Good afternoon, it's Paul here!

As is often the case, I'm running late today, so this article will be updated througout the afternoon.

To get you started though, here is the link to yesterday's report. I added some additiona;l comments on FootAsylum & a new section on Revolution Bars (LON:RBG) to Graham's report. Although that has since been overtaken by events today (more on that below).

Revolution Bars (LON:RBG)

Share price: 177.5p (down 5.1% today)

No. shares: 50.0m

Market cap: £88.8m

(at the time of writing, I hold a long position in this share)

Results of Court & General Meeting - the 203p cash offer from Stonegate has lapsed, due to inadequate support from RBG shareholders.

I'm struggling to get my head around the 2 tables provided in the announcement today. One is for the court meeting, and the other is for the company general meeting. There's a large difference between the votes, which I don't understand. Have any readers worked out what's going on?

Anyway, it doesn't really matter, because the overall result is that shareholders have not supported the takeover scheme of arrangement to anything like the necessary 75% threshold. All of which makes me wonder why Stonegate did not seek assurances from the main RBG shareholders before going ahead with a formal offer? Also, why did RBG management recommend the offer, if shareholders were not going to back it? Most odd. The only explanation I can come up with, is that perhaps Deltic's intervention de-railed support for the Stonegate offer, as RBG shareholders began to realise that the 203p cash offer was not a good price after all?

RBG today reassures shareholders that the company has a promising future;

The Board remains confident regarding the underlying strength of the Revolution business and its ability to operate and grow as a standalone business, not least given the scale and strength of Revolution's new venue pipeline and the returns achieved by new venues opened in the last two years.

The Board considers that its clear and focused strategy, the quality of Revolution's sites and customer proposition, and the talent within the business, leave the business well placed for further growth.

Revolution is proud that it has delivered 16 consecutive quarters of like-for-like sales growth.

The Board is pleased that the management team is now able fully to focus on running the business, starting with the successful delivery of the important Christmas trading period. The Board would like to thank shareholders for their support of the business during this extended offer period and will work tirelessly to deliver its strategy and to maximise shareholder value.

There are some good points in the above. In particular, the first paragraph emphasises what I've always maintained about this company - that it is a good quality roll-out, gradually delivering excellent returns from a 4-year high quality pipeline of new sites. RBG typically spends a lot of time & energy seeking change of use from local authorities, in order to obtain very cheap rents on excellent town centre sites. Hence why its rent as a percentage of sales is low, and falling.

My opinion - the fact that a lot of RBG shareholders rejected the 203p cash offer, clearly shows that many shareholders think the company is worth more than that, and are prepared to sit tight and wait for the value to rise above it. I'm firmly in that camp. Obviously, with hindsight, I got it wrong in expecting that the 203p (or a better offer) would go through. Although the company is clearly now very much in play, so I wouldn't be surprised if another offer comes along at some point - maybe after Christmas, once important peak trading is in the bag?

So whilst we've taken a short term hit of about 33p per share in the last few days, as the Stonegate bid unravelled, I'm very confident that longer-term, we'll get that back, and more on top.

Whilst trading conditions are not great for the sector right now (softening consumer demand, and well-known cost headwinds), RBG has 2 things which protect it - the new FD has identified about £2m in cost savings (a lot of which is from a new, app-based staff rota system), but also from streamlining the food offering - to improve it (a good thing, as it's rubbish), but also to reduce the preparation time by altering the menu. Plus of course an additional flow of new profits each year from new site openings.

If people rejected an immediate 203p cash offer, then presumably they would be keen to buy in the open market now at 177p. However, there will also be shareholders who were holding for the 203p offer, who may now have shorter timeframes, and want out. Although it's strange why they didn't sell at 210p when they had the opportunity? Perhaps there was not adequate liquidity in the open market at the time - a point I keep coming back to - with small caps, the quoted price is often just theoretical, as only small trades can go through in the market at that price.

What has been very firmly established, by both the interest from Stonegate, and Deltic, is that RBG is worth a lot more to a trade buyer, than the stock market has given it credit for. This might well change attitudes of investors towards this share, once the shareholder register has reshuffled, with disappointed holders having sold out - I've no idea how long that could take, but it could be a long time, who knows?

Overall, I feel that it's unlikely that RBG will still be an independent company this time next year. It's in play, with 203p now established as the price to beat. Even though it's a bit painful taking a short term hit, I'm rather pleased that an opportunistic bidder (Stonegate) has been rebuffed.

