Good morning!

Fastjet (LON:FJET)

Share price: 43.8p (down 35% today)

No. shares: 66.4m

Market cap: £29.1m

Profit warning - and it's a bad one;

Based on current management forecasts, the Board expects results for 2016 to be materially below market expectations and the Group no longer expects to be cash flow positive for the year.

Did anyone believe the company's assertion in Dec 2015 that it would reach cashflow breakeven? I made it clear in my report here on 22 Dec 2015 that I was highly sceptical about this claim (although if true, then the shares might be worth a closer look).

This really is quite scandalous actually. You can't just tell the market that you're approaching cashflow breakeven, then retract it 3 months later, with some half-baked excuses about poor trading conditions that we've been given today;

Further to the operational update in December 2015, the challenging market conditions affecting much of the African aviation industry have been a lot more prolonged than management originally forecast.

Surely management should have been taking a prudent view in their forecasting, not assuming that market conditions would improve? Why did the NOMAD (Liberum Capital) approve the Dec 2015 RNS which gave an unrealistically rosy view? That will have cost some investors losses - since they will have relied on that upbeat statement to buy shares.

Action is being taken to stem the losses (stable doors spring to mind);

fastjet has already taken action to manage its operating costs and overheads and is implementing further measures including reducing capacity and rationalising the route network to align it with current demand.

It gets worse - the company might need to raise more cash;

The Board monitors the Company's cash position very carefully and with over $20m of cash available at the end of February 2016, and based on current forecasts, it has sufficient funds to meet its operational requirements. The Board may consider raising further funds during the year to provide additional headroom and ensure the Company has the necessary resources to fund future growth as market conditions improve.

So, it's got enough cash, but it hasn't, at the same time.

EGM requisition - Easy Group (12.6% shareholder) has requisitioned an EGM to get rid of the CEO & Company Secretary. That sounds a very sensible proposal to me.

My opinion - this is yet another jam tomorrow company that has gone disastrously wrong. Management clearly don't have any credibility, and the next fundraising could well be on very punitive terms, if they are able to raise any fresh money at all. So it seems madness to me, to continue holding these shares, when severe dilution may be on the way, potentially.

Fastjet has never managed to demonstrate a viable business model so far. I don't understand why people have poured so much money into it, on seemingly little more than hope that it might be able to create a viable business at some point in the future. It remains a complete bargepole stock for me.

If an airline can't make money now, with fuel so cheap, there's probably no hope.

Avingtrans (LON:AVG)

Share price: 144.5p (up 10.7% today)

No. shares: 27.7m

Market cap: £40.0m

(at the time of writing, I hold a long position in this share)

Many thanks to the reader who gave me a nudge to look at this aerospace group's interim accounts here on 18 Feb 2016, as it looked a good value situation. Although the shares are rather illiquid, so it's difficult to trade. I picked up a small position in the shares after digesting the accounts, and reading a positive broker note.

10-year contract with Rolls-Royce - this is a big contract that's been announced today;

Sigma Components, which forms Avingtrans PLC's aerospace division, has signed a ten year contract with Rolls-Royce valued at more than £75m to supply pipe assemblies for a range of engine programmes including the rapidly growing Trent XWB variants fitted to the Airbus A350.

A note from FinnCap this morning leaves forecasts unchanged, but comments that this contract gives increased visibility. I suppose it depends on what commercial terms have been agreed with RR, and how much profit AVG will make on the components they make, which of course is not disclosed.

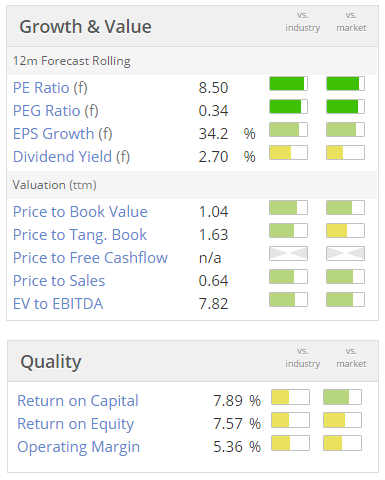

My opinion - this can be a troublesome sector, so it's one I usually avoid. However, Avingtrans does seem to be on a roll (and a royce!), and still looks good value against next year's forecast. A major new, long-term contract in the bag, looks to strengthen the case for this share.

Due to my reservations about the sector, and the illiquid nature of the share, I've only taken a small position here. So far, so good!

APC Technology (LON:APC)

Share price: 9.8p (up 26.5% today)

No. shares: 91.6m

Market cap: £9.0m

Strong order book - an upbeat-sounding announcement from this electronics distributor. Also an experienced-sounding CFO has been appointed.

Looking back at the last set of accounts, they're pretty bad. The balance sheet is weak too, although note that a small Placing was done at 6p last month.

My opinion - performance has been erratic in the past, and it's difficult to see any attraction in the shares based on those historic numbers. With a stronger order book announced today, maybe things are improving now? It's not for me.

Cambria Automobiles (LON:CAMB)

Share price: 80.8p (up 2.3% today)

No. shares: 100.0m

Market cap: £80.8m

Trading update - a very good update today from this growing car dealership chain;

Trading in the first five months of the financial year has been substantially ahead of the corresponding period in 2014/15 on both a total and like-for-like basis.

New vehicle unit sales were up 3.8% (like-for-like down 1.2%) and gross profit per retail unit continued to improve year on year. Used vehicle sales also performed well, with unit sales 4.3% (like-for-like 2.3%) ahead of the same period in the prior year. Gross profit per unit continued to increase and this performance further enhances the profit derived from the used car segment of the business. Growth in the Group's aftersales operations has also continued, with profitability up by 4.1% year-on-year (like-for like flat).

