Good morning!

Brexit impact

This is probably the most important issue of the moment, determining what shares are worth, so I will continue to focus closely on what is happening. Here is a link to search for companies mentioning "referendum" in their RNSs. It's very useful - take a look.

I'm increasingly coming round to the view that most sectors are gradually getting back to business as usual, post Brexit. That's not to say it won't have some impact, but evidence is mounting that we're not heading for any imminent catastrophe.

An example - one of America's largest banks, Well Fargo, has just agreed to buy an 11-storey London office building for c.£300m. That's surely a good endorsement of their perception of London remaining a major international finance centre. Also, of course the weakness of sterling just made everything a good deal cheaper for American (and other overseas) buyers.

In a similar vein, an update from British Land (LON:BLND) yesterday was reasonably reassuring. There's an article in The Times today, pointing out that BLND has very low leverage now - LTV of only about 30%, its properties are 99% let on longish leases (so fixed rents), and the shares are at a deep discount to NAV. So the market is perhaps pricing-in too much of a downturn? Who knows, time will tell. I'm tempted to dabble though, as the discount to NAV should reduce if confidence returns.

Currencies

Sterling is doing exactly what floating exchange rates are supposed to do - i.e. when a country has some kind of economic shock, then its currency devalues. That makes it more competitive, and attracts inward investment, which enables the economy to recover. Although it also pushes inflation upwards, due to the higher cost of imported goods.

So if the currency devalues too much, then it can trigger a vicious circle of hyper-inflation, and collapse of the currency. So a controlled devaluation is good, whereas a massive & disorderly devaluation is bad. A bit of inflation also helps inflate away Govt & consumer debt of course, which is handy.

We've seen the fall in sterling attracting inward investment this week, not only with the property purchase mentioned above, but also with the arguably opportunistic Japanese takeover bid for ARM Holdings (LON:ARM) - again it's the devaluation of sterling which made it more attractive as a takeover target. So Remain claims that inward investment into the UK would dry up, already seem to be very much wide of the mark. Although I suppose it depends what type of inward investment we're talking about?

Eurozone

The reason I believe the single currency Eurozone is doomed to eventual failure, is because it doesn't have a mechanism whereby countries can devalue in hard times, to stimulate economic recovery. Instead, countries like Greece, Portugal and Italy, are locked into an uncompetitive exchange rate, and permanent economic doldrums. That makes debt impossible to repay of course, so eventual debt default & falling out of the Eurozone looks the only solution, long term.

Meanwhile Germany continues to benefit from an artificially low exchange rate, which stimulates its export-led industry. Yet Germany refuses to make the substantial transfer payments to the South of Europe, which it should be paying out of its bumper profits. The status quo is not going to work long-term. You can't have monetary union without political union, and transfer payments from rich to poor parts of the currency union.

We haven't had a Eurozone crisis for a while, but there's no doubt in my mind that another one is looming. The pattern is depressingly familiar - deals are only struck right at the last minute, when the financial system is teetering on the brink of collapse.

As usual, the above is just my personal view on things. You might see things differently, which is fine, that's what makes a market!

Ricardo (LON:RCDO)

Share price: 760p (up 0.3% today)

No. shares: 52.9m

Market cap: £402.0m

Trading update - this company's description of its activities is as clear as mud, so I don't really understand what it actually does. It appears to be some sort of consultancy & engineering activities mainly serving the automotive sector.

Ricardo is based not far from Brighton, so I wonder if we could entice management to come along to the ShareSoc Brighton meeting in September, to give a presentation?

The shares have looked rather pricey when I've looked at it before, although the excellent track record of growing profits, and fairly good quality scores, are clearly the reason for that. You have to pay up for quality companies, usually.

Note that the company has a 30 June year end, so this is a full year update, and it's in line with expectations;

We expect profit performance for the year to be in line with our expectations and the business is well positioned as we enter the new financial year.

The immediate outlook sounds good, with a strong order book;

Further to the trading update of 19 May 2016, overall customer activity in the last two months has been positive leading to a strong year-end order book and a good pipeline across multiple geographies and different business segments...

