Good morning!

At the suggestion of a reader, we're trying out a new system. Either me or Graham will put up a "placeholder" article in the evening, for the next day's news - trading updates & results statements, as usual.

The idea is that there's then a place for readers to post your comments on interesting RNSs from 7am onwards. In particular, if you would like me (Tue-Thu) or Graham (Mon & Fri) to cover a particular stock, then you can put in a request early on in the comments section, and if other people could click on thumbs up, then we'll focus on the requests which have the most thumbs ups. Ideally let's try to focus on the most interesting RNSs, not just humdrum results that are in line with expectations, as they're so boring for me & Graham to write-up. We like profit warnings, or excellent results where there could be good money to be made.

Also, it would be great for readers to post your own thoughts on particular results & trading updates. Especially if you know the company well, and can draw out points which the rest of us might miss.

So let's give this a try. If it works, and people like it, then we'll continue. But for now, this is a trial.

Regards, Paul.

P.S. I think Graham will be starting off the main sections tomorrow morning, as I have to prepare my legal defence for some neighbours who are suing me over a ridiculous matter (replacing skylights in my flat). So I have to prepare my legal defence, and it's taking me ages this evening, so Graham has kindly agreed to do some SCVR work in the morning, to give me more time to finish off my legal defence.

For anyone who missed it, I published a review of results for y/e 30 Jun 2017 from dotDigital (LON:DOTD) in yesterday's report. So here is the link to that. In a nutshell - lovely figures, but as with so many things in this roaring bull market, the valuation of DOTD is looking rather toppy!

Revolution Bars (LON:RBG)

Share price: 178.6p (up 0.6% today)

No. shares: 50.0m

Market cap: £89.3m

(at the time of writing, I hold a long position in this share)

CEO resigns - yet another twist in the story here. After yesterday's Stonegate 203p cash bid lapsed (due to inadequate support from RBG shareholders at the votes) - today the CEO Mark McQuater has resigned with immediate effect.

The Chairman is taking the reins temporarily;

Keith Edelman, Revolution's Chairman, will assume the role of Executive Chairman until a suitable replacement for Mark McQuater has been found. Further updates will be made in due course.

Commenting, Keith Edelman said:

"On behalf of the Board, I would like to thank Mark for his contribution to the success of Revolution. The business and brands have grown and developed over his four and a half year tenure as CEO and the business is well positioned for its next period of growth. We wish him well for the future."

You can never really tell in this type of situation, whether the CEO was pushed, or decided himself to step down. I suppose his position was untenable, given that he recommended the 203p Stonegate bid, which shareholders then rejected. That suggests a lack of communication, or any relationship with the biggest investors - not a good situation.

Plus there was the debacle in May 2017 over a profit warning that was blamed on known factors, such as rising costs. The recently departed CFO took the blame for that, but really the CEO also deserved to take some of the blame too.

My opinion - So where does this leave the company? I would say - very vulnerable to more bid approaches. We already know that a competitor thinks it's worth more than 203p per share. I say "more than", because bidders only bid if they see value over & above the price they're offering. Plus Deltic might now resurface - I wonder if they might now talk to say a Private Equity backer, to see if they can get the funding for some kind of merger deal?

The whole sector is busy with corporate action, so my hunch is that it possibly won't be long before RBG is once again receiving bid or other deal approaches. Time will tell.

Flybe (LON:FLYB)

Share price: 36.5p (down 17.0% today)

No. shares: 216.7m

Market cap: £79.1m

H1 2017/18 update - this is a regional airline. It's also a serial disappointer, in terms of results & newsflow. Today is no exception.

The latest problem is that aircraft maintenance costs are greater than expected;

Flybe announces that, following a detailed review of aircraft maintenance, it has incurred higher than expected related costs in the first half. This reflects the drive to further improve the reliability of its aircraft, particularly the Bombardier Q400 turboprop, with improvements already being seen.

The impact is helpfully quantified;

As a result, adjusted profit before tax is currently expected to be in the range of 5m to 10m for the first half of this financial year (H1 2016/17 adjusted PBT of 15.9m).

This is after charging the additional IT costs, as previously announced, of around 6m in the first half of this year related to the development of a new digital platform.

So H1 profitability well down on last year. H1 covers April - September 2017 inclusive, which once imagines would be a lot busier than the H2, winter period. I'll check the last accounts, to see what the seasonality is like. So looking at 2016/17, in H1 the company reported an adjusted profit of £15.9m. Yet for the full year, that was an adjusted loss of £6.7m. That suggests there is a significant seasonality to profits, with H1 being a lot better than H2.

Therefore, with H1 now only expected to deliver £5-10m profit, then the full year is likely to be loss-making.

Outlook/ Directorspeak sounds optimistic, but I'm not sure how credible this is;

"While half-year profits are lower than expected, I am confident that we are still on a clear sustainable path to profitability in line with our stated plan.

The increased maintenance costs are disappointing, but we are already addressing these in the second half and remain focused on improving our cost base and reliability performance. Our Sustainable Business Improvement Plan is delivering benefits with the fleet size now reducing, and consequently both yield and load factors are increasing. The net debt, as expected, remains broadly in line with year ended 31st March 2017."

