Good morning!

I hope you didn't mind me taking a duvet day yesterday - but since I'd written reports all the way through my holiday in Greece, fancied a rest. Also, there was nothing of interest on the RNS, so it would have just been going through the motions on boring stocks.

Investor show tomorrow

Tomorrow it's the Shares Live investor show, at the Islington Business Design Centre - a good venue, and easy to get to (almost opposite Angel tube station).

Looking at the agenda, there are plenty of interesting talks. Our own Ed (the boss!) is doing his brilliant talk on behavioural finance. He does it once at each investor show. If you haven't heard it yet, then it's worth coming along to this show just to see it - fascinating stuff, and brilliantly demonstrated, with entertaining audience participation too.

I'll be dropping in at some point in the afternoon, to wander around and chat to people, ending up in the pub opposite no doubt at some point.

The rest of the Stockopedia team will be on the usual stand, and we all enjoy meeting members, so do stop by to say hello!

Richoux (LON:RIC)

Share price: 20.6p (down 8.4% today)

No. shares: 92.1m

Market cap: £19.0m

Interim results, 28 weeks to 10 Jul 2016 - it seems odd that the company is reporting figures for a 28 week period. I could understand 27 weeks (as opposed to the normal 26 weeks), because companies which work on a weekly reporting basis have to occasionally have a catch up week, due to 7 days * 52 weeks only being 364 days, 1 day less than a normal year, and 2 days less than a leap year.

I've been keeping an eye on this share for many years, and did briefly hold a few c.2004, but decided at the time that it was dead money, because the company wasn't really going anywhere. It's a potentially good roll-out though, of restaurants, including the rather quaint "Richoux" cafe/restaurants - there's one on Piccadilly.

However, not all retail roll-outs are good, and deserve a premium rating. This one strikes me as a bit of a muddle. Although small, it has 3 different formats - Richoux, Dean's Diners, and Villagio. To my mind, small retailers need to really focus on one format, and make that a commercial success, then roll it out nationally. Diverting into different formats early on, doesn't seem right to me.

Although there are benefits from having several formats - it can be difficult & expensive to dispose of loss-making shops. So re-branding a shop can be a clever way to turning around a loss-making shop. If the re-brand works of course. I've seen some horror stories close-up, where a loss-making shop was re-branded, only to see turnover halve once it re-opened.

The fact that Richoux has just plodded along for many years, without any meaningful expansion, makes we approach it sceptically - what's going to change suddenly, to make this an exciting growth story? Sure, turnover has more than doubled in recent years, but it's still peanuts.

Also, all retailers are facing serious headwinds at the moment. In particular, living wage is driving up their cost base. Also, cheap money means that there's arguably been over-investment, leading to over-capacity in the restaurant sector. We're spoiled for choice where to eat these days, but so many formats are boring & samey I feel. So restaurants really need to stand out as offering something much better than the competition, in order to attract enough custom to trade well. Therefore I am additionally sceptical at the moment. Something has to be dirt cheap in this sector, or offer spectacular growth potential, to tempt me in. I can't see either of those qualities with Richoux.

A quick skim of the figures confirms my preconception that this company appears to be going nowhere fast;

Revenue up 5.7% to £7.1m (for 28 weeks remember)

Moved from a £314k operating profit in H1 2015, to a £233k operating loss this time. This makes me wonder if they added on a cheeky extra week's trading to mitigate the loss?

Impairment charge on fixed assets for under-performing shops of £352k - this tends to be a slippery slope in my experience, so expect more impairment charges in future.

Cash generation has plummeted too, although it's still well financed, with £3.1m net cash.

The company doesn't pay dividends. Which makes you wonder what is the point of it existing, other than to provide employment for the staff & Directors?

Outlook comments contain nothing specific on trading;

The Group will be focusing on improving performance of the three principal trading formats at existing sites but will continue to evaluate new sites for further acquisitions as and when suitable opportunities present themselves.

