Good afternoon, it's Paul here.

I'm starting late today, but will be working on this report for the rest of the afternoon, as I've got the rest of the day free. The header shows the companies that have caught my eye today.

Interquest (LON:ITQ)

Share price: 24.6p (down 24.3% today)

No. shares: 38.7m

Market cap: £9.5m

Termination of NOMAD and suspension - this is a small recruitment company. The story so far goes like this. The Chairman & major shareholder, Gary Ashworth, together with the executive Directors, tried to buy out the company on the cheap, with a 42p cash offer recently. This was opposed by the only independent Director, and a group of shareholders who resisted the opportunistic & under-priced takeover bid. Chisbridge didn't get enough acceptances to de-list the company (75% needed). The major shareholder (via a takeover vehicle called Chisbridge Ltd) now owns 58.3% of Interquest. So the company has been in limbo recently, with it being unclear what would happen next.

It was clear to me that management wouldn't want to keep the stock market listing. Indeed I warned readers here on 29 Aug 2017 of what might be ahead, saying,

My opinion - I just don't trust management here, so for me it's uninvestable. The problem is that management tried to take it private on the cheap, but failed to secure enough acceptances. So it's now in limbo, with management in control, holding 58% of the company. What happens if they decide to de-list the shares? That would trigger a collapse in the share price probably. (SCVR: 29 Aug 2017)

Unfortunately for shareholders, my prediction was exactly right.

However, what the company has now done can only be described as despicable.

Today, it announces that it provided 1 month's notice to its NOMAD on 10 Aug 2017, so that means under rule 1 of AIM (requirement to have a NOMAD) that the shares will be suspended on 9 Sep 2017.

It is also, bizarrely, claiming that it can't find another NOMAD to replace Panmures! How utterly ridiculous. I find this a ridiculous assertion, and I don't believe it;

InterQuest Group plc Group, the AIM listed company focused on digital recruitment and solutions, announces that it has provided one month's notice of termination to its nominated adviser and broker Panmure Gordon (UK) Limited on 10 August 2017.

The Company immediately commenced the process of finding and appointing a new nominated adviser and broker in the ordinary course, and confirmed at the time, as well as subsequently, that it was confident that a new appointment would be made within the requisite notice period.

The Company identified, and has been in discussions with, replacement nominated advisers and brokers but it is now apparent that it may not be possible to conclude an appointment of a new nominated adviser before expiry of the contract with its existing nominated adviser, which the Company will not extend, and which will come to an end on 9 September 2017.

Pursuant to Rule 1 of the AIM Rules for Companies, if an AIM company ceases to have a nominated adviser, trading in its AIM securities will be suspended. Accordingly, if no appointment is made by 9 September 2017, the Company's shares will be suspended at 7.30 a.m. on 11 September 2017. If, within one month of that suspension the AIM company has failed to appoint a replacement nominated adviser, the admission of its AIM securities will be cancelled.

Appointing a replacement NOMAD is a simple process. There are lots to choose from. So it's just not credible that a new NOMAD couldn't be found in time. The way I look at this, Interquest's major shareholder has cynically used AIM Rule 1 as a mechanism to de-list the shares deliberately. It's being dressed up as an unfortunate situation, but that's clearly nonsense.

My opinion - occasionally (e.g. with China frauds) the NOMAD resigns, and no other NOMAD will touch the company, so it de-lists via rule 1. That is understandable. However, in this case Interquest deliberately fired its NOMAD, and won't extend the contract. It claims to have not been able to find another NOMAD in time, but that's quite obviously untrue. If they had wanted to find one, they would have done so.

Management of this company are clearly incompetent (evidenced by poor performance of the business & multiple profit warnings), and also totally untrustworthy. Add morally bankrupt to that list, after today's announcement.

So I've made a note of the Directors names, and won't be investing in anything they control, ever again. If people behave in a despicable fashion once, then they'll do it again.

