Morning!

Quick update on the schedule - Paul is coming back tomorrow. So this is my final write-up of the week.

It's busy in RNS-land. I'll try to punch through a decent number of updates.

Graham

Purplebricks (LON:PURP)

- Share price: 412p (-0.7%)

- No. of shares: 270.6 million

- Market Cap: £1,115 million

Purplebricks Targets California

Starting off with an easy, non-financial RNS, this gives us details about Purplebricks' US expansion plans.

One element it doesn't provide is timing, merely saying that it will launch "later this year".

Purplebricks is targeting California for its US launch due to the state's strong housing and economic fundamentals. According to data compiled by the California Association of REALTORS® and other publicly available information pertaining to US homes sales, California ranks #1 in transactions nationally with total sales commissions exceeding $11.5 billion. As it builds a strong brand presence in California, Purplebricks intends to expand into other key US states via a controlled roll-out strategy with a plan to accelerate coverage, as required.

Hundreds of real-estate agents will be targeted for recruitment, and the formula of TV marketing and technology will be applied.

My opinion: I'm increasingly sceptical of the potential here, and indeed at this stage would be strongly tempted to short Purplebricks at the first sign of trouble (although I'm trying to get out of the habit of shorting anything).

My scepticism was growing when the market cap was at £700 million in February, and peaked recently when it approached £1.2 billion.

The £50 million cash it raised back then won't be enough to bring its US plans to fruition, but, more importantly, I just don't see how Purplebricks is going to become a core part of the real estate market infrastructure.

Unlike the housing portals, it's not a directory. So the network effects don't apply. Its agents have to do the dirty work of creating the ads which are then used on those portals.

The major differentiating factor is the marketing budget, building up the brand name so that more and more people will want to use it - but that marketing budget is the reason for its losses so far.

Whenever it stops marketing so heavily, what is the competitive advantage which will keep people using it? I don't think there are network effects, which sort of leaves the company relying on the ongoing value of its mobile apps.

For this to be worth over £1 billion seems wrong to me. But I've been wrong before!

Watchstone (LON:WTG)

- Share price: 137.75p (-1.6%)

- No. of shares: 46 million

- Market cap: £63 million

This is just a footnote on the £QPP saga.

In case we have some new readers, Quindell was the controversial insurance outsourcing business which sold itself to major Australian law firm, Slater & Gordon, amid accusations of financial shenanigans.

S&G took on debt to buy most of Quindell's assets for £637 million. On the subject of shorting: I was short Quindell at the time, so I found that rather annoying! And it didn't make any sense, since people like myself thought that Quindell was at risk of going bust.

S&G has subsequently discovered that it didn't do such a very good deal, and its own shareholders have been almost completely wiped out by the transaction. Its creditors are planning to restructure it after a $1 billion loss last year, most of which is related to Quindell write-downs.

The remaining assets of Quindell which S&G didn't want to buy were renamed as "Watchstone", and today's news is confirmation of High Court proceedings by S&G "for breach of warranty and/or fraudulent misrepresentation", for up to £637 million plus interest.

While Watchstone shares might be amusing to trade, I am confident they are a complete waste of time in terms of finding a good-quality business you might want to hold for the long-term.

GYM (LON:GYM)

- Share price: 196p (+1%)

- No. of shares: 128.2 million

- Market cap: £251 million

Capital Markets Day Trading Update

For clarity, I do not currently own shares in GYM.

This is helpful update on progress at the low-cost gym operator.

I dabbled in shares of GYM earlier this year, but on further review did not have the conviction to continue holding them for the long-term, at that price.

But I still really like the concept and business model, and it's something I might revisit.

Trading in the first five months of the year was in line with market expectations, and the full year expectations are unchanged.

Six new sites are being opened in H1, including two acquired from Fitness First - a sign of the changing times in the sector. It sounds difficult to achieve, but The Gym confirms today that it expects to open "toward the top end" of 15-20 sites this year.

And membership numbers are up 19.6% versus 11 months ago. Can't complain about that.

My opinion: I still think this is one of the more interesting growth stocks in the UK, and could be tempted to dabble in the shares again.

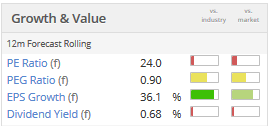

The forecast PE ratio is 24x, and the growth is real.

Something to keep on the watchlist.

Norcros (LON:NXR)

- Share price: 173.75p (+4%)

- No. of shares: 61.3 million

- Market Cap: £106 million

Results for the year ended March 2017

There's lot of reader interest in this UK and South African-based provider of bathroom equipment (showers, taps) accessories, tiles and adhesives. These results have already been discussed on Stockopedia today at this link.

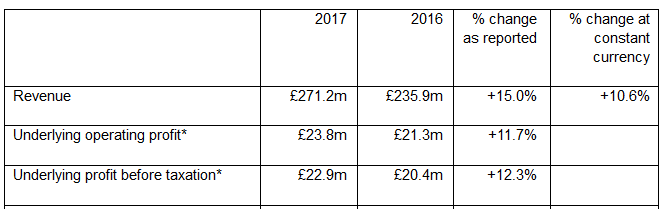

Headline results are encouraging:

Checking the footnote, I see that there is a litany of items added back in to get the "underlying" performance.

Paul has covered this before, so check his April coverage of Norcros at this link for a discussion of the adjusting items.

I would give the company some credit for the adjusting items, but it's safer to value based on statutory numbers: actual operating profit was £16.8 million, which was then reduced to £11.5 million of PBT by losses on FX contracts, bank interest and and interest on the pension fund deficit.

My opinion

My current stance is to eschew companies whose accounts are too complicated, barring exceptional circumstances.