Brexit comments are also reassuring, confirming my view that good quality companies with a decent geographic spread of sales are generally shrugging off Brexit worries;

The vote by the United Kingdom to leave the EU has clearly caused some uncertainty within the wider market and we continue to monitor the situation carefully however do not expect it to have any significant impact on our performance.

The diversification and international spread of our customers and operations is helpful and we have had confirmation that the recently awarded EU research funding through the Horizon 2020 framework will remain in place.

Valuation - bear in mind that it does have some debt, and an £18.5m pension deficit.

Taking those into account, I reckon the current valuation is probably about right. That said, this company has often attracted a premium valuation, so there could be further upside on the shares maybe, providing nothing goes wrong?

My opinion - overall, I like it. It's tempting to just buy a few, tuck them away, and forget about them for 5 years. The price will probably be a good bit higher then.

However, 5 years is a long time, and things can go wrong even at the best companies. I like a bargain, so am more inclined to put this share on my "buy on a profit warning, or general market sell-off" list.

Entu (UK) (LON:ENTU)

Share price: 39.5p (down 27.5% today)

No. shares: 100.0m

Market cap: £39.5m

(for the avoidance of doubt, I no longer have a long position in this share)

Interim results to 30 Apr 2016 - not good I'm afraid. Personally I ditched my Entu shares, at a loss, a little while ago, because it struck me that big ticket consumer items could possibly be deferred, in a time of economic uncertainty.

This share has always looked great value, but I'm afraid it now appears that it was cheap for a reason. The company's relatively short (since Oct 2014) history as a listed share, has really been one of serial disappointments.

Key points (remember these are only 6 month figures);

Turnover up 11.6% to £51.2m

Profit before tax (on continuing operations) has collapsed by 75% to £1,047k - clearly a very poor result

Discontinued operations (the solar division) is an additional loss of £509k, but here's the strange thing - the company seems to have moved over its overheads (presumably mainly salespeople?) from the solar division to its home improvement division. They say this has had a £2m impact on H1 profit, and will have a £3.5m impact on full year profits.

Although looking at the quote below, it sounds more as if the solar division was absorbing some central overheads, which now have to be absorbed by the other divisions;

Reported gross profit and reported EBITDA are both lower due to a number of non-recurring items and EBITDA is also impacted by £1.4m of central overheads charged formerly to the discontinued operations, but covered by our continuing operations in the first half of 2015/16. As noted in the Chief Executive's Statement, decisive actions have now been taken to remove cost from the business. A reconciliation between underlying and reported results is set out at Note 16.

Therefore, the fall in profits does not look like a temporary factor, it's a real underlying fall in profits.

Cost-cutting is necessary to restore profits, clearly. This action has been taken, as follows;

It's been a challenging year and, whilst we have taken decisive action to reduce the central overheads formerly charged to the discontinued Solar business (£4.0m annualised), the timing of our actions means we will carry approximately £3.5m of this cost in this financial year. As result of this, and despite the momentum we built in the core business in the second quarter, full year outturn will be below market expectations.

Dividends - the interim divi has been slashed from 2.67p last year, to just 0.5p this year.

Balance sheet - there's not much on the balance sheet, other than trade debtors, and trade creditors. It has no cash, but negligible interest-bearing debt, of £891k.

Outlook - there's some hope here;

Home improvements business performed well overall with record order book at the end of H1 and full FCA authorisations secured.

However, it's not enough to salvage 2016 results;

Full year outturn will be below market expectations.

Brexit - doesn't sound as if it's having much, if any impact so far;

We have also refocussed our strategy, restructured our business and reorganised our senior team. There is still work to do, and the long term impact of Brexit is as yet unknown, but focus in the second half will be on improving returns in the core home improvements business and continuing to drive efficiencies to position the business for growth in 2017."

My opinion - I'm not surprised the results are poor, hence why I ditched my shares. Given that this company has messed up before, there was a high likelihood of some more excuses for under-performance.