This is madness, and is completely the wrong strategy. If you have three formats, which collectively are struggling to breakeven, then the last thing you do is open more of the same! They should stop all expansion, and concentrate on getting the format(s) right. Then, and only then, should they do a roll-out.

My opinion - Based on today's figures, I would say the market cap is far too high. This is a small, struggling restaurant group, that needs a thorough sort-out. New management is needed, in my view, before I would consider buying any shares in it.

Having said that, I think this group has been sitting on a gem, but not doing much with it - namely the Richoux cafe format. This needs modernising a bit (not too much, as its quaintness is part of its appeal), and then rolling out once they've got the format right, and individual stores are highly profitable.

This niche is the same as has been successfully done by Patisserie Holdings (LON:CAKE) and another chain called "Paul". Upmarket patisserie/cafes are very much in vogue, and a great space to be in. This is where Richoux should be going.

So there's perhaps an argument for tucking away a few shares for the long-term, in the hope that at some point it might get new management in that can energise the whole thing. There again, if I'd kept my shares from 2004, I'd still be here, 12 years later, with nothing to show for my investment.

All in all, today's numbers are poor, and I'm surprised the share price hasn't dropped further. Mind you, the share is so illiquid, that there are probably plenty of shareholders who would like to exit, but can't. That's the trouble with micro caps - the price is often completely artificial, because shareholders can't actually sell.

Avon Rubber (LON:AVON)

Share price: 923p (up 10.4% today)

No. shares: 31.0m

Market cap: £286.1m

Trading update - this covers the 5 months to 31 Aug 2016.

I'm impressed. The company confirms guidance for the current year;

The Board expects 2016 full year Profit before Tax to be in line with current market expectations.

So why are the shares up 10.4% today, if it's just confirming existing forecasts?

I think it's because the commentary sounds upbeat, with several upbeat remarks about the outlook for 2017 in both dairy & gas masks.

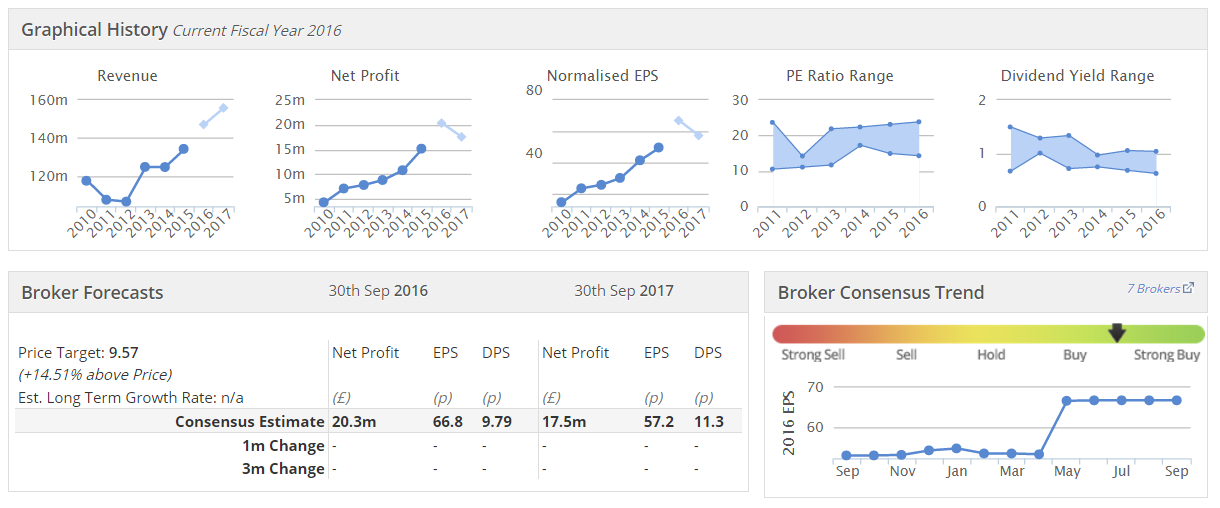

My opinion - I like it. The valuation doesn't seem stretched, given that the company has performed very well - see the excellent progression of turnover & more importantly profits, in the Stockopedia graphics below. Also note that broker forecasts have been upgraded quite a bit - although there have been several acquisitions, which will have obviously helped growth.

