Good morning!

Late reports from last week

It was a busy weekend for me, with 3 SCVRs to write, in order to catch up, which I've done as follows;

Mon 14 Mar - 2 interesting companies dissected, TUNE & GOAL

Tue 15 Mar - mainly FCCN, but brief comments on: ZTF, PEG, SAT & BGO

Fri 18 Mar - RBN, IDEA & HCL (delisting)

Also, just to clarify, these reports are free. They're not part of the Stockopedia subscription. I work 52 weeks per year, as such the arrangement I have with Stockopedia is that I can take the occasional duvet day. So there will be a report here most days, but not every day. Duvet days are usually days where there's very little news of interest, as I check this on my iPad at 7am each day.

Furthermore, I don't commit to covering all companies - over 500 in my universe would be ridiculous for one person to cover comprehensively. So each day I select what look to me the most interesting results & trading updates, with a particular focus on profit warnings, and any other unexpectedly good or bad news. That's the stuff which is most interesting to investors, and where I can add value by untangling things. I'm not going to waste my, or your time writing a dreary article about in line results - that doesn't add any value at all.

If a report is late, then I catch up later. Sometimes reports will be finished by 1pm, when the email goes out, often they're not, and I carry on updating the article during the afternoon/evening. So it's always worth refreshing the page later in the day. I Tweet if an evening update is done.

You might feel that the above sounds unprofessional, but I've found it's the only way I can maintain a 52-week per year service on my own. You can't keep your foot to the floor permanently, or you'll burn out. Also, I'm a freelance writer, not an employee, so it's designed to be flexible.

I hope that clarifies things for anyone who required clarification - although most people seemed to have already worked it out & be perfectly happy.

Interviews

I recorded another (very long!) investor interview over the weekend, with renowned investor/trader Richard Crow, that is also available free, on my ad-free website here.

I hope people find it interesting, I certainly did - Richard is always full of interesting insights and stock ideas, and he's got an outstanding investing track record, as indeed do all the people I interview - that's a prerequisite to me wanting to record an interview.

accesso Technology (LON:ACSO)

(at the time of writing, I hold a long position in this share)

I'm interviewing the CEO, Tom Burnet, of Accesso tomorrow afternoon. Therefore if you wish to submit a question (I've only had a few so far, so more are needed please) for me to ask him, then please use this form to do so.

On to today's news

Tungsten (LON:TUNG)

Share price: 56.5p (up 4.8% today)

No. shares: 126.1m

Market cap: £71.2m

Edi Truell resigns - the founder has stepped down from the Board, although he was only in a Non-Exec role more recently anyway.

I like the slightly barbed comment from the company;

"The Board of Tungsten would like to thank Edi for his significant contribution to the creation of Tungsten."

So in other words, they're not thanking him for his contribution since the creation of the company. I don't blame them, he's been a loose cannon who ramped the shares ridiculously high on promises of billions & trillions, that have conspicuously failed to appear in reality.

Former shareholders (including myself) were taken in by Truell, and lost money on this share as a result. So he gets a parting V-sign from me, and I'm sure many others. as he disappears into the sunset.

Also there is a separate announcement today, where the Board slaps down Truell's attempts to take the company private.

Response to press speculation - this is worth repeating in full, as it's a glorious slap down for Truell;

The Board of Tungsten Corporation Plc ("Tungsten") notes the recent media speculation in relation to Edmund Truell ("Mr. Truell") and his purported offer for Tungsten assets and wishes to provide a clarificatory response.

Mr. Truell ceased to be CEO in July 2015 following a very difficult period for the company and we have today announced his resignation from the board. Since July 2015, Mr. Truell has made a number of suggestions in relation to combining operating businesses owned by Tungsten with other businesses in which he has an interest, including Tantalum, a vehicle telematics business.

