Good morning!

It's starting to feel like a bull market again, with some remarkable recoveries in share prices from the recent Brexit sell-off. This is probably because most companies reporting seem to be dumbfounding the doomsters, and saying that it's pretty much business as usual.

Although we should also bear in mind that economic downturns happen gradually, and then feed on themselves, so we could have a deterioration yet to come. I have been pondering the recent comments from Victoria (LON:VCP) (in which I hold a long position), saying that the impact of Brexit is positive for them - mainly due to weaker sterling.

This got me thinking - we don't have to buy or hold the entire market. We can & should cherry-pick. So based on reports from many companies in the last month, at the moment I'm looking for bombed out shares with the following favourable characteristics;

Dollar earnings - or a broad spread of international earnings, which insulates (or benefits from) translation into weaker sterling. E.g. Empresaria (LON:EMR) , or 4imprint (LON:FOUR) .

Exporters - companies based in the UK which export a lot of product - they just got a lot more competitive (although bear in mind that any imported raw materials they use will also rise in price).

Import substitution - UK vendors of products, which are benefiting from weaker sterling, and can steal market share from imports - e.g. Victoria (LON:VCP)

Hospitality - forex movements, and terrorism means more people holidaying in the UK. Also there is some evidence that UK consumers want to do more things, rather than buying more stuff. Pub groups have been reporting good sales recently.

Defensive - anything non-cyclical, or counter-cyclical is worth considering, if it's cheap, and you think there's a recession coming (personally I'm not convinced there necessarily will be a recession, but we'll have to see).

Growth companies, particularly small caps, which have found an exciting niche, tend to carry on doing well, even in an economic downturn. So I'm thinking here about successful, rapidly growing e-commerce businesses, for example Boohoo.Com (LON:BOO) (in which I hold a long position).

Oversold - companies which are trading well, and have stated a positive outlook recently, but where the share price has been battered well below what seems sensible - a good example of that is I think Staffline (LON:STAF) (in which I hold a long position)

That's not an exhaustive list, but I think it provides some interesting areas to focus on, if you think the UK economy is likely to contract.

Of course, if the UK economy does better than expected, then sterling could recover against the dollar, and the opportunities above would then reverse! So it pays to stay vigilant, because things can change rapidly as the market anticipates likely economic changes, and re-prices everything very quickly these days. E.g. look at the astonishing movements in housebuilders' shares recently - very violently down, and now rapidly recovering. Although personally I've now banked the recent profits on all my housebuilder shares.

On to today's small cap results & trading updates.

Bonmarche Holdings (LON:BON)

Share price: 109p (down 6.4% today)

No. shares: 50.0m

Market cap: £54.5m

Q1 trading update - covering the 13 week period ended 25 June 2016.

To recap, I last reported on this value clothing retailer here on 10 Jun 2016, reporting on its full year results to 26 Mar 2016. The figures then showed that a 0.7% increase in LFL sales wasn't enough to maintain profitability, which dropped by nearly 15%.

In its outlook statement back then in June, it said that;

The beginning of FY17 has continued to be tough due to poor weather, however our full year expectation is unchanged provided trading conditions normalise. [PS: from 10 Jun 2016 update]

Today, the Q1 update gives figures, and they're very poor in my view, key points;

- LFL store sales down 8.1% Y-on-Y in Q1 - much worse than the previous quarter, when LFL was up 0.4%.

- Website sales have also gone into decline, down 2.7% Y-on-Y, in Q1.

- Blamed on bad weather.

- Full year expectations unchanged:

"our expectation for the full year remains unchanged on the assumption that trading conditions normalise through the autumn season. The Company's financial position remains sound.

Sorry, I don't buy this explanation. Poor weather had some impact on clothing sales in Apr-Jun, but not enough to cause an 8.1% drop in LFL sales. So the company is in denial I think, and it clearly has some home-grown issues that it's not facing up to.

You hardly ever hear clothing retailers say that our stock wasn't good enough, and we lost market share because competitors were better than us. Yet that's what the truth very often is, when weather is blamed.

For that reason, I am deeply sceptical that it will indeed meet full year expectations - another profit warning looks a virtual certainty to me, later this year. Something along the lines, of that trading has improved, but not enough to recoup the Q1 loss.

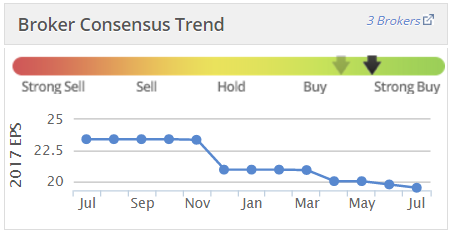

Brokers are lowering forecasts, usually a sign that things are not going well, and often the revised forecasts are still too optimistic;

My opinion - I've been an investor through several economic cycles now, and over time you get better at spotting trends. Lower net margin retailers can be fantastic investments in a recovering economy, as they have high operational gearing.

