Good morning!

I've got a half-written section on 32Red (LON:TTR) to finish off from yesterday, so will update that later. I've been ill this week, so it's all been a bit of a struggle.

Probably the most frequently asked question posed to me is this: "Why do Gattaca shares keep going down?"

There's a trading update this morning, so we might be about to find out.

Gattaca (LON:GATC)

Share price: 290p (up 0.3% today)

No. shares: 31.2m

Market cap: £90.5m

(at the time of writing, I hold a long position in this share)

Trading update - for the 6 months to 31 Jan 2017.

Gattaca is a staffing group, specialising in engineering & technology sectors. It was formerly known as MatchTech, and it bought Networkers International (formerly a separately listed company), and the combined group now trade under the Gattaca umbrella.

This looks fine to me, with the key bits saying;

The Group delivered solid results during a period of some instability in the UK, following the EU referendum on 23 June 2016.... the Board has confidence that profit for the full year will be in line with its previous expectations.

It throws me off balance when trading updates include the word "previous" expectations. What previous expectations? What has changed since? When was previous? 3, 6, 9 m or 12 months ago? Further back than that? It's too vague.

What this announcement should have said is that trading is in line with market expectations, which the company believes to be PBT of £x, and adjusted EPS of y. I do wish that we could have some consistency and clarity in trading updates.

Some data is given for NFI (net fee income), which was down -2% in H1, or -5% in constant currency. Not great, but that appears to have been what was expected.

Broker note - Equity Development (commissioned research) has put out an updated note this morning. I like the Gattaca notes, written by Paul Hill. His notes are always worth a good look, as they often contain much useful background. In the case of Gattaca notes, he also covers various other companies in the sector. Harvey Nash & Gattaca stand out as the cheap ones. Although personally I've never been drawn to Harvey Nash in the past, maybe I should have a fresh look at it?

Revised forecasts today from ED, for Gattaca show current year profit forecast raised by 4.2% to 41.2p EPS, and next year to 45.4p EPS. It's important to stress that the main reason for the forecasts being raised is an acquisition announced today (see details below).

Net debt - is forecast by ED to be £30.5m at this year end - 31 Jul 2017. That looks OK to me, it's not a problem level of debt in my opinion. Although obviously if business were to fall off a cliff, then debt would become more of a problem.

Dividends - note the excellent dividend yield, currently around 23.5p for this year, giving a yield of about 8.1%. That's usually a red flag, being too high to be sustainable. In this case however, I can't see any problems, and that level of payout does indeed look sustainable - although there's probably not much scope for it to go higher.

Acquisition - this looks a fairly straightforward bolt-on acquisition, with initial consideration being £6.9m for 70% of the company, payable in cash. Then options arrangements which take the maximum payable to £15.0m. The company being acquired, Resourcing Solutions Ltd, is profitable, and operating in the same sector as Gattaca.

My opinion - it's a fairly obvious conclusion - with a current year PER of just 7.0, and what looks to me a sustainable dividend yield of 8.1%, this share just looks too cheap to me.

The market seems to have been pricing-in heavily declining earnings, but that hasn't happened. Indeed, the outlook for IT & engineering staffing seems to be fairly buoyant, with major infrastructure spending in the UK being high.

We've seen recently with Staffline (LON:STAF) how sentiment can suddenly change, and it's shot up over 30% in recent weeks. Annoyingly, I missed out on that rise, due to it coinciding with me moving the position from one account to another. Then I waited for it to drop back down again before buying back, and that never happened. Such is life, accidents will happen.

The only reason I can think of for GATC shares being so depressed, is that there could still be an overhang of old Networkers shareholders dribbling their Gattaca shares out into the market? Who knows? With illiquid shares, pricing anomalies can persist for a long time. At least in this case shareholders can sit and collect the whopping 8% divis whilst we wait for the overhang to clear.

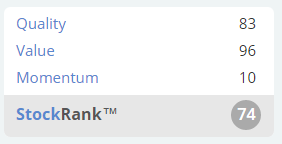

As is often the case, the Stockopedia StockRank nicely summarises the situation here - it's cheap, and has a high quality score too, but momentum is on the floor:

Mind you, we can possibly anticipate a rising Momentum score, once the share price bottoms out, and the latest broker forecasts (with higher EPS) feed through.

Therefore for me, the fundamentals justify sitting tight, even though I can also see why some people would just chuck them out in frustration. We've seen a number of examples recently of shares which inexorably head lower, despite management protestations that everything's fine, only to see catastrophic bad news later emerge (e.g. Fairpoint (LON:FRP) ). So where there's a mismatch between the share price and the fundamentals, it does make me uneasy that there could be problems lurking that management have not 'fessed up to.

Although this does look a proper business, generating real profits & cashflows, so on balance I think it's probably just been caught up in general investor negativity towards the sector.

French Connection (LON:FCCN)

Share price: 40.75p (up 2.5% today)

No. shares: 96.3m

Market cap: £39.2m

(at the time of writing, I hold a long position in this share)

Sports Direct shareholding - a contact has just alerted me to an RNS stating that Sports Direct has just emerged with an 11.2% opening stake in this embattled fashion brand.

I would love to be a fly on the wall when Mike Ashley meets Stephen Marks, that would be hilarious. Both have ridiculous egos, I am told.

Sports Direct has a history of frequently taking shareholdings in other brands, seemingly to facilitate commercial relationships - e.g. becoming a vendor of the other brand's products, or sharing space in shops, etc. So it doesn't necessarily signify any hostile intent on the part of Sports Direct towards FCCN.

What I'd really like to see is Sports Direct increase to a 29.9% shareholding, and really start shaking things up. Marks's performance at FCCN has been utterly dismal, and the only reason he's still in charge is due to his near-controlling, 41.7% shareholding. It would be great to see him turfed out, and some proper shareholder value created here.

I remain of the view that the strongly profitable brand licensing, and the wholesaling/overseas operations at FCCN are worth multiples of the current market cap. So there's clearly value there, if a solution can be found for the nightmare retailing division, which is where the losses are being incurred.

Anyway, with SPD having emerged here, it's one that I'll be keeping a closer eye on.

On The Beach (LON:OTB) - this update is quite confusing - lots of blurb, but not at all clear as to whether the overall picture is good, or not so good. Some clarity finally arrives in the last paragraph;

"The first four months of the new financial year has delivered a further solid period of growth for On the Beach. Our strategy of investing in our brand, hotel supply and technology to drive growth has delivered performance in line with the Board's expectations;

with consumers attracted to our wide range of value for money beach holidays. Our second nationwide television advertising campaign started on Christmas Day and has helped drive this strong performance as our brand awareness continues to grow.

The Board remains confident in the Group's outlook and will continue to evaluate opportunities to enhance its market share position."

Overall, this company seems to have carved out a profitable niche in short haul beach holidays.

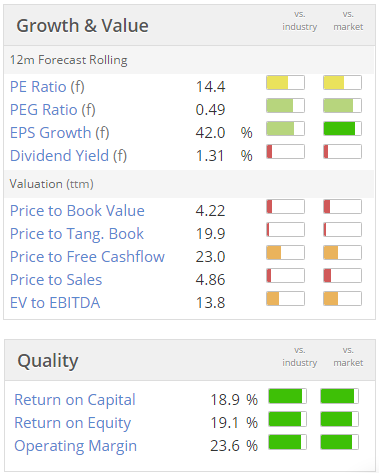

As you can see from the StockReport, it seems reasonably priced, on current forecasts. So it looks quite a nice GARP share, worthy of further research, in my opinion:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.