Dividends haven't amounted to much, but given that this share has, amazingly, more than 20-bagged since 2009, I don't suppose long-term shareholders are that bothered about dividends! The money has been put to far better use within the business.

That's the thing with divis - they're usually, but not always a good thing. If a company has exciting growth potential, then it's far better for the cash to be invested internally, not paid out in dividends.

SThree (LON:STHR)

Share price: 252p (up 0.7% today)

No. shares: 128.3m

Market cap: £323.3m

Q3 trading update - I don't seem to have covered this company here before, which is odd, it somehow slipped through the net. It's a specialist staffing group, with a particular focus on technology, also banking & energy. It has UK & overseas operations, which has been a benefit for other staffing companies (e.g. smaller Empresaria (LON:EMR) ) since it smooths out factors like the Brexit referendum.

Sthree today gives lots of data about how its various parts are performing. There has been some negative impact from the referendum, which is not surprising, given that uncertainty will have particularly affected the banking sector.

Overall it says;

'Looking ahead, the continued momentum of our Contract business, the strength of our performance in Continental Europe and the benefit of restructuring measures taken earlier in the year, leave us well-positioned for our seasonally most significant fourth quarter. Our expectations for the full year are unchanged.'

That sounds alright. Note that broker expectations for this year have already been lowered, from about 24p to c.20p EPS. So the PER is now about 12.5, which looks a sensible valuation.

Dividends - a high yield of 5.6%, but it's been static for years, and is not well covered. So I'd treat that with some caution - in a downturn, the divi would probably be cut, in my view.

My opinion - the beauty of the StockReports here, is that I know where to look for all the key numbers which give me a quick overview of any company in about 60 seconds! This is why Stockopedia is my main research tool. Am not doing a sales pitch here, am just telling it how it is.

SThree is certainly investable from my point of view. The balance sheet looks OK, and valuation reasonable. Although I think there are probably better bargains in the staffing sector. My favourite remains Staffline (LON:STAF) (in which I hold a long position) - which I think has very good potential upside, providing nothing goes wrong with its welfare to work programmes with the Govt.

Hornby (LON:HRN) - there's an in line with expectations update from Hornby today. I nearly fell off my chair with surprise - having come to expect that Halley's Comet might put in an appearance before this turnaround built up steam. Maybe its time to take a fresh look at this one?

Victoria (LON:VCP) (I hold a long position in this share) - a good solid update today.

Given that good performance is already in the price, this update is largely price neutral, I would say. Still, it's reassuring, and I like the comments about further acquisitions. Victoria has done astonishingly well from previous acquisitions, so I'm minded to continue holding for the foreseeable future. 2000p per share looks attainable in my view.

The Group is pleased to announce that it continues to make good progress in its key UK and Australian markets and is on track to meet all objectives for the current financial year.

Victoria has found no shortage of demand from its customers following the outcome of the EU referendum.

In addition to organic growth, the Group is continuing to look for further acquisition targets and there is no shortage of opportunities.

With a strong platform for growth in place the Board continues to remain confident for the future and committed to delivering returns for shareholders.

Right, I have to dash. Off to talk shop with investor friends for the rest of the day.

Have a smashing weekend, and maybe chat to you at the Islington investor show tomorrow?

Regards, Paul.

(usual disclaimers apply - mainly that these are my personal opinions only, which will sometimes be right, and sometimes wrong. These reports are never recommendations or financial advice. We encourage readers to always do you own research, and invite your views in the commentary section - I see investing as a team sport! Thanks)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.