Good morning!

ShareSoc Supper (Richmond) - 1 March

This new monthly investor event is being held a week today, Tue 1 March, a stone's throw from Richmond railway station. The company presenting is Adept Telecom - quite an interesting one.

Details here. As with all these "Mello-style" events, they're friendly & enjoyable, and well worth supporting, if you can. A good way to meet company management, and to network with other investors. There are still some places available, if you're interested.

Stanley Gibbons (LON:SGI)

Share price: 43.5p (down 32% today)

No. shares: 47.1m

Market cap: £20.5m

Funding & trading update - I last looked at Stanley Gibbons on 13 Jan 2016, when the company said it needed more funding, but was looking at alternatives to a "relatively unattractive" equity fundraising (given the discount to NAV).

Today's update indicates that they've changed their mind;

However, having considered the various alternatives, the Board is now confident that an equity raise is the most expedient and efficient method by which to raise the capital necessary. Accordingly, the Group is in the process of raising approximately £10.0 million of new equity (the "Fundraising"). The Board intends that the Fundraising will be executed in a manner that recognises the pre-emption rights of existing shareholders insofar as is possible and will make a further announcement regarding the Fundraising next week.

So a £10m fundraising, with the mkt cap now at £20.5m (at 8:12 on 23 Feb 2016 - the price may move about a fair bit today) means quite a bit of dilution, especially if investors injecting the new funds play hard ball on price - they might demand a deep discount, who knows?

The "insofar as is possible" comment regarding pre-emption rights suggests possibly an Open Offer attached to a Placing, perhaps? I doubt whether they would go to all the costs, and time, of doing a Rights Issue - a much more involved process, since it requires publishing a detailed prospectus. It sounds as if the fundraising process is well advanced, with another update next week.

Cost-cutting is underway (better late than never);

The Board has already initiated a review of the business, particularly its cost base and effective utilisation of properties and other resources. The Board has identified and begun to implement cost savings which will amount to at least £5.0 million on an annualised basis

It's rather concerning that the company mentions that it is using a consultant to manage this process, who will become a Director in due course. That suggests question marks over the competence of existing management (not that that's really in any doubt, given the catalogue of failure in recent years).

Bank debt - this is particularly worrying, as the £10m in fresh equity being raised is only really enough to make a dent in the bank debt, in particular repaying a £6m overdraft extension that is due at the end of next month. So there is a lot of bank debt remaining - this fundraising is not a proper sort-out, it's just a stop-gap measure by the looks of it;

In addition, the proceeds of the Fundraising will be used to repay approximately £6.0 million that has been made available to the Group by way of an additional overdraft facility repayable by 31 March 2016 and which is expected to be substantially drawn before completion of the Fundraising. The Group's total gross indebtedness at 31 January 2016 was £22.6 million and it is expected that following completion of the Fundraising, the total bank facilities available to the Group will amount to £19.5 million. These facilities will not be due for review until 31 May 2017.

Current trading - not great, but a £1-2m loss is hardly a disaster either;

The Group has continued to experience lower revenues throughout the business, with sales of rare collectibles to high net worth clients being at a lower level than expected and trading being particularly difficult in the interiors division. Additionally, the integration of recent acquisitions has still not achieved the level of cost savings that is required and there has been continued investment in the online platform. As a result of these factors, the Board now believes that for the year to 31 March 2016 the Group will report an adjusted loss before tax of between £1.0 million and £2.0 million.

I suppose it depends what the adjustments are. If there is a big inventories write-down, then the real level of losses would be much greater. That's my biggest worry here - how much are the inventories really worth, if they had to be priced to sell? Probably a lot less than book value.

Resignation of auditor - this is extremely unusual. Normally companies try to gloss over the resignation of the auditor, so I suppose SGI deserves respect for telling it like it is. Personally I wouldn't hold shares in any company that had just made this statement;

The Group is also announcing today the appointment of BDO Limited as auditors following the resignation of the current auditors because they consider the risks and uncertainties associated with the audit to exceed the level that they are willing to accept.

That said, the new auditors, BDO are a well-known, medium-sized firm of auditors. I wonder what approach BDO will take to valuing inventories? With a new auditor, there is an increased risk of a firm line being taken on valuation, I imagine.

My opinion - I put this share (belatedly) on my Bargepole List after the last announcement. Good thing too. Is it worth bottom-fishing after today's additional sharp fall in share price? Absolutely not, in my view. There are always some people prepared to have a punt, in the hope of a rebound, and sometimes they get lucky.

However, for me, I don't think SGI is a quick fix. The group seems to have serious, and ongoing problems. We don't know what terms the latest fundraising will be on - so why buy shares in the market now, at 45p, when you might wake up one morning next week and discover that other investors are buying new shares at a significant discount to that? It doesn't make sense.

Furthermore, this is not a belt & braces fundraising, it's just a stop-gap. The group may well need another fundraising, if inventories remain difficult to liquidate.

Finally, the balance sheet value at SGI is highly questionable. The book value given to its collectibles might have been valid in a buoyant market, but now that sales are slow, the valuations may be way too high, we don't know. So I feel that hanging my hat on book value is particularly risky in this case.

So for me, the bad news looks far from over, hence I personally would not consider investing here at all, at least until the latest equity fundraising has been finalised. Even then the shares would have little attraction for me. If everything in inventories was written down to fire sale prices, and there was some equity left, at that point it might be worth a closer look.