So minority shareholders here have been shafted. I really hope someone takes legal action against Interquest's Directors. I think what they're doing could actually be illegal. There's a law which enables minority shareholders to take action if their interests are being compromised by majority shareholders, which is clearly the case here.

If people don't fight back against unscrupulous management, then sacking your NOMAD and claiming to be unable to find a new one within a month, could become the new de facto route for companies to de-list without securing 75% shareholder approval. That would be a massive backward step, and would undermine the whole AIM market. So Interquest management need to be stopped.

The problem with a company announcing it is de-listing their shares, is that it immediately kills the share price - usually by about 50%, thereby destroying substantial shareholder value. Few investors want to (or are able to) hold shares in unlisted companies. So announcing a de-listing then becomes a mechanism by which controlling shareholders can buy out minority shareholders in the market, for a song. It's daylight robbery, almost. So this is now a big concern over small AIM stocks, especially where there is an unscrupulous controlling shareholder. For this reason, we need to look very carefully at any companies where there is a big controlling shareholder.

After all, why go to the trouble of making a formal offer for a company, if you can just announce an intention to de-list, and then buy out minorities on the cheap? A very dangerous precedent may be in the process of being set here. So I urge readers to contact AIM, to urge a change in the rules - perhaps requiring companies to have an alternative NOMAD lined up, before they are allowed to fire the existing NOMAD?

Fulham Shore (LON:FUL)

I see that Directors have made some share purchases, following yesterday's profit warning.

The only Director buying in any significant size is the MD, Nabil Mankarious, plus a family member, buying 1.25m shares - costing £172k. Whilst that may sound a decent vote of confidence, it's immaterial in the context of his total shareholding, which is worth about £16m.

Other Directors have made relatively insignificant purchases.

It's always tricky to gauge how important share purchases by Directors really are. Personally I'm not a fan of Director buying immediately after profit warnings. It looks too much like a PR stunt. On the other hand, maybe it's better than no Director buying at all?

My opinion - I've been pondering whether to buy back into this share, but have decided against it for now. There's a tiny scrap of stock left in one of my SB a/c's, but it's insignificant. For me, risk:reward isn't quite right at the current price. As we discussed here yesterday, hospitality is just a horrible sector for investors right now - with cost increases & reduced demand, and over-capacity. Therefore I would want a highly attractive entry price to tempt me back in.

Audioboom (LON:BOOM)

Share price: 2.0p (up 8.0% today)

No. shares: 930.6m

Market cap: £18.6m

Q3 update - this company is "the leading spoken word audio on-demand platform". Its financial performance to date has been lamentable, and only multiple fundraising rounds have kept it going.

However, I always keep an open mind - if the facts change, then I chance my view on any share. This Q3 update this morning reads very well, and I'm impressed that the company is achieving strong triple-digit percentage increases in revenues. Here's a snapshot;

The Company's strong financial and operational performance has continued into the third quarter with revenue increasing 329% compared to the corresponding period in the previous year.

In addition, revenues increased 32% over the second quarter of the current financial year to £1.49m (Q2 2017: £1.12m).

Third quarter revenues were therefore another quarterly record for the Company with record forward bookings already received for the final quarter of 2017...

That was certainly enough to make me put down my spoon, and disregard my cornflakes at 7am today! So I did a bit more digging, but unfortunately the numbers still don't stack up for me. The problem is that BOOM's gross margin is low, yet its fixed costs are high. So whilst that very strong revenue growth is excellent, it probably won't translate into profits.

Also, you really do have to take this company's commentaries with a giant pinch of salt, as they're wildly over-optimistic, misleading really, in how they describe trading. For example, "strong financial and operational performance" just is not true. It's a loss-making performance. What would be more accurate, would be to say, "terrible, but improving financial performance!".

Here is my review of the recent interim results, which pour cold water over stellar revenue growth, which failed to turn into profit. Also the company will need more cash fairly soon, in my view. Note that the FD walked away recently too.