To be fair though, the Govt's sudden change in policy on solar feed-in tariffs was a bolt from the blue, killing that part of the business stone-dead. What concerns me though, is that the solar division appears to have been flattering overall group results. Now it's gone, the remaining business doesn't look very good.

Cost-cutting should straighten that out, so the outlook for 2017 could be one for recovery. At some point I might revisit this as a possible 2017 turnaround, but overall I feel management credibility is now pretty much gone. So I might just put this one down to experience, and forget about it.

Sorry if my previous bullishness on this share influenced readers, and my apologies if you lost money on this. Whilst I never give recommendations, nor buy/sell advice, I do understand that my posts can influence reader views on things. Over the longer term, I tend to get about 60% right, and 40% wrong, which gives a very satisfactory overall result. So always bear that in mind! There's no substitute for DYOR. Unfortunately, ENTU was part of the 40%. There we go.

Safestyle UK (LON:SFE)

Share price: 245p (up 4% today)

No. shares: 82.8m

Market cap: £202.9m

Half year trading update - in stark contrast to its smaller competitor mentioned above (Entu), Safestyle has reported a sparkling update today. This covers the 6m to 30 Jun 2016;

Since our last trading statement at our AGM on 19 May 2016, the Company has continued to trade in line with our enhanced expectations for the current year. Order intake in the first half was up 19.7% on prior year, which is expected to deliver H1 sales revenue of £83.5 million, an increase of 12.8% (H1 2015: £74.0 million). FENSA statistics show that we have increased our market share year on year to 10.0% from 9.5%.

During the first half of the year our order book increased significantly and we will benefit from a controlled release of some of this increase in the second half.

Profits are turning into cash too;

Cash flow has continued to be strong and we had net cash of £23.6 million at 30 June 2016 (30 June 2015: £14.9 million).

Brexit comments are very encouraging, both for this company, but also as evidence that consumer confidence appears to be holding up well;

We are very pleased with our performance in the first half of this year. Whilst the longer term impact of the referendum decision on the broader economy remains to be seen, there has been no short term detrimental effect on our order intake.

So, another example of it being business as usual, for good quality companies.

Outlook - for the full year is in line, and I like the bit about out-performing the market;

The Company has a proven successful model, with a growth strategy underpinned by a combination of our expanded product range, attractive promotional finance package, continued geographic expansion and financial strength. As a result, the Board remains confident in our ability to continue to outperform the market and achieve full year results in line with management expectations."

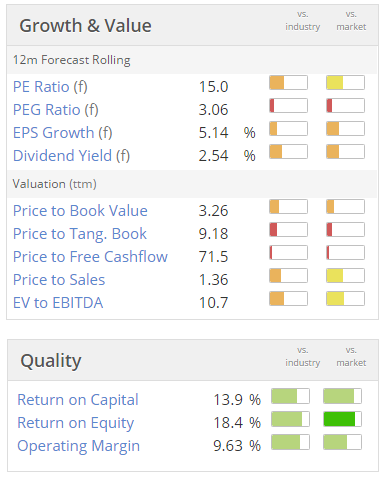

Valuation - the valuation, growth, and quality scores all look pretty good here, and there's a nice divi too. Although bear in mind that this type of business is cyclical, and vulnerable to rising interest rates and possibly weakening consumer confidence;

My opinion - Safestyle is clearly doing something right, that Entu is clearly not doing.

However, a lot of the difference might be their business models. Entu gives away some margin to its sister company, Epwin (LON:EPWN) (which manufactures the double glazing for it). A cynic said to me that splitting Epwin & Entu into 2 companies, and floating them both, could have been an exercise in maximising the overall sale price for the vendors!

With affluent baby boomers, and ultra low interest rates likely to persist for some time, and apparently little to no impact from Brexit so far, it seems likely that Safestyle may continue forging ahead for some time to come.

Staffline (LON:STAF)

(at the time of writing, I hold a long position in this share)

Private investor presentation - an excellent initiative here from Staffline - the company is inviting private investors to a results presentation in London, at Buchanan's offices.