These accounts are complicated, and perhaps unnecessarily so. I would prefer to see a heavier emphasis on the simpler, statutory numbers, and the company could then argue why an improvement is due in future years.

The underlying business sounds pretty decent, including for example the number one electric shower business in the UK.

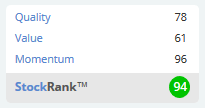

The stock gets a fantastic StockRank, with good measurements on all dimensions:

So on that basis, this could be worth a closer inspection. The £63 million pension deficit and £23 million in bank debt look manageable.

Checking the Strategy comments, however, I see that Norcros is in the middle of a planned doubling of revenue from the 2013 level, to reach £420 million by 2018.

Today's statement admits this this goal is somewhat unrealistic, but again commits the company to achieving it.

Note the difference between this and a company like The Gym: Norcros is trying to buy its growth, while The Gym is expanding organically. I far prefer the latter type of growth.

And Norcros is still committed to growth by acquisition:

Our track record in acquiring quality businesses in our targeted sectors and geographies, and our skill in seamlessly integrating them into the Group and further developing them, together with our growing pipeline of opportunities gives me confidence that we will continue to successfully execute our acquisition growth strategy.

While the company is also seeking synergies and organic, the prospect of many more years of very complicated accounts and acquisition-related costs is enough to turn me off this share. I might be missing out, but I'm a lazy investor and this is too much effort for me to get stuck into!

Castings (LON:CGS)

- Share price: 462.4p (-1.4%)

- No. of shares: 43.6 million

- Market cap: £202 million

This old-school industrial group (founded 1835), with two foundries and a machining business, reports a 10% reduction in annual revenues for the year ended March 2017.

This was already priced in by the company's prior warning that a major machining contract was coming to an end, so that machining revenue was down 30%. On that point:

Replacement work has been secured and it is hoped that turnover and profitability will increase back to previous levels during the next two years.

Further down the statement, we read that "a large proportion of the resulting available capacity" has been filled by new orders. Not all, then, but hopefully most of it?

Output at the foundries is down too (by 9%), with a marginal reduction in sales, so returning to prior levels will take some effort across the board.

Dividend is lifted, so the full-year return is 13.97p (up from 13.71p last year - and they also paid a 30p special in 2016).

It's a reassuring sign to see dividends increase even when results are mediocre. It shows that previous payouts were prudent!

Outlook is terse:

It appears that the customer demands at the present time remain steady.

The situation concerning Brexit is creating a certain amount of concern in the manufacturing sector and the sooner the Government negotiates a deal to remove this uncertainty the better it will be for planning the future.

"Steady" - not expecting any change then, beyond the replacement machining work already mentioned.

Balance sheet: Worth mentioning the fantastic balance sheet, with an excess of currents assets over total liabilities of some £49 million.

My opinion: You've probably guessed that I have a favourable view of this company.

It's not going to be the next Tesla (not that it would want to be!), but it's a solid, boring business with a great track record.

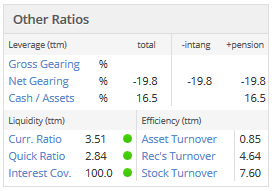

These gearing percentages and high liquidity ratios hint at the safety-first approach to balance sheet management which it employs:

Severfield (LON:SFR)

- Share price: 82.4p (-2.5%)

- No. of shares: 299 million

- Market cap: £246 million

Results for the Year ended March 2017

Another set of final results out today.

Severfield describes itself as "the largest structural steel business in the UK and one of the biggest in Europe".

Services encompass design, manufacturing and contract management.

It took on 110+ projects during this most recent financial year, including highly visible projects for Wimbledon Tennis, Tottenham Hotspur and at Bishopsgate.

The consequence is a nice set of results:

- Revenue up 10% to £262.2m (2016: £239.4m)

- Underlying* profit before tax up 50% to £19.8m (2016: £13.2m)

-

Continued strong cash performance with operating cash conversion of 112% (2016: 150%), resulting in year-end net funds of £32.6m (2016: £18.7m)

Dividend is up more than 50% and Severfield reckons that its return on capital employed improved to 14.6% (from 9.7%).

However, the UK order book is down by 27% to £229 million which it describes as representing a return to more "normal" levels. The order book at the Indian joint venture takes up some of the slack.

My opinion: I like the way the company works toward a 10% ROCE target - that's essential for good disciple in capital allocation.

The strategic objective is to double 2016 PBT by 2020. I much prefer a PBT target compared to a revenue target, and in combination with a ROCE target, it seems like a commendable set of financial goals.

To achieve them, the company is targeting higher margins, more speed and efficiency, and better quality of client service, as the means of achieving its growth ambitions. That's so much better than growth via acquisition! Companies growing via multiple acquisitions could not claim to enjoy the following, as Severfied does:

Continued stability in our organisational structure and management team remain a key strength of the business

This statement sounds very important:

Whilst the most recent order book has reduced to £229m, the strong and good quality order inflow during 2017 will continue to support improving performance in the current financial year. Our normal order book levels typically equate to eight to ten months of annualised revenue so whilst, as expected, the order book has come off its peak, it remains at a level which supports good progress towards our strategic targets.That means a £229 million order book should on average be associated with annual revenues in the range of £275 - £343 million.

If that continues to hold true, then Severfied should be on track for further sales growth against the £262 million result which has just been recorded.

So overall, I have a positive impression of the company and the outlook.

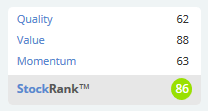

And the Stockopedia metrics love it, which is always good to know:

That's it from me today. Hope you find this interesting, and see you next time!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.