The Board received an outline of a new transaction structure from Mr. Truell on Saturday 19th March 2016 which, like its predecessors, did not involve an offer for Tungsten's shares but instead suggested that Tungsten's network business and the cash it expects to receive from the proposed sale of its bank be combined with certain assets in which he has a majority interest in, including Tantalum.

The resulting effect of this conceived combination would be that Tungsten's primary asset would be a minority stake in an enlarged group of disparate, illiquid assets controlled by Mr. Truell and Tungsten itself would be transformed into an investment vehicle. The Board of Tungsten has spent considerable time reviewing these suggestions, including the most recent proposal, and found them to date to be universally without merit for shareholders. [ouch!!]

The Board believes it has made significant progress in addressing the challenges facing Tungsten and now believes that the Group strategy as set out at Tungsten's Capital Markets Day on 9 February 2016 remains the best and most certain path to maximise the creation of shareholder value.

The Board's priority is to oversee the effective execution of this strategy under the leadership of Richard M. Hurwitz, Chief Executive Officer, and his executive management team; it believes that distractions from that risk destroying value. [ouch again!]

Translation: bugger off, and stop wasting our time.

My opinion - Tungsten has an appalling track record, but with the cash it expects to receive from the sale of its bank, there should be enough in the kitty to have a decent stab at making it work.

So it's not a completely ridiculous punt at the current valuation. Although, whilst 56.5p per share might seem cheap relative to the previous share price highs of 300-400p, it's important not to anchor ourselves to what was in reality, a totally spurious former high, built on unrealistic assumptions about performance.

£ 71.2m is a fairly chunky valuation for a business that has yet to demonstrate anything near a viable business model. Sure it has cash, but how long will that last? I'm keeping this on the speculative watch list, but for me there needs to be unambiguous progress in the financial statements, and a clear path to profitability, before I would get involved again.

Brady (LON:BRY)

Share price: 51p (down 9.7% today)

No. shares: 83.0m

Market cap: £42.3m

I've been highly critical of this software company in the past, because it warned on profit last autumn, only a couple of months after saying everything was fine. The company got in touch through an adviser, and asked if they could have a right to reply. So I recorded an interview with Brady's unflappable CEO, Gavin Lavelle here on 21 Dec 2015.

I think he gave good answers, to some quite tough questions submitted by readers, and hats off to him for facing the music after things had gone wrong. I listened back to the interview last week with a friend, and we agreed that the company's big problem is that it has limited earnings visibility - since profit is heavily dependent on Q4 licence wins/renewals. Although about half turnover is recurring, so there is some stability there.

I don't currently hold this share, having cut them in a general pruning of my portfolio during wobbly market conditions in Jan-Feb 2016, as mentioned in previous reports - I tend to chuck out my lowest conviction long positions when the market goes wobbly - you have to when using gearing.

Results y/e 31 Dec 2015 - the reaction of the share price is obviously the first thing to look at - and being down nearly 10% today, clearly these results/outlook have not impressed.

I'm a bit confused, because in Jan 2016 the company reassured that it was on track to meet lowered expectations. So I've got an EPS forecast of 2.47p. But the actual result is adj. EPS of 0.98p, well below expectations.

EDIT - Many thanks to Charlie, who emailed me the most recent broker notes, and pointed out that the adj. EPS of 0.98p reported today actually exceeds the revised expectations - N+1 Singer were forecasting 0.6p adj. EPS after the profit warning. So it looks as if the broker consensus figure I used above hadn't updated for the most recent forecasts, so mystery solved, and my apologies for any confusion. The results are indeed slightly ahead of revised forecasts. Am happy to correct this point - if ever any factual points are incorrect, do let me know, as I want to get things 100% accurate.

The company was loss-making in statutory (i.e. before adjustments) terms, with a pre-tax, pre-exceptional loss of £ 928k for the year. Exceptionals of £ 469k took that to a £ 1,397k loss. Not great, but that's what happens when you have a semi-fixed cost base, but get a significant part of turnover from licence wins. It's bound to cause erratic performance, if licence revenue doesn't do what you expect it to do. It's precisely this problem which has motivated many software companies to move over to a SaaS revenue model, to reduce or eliminate dependence on lumpy revenue from licence wins.