In fairness, brokers were already forecasting a substantial increase in both turnover, and profits, due to new sites acquired. No mention is made in today's update of performance versus market expectations, therefore I assume the company is trading in line. So today's news is really price-neutral, providing reassurance, rather than increasing expectations.

My opinion - I like this company, and was very impressed with the entrepreneurial flair of its CEO at a presentation some time ago.

Based on expectations of 7.9p, the PER is currently just over 10. There is also the reassurance of a solid balance sheet with lots of freeholds.

A word of caution though. New car sales are artificially high at the moment, due to the distortions created by ultra-low interest rates. Whilst dealerships make money from used car sales, and servicing too, with the macro factors currently in play, we should be valuing these companies on a low PER.

Therefore where's the upside? I think it's very unlikely that the PER will rise above 10, and earnings may be at or near a cyclical peak. What happens if/when the next credit tightening cycle occurs? Therefore the whole sector doesn't appeal to me at all. Although CAMB is certainly one of the best in the sector, in my view. There is takeover potential too, as I think consolidation is likely at some point.

Trying to guess what will happen with macro factors can be very difficult. Maybe interest rates will stay low forever? So there's also a case for just ignoring macro stuff, and concentrating on the value here. A StockRank of 98 appeals too.

Telit Communications (LON:TCM)

Share price: 225p (up 7.3% today)

No. shares: 114.8m

Market cap: £ 258.3m

Background - I last looked at this maker of modules for internet of things applications (a very trendy sector at the moment) here on 6 Nov 2015, and didn't like it one bit. The profits largely come from capitalising a ton of costs onto the balance sheet. Also it has other red flags, including simultaneously having cash and bank loans.

I've been asked to look at the 2015 results, published today;

Results y/e 31 Dec 2015 - it's just more of the same. The apparently impressive P&L is achieved by diverting loads of internal costs onto the balance sheet. That may be allowable, but it's creating bogus profit the way I look at things. So for me, the adjusted EBIT of $30.6m is fiction. Reality is cashflow, consider the figures below;

Post-tax operating cashflow was positive at $41.2m, very impressive. However, investing activities used up the bulk of that, $35.3m, of which the largest part ($26.1m) is capitalised development spending. That's allowable as an accounting treatment, but you'd be a complete fool to value the business on a multiple of its reported profits, when so much of its internal costs are by-passing the P&L.

The narrative does however address this point, and offers jam tomorrow;

"After several years of making acquisitions and high R&D investment, we are now in a position to scale the business and benefit from our operational leverage, and as such, we will continue to reduce R&D, Sales and Marketing and G&A costs as a

percentage of revenue.

"As these cost elements reduce as a percentage of revenue and we continue to scale, we also anticipate that the business will start to generate significant free cash flows.

I'll believe it when I see it!

Dividends - there aren't any, as you would expect from a business that doesn't generate much free cashflow.

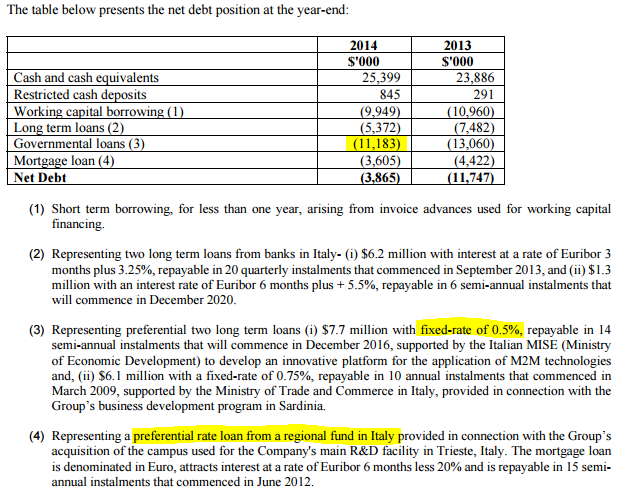

Balance sheet - another red flag is that the group reports cash of $29.8m, but simultaneously has $28.8m of loans. How very odd! I've done a bit of digging, and actually there appears to be a reasonable explanation for this, or at least some of it.

Looking at the 2014 Annual Report, a breakdown is given of the net cash position, and note that some of the loans (from Italy) are at very low interest rates, hence I can see why the company would not necessarily want to pay off these loans with its cash pile.

My opinion - this group is certainly operating in an interesting sector, and with more & more devices (cars, and progressively smaller things too) becoming internet connected, then I can see why investors might like this as an investment theme.

Telit doesn't really make much proper profit though, once R&D spending is taken into account. I like to see high profit margins, indicating pricing power, but that's not the case here. So perhaps it's just a generic maker of product which could be sourced from many other companies, and might be subject to downward pricing pressure over time? I don't know, am just asking the question.

The company mentions falling selling prices in the narrative today, saying this is driving growth. Fair enough, but it is also squeezing margins for manufacturers, unless they are able to drive out cost at an equal or greater pace;

The report, which was published in June 2015, projects an average selling price decline for the period 2015-20 of 5% CAGR for 2G modules, 5% CAGR for WCDMA/HSPA (3G), 9% for LTE multi-mode (4G) and 14% for LTE single-mode (4G), this trend of declining prices is fuelling the growth of the industry.

Overall, I'm not terrible keen on this one. Once it starts making proper cashflows, and paying divis, then it might be of more interest.

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.