My opinion - it's still nowhere near being a viable business. More cash will almost certainly be needed soon. The trading updates are bait to persuade people to buy the shares, in my view. Then when results come out, the actual performance in terms of losses, is far worse than would have been imagined if you'd uncritically read the trading updates only.

The StockRank is still a bit fat zero too.

However, to be fair, the company is now reporting excellent revenue growth. If that continues, then who knows, it might at some point manage to reach breakeven & then profitability? As yet though, I don't see that on the horizon.

Crimson Tide (LON:TIDE)

Share price: 3.33p (up 7.4% today)

No. shares: 453.5m

Market cap: £15.1m

(at the time of writing, I hold a long position in this share)

Interim results - for the year ended 30 Jun 2017.

This is a tiny UK-based software company, which provides "smart mobile working" apps (called mpro5) for smartphones & tablets. The software looks great, and helps companies manage mobile workforces. However, on checking the Android Play Store, it seems to have only had about 1k downloads there, and some reviews are negative. I couldn't see from the Apple App Store what the number of downloads are. Perhaps a more IT-savvy reader might be able to check this out?

I took a modest long position in this share a while ago, due to liking the client list, and that the product seems to enable clients to be more efficient, eliminating paper trails. Also, I like the fact that, despite being a tiny company, it has tended to make small profits, as opposed to so many tiny companies on AIM which constantly lose money. This is helpful because the company has self-funded its operations, therefore has not diluted shareholders - you can see from the StockReport that the average number of shares in issue has barely changed in the last 6 years.

The company had previously stated that it intended to increase overheads, to drive expansion. So today's interim results need to be viewed in that context.

A few points of note;

Revenue growth is good, at +32% on H1 2016, but is still tiny in absolute terms, at just £1.1m.

Note that revenues are recurring in nature;

Our turnover has increased quite significantly and, of course, is now almost entirely comprised of long term and contracted subscriber revenue.

Profit before tax of £142k - again, tiny, but up 16% on H1 2016

Directorspeak - the Chairman commented;

"We have invested in sales & marketing resources to ensure that we can take Crimson Tide to the next level. Our performance has been very good and we are very excited about the latest release of mpro5 which is a sea change in terms of performance and usability. The breadth of mpro5's capabilities is starting to be recognised in new markets with a wide range of new opportunities. We are very excited for the future"

He sounds a happy chap!

International expansion - seems to be done on a shoestring. I like the fact that the company is using local partners which it already knows, rather than incurring unnecessary overheads, offices, etc.

Balancing growth & profitability - this is music to my ears, particularly the last sentence;

Our profitability increased during the period, however this was not the Board's primary consideration for 2017. We wanted to continue to be profitable in an investment and expansion stage of our development and I am particularly pleased that we achieved this balance.

It is our intention to continue to invest and expand and we are mindful of not properly exploiting the opportunities in front of us. The message to our team is that we are aiming to be a much larger entity in the coming years than our previous base allowed.

OK, words are cheap. So we'll see what actually happens.

Balance sheet - looks fine to me, no issues.

Cashflow - the same, I don't have any concerns.

My opinion - the market cap of £15.1m looks rather high, for such a small business. That said, we're really buying into the future potential. Revenue growth isn't bad, and the company is self-funding its own expansion.

I'm quietly hopeful that the company might grow into (and hopefully beyond) the current valuation. Although it's not a share for the impatient - the share price has gone sideways since a big jump in Jan 2016. This stock is probably too small & illiquid to appeal to most people.

Best Of The Best (LON:BOTB)

Share price: 330p (unchanged today)

No. shares: 10.1m

Market cap: £33.3m

(at the time of writing, I hold a long position in this share)

AGM trading update - this little company operates a weekly supercar competition - it's great fun, cleverly set up, and I play about once a month. Originally just based in airports, it is now mainly online.

If Interquest management (see above) are scoundrels, then BOTB management are the total opposite - decent, thoroughly trustworthy people. They look after shareholders with special divis, whenever the business has surplus cash, and are an open book in terms of communication & welcoming feedback & input from shareholders.