Dividends - the company has suspended divis to "maintain our strong balance sheet", a policy which, "...will be reviewed as the commodity markets recover...". This seems unexpected bad news, as broker consensus is for a 2p dividend. This brings a good track record on growing divis to a shuddering halt.

Outlook - cost-cutting was done late in 2015, so that should provide a springboard for higher profits in future;

The impact of the restructuring of costs achieved in 2015 together with tight control of ongoing costs should result in significantly higher profitability in 2016 and beyond.

Although the overall market outlook remains uncertain, the Board is confident that Brady will continue to take market share demonstrated by its ability to sign and deliver increasingly large contracts with global leaders and its strong list of referenceable customers who already rely on Brady systems to run their businesses.

Brady operates in a large, global market: everybody on the planet is reliant on commodities and energy; the recycling market is growing strongly; and Brady continues to be well placed for profitable growth.

Balance sheet - NAV is £ 29.5m, but as you would expect from a software company, intangibles dominate the picture. Strip out those, and NTAV is slightly negative, at -£ 355k. So much for the claimed strong balance sheet! If the balance sheet really was strong, then the dividend wouldn't have been passed, would it?

That said, the cash position looks fine at 31 Dec 2015, with £6.6m in the bank, although that's mainly come from customer up-front payments (which are recorded as a corresponding credit, deferred income of £5.4m). The year end tends to be a seasonal high for deferred income with most companies, so the cash position is probably lower at other times of the year.

Note also the £ 2.2m pension deficit, that would need checking out.

My opinion - the upside case is that costs have been cut significantly, so 2016 should perform well. Also, as commodity markets recover, then the macro picture could turn from a headwind into a tailwind.

Overall though, I'm spooked by the limited earnings visibility, due to reliance on licence wins, and that the company really has no idea how much profit it will make until the end of the year. So how on earth are we supposed to value the shares? With no dividend now either, I'm struggling to find a reason to invest here.

Buying the shares really is a leap of faith, backing management to deliver better results this year, which they should do, due to cost-cutting. Is it worth £42.3m market cap though? Who knows, it's impossible to say really, as we don't know what profit it's likely to produce, you just have to make an informed guess. I don't know how to value it, given that you can't really rely on broker forecasts as being anywhere near accurate.

FW Thorpe (LON:TFW)

Share price: 235p (up 6.9% today)

No. shares: 115.7m

Market cap: £ 271.9m

Interim results to 31 Dec 2015 - this family-run lighting company put a slight question mark over things in Nov 2015, which I reported on here, when it reported a, "mild softening in some of our markets, with others faring well". Overall it predicted a "satisfactory result" for the current year.

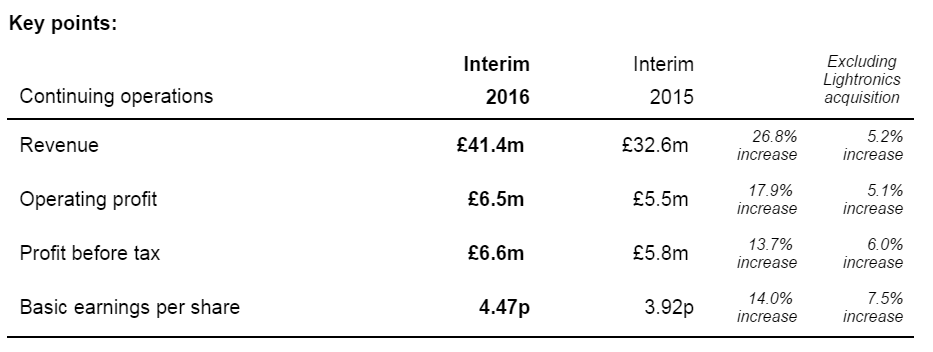

Interim figures look good to me. The headline numbers below are boosted by the acquisition of Lightronics in Apr 2015, which today Thorpes confirms is trading ahead of expectations (driven by one-off projects).