However, in an economy which is turning down, that operational gearing works in reverse. So a 5% net profit margin turns to zero, or even losses, if sales fall by c.10%. That's not far off the sort of fall BON is reporting for Q1. Remember that their costs are rising too, with various measures which are putting a greater burden on employers, such as Living Wage, but also pension requirements, and the forthcoming apprentice levy.

So I reckon profits could easily crash at this company. It was these fears which led me to sell my shares for a loss recently. Clothing retailers are also big importers, so they're facing another headwind from higher import prices next year, once forex hedges expire.

It looks superficially cheap, but I think it could be a value trap, with worse news to come potentially.

Optimists may disagree though. So if the company does indeed claw back its Q1 shortfall later this year, then the current fwd PER of just over 5, might end up looking like a bargain. The forecast divi yield is also attractive, but again I wouldn't hang your hat on that yield being maintained.

I think High Street rents will need to come down substantially, over time, especially in secondary locations. So extreme caution is needed when looking at property companies focused on retail.

Impellam (LON:IPEL)

Share price: 670p (down 1.1% today)

No. shares: 50.3m

Market cap: £337.0m

Interim results - for the 26 weeks ended 1 July 2016. As with Staffline yesterday, I'm impressed with the prompt reporting schedule.

The highlights section looks good, but digging a bit deeper, I'm less impressed.

Growth has come from acquisitions, and that has seen a very large increase in net debt, up from £39.4m a year ago, to £109.7m now. Although the latter figure is £8.5m down from 6 months ago.

I tend to look closely at gross debt, because many companies squeeze their working capital at the interim & year ends, to minimise net debt (i.e. gross debt, less cash), hence presenting the most favourable possible picture. This makes Enterprise Value quite a dangerous concept, as it's often valuing a company on a very atypical net cash figure, which may have been window-dressed for the period end. To be more reliable, Enterprise Value really should be based on average daily net debt throughout the year.

Gross debt can often be a more reliable indicator of the worst position for cash/debt in the year. So a pessimist would value the company using gross debt, and ignore cash altogether.

In this case, gross debt is £188.3m, which is too high for comfort, in my view.

Adjusted EPS is 36.1% higher, at 44.9p for H1, but this is flattered somewhat by a low tax charge, so that would need checking.

Outlook comments seem less confident than what we had yesterday from Staffline (LON:STAF) (in which I have a long position), but are still saying in line with expectations;

Like many of our competitors, we have seen a softening in the permanent recruitment market in the UK since Q4 2015. Given the current social, economic and political uncertainties in the UK we do not expect this outlook to change.

However, we expect our businesses to continue to perform well in our key markets and we are confident that our differentiated high retention strategy, our portfolio of market focused contingent worker Specialist Staffing businesses complemented by our high performing Managed Services businesses, will deliver results for the full year in line with management expectations.

I saw somewhere else that Impellam makes 90% of its gross profit from temps, and that still seems to be a buoyant area in the UK.

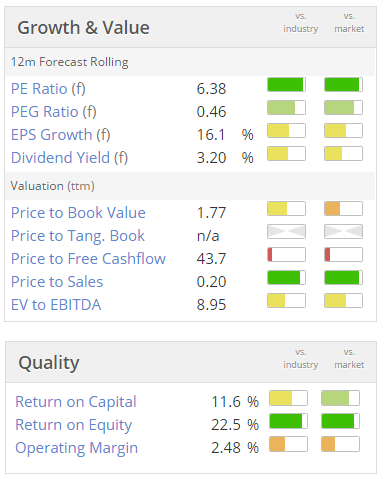

Valuation - if we assume that nothing goes wrong, and full year forecasts are indeed achieved, then the valuation looks appealingly low;

Note the "n/a" next to "Price to Tang. Book" - this is a very useful quick check - it means NTAV is negative, indicating a weak balance sheet.

My opinion - despite the low PER, I can't get comfortable with this share - it's one I've held before, and done well on.

The balance sheet seems weak, with too much gross debt. That wouldn't necessarily be a problem, if the business was delivering strong organic growth, and throwing off a lot of cashflow, but that doesn't seem to particularly be the case.

The shares are very illiquid for the size of company, due to Lord Ashcroft holding nearly 52%, and other large shareholders, making the free float quite small.

The spread of international business is good, which should help smooth out forex movements, and boost sterling profits.

Overall, given that they are on not dissimilar valuations, my preferred pick is Staffline (LON:STAF) (which I already hold, and have bought more today). STAF looks to me more like an out-performer, compared with IPEL, which seems to be struggling a bit in some territories and recouping it in others.

Also I like the way STAF is rapidly repaying its debt, and should be debt-free by the end of 2017, whereas that doesn't look likely here with IPEL.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.