Everything seems to be on track;

The Group is pleased to announce that it continues to make good progress, building on the success of its new website and is trading in line with market expectations for the current financial year.

In addition to acquiring new customers through existing digital and airports channels, a new TV advertisement has been produced which is increasingly being aired across a range of digital and terrestrial channels, to enhance the BOTB brand and to introduce new players.

Valuation - the forward PER might look a bit pricey, at 24.8, but I think this misses the point. It's the potential of the business that intrigues me. My feeling is that with a big marketing budget, this business could become multiples of its current size, especially internationally.

The ROCE and ROE are very high, so this is a quality business that could scale up and become very much more profitable. So I hope management find a way to grow the business more aggressively, as it has considerable potential in my view.

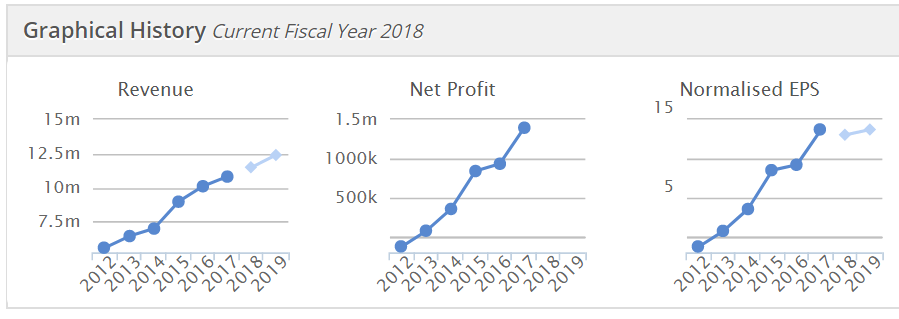

Note the pleasing progression in revenues & profits;

Koovs (LON:KOOV)

Share price: 35.75p (down 12.8% today)

No. shares: 175.4m

Market cap: £62.7m

Preliminary results - for the year ended 31 Mar 2017 - so that's taken them over 5 months to produce the figures. Late figures are usually lousy figures, and that's very much the case here (as usual).

This company was meant to be the Asos of India. However, today's results just confirm how ill-conceived its business model is. Instead of building up the business gradually, with a modest cost base, instead Koovs set up a bloated central overhead, and to date is not selling anywhere near enough clothing online to justify its costs.

Although the sector is different, the similarities with BOOM above are quite striking. Both companies trumpet strong growth, positive KPIs, etc. Yet both are haemorrhaging cash, and gloss over their heavy losses. Both have required (and will continue to require) repeated cash injections, from optimistic shareholders.

I was chatting to a city friend about this the other day. Why do Institutions pour money into basket case companies? He reckons it's because they view investments below 1% of their portfolios as just being "option money". So they might lose the (clients') money, but it could be a ten or hundred-bagger. That really infuriates me, as it's essentially gambling with other peoples' money. I bet they don't take such a cavalier approach with their personal money. Or maybe they do, I don't know?!

Looking at the results today, the person that wrote the RNS appears to be delusional, e.g.;

Pre-tax loss stable* at INR 1,691.3m / £19.3m (2016: INR1,650.4m / £16.7m) reflecting implementation of capital discipline and cost control measures

That's actually a case of losses getting worse (especially when translated into sterling). Also, these thumping annual losses are on revenues of only £8.7m for FY2017. How can any company lose so much money, on so little turnover? Basically it's because Koovs sells clothes for less than their cost - which doesn't sound very smart to me! The £8.7m revenues produced a gross loss of £3.4m, which is worse than the prior year. So there is no gross profit, to cover the £16.3m overheads. Hence the £19.6m operating loss overall. This is complete madness in my view! There's no point in growing sales, as that will just increase the losses, given that the gross margin is negative.

Funding - due to the awful financial performance, it needs continued cash injections, and it looks like they're struggling to find takers;

Funding will still be a requirement in FY18 with the company announcing a £15m requirement in May 2017, of which £8.9m has already been secured though the issue of convertible loan notes and we will be seeking to complete the capital raise in due course.