The key numbers on valuation are not based on PER multiples. It's all about working out what central costs could be stripped out of RBG by a trade buyer (brokers reckoned between 40-60%, so a substantial saving), plus what additional cost savings could be achieved (mainly from lower drinks purchases, due to the industry working on discounts for higher volumes, so-called "retros"). I've seen research suggesting that the above could achieve an EBITDA of £20m+ for RBG, and the industry average is about 7-times, which implies an enterprise value for RBG of about £140m. That's 280p per share. Hence why the 203p offer from Stonegate failed to excite RBG investors. Would an acquirer actually pay 280p per share? Probably not, but you never know, if several competing bidders emerge.

In the meantime, RBG is growing at about 6 new sites per year. They have an initial loss-making period, but within 9 months are generating very strong EBITDA of about £400k p.a. (for £1m capex cost). Therefore, even if the existing estate comes under some pressure in its profitability, the flow of new sites should at least offset that. Hence why I think the profit outlook for RBG is actually pretty good. Remember also that it is self-funding its expansion from cashflows, with hardly any debt, and is paying a reasonable dividend on top. There's plenty to like here, but many investors remain resolutely determined to completely ignore the upside. It's so strange the way investors can sometimes just refuse to even look at the numbers, if they have a fixed opinion that they don't like a particular sector. That's what created the pricing anomaly here in the first place.

In the short term, obviously I'm kicking myself for not having sold more at 210p (I only sold 20%, but am wishing now that I'd cashed in the whole lot!). Longer term though, I think my eventual exit here should be well above 210p. Plus there's a 3% divi yield whilst I wait.

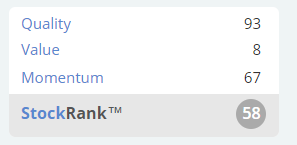

Stockopedia rather likes it too. The StockRank is healthy;

Interestingly, the StockRank Styles is positive about RBG too, with the computer algorithms rating it a "Super Stock".

We often get lots of interesting discussion on this share, with opinion fairly polarised, so I'm looking forward to reading your comments later on.

Another thought - I wonder whether the Institutions which rejected the 203p cash offer might support the share price in the open market? After all, if you're a fund manager that voted against the 203p bid, then it would be awkward & potentially career-damaging if the share price subsequently dropped & remained a lot lower. So at that point, it would make sense for fund managers to buy the stock in the open market, and hoover up the sellers.

I haven't decided the level where I would start buying more. I've already got tons of them, so position size is an issue - you always have to factor in the risk of another profit warning, as market conditions are tough. Overall though, I think I'd probably find 150p or below irresistible, assuming no negative news is issued. I hope the distraction of the bid approaches has not harmed the business operationally in the short term, which it might have done. But again, not really a worry for those of us who think longer-term.

UPDATE: I see that Deltic has just put out an announcement, commenting on the Stonegate bid lapsing. I'm not sufficiently clued up on the technicalities of Takeover Panel rules, so clearly I need to do some studying on this. However, it looks to me as if Deltic is still sniffing around & wants to revive its merger proposal.

UPDATE 2: There's quite a nice announcement just out from Stonegate, the key part saying;

Stonegate wishes Revolution and its shareholders every success in the future as Revolution continues as an independent business. Stonegate has built its business by being a disciplined buyer of pubs and pub estates. Since creation, Stonegate has grown to over 700 sites and is the UK's leading drinks led licensed retailer as a result of this discipline.

Commenting on the results of the Scheme vote, Ian Payne, Chairman of Stonegate, said:

"Stonegate has always been disciplined in its approach to acquisitions. We put forward what we believed to be an attractive proposal and made an offer at a 62 per cent premium to the undisturbed share price which was unanimously recommended by the Board. However, we respect the shareholders' decision and wish them all the best."

So that's that then, by the looks of it.

I think the takeover rules restrict if/when Stonegate can approach RBG again, but it sounds as if, for now anyway, they don't have any intention to do so.

Cloudcall (LON:CALL)

Share price: 148.5p (down 2.0% today)

No. shares: 20.1m before Placing, +3.963m new shares = 22.56m after Placing

Market cap: £33.5m

(at the time of writing, I hold a long position in this share)

Proposed Placing - to raise £5.7m at 143.5p.

My broker rang early last week, asking if I wanted to be made an insider on a deal. I agreed (which then makes me strictly unable to say anything to anyone about the deal, until it's made public, which has happened today). My heart sank when he revealed that the company name was CloudCall - as it's an existing position of mine, which I've increased a lot lately, on the basis that it had strenuously claimed that it did not need to raise any more money. It's not the first time this has happened either, the company's made a habit of promising breakeven, saying it has enough money, then doing repeated placings.

