Good morning, it's Paul here!

I'll be writing all 5 reports this week, as I've given Graham the week off, since he was such a superstar covering for me last week!

Isn't this heatwave marvellous! That was part of the reason that my report on Friday fizzled out, sorry about that. I tried to shock my Mum, by disclosing that I'd been nude sunbathing on my terrace. She brushed it aside, replying, "Oh, your father & I used to wander around the house naked all the time, in the 1970s, until you started complaining!"

Good weather should be positive for pubs, and retailers. Although when it's this hot, clothing sales usually dip initially, as people head for parks, the beach, and of course their ghastly, stinking BBQs, instead of shopping centres.

I'm still mulling over those retail figures from last week. The growth in online is extraordinary - still growing at 20% p.a. overall. That's creating terrible conditions for traditional retailers without their own decent online presence - it's like being permanently in recession for them - sales leaking away online, plus consumer disposable income now falling too. Also the threat of higher interest rates may be looming. Not to mention the unstable political situation, Brexit (will it, won't it happen? Nobody knows, nor on what terms). Plus the nightmare scenario of a hard-left Corbyn Govt, propped up by the SNP, destroying the economy with the usual left-wing profligacy.

Bull markets certainly climb a wall of worry, and I'm amazed that the market is as buoyant as it is right now. Last week's wobble seems to be receding, with a lot of fashionable growth stocks now bouncing back from sharp falls last week.

For the time being, I'm leaving BMUS 40% in cash. I just don't see any compelling buying opportunities at the moment, given that most stocks are expensive, yet there are so many risks out there. Risk:Reward looks lousy to me at the moment, with the market generally. Hence why I'd rather hang on to the excellent gains in the last 2 years, and have some powder dry to deploy in the event of a significant correction - there will be one eventually, things are way too buoyant at the moment. When buying the dip stops working, I think we could see a big market correction.

Value vs Growth investing

I was chatting to Ed (the boss here) about growth vs value investing. He was saying that value investing performs best in the long term. However during bull markets, there are periods when growth investing can be spectacularly successful - providing you cash out at or near the top. Everyone looks a genius in a bull market, but only the best investors hang on to those gains longer term.

That's very much been my experience, when I decided to focus more on growth shares about 2 years ago (with a particular focus on the fastest growing eCommerce companies, e.g. Boohoo.Com (LON:BOO) and G4M, both of which have been spectacularly good investments). Although I'm very conscious that this currently successful strategy will stop working, sooner or later.

We are seeing once in a lifetime changes in business models right now. The internet has completely changed some sectors, and is gradually destroying long-established traditional sectors. Internet disruption started with books & music, but has since moved on to many other sectors too. Estate agents' traditional model just looks broken now, for example. What's going to happen to all those (largely unnecessary) people & offices?

This got me thinking about whether value investing really will prove to be as successful in future, as it's been in the past? After all, if you chase low PER stocks, you're likely to end up in businesses that are in structural decline. In the past, value stocks have often bounced back, but that won't happen now, if the business model has been turned upside down by internet disruption. Cheap shares are likely to just get cheaper, until the declining company eventually goes bust.

Bottom up vs top down?

Many readers send me messages & emails, too many for me to reply to, but I do at least read everything sent to me. One reader commented that I should change my approach of being a bottom up stock picker, and consider macro economic factors! I thought that was an odd message, because that's exactly what I already do!!

As investors we can't just look at the figures, and ignore macro factors, business models, sectors, etc. Everything has to be taken into account. Taking Trinity Mirror (LON:TNI) as an example, the numbers look amazing - a fwd PER of just 2.89, and a dividend yield of 5.55%. Even the StockRank is very high, at 90. However, we all know that the business is in steep, structural decline, because each year fewer people are buying newspapers. Therefore, despite being superficially attractive, the share is probably not going to be a good investment long-term (there are often good short term trading opportunities though).

So internet disruption is a huge factor that we all need to carefully consider, before rushing into value shares, many of which could turn out to be value traps - declining businesses, which are cheap for a reason.