It would be worth checking out the terms of the convertible loan notes, to see what extra dilution there is likely to be.

Combined, we expect that these progressive steps will provide the foundation for profitable growth and positive cash flows by FY20.

Translating the above, that means the company is expecting to continue to be loss-making in FY18, FY19, and FY20.

My opinion - performance here continues to be so dire, that it would take a giant leap of faith to imagine that this company will succeed in reaching profitability. It all really hinges on whether it can find financing sources to get there without running out of cash.

You never know though, if it can stay afloat, and achieve massive increases in sales and gross margin, then it could succeed. I just cannot see any signs yet of that being likely to happen. If the facts change for the better, then I'll change my opinion on it. But for now, my view is extremely negative, based on these awful figures, and the need for more cash.

I'm flagging fast now, so will just add a couple more brief comments

McBride (LON:MCB)

Results out today are roughly in line with expectations (slightly ahead of one broker note I've looked at). There's been a really good turnaround in the household division, but the personal care division reported a loss of £0.7m down from a profit in the prior year of £2.7m. So this division clearly needs sorting out. Given that the group has done well in sorting out the other division, then there could be upside here too maybe?

Outlook comments for the next year contain an H2-weighting comment, which normally makes me a little nervous.

Balance sheet - I'm not madly keen on this, as there's a fair bit of debt, and £42.2m pension deficit. Debt has recently been refinanced.

My opinion - it's not the sort of company that would particularly excite me, but the turnaround so far looks very good.

However, I do think it might be worth a closer look. The StockRank is 95, and the style is "Super Stock". Also, the valuation metrics do look quite appealing - e.g. forward PER of 12.1.

So overall, it could be worth a closer look, possibly?

This stock qualifies for 2 Stockopedia screens, namely "Bold Earnings Revisions", and "Value Momentum". I'm going to take a closer look at the Value Momentum screen, because at a quick glance it has a good track record (up 200% since 2012), and I can see some nice stocks on the list of companies which currently qualify. So this is a really good way of finding new stock ideas, which might otherwise have been overlooked by the market.

At some point the market is likely to switch back from growth stocks to value stocks, so I'm on the lookout for dirt-cheap stuff.

SCISYS (LON:SSY)

Quite a nice update from this bespoke software & support group. It says;

...The Directors remain confident that SCISYS will comfortably achieve current full-year guidance, a view supported by its 30 June 2017 order book value of £64m and buoyed by recent contract wins.

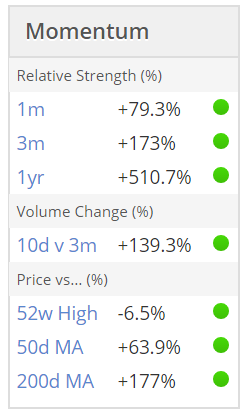

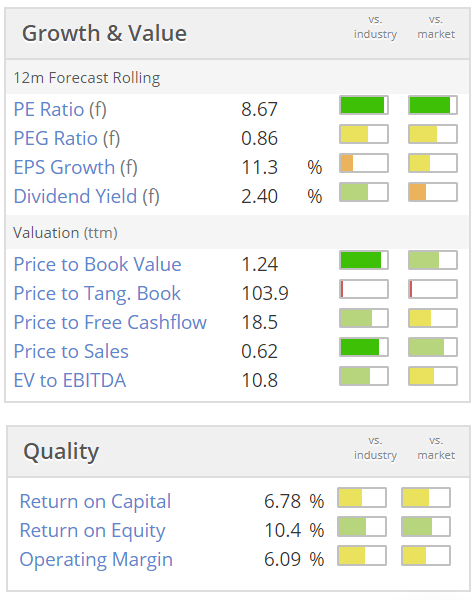

As you can see from the Stockopedia graphics below, it looks cheap on a forward PER basis;

The trouble is, it's always been cheap. So why would it re-rate now?