The organic growth figures are more modest, but still good (or as the company itself describes growth today, "solid rather than outstanding" - organic revenues & operating profit both up just over 5%.

Balance sheet - almost embarrassingly strong! NTAV is £ 70.9m, which includes cash & deposits of £ 34.2m, or nearly 30p per share. As we have seen, this gives the group scope to make acquisitions which boost earnings. So it's an additional asset to value on top of the usual PER multiple basis of valuation, in my view.

Outlook - this group has a track record of trying to keep expectations grounded, so this is nothing to worry about;

The first half of the 2015/16 year has been driven by exceptional performance of Lightronics BV and marked further progress at TRT Lighting our road tunnel and street lighting systems manufacturer. Your Group continues to strive for growth and the Board is cautiously optimistic about the rest of the financial year.

So they should do alright this year, I reckon.

Dividends - The interim divi has been increased by 9% to 1.2p, and a special dividend of 2p will be paid at the same time. It seems strange to me that, when the company is swimming in cash, management are so tight with the divis.

Valuation - I can't find any broker forecasts. However, it looks set to do perhaps 11-12p EPS this year. That means the shares are pretty fully priced, at a PER of around 20. Take off the surplus cash, and that comes down to about 17. That looks about the right price to me.

My opinion - this seems such a well-run business, making sensible acquisitions, and with a great long-term track record. It also has a fantastic balance sheet, so I like it a lot.

The current valuation looks about right, I think it's important not to chase up good quality companies onto toppy valuations. A PER of 17-20, depending on how you work it out, is high enough in my view - so no obvious valuation anomaly (high or low) at the moment, but I bet this company will probably do well long term. It's one of my favourite traditional type of company.

K3 Business Technology (LON:KBT)

Share price: 345p (down 2.1% today)

No. shares: 31.9m

Market cap: £ 110.1m

Interim results to 31 Dec 2015 - I've had a quick skim over these numbers, which look pretty good at the P&L level, as previously indicated in trading updates. So the figures are in line with expectations.

As before, my reservations with this company surround its still rather weak balance sheet - NTAV is negative at -£ 8.1m.

Also, looking at the cashflow statement, it's not really generating much free cashflow. So in H1, net cash generated from operating activities was £ 4.4m, but then £ 2.2m of development spend was capitalised - so half of cashflow.

This lack of decent cashflow generation is reflected in the miserly dividend yield of 0.5%.

My opinion - overall, I can't get comfortable with this company, and given that the shares have had a good run in the last year, won't dwell any further on it.

A few quick snippets before I set off for Mello Beckenham, where Lakehouse (LON:LAKE) are presenting tonight;

Earthport (LON:EPO) - another set of diabolical figures from this joke company. Even though the shares have been collapsing, it's still valued at about £130m! Total madness, multi-year madness. Losses have gone up, to £ 5.6m in just H1. The company has plenty of cash in the bank, as people keep wanting to pour money down the drain - i.e. buying new Earthport shares. When this one finally does collapse, it will be one of the longest-running farces on the London market.

YouGov (LON:YOU) - the same as usual. They're stuffing costs onto the balance sheet, in order to inflate the adjusted EPS, which has come in at 3.4p (up from 2.6p prior year). I feel that the statutory EPS figure is the more reliable one, which is 1.2p in H1.

The shares remain very significantly over-valued, in my opinion.

Brainjuicer & NetPlay - sorry I've run out of time. Will look at these another time.

Pittards (LON:PTD) - results were not too bad - it's still profitable, in a bad year. However the issue remains of a highly inefficient balance sheet, stuffed full of inventories, financed partly through bank loans. The company does however now own the freehold to its main site in Devon.

All done for today. See you tomorrow, if not at Mello Beckenham tonight!

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.