of thing, but it certainly makes me wary about opening new long positions, and I'm opening up some new US large cap short positions - as it feels to me as if things could get worse before they improve.

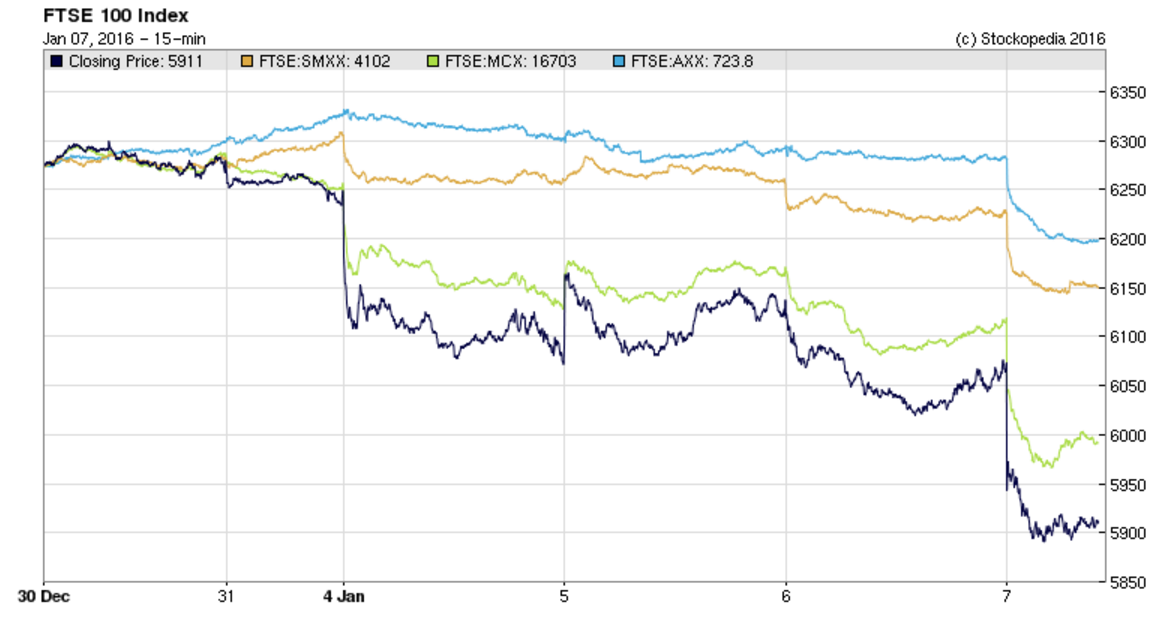

Small caps - thankfully, all the above has not really had much impact on UK small caps, which is similar to what happened in Aug 2015. Check out the chart below, for the last 5 days, for the various UK Indices - small caps (the top 2 lines, light blue & beige) have held up much better than large (resources sector-heavy) or mid caps:

Anyway, onto some company-specific news for today.

Somero Enterprises Inc (LON:SOM)

Share price: 133.75p (up 12.9% today)

No. shares: 56.1m

Market cap: £75.0m

(at the time of writing, I hold a long position in this share)

Trading update - there's a super update today from this America-based maker of laser-guided concrete screeding machines - which are in demand because modern warehouses (for ecommerce fulfilment, etc) need the almost perfectly flat concrete floors which apparently can only really be achieved using a Somero machine. That's what the company claims anyway.

In the six months since 30 June 2015, the Company performed strongly, particularly in the final quarter with monthly sales at an all-time high in December, which is not traditionally the strongest month of the year. As a result, the Board is pleased to announce that the Company now expects to report Revenue ahead of current market expectations for the full year. Furthermore, as a result of an improved gross margin performance, the Company now expects to report EBITDA materially ahead of current market expectations for the period.

Terrific stuff - the ideal scenario, where you beat on top line, and achieve higher margins. That gives a lovely geared impact on the bottom line.

Outlook - very encouraging, in my view;

The year-end demand for the Company's products in North America was predominantly driven by technology upgrades and fleet additions, highlighting lengthy project backlogs for our customers that extend well into 2016.

On a product basis, while large line machine sales continue to represent the majority of our volume, small-line revenues, including the S-485 introduced at the end of 2014, were key contributors to growth.

While it is too early to provide detailed guidance for 2016, the Board is confident that it will deliver another year of growth and that the high-level of activity in December will continue into 2016 providing a solid start to the year.

This should mean that Somero shareholders should be able to relax for a few months - although a US Recession, if it's of any significant magnitude or duration, would inevitably put a dampener on things.

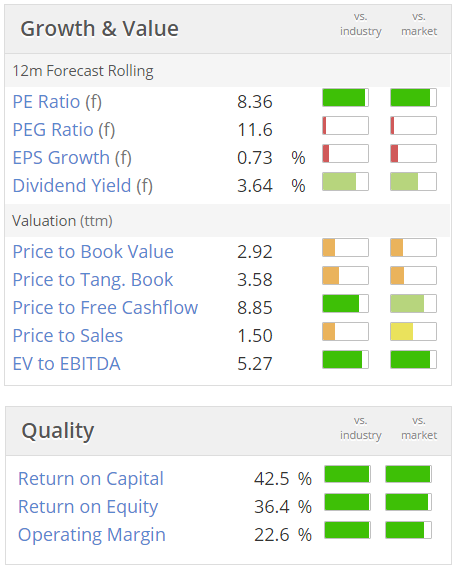

Valuation - this is the interesting bit! Look how cheap these shares are (on a fwd PER basis), based on last night's closing share price;

I'm struggling to think of any share where the quality scores are so high, there's a good divi yield, a fwd PER of only just over 8, and then the company puts out a "materially ahead" trading update. Better still, the company has a strong balance sheet with net cash.