Note that a big acquisition was made in 2016, which involved taking on a fair bit of debt, which is material compared with the market cap. It's not necessarily a problem, but needs to be factored into the valuation.

My opinion - I quite like this business. The price looks about right to me. It's too illiquid for me - I've tried to buy several times before, and there were only scraps of shares available.

Frontier Developments (LON:FDEV)

A reader has asked me to have a look at this company, which describes itself as;

... a leading developer of video games based in Cambridge, UK

The share price has absolutely gone bananas, as you can see from the Momentum box on the company's StockReport.

Obviously, relative strength means the price out-performance relative to a particular benchmark. I'm not entirely sure which benchmark is used in this case. But the share is +510.7% above it, just in the last year - outstanding!

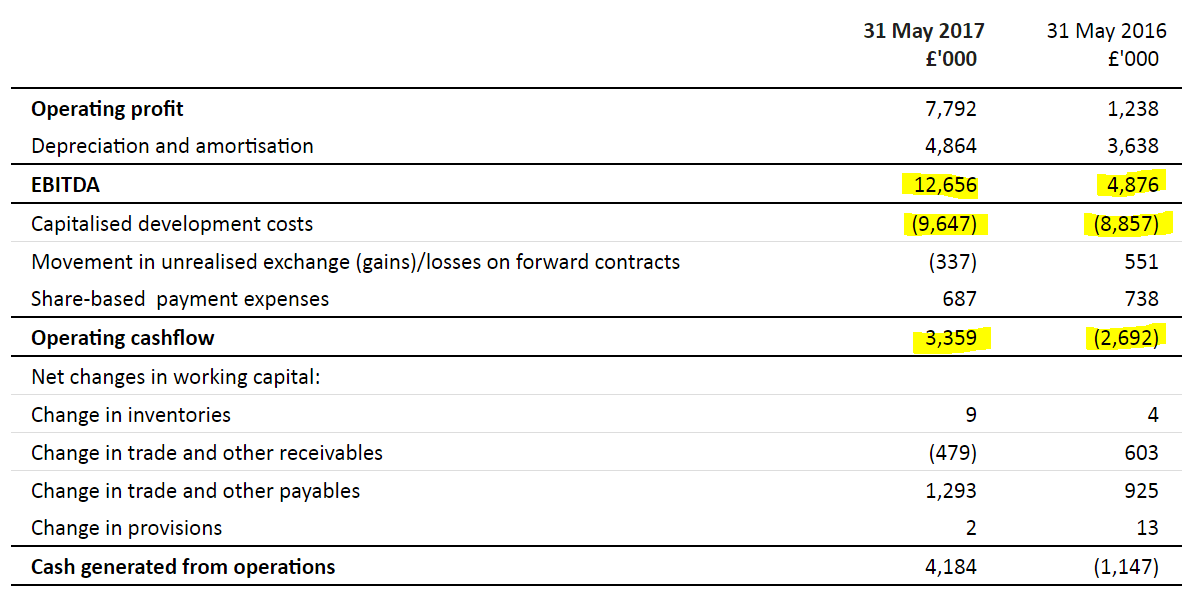

Results today for the year ended 31 May 2017 look absolutely stellar on the P&L. Operating profit has shot up from £1.2m in Fy2016, to £7.8m in FY2017.

Looking through the numbers, my main concern is over the amount of development spend being capitalised. This section is quite revealing;

As you can see above, of the £12,656k EBITDA generated in FY2017, almost three quarters of that was spent on capitalised development costs. So operating cashflow was only £3,359k, which is tiny relative to a market cap of £464m (after today's 10.5% share price rise to 1237p).

My opinion - I haven't looked into, and probably wouldn't understand the company's business model. However, anyone holding this share really would have to be super-confident that profits and cashflow are not only sustainable, but are definitely going to rise very considerably more. They need to, in order to justify such a big valuation.

For me though, I wouldn't touch a video games company that has only made £3.4m operating cashflow, but is valued at £464m. Good luck to holders - who so far have laughed all the way to the bank!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.