Good morning! Paul is off today, so there's no need to look for a Part 2.

HSS Hire (LON:HSS)

HSS Hire (LON:HSS)

No. shares: 154.8m

Market cap: £130m

Fair dues to Paul for noting that he saw no alternative to an equity fundraising at this equipment hire company (link here - and thanks to a reader for pointing out this was as far back as November 2015!).

I've also written bearishly on this company before, and have been surprised to see the share price remain somewhat resilient over the past year.

However, this potential placing is much smaller than the amount which I and perhaps others would have viewed as necessary to fix the balance sheet. I suppose bulls might interpret it as a message, from the two institutions taking part, that the hole in the balance sheet is not so large

Shares are up a little bit on the news, so perhaps the placing is being seen as a good show of support from the private equity/hedge fund owners (who will own c.76% of the company after the deal, up from 73.4%).

Rationale:

The scale and complexity of the programme (including

£12.5 million of previously announced one-off costs for the nine month

period ended 1 October 2016), together with the on-going investment to

support revenue growth, has led the Board to conclude that an equity

injection would strengthen the balance sheet of the Group and provide

additional flexibility to fund fleet investment as it completes the

change programme in early 2017.

The programme being referred to involves the use of a new "National Distribution and Engineering Centre", which is supposed to transform how the company operates. Implementing change across the business is taking slightly longer than expected (forecast until Q1 2017 rather than by the end of 2016).

My opinion: It's interesting that the owners are willing to pour some more money into this, albeit just a fraction of the value of their existing holdings. They must be convinced that the next 2-3 years, at least, could turn out in a reasonable way for them.

For those of us on the outside looking in, in my opinion, it's not a transformational deal and it is quite possibly a sign of things to come - dilutive equity injections to keep the company ticking over in the short-term.

Net debt at the start of October was £240 million, which had increased despite the company stating at the interims that net debt was expected to reduce in H2 (from £239 million). This was blamed on exceptional costs.

Most of the debt is in the form of senior secured notes, carrying an annual interest bill of £9 million and maturing in 2019. On top of that there is c. £100 million of bank debt.

Using the company's preferred measure of "adjusted EBITA", ignoring all of the necessary reinvestment and exceptional costs, I can see it making its interest payments - I just don't see much value in excess of that, for equity holders.

Throw in the reinvestment needs of the business and the exceptional costs, and the refinancing risk as 2019 gradually approaches, and it looks highly unappealing to me.

Share price: 232.5p (+6%)

No. shares: 31.9m

Market cap: £74m

Post-Close Trading Update (six months ended 30 November 2016)

This unusual coal-support services-property group looks to have reached a position of stability and relative confidence, after years of turmoil:

The Group has experienced more stable trading

conditions during the period with underlying Group profits for the six

months expected to be in line with management expectations. Hargreaves

anticipates a strong second half with expected outperformance in Coal

Distribution and Property & Energy that will more than offset the

impact of the expected contract delays in Industrial Services.

So it's a boost to the outlook for the full year.

Interestingly, it's the Coal division which is leading the expected improvement (not the Industrial division), as a consequence of higher demand for coal and higher prices.

Legacy issues appear to be under control:

Management remain pleased with the rate of conversion of legacy assets into cash. As reported in October the Group's existing coal stocks have been sold and we continue to expect the full recovery of loans to the Tower joint venture. Working capital performance across the Group also remains in line with expectations. The Group is currently targeting to close the financial year with less than £5m of net debt.

(the next section of text was wiped out by an accident and what follows is a rewrite)

My opinion: I think there is possibly still further upside to be had here, as there are both balance sheet and earnings-related reasons for optimism!

On the balance sheet, the Property division is looking to create £35 - £50 million of incremental value from various property and energy assets. This would add to the company's last-reported tangible net asset value of c. £120 million (May 2016).

On the earnings side of the equation, the Coal division is amazingly still profitable but the Industrial division is also seeking to generate £10 - £15 million of operating earnings per annum in the medium-term.

All of this is much easier said than done, of course, but achievements so far would suggest that we are dealing with a credible management team here.