My opinion - I've lost money on this share in the past. My mistake was to rely too much on turnaround hopes, and optimistic broker forecasts. The trouble is that the company repeatedly fails to meet let alone beat forecasts.

Which inevitably makes you start asking the question as to whether this is a viable business at all? My feeling is that it looks, at best, a marginal business, which might survive, but probably won't ever generate decent returns for shareholders.

There's too much competition, and too many moving parts which can scupper profitability. The structural problem with Flybe seems to be that it just can't fill its planes with adequate bums on seats, to generate a decent economic return.

Overall then, I'm very reluctant to buy into the perpetual turnaround story here. It's just best avoided, in my view.

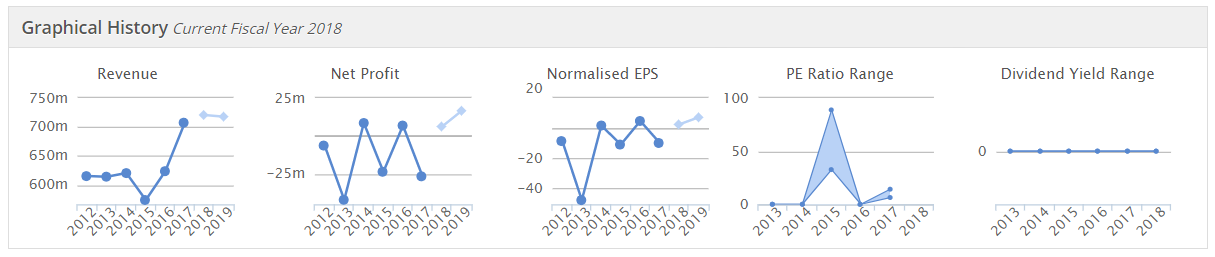

The Stockopedia graphical history beautifully sums up everything about this company - no sustainable profits, no divis, erratic performance, and lots of effort (big turnover) for no reliable returns. It's amazing how useful these little graphs are, as you can glean the big picture on any company in seconds;

Foxtons (LON:FOXT)

Share price: 78.5p (up 7.5% today)

No. shares: 275.1m

Market cap: £216.0m

Trading update - this is a Q3 update (3 months to end Sept), from this mainly London-based estate agency & lettings business.

The 2-year chart below clearly demonstrates the multiple problems that Foxtons is facing - e.g. big increases in Stamp Duty at the top end which reduced transaction volumes, over-supply at arguably unrealistic prices, loss of confidence in buyers, emerging online competition at much cheaper prices (e.g. Purplebricks (LON:PURP) and others), worries about Brexit, Government abolition of letting fees for tenants, increases in business rates for its branches in London, the list just goes on & on.

So it's really a question of will Foxtons survive, and if so where will the share price bottom be?

On the mitigating side, staff will be paid by results, enabling wages to fall when times are tough. Also the lettings side of the business is steady in all market conditions, offsetting the cyclicality of the property sales side of the business.

In today's update, the key sentence says this;

The Group's performance during the quarter was in line with the Board's expectations...

More detail is given, on turnover in the various divisions.

Several important points are then made;

During the quarter we continued to manage our cost base in line with our plan. Cash flow also remained strong during the quarter, supporting a strong balance sheet with no debt.

Nic Budden, CEO, said:

"This was a resilient third quarter performance when set against the challenging conditions in the London property market. We have maintained our relentless focus on delivering a leading proposition for our customers and in our lettings business we are pleased with the reaction to our recent growth initiatives."

I've not found any broker notes in my inbox today, but seeing as it's an in line update, we should be able to rely on the consensus forecasts shown on Stockopedia, of 2.81p EPS for 2017 as a whole. At 78p per share, I make that a current year PER of 27.8 . Whilst that may sound high, the market is clearly pricing in some recovery of earnings in future.

Balance sheet - whenever a company claims to have a strong balance sheet, I always have to check, as often they're lying.

In this case, the balance sheet looks OK. A few key stats (from the most recent half year report);

NAV: £139.6m

NTAV: £19.8m (note how most of the balance sheet disappears when you write off intangibles)

Current ratio of 1.49 is strong enough. Current assets includes £10.6m of net cash.

One oddity - there is a long-term liability of £16.8m deferred tax liabilities. That sticks out like a sore thumb, and I would be interested to find out what this item relates to?

Overall then, the balance sheet looks adequate, and I'd say there is very little danger of the company going bust.

Although the company might now be regretting having been so generous with dividends & share buybacks in the previous year - a reminder of how quickly property markets can go from boom to bust.

My opinion - there was talk in the press recently that the Chancellor of the Exchequer might slash Stamp Duty for first time buyers, in order to stimulate the property market. That helped give Foxtons shares a boost on Monday. In the good years, Foxtons is a cash machine, so I can see why some people might want to take a punt on it, in the hope of a London property market revival.

For me, I'm not convinced enough that there's sufficient upside from the current valuation. It's the sort of thing I'd want to pick up on a really bombed-out valuation, say 40-50p per share feels about right, rather than the current 78p per share.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.