My opinion - this looks to me like a glaring pricing anomaly. I feel that the market is being excessively pessimistic about the company. True, it's highly cyclical - profits dropped off a cliff in the bad recession of 2008, but the company survived & moved back into profit thereafter.

It is now expanding into new markets (China, India, etc), so the next cyclical high in profits should be much larger than the previous one, as it's now a global (as opposed to US) company. Also, there is just more demand for its products, as perfectly flat floors are much more important these days, with more warehouse automation, higher stacking racks, etc.

In my view, the market is missing a trick with this company, and has fundamentally under-priced it. To my mind, the shares are worth 200p+, but as usual that's just my personal opinion, and of course I'm talking my own book - as disclosed at the top of this section.

I understand, and respect the more bearish view, that the company is too cyclical to consider a safe investment, so I encourage a civilised bull-bear discussion in the comments section below.

Small Cap Charts

Another point that I want to make is that this situation reinforces my view that charting analysis is a waste of time in trying to predict how a company is performing, for small caps anyway. Look at Somero's chart above - a gradual slide down through the autumn - so many investors were probably (like me) expecting a subdued trading update, or even a profit warning. That's what the chart was telling us as likely.

Yet here we are today, with a cracking update, saying that Q4 was strong, and Dec their best ever month! So there has been a complete disconnect between the company's performance, and its share price movements - they've gone in opposite directions.

What this tells me, is that small caps are simply too illiquid to draw any meaningful conclusions from the share price movements. There can often be big potential sellers & buyers, who are not able to transact, due to lack of liquidity. Therefore the share price really only reflects what retail punters are doing, who don't have access to inside information in the main, and are hence effectively trading blind, between company trading updates.

It only takes one fund manager to start dripping out stock in the market, to depress the share price for months (or even years!) in a small cap. He might be selling for any reason, e.g. fund redemptions, rebalancing, so completely unrelated to how the company is actually performing.

Whereas in larger caps, the stocks are so liquid, that buyers and sellers can generally transact freely, so the share prices on large caps are a much better representation of market sentiment - hence I can see that chart analysis on large caps makes much more sense, as an accurate gauge of market sentiment.

This is all great news for small cap stock-pickers, as it means that we'll get far more pricing anomalies in small caps, than elsewhere, due to the lack of liquidity. But it also means that, when a share price is falling for no apparent reason, it's just as likely to be a buying opportunity, as it is to be insiders selling due to imminent bad news.

Majestic Wine (LON:MJW)

Share price: 355p (up 8.6% today)

No. shares: 70.7m

Market cap: £251.0m

(at the time of writing, I hold a long position in this share)

Xmas trading update - this update covers the 10 weeks from 27 Oct 2015 to 4 Jan 2016, which the company notes delivers 30% of total annual sales, so clearly a crucial period.

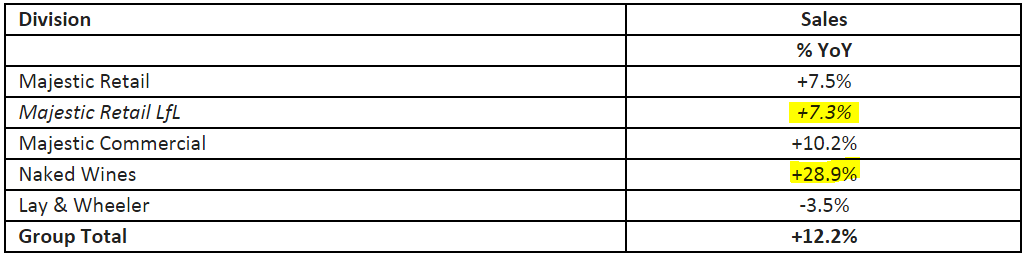

The numbers look good, with the largest part of the business (the shops) delivering a very impressive +7.3% LFL sales uplift. ("LFL" means like-for-like - so it's a performance measure which strips out the impact of branch openings & closures, to show the underlying performance).

Also note that the sexy, growth part of the business, Naked Wines (recently acquired, crowd-funding platform for wine buffs) is also delivering impressive growth, as is the commercial division.

The excellent sales performance is however tempered somewhat by higher costs, and slightly lower gross margin percentage.

Outlook - the new CEO, Rowan Gormley, nicely reins in investor exuberance with this classy comment;

...However there is still much to do. We are only three months into our three year plan and although this performance is pleasing it is too early to call it a trend.

My opinion - for me, the big takeaway from this announcement, is that it validates the unusual choice of CEO. It's obvious from the Naked Wines website, which he founded, that he has considerable flair.

Therefore, whilst the acquisition of Naked Wines seemed a rather bizarre change of direction for MJW, it now looks increasingly likely that it could work. My worry was that an internet whizz coming in to run a traditional retailer, might mess things up. However, he seems to be doing good things, and getting results.

Overall then, whilst it's tricky to value at the moment (as short term profits are being restrained deliberately to build the business), I think this share remains an interesting punt, in a way that may not be immediately obvious from the fairly high forward PER.

The nature of the business is changing, which is a recurring theme with many retailers, which need to reinvent the way they do things, to cope with the internet age. The bull case with MJW is that the strategic changes made by the new CEO could pay off in future, with the shares attracting a growth company rating, as opposed to a declining old-style retailer rating (think a PER of 20+, as opposed to 10-12).

The bear case is that the shares might look too expensive in the short term, on conventional metrics. Also, competition with supermarkets, and other online wine clubs, is intense.

Note that the shares also rose sharply, and inexplicably yesterday - the day before a price sensitive positive announcement - funny that.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.