All that said, I think a lot of growth shares are now significantly over-valued, and this does feel like the later, euphoric phase of a bull market. So I remain cautious & nervous. That said, practically everyone who tries to predict the overall market direction gets it completely wrong & ends up looking a fool. On that note, I attended an investor lunch about a year ago, when an experienced analyst (who charges for his advice apparently) dramatically announced that we were now in a bear market, and that people should be selling everything. I wonder if he's still got any clients left?!

Hence why I've learned to just admit that I haven't got a clue what the market overall will do, and very often it does the opposite of what I expect! Although going along with the prevailing trend is usually sensible (i.e. buying the dips in a bull market, and selling the rallies in a bear market).

Therefore, my view is that good investors need to be both a bottom up stock picker, and a top-down thinker too. We may not be able to predict what the market overall will do, but we can identify and act on individual sector trends. Mind you, Ed reckons that these points are already baked into share prices, hence why he's a fan of using algorithms, rather than manually stock picking.

Overall, the best advice I ever received was that, whatever your particular approach to investing, "just do more of whatever works, and stop doing things that don't work" (easier said than done!).

Right, on to some small caps

Bonmarche Holdings (LON:BON)

Share price: 93.8p (down 2.8% today)

No. shares: 50.0m

Market cap: £46.9m

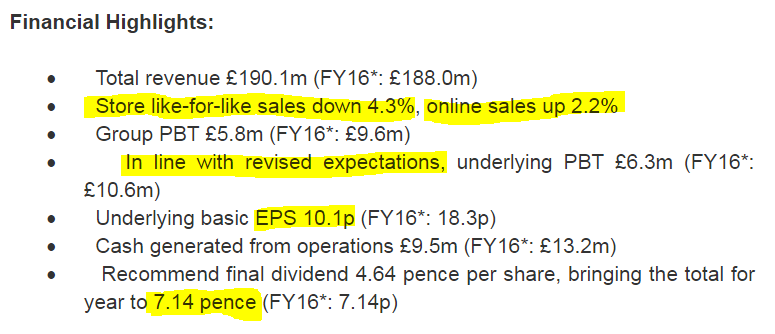

Preliminary results - for the 53 weeks ended 1 Apr 2017 (NB. the extra week usually boosts profits).

This is a retailer of low-priced clothing, focused on the over-50 female demographic, from 327 stores.

These figures look poor to me, but that is what the market is already expecting, hence why the share price is only down a little today. If these are the highlights, I wouldn't want to see the lowlights!

This is a great example of how vicious operational gearing can be when sales are declining. In this case, a 4.3% drop in store LFL sales has resulted in a 41% drop in underlying profit before tax. Less gross profit, but a largely fixed cost base, is a horrible situation to be in. Hence why I really don't like this sector at all, at the moment.

My feeling is that perhaps some investors might have been lulled into a false sense of security in recent years? Profits at many retailers have been steadily rising since 2009, but are now set for steep falls - due to the numerous negative factors hitting the sector.

Look how broker EPS expectations were lowered here in the last 12 months - halved from what EPS was expected a year ago;

Outlook comments are as follows (and there's more detail in the narrative);

Trading since the beginning of the new financial year has been in line with the Board's expectations and the financial position of the business continues to be sound, with no net debt and a balance sheet which provides a stable platform for the future.

We believe that the challenging market conditions are likely to continue but, as noted above, we are confident in our strategy and remain focused on executing it successfully. We believe that the 50 plus market continues to be under-served and this, combined with the forecast increase in the number of people who are potential customers for Bonmarché, positions us well for future growth. We therefore aim to meet our overriding objective of growing profitable sales by gaining market share.

Dividends - the company has remained generous with the divis. So the total payout of 7.14p is flat against last year, and represents a cracking yield of 7.6%.

The trouble is, that dividend cover has now fallen to 1.4 - that doesn't leave much scope for a further fall in profits, before future divis would need to be cut.

Generally I find that divi yields over about 6% need to be treated with suspicion - as that is the market warning us that the divis may not be sustainable at that level.

Online sales - an increasingly important area. To survive & prosper, I think retailers need to be successful at multi-channel, especially internet & mobile.