However, placings are really all about price & dilution. The worst kind are when a company needs to raise money from a position of weakness, and there's a huge discount - as that type of deal dilutes private investors who don't have a chance to participate (unless you get yourself classified as a professional investor, in which case you can take part in placings).

Therefore, I was delighted to discover that the latest CloudCall placing has been done at only a small price discount. So existing holders have been protected nicely. My broker commented that the Institutions are showing clear support for the company, by not demanding any significant discount. This confirms my view that the market's perception of CloudCall has radically improved this year. The market is now seeing this as a growth company with considerable potential, whereas a year or two ago it looked a bit of a basket case.

Situations like this, when companies reach a tipping point, where investor focus changes from worrying about losses, to getting excited about growth & future profits, can often be fantastic investments in a bull market. I specifically look for that type of scenario. Hence why I loaded up with CALL shares both personally, and in BMUS earlier this year. I think investors who remain fixated with a negative opinion on stocks, and miss the key turning points, have a huge weakness in their strategy. We have to learn to change our minds on stocks, when the backdrop suddenly improves - no matter how negative we've been in the past. The early bird catches the worm, in terms of spotting changes in market sentiment.

The company was actually bearing down on breakeven, and looked set to achieve it in mid-2018. However, once again, the company has decided to accelerate its growth plans, rather than focus on breakeven. Some people like that (clearly the institutions do, or they wouldn't be funding this placing at only a small discount), some people may not.

The growth opportunities are;

Microsoft Dynamics - a big CRM system, which CloudCall is integrating with for launch around now. So a big sales & marketing push is required. This apparently targets up to 5m potential new users for CloudCall.

Bullhorn - this has been a key client relationship for several years, and the plan is to accelerate winning clients within Bullhorn's larger (following an acquisition) user base. Penetration into Bullhorn's client base has been very successful so far.

Technical development - including;

Accelerate development of its Euro billing and European servicing capacity.

Development of new messaging products based around SMS and instant messaging technologies

Current trading - there's an in line with expectations trading update buried within today's announcement.

My opinion - as regular readers here will know, I've been a long-term bull on this stock - because I tried out the product (and am still a user), and saw it's clear potential. OK, I was about 3-4 years too early with my enthusiasm, which has taught me not to get excited about jam tomorrow shares. It's better to just monitor companies like that, and wait for the tipping point when it's becoming commercially viable - which is often at a much lower share price, after several placings. Practically all jam tomorrow shares take far longer, and burn far more cash, than the original business plan - something to bear in mind at all times (this is a "memo to self" as much as anything!).

I'm reading independent broker commentary which is becoming increasingly bullish on CloudCall. Also I've spoken to several Institutional shareholders who are also increasingly excited about the company's potential.

So for me, the glass is very much half full, and I see the likelihood of a continued stair-step move upwards in the share price, over time. That could get derailed if something goes wrong, of course, as with any company. Also there's the risk of the share price over-shooting & then correcting.

I very much like the focused sales strategy - directing resources at 2 specific areas of main growth - Bullhorn and Microsoft. Let's see what happens, but I think this one is heading higher, with investor sentiment now very much more positive.

The most interesting book I've read in recent years, is by Mark Minervini - trade like a stock market wizard - what a dreadful title! However, the book is an absolute gem - he has a proven method for identifying & profiting from multibagger stocks. He's only looking for super-performance. So when I look at growth companies, I ponder whether they fit his various criteria. I think CloudCall is a possible candidate to be viewed as a Minervini superstock. He looks for confirmation from the chart. I've annotated the CloudCall chart below, and it does seem to fit the model to be a Minervini-style purchase. (NB. I did this from memory, as don't have my copy of the book with me, but I think this is right!);

I'm receptive to any investment strategies that work. Hence why I've happily blended in some Minervini ideas into my own strategy, and so far, so good!

I have to take a break now, but will be back later to do an additional section on dotDigital (LON:DOTD)

Right, later than planned, but here goes with a brief review of results today from;

dotDigital (LON:DOTD)

Share price: 82.75p (up 13.4% today)

No. shares: 295.6m

Market cap: £244.6m

Final results - for the year ended 30 Jun 2017.

This is a technology company, providing email marketing software based on its "dotmailer" platform. Regulars here will know that I've held this company in high regard for several years, whilst at the same time having some concerns over the long term sustainability of earnings derived from emails. My problem is that emails are the bane of our lives - taking up so much time, and I do wonder whether eventually we'll all just reject email as a way of communicating altogether?