For now though, I can't see any reason to get involved. The upside is uncertain, and the downside risks are currently unknown.

dotDigital (LON:DOTD)

Share price: 45.5p (down 5.7% today)

No. shares: 293.5m

Market cap: £133.5m

(at the time of writing, I hold a long position in this share)

Interim results to 31 Dec 2015 - these H1 figures look excellent to me.

Revenue up 28.6% to £12.9m

Profit before tax up 30.4% to £3.3m

Note that the tax rate seems low in this, and prior period - does anyone know why?

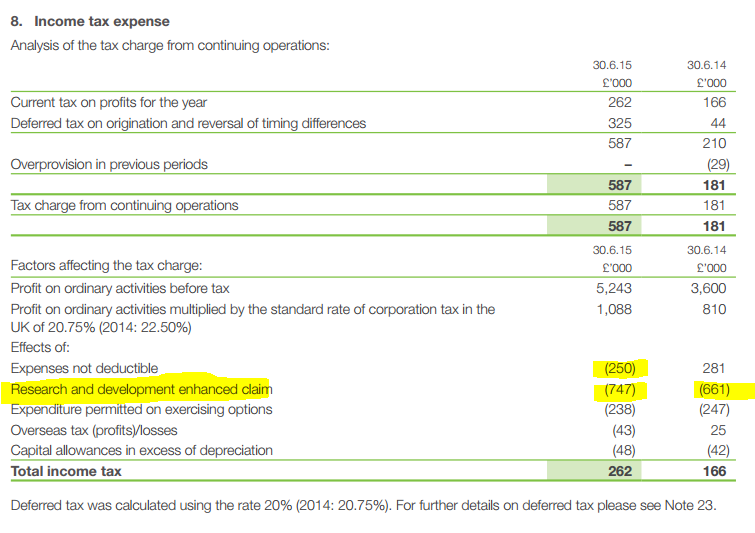

EDIT - I couldn't leave this hanging, so have checked back to the last Annual Report, and the main factor in DOTD's low tax charge seems to be R&D tax credits, see note 8 below;

Also note that I've found another casting error! The second one in a week.

The figures above for 2015 don't add up, and that's because the (250) figure highlighted above should actually be a positive, not a negative. If you recalculate it that way, the figures then add up. So more slapped wrists for the audit juniors here - you just can't seem to get audit juniors of the quality that we used to have in the early 1990s ;-)

Balance sheet - very strong, with cash constantly rising - net cash is now up to £14.8m, or 5.0p per share.

Note that, whilst the company does capitalise about £1.6m p.a. of costs into intangible assets (development spend presumably?), this is very similar to the depreciation/amortisation charge. Therefore, it looks a perfectly reasonable accounting treatment, as it does not exaggerate profitability.

Dividends - the company is strangely tight, paying only 0.36p last time, and there is no interim divi. Given how much cash the company has, I think it should rebase the divis at a much higher level, unless the Directors have other plans for the cash pile?

Outlook - this bit has knocked the share price slightly today, as brokers have trimmed their forecasts for 2016/17;

"The strategy of focusing on fast growing medium/light-enterprise businesses and Magento clients has driven average monthly spend up by 31%. This combined with a focus on longer term contracts and client retention is leading to notably higher client lifetime values.

H1 2016 will see a keen focus on developing a robust channel and reseller pipeline especially in support of our geographic ambitions in USA and APAC.

Based on the strong performance at the half year to 31 December 2015, the growing demand for marketing automation, the newly released product features and investment strategy, the Board remains confident of delivering strong growth, underlying profitability and increasing shareholder value for this year. The investments were slower than expected in 15/16 and therefore will lead to an increased EBITDA in the current year but will see a marginally slower revenue growth in 16/17. The long term outlook for dotdigital remains positive and we look forward to providing further progress at the time of our year end trading update in July 2016."

Valuation - FinnCap has an adj EPS forecast of 1,72p for this year, so at 45.5p the shares are rather expensive - that's a PER of 26.5 times. However, if we take off the 5p per share net cash, then the cash-neutral PER drops out at 23.5 times. That's high, but not outrageous for a rare situation of a company delivering strong organic growth, internationally too (not just UK).

Looking at 2016/17, EPS forecasts have been reduced by about 8% today, due to the slower than expected ramp up in selling overheads. This might possibly have something to do with disruption to management, with the CEO being unable to travel, after an operation in January? (the CFO has become interim CEO to cover for her whilst she convalesces, and the original CEO is coming in 1 day per week also).

Nevertheless, the 2016/17 forecast of 2.28p EPS is still a strong uplift on the current year forecast (a 32.6% EPS growth rate). Looking at PER for 2016/17, and stripping out the 5.0p per share of net cash again, it looks fine to me, at 17.8 (calculated as 45.5p share price, less 5.0p net cash, divided by 2.28p forecast EPS).

On this basis, I think the current share price stacks up.

My opinion - it's very rare to find strong, organic growth. When you do find it, and providing it looks sustainable, then it's worth paying up, in my view.

I'd say that DOTD shares look priced about right for now, but providing execution continues to be good, then I see plenty of scope for the shares to move usefully higher over the next say 2-3 years - that's my investing timescale here.

It would be good to see the company either use its cash pile for a sensible acquisition, or to pay much more generous divis. I'm not keen on companies hoarding cash for no particular reason.

Revenues here are sticky, being recurring monthly payments, mostly. So that gives smashing visibility of earnings, and a greatly reduced risk of a profit warning.

All in all then, a very nice company in my view. The shares are quite pricey, but for good reason. It's a nice long-term hold, in my view - providing nothing goes wrong, of course.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.