BON reports online sales of £16.1m, up only 2.2% on last year. As mentioned above, online overall is growing by c.20% p.a. at the moment. So to be considered successful, I would want a bare minimum of 20% online growth. The 2.2% growth here is dismal, and says to me that their internet strategy is not working as it should be.

I appreciate that the over-50s demographic may be part of the problem. Whilst there are plenty of silver surfers, it's probably safe to assume that relatively low income over 50 females are less likely to be buying frocks on their iPhones, than say a BooHoo or Asos customer.

The £16.1m of online sales represents only 7.1% of total sales (NB. take care to compare like with like, so I used the 53 weeks, incl. VAT figures). That's not very good.

Balance sheet - is fairly strong.

NAV is £34.8m. If we deduct intangibles, then NTAV is £29.0m.

The current ratio is sound, at 1.38.

Cash is down sharply, from £13.0m a year earlier, to £6.9m at 1 Apr 2017. Some of that drop is due to timing of capex payments. Note that the company is spending heavily (£5.6m in the year) to update its IT systems.

There is an asset of £6.7m described as "Derivative financial instruments" - I'm not sure what this is, and can't find any other reference to it.

My opinion - I would need a very good reason to invest in a company which has just reported a 40% drop in profits. Some of the issues seem to be self-inflicted mistakes, which the company is trying to rectify - although the narrative doesn't sound particularly strong on that front.

Brokers are forecasting that this year's profits should rise. How likely is that though? We know consumers are feeling the pinch, and retailers are facing multiple cost pressures, plus intense competition.

Therefore I'm sceptical about what upside there is for this company's profits? Its profit margin is now wafer thin, at only 3.3% of revenue (down from 5.6% last year). That's far too low to interest me. It can be a serious mistake to buy into weaker retailers in the good times, as their thin profit margin can easily turn into heavy losses in a recession.

Overall, this share just doesn't interest me. It's not a very good business, and performance has been weak. So why get involved, when the outlook for retailers is so poor?

Premier Technical Services (LON:PTSG)

Share price: 129p (up 4.5% today)

No. shares: 91.5m

Market cap: £118.0m

AGM statement - there's a reassuring trading update today from this company. It's an acquisitive group of niche service providers - e.g. high level cleaning of buildings, lightning conductors, electrical testing, etc.

The company has a 31 Dec 2017 year end, and it sounds like things are going well;

"I am pleased to report that the Group has seen continuing sales growth and strong levels of orders in the year to date. Working capital utilisation and profit levels are also in line with the Board's expectations.

I met management last year, and was very impressed with their approach to running the business. They're very focused on efficiency, and working to a strict process. E.g. they've written their own App which has automated a lot of functions, thus eliminating paperwork and inefficiency. Vehicles are serviced overnight, so that there's no down time. Mobile staff are out working for clients all the time, and are discouraged from calling into the office. All great stuff, which enables this company to improve profit margins at companies it acquires - thus making an acquisition-driven strategy worthwhile.

Outlook comments are also positive;

"The Group has secured new contract wins across all its disciplines, including a number of multi-discipline framework agreements with new and existing customers and our contract renewal rates remain high, which underpin our organic growth plans. Nimbus Lightning Protection Ltd which was acquired in January has been successfully integrated into the Group and is contributing both at a turnover and profit level.

"The Board is confident that the business is in a strong position to continue to grow both organically and through carefully selected acquisitions, which seek to achieve sector dominance in our chosen areas of operation."

Valuation - this valuation looks about right to me, possibly slightly warm, as companies in this sector don't tend to justify high ratings;

My opinion - this strikes me as a pretty good company, with a good business model (decent profit margins, and recurring revenues), and strong management.

On the downside, I'm not keen on the balance sheet, which has NTAV of about nil. Also, receivables seem very high - which for me is a red flag.

Another red flag is the shareholder structure, where management own too much, and Hawk Investment Holdings being involved is not a positive, the way I see things. Director remuneration also needs a close look - I seem to recall there were some overly generous payouts re bonuses or options.

Therefore, overall it's not for me. I'd look at if more positively if & when they get debtor days down to a more normal level of 60 days or less. Also I'd like to see management shareholdings reduced. Some skin in the game is good, but I think it's too high here.

(work in progress)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.