I'd really like to see more companies & PR companies arranging results presentations for private investors too. They do numerous results meetings for institutional shareholders, and brokers, so why not tack on an extra meeting for PIs too?

Here are the details if you fancy going along (I'll try to make it, but am on the reserve list at the moment). We get fed too!

The presentation will take place at 1.30pm at the offices of Buchanan, 107 Cheapside, EC2V 6DN and a lunch will be provided.

Admittance is strictly limited to those who register their attendance for the event. To register for the event, please contact Buchanan on 020 7466 5000 or staffline@buchanan.uk.com.

So bravo for this initiative, so let's have more of these from lots more companies please!

I'm running out of time, so a few quick comments before I finish;

Pennant International (LON:PEN) (I hold a long position in this share) - says it's expanding, so has taken on some additional premises. Augurs well. The market likes this, and the shares are up 5% today to 58.5p - recovering nicely from recent setbacks.

Ideagen (LON:IDEA) - good results out today. A few comments;

- 10% organic growth is positive.

- Total revenue growth +52%, due mainly to acquisitions.

- Share based payments look rather high at £936k.

- Adjusted diluted EPS up 26% to 2.66p, so a PER of 20.7 at 55p per share - hardly a bargain.

- Net cash of £6.3m.

- Note that it capitalised £1.6m of development spend onto balance sheet.

- Tax credit boosts EPS.

Outlook comments sound positive;

The market for GRC management solutions remains fragmented and the drivers are long term and highly strategic. Trading since the year end has remained robust. Whilst we remain alert to prevailing economic and political conditions we have a strong presence in a variety of different markets across the globe, which, together with the high levels of recurring revenues and repeat business derived from our 2,200 customer base, provides me with confidence in the future prospects for the Group.

Brady (LON:BRY) - trading update for H1 to 30 Jun 2016.

- In line with expectations

- Revenue up 4%

- Returned to profit due to cost-cutting

- Forex movements are a net overall positive

- Net cash over £6m

- Cenkos forecast 3.2p EPS for 2016, and 3.3p for 2017. So at 68p per share, it's looking expensive on a PER basis

- Shares only attractive if you use some other valuation metric! Or if you think it could out-perform forecasts

- Commodities markets improved somewhat this year, which may help

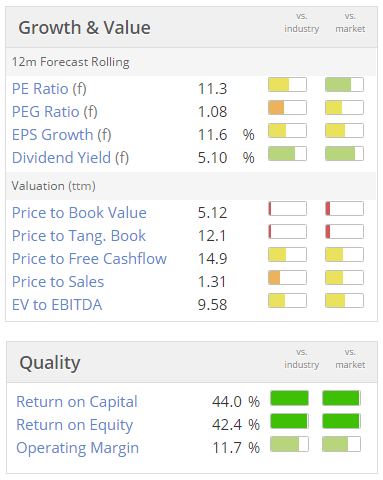

Gateley Holdings (LON:GTLY) - results for y/e 30 Apr 2016 look good to me.

- EPS a whisker above forecast, at 8.98p

- PER is about 12, at 108p per share

- Good divis - yield is about 6%

- High profit margin - good quality business

- Positive outlook comments

- BUT - very high debtors on balance sheet unnerves me. Probably unavoidable due to sector it operates in - W-in-P builds up, then jobs invoiced when complete.

- Cashflow looks genuine.

- I wonder how variable the cost base is? That's key to maintaining profit in a downturn.

- Seems to have a good spread of activities.

- Looks a proper legal firm, not just ambulance chasers.

- Overall - I quite like it, might be worth a deeper look.

DP Poland (LON:DPP) - market going crazy over its strong LFL sales (up 28%), but ignoring the fact that it will still be heavily loss-making! Market cap is nearly £60m, which is complete insanity. Massively over-valued.

Punters likely to get a rude awakening when next set of results come out, and they realise what a tiny, and still heavily loss-making business it is.

If you want to punt on a retail roll-out, choose a decent one, like Crawshaw (LON:CRAW) or Patisserie Holdings (LON:CAKE) . This one is garbage, in my view, and horrendously over-valued.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.