There's no sign of that so far, as DOTD has delivered another excellent set of results. It's a lovely very high margin, cash generative business. I can't see any accounting shenanigans here, just a business that produces lovely cashflow, and has now built up a net cash pile on its balance sheet of £20.4m - with acquisitions being the likely use of that surplus cash.

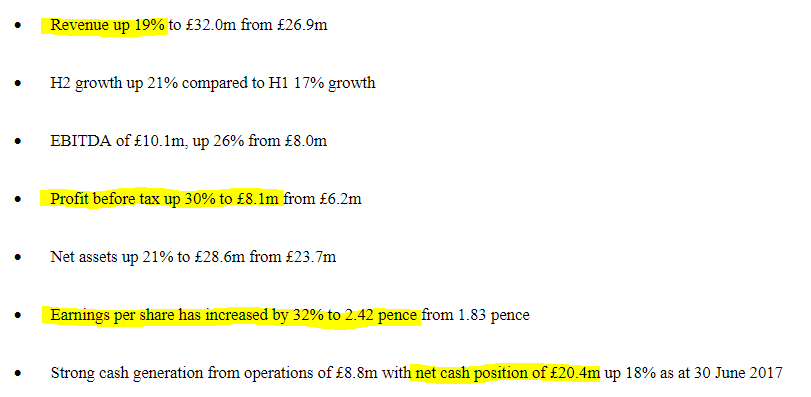

Here are the financial highlights today. I've highlighted a few figures that particularly impress me;

Valuation - there's really only one question that matters - excellent though it is, is this company really worth £245m? This is the same question we're having to ask (on valuation) for many growth companies right now.

It really all depends on whether this increasingly euphoric bull market is likely to continue in the same vein, and for how long? In normal market conditions, most people would probably conclude that the valuation of DOTD (and numerous other growth companies) was high enough, or too high for now. The trouble is, in current market conditions, that doesn't seem to pertain. Prices just keep going up, and people who worry about valuation are left behind. It's all going to end in tears, we just don't know when.

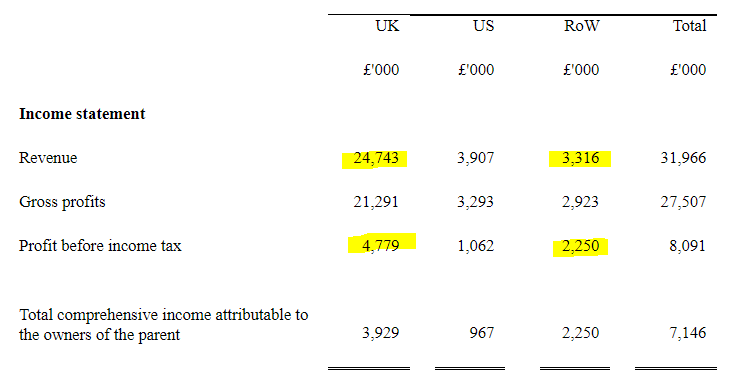

International growth - one aspect of DOTD is that it's successfully achieving profitability overseas, on low revenues. That's really impressive, and something few UK companies achieve. see note 3 on segmental reporting in today's results;

I have to say that these figures don't look right to me. I've highlighted the big discrepancy between the huge % profits from Rest of World, which makes 68% profit margin, and UK, which makes 19% profit margin. This says to me that the UK segment is absorbing almost all the central costs, and the overseas divisions are not being recharged for their fair share of the group costs. So I would take this table with a pinch of salt. They need to properly reallocate group costs to the various territories.

Nevertheless, it does seem to suggest that DOTD is able to bolt on more sales overseas, profitably. That could become very exciting growth overseas, who knows?

My opinion - we're in a roaring bull market, and this is exactly the kind of company which investors love right now - decent growth, high gross and net margins, lovely strong cashflow.

It's expensive, but for a reason - it's executing very well indeed.

In terms of how high the valuation can go? Who knows - that's where we enter the realms of speculation. But so far, so good. I think this is a much higher quality company than lots of other things out there on stretched valuations.

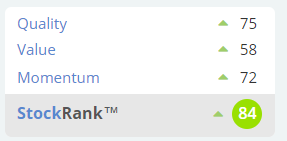

Stockopedia sees this as a "High Flyer", and the StockRank reinforces that it's high quality, with good momentum, but far from cheap!

We have to stop there. Thanks for reading, and see you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.