Share price: 48p (-9%)

No. shares: 175.4m

Market cap: £84m

Interim Results (six months to 30 September 2016)

I wouldn't normally cover this, since it operates in India, is listed on AIM, and has been publicly quoted here for less than three years - that puts it outside my personal risk tolerance levels automatically!

But it has been mentioned on the SCVR pages before so I'll briefly show the results:

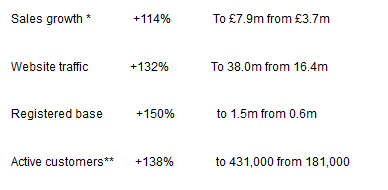

Huge growth numbers but as Paul would point out, it is still at an early stage of development. In Mt. Everest terms, it's still not far from Base Camp!

I do like the fact that it promotes its own label. With private label collections at a healthy 40% of all sales, that makes it a lot more than just an ordinary internet-based distributor.

Financial results:

A loss in the six month period of £9.1 million, significantly worse than the £5.7 million loss recorded in the same period last year.

Closing net cash was £7.7 million, and it raised a further £12.9 million last month. So it should have enough to get to the end of this financial year, at least.

My opinion:

I don't understand why the company is operating at a negative gross margin of minus 20%.

To test the business model for future success, shouldn't it at least have the discipline to ensure a positive margin on sales? Anybody can buy something and sell it for 20% less than it costs to produce, surely?

I couldn't possibly buy into a retailer with a gross margin like this, so it's not for me.

Watkin Jones (LON:WJG)

Share price: 117p (unch.)No. shares: 255.3m

Market cap: £301m

An upbeat RNS from this construction and development company:

In summary, it has:

- Forward sold student accommodation on Stratford High Street (Duncan House) for an undisclosed fee.

- Received planning consents for three developments, two in Aberdeen and one in Sheffield.

- Sold its Athena Hall development in Ipswich for an undisclosed amount. A subsidiary of Watkin Jones will continue to manage it for the new owner.

Despite the lack of precise financial figures, protecting the commercial sensitivity of these various deals, the numbers of student beds help us to understand their potential size.

- Stratford: 511 beds.

- Aberdeen/Sheffield: 1360.

- Ipswich: 590.

Note that the first two developments include substantial commercial/educational space in addition to student accommodation.

Ahead of the 2016/2017 academic year, the company delivered 3,819 beds in total. So the deals announced today involving 2,461 beds are certainly material.

CEO comment:

The planning consents granted for Pittodrie Street and Caledon House are exciting as Aberdeen is an important contributor to the knowledge economy in Scotland, with two universities and approximately 21,000 full time students, and there is a recognised need for purpose built student accommodation in the city. The redevelopment of Rockingham Street in Sheffield provides us with an opportunity to further extend our reach in this important University city.

"With the forward sale of the student accommodation development at Duncan House now completed we can concentrate on the construction phase of this significant development, which will serve the University of London when completed in the summer of 2019. We expect the Duncan House development to make an important contribution to our earnings over the next three years.

My opinion:

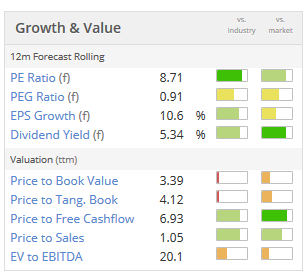

Stockopedia quite likes this share, and it has a Stockrank of 80.

Here are the growth and value stats:

While the shares are cheaper than the market a whole in PE terms, the level of risk here needs to be considered.

Think of visibility, as described in the trading statement last month:

The Group continues to add sites to its strong development pipeline and, at 30 September 2016, it had a total of 21 developments with 6,814 beds targeted for delivery during 2017 and 2018.

The Group's pipeline beyond 2018 is also looking robust with over 2,000 beds across a number of sites already secured.

While these numbers do suggest that the company deserves its currently positive growth outlook, there is a lot of potential variance when we are talking about an average of 10-12 developments per year.

Because of this variance, I think it's important that the shares are priced in such a way that investors do get adequately (i.e. richly) rewarded, if or when the developments succeed. So on that basis, I'd argue that the current share price is probably not far wrong!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.