Good morning!

I'm writing from my underground bunker in advance of the post-tropical rain which is about to strike Ireland.

There's an eerie silence outside, unusual cloud formations have appeared, and the animals are acting strangely.

All in all, these are fine conditions in which to write about a few stocks:

Footasylum (LON:FOOT)

It's a new fashion retail float, so I'm sure many readers will be looking at it either as a potential purchase or as a comparison with their existing holdings.

The basics:

The Company retails "on-trend" product ranges which are predominantly aimed at 16 to 24 year old fashion-conscious customers and are sourced from an extensive stable of third party and own brands.

Similarity with Boohoo.Com (LON:BOO) in terms of age bracket but with the emphasis on footwear, obviously!

The Company operates a multi-channel model which combines a 60-strong store estate - in a variety of high street, mall and retail park locations in cities and towns throughout Great Britain - with a fast-growing eCommerce platform and a recently launched wholesale arm for distributing its own brand ranges via a network of partners. In FY17, the store estate accounted for 71 per cent. of revenue and eCommerce accounted for 29 per cent.

Next (LON:NXT) (in which I hold a long position) enjoys 47% of branded sales from its online Directory arm, so Footasylum hasn't quite achieved that sort of mix yet. But 29% online is still a significant level to have reached already.

The retail growth plans in a nutshell are to open 8-10 new stores per year, with the potential to get to at least 150 (presumably over the next decade, given that it currently has 60).

Management plans are a bit unusual: the former Chief Executive off JD Sports Fashion (LON:JD.) is scheduled to join Footasylum as Executive Chairman in June 2018. But they already have a CEO, so it looks as if there is going to be some kind of power split between her and the Exec Chair? Clarity would be helpful.

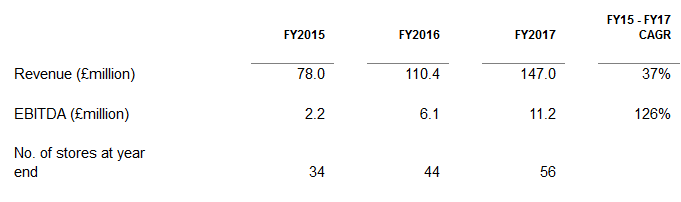

Financial results are presented as follows:

Growth numbers are clearly quite good but we have to make the standard disclaimers in relation to EBITDA.

And in general, investors need to be careful about pre-IPO numbers being puffed up a little.

For example, if some maintenance capex is neglected in the year or two ahead of IPO, this can result in lower depreciation charges and therefore earnings can look artificially high.

Footasylum says it plans to make "significant investments over the next three years in increasing the Company's digital presence as part of a broader upgrade of its IT systems to support growth."

So that's a large part of what the IPO investors will be paying for: upgrading the company's IT systems. And if, say, spending hasn't been enough to keep the systems up-to-date over the past couple of years, that's the sort of thing that could temporarily increase earnings. These are the difficult questions that are worth asking, in my opinion!

As the recent debacle with Accrol Group (LON:ACRL) helped to demonstrate, IPOs can look fine for a year or two until the hidden problems/risks emerge. I still find them really interesting, I just think an extra dose of scepticism is needed!

Getting back to Footasylum, the sales split is 71% menswear, 8% womenswear and 18.5% childrenswear (plus 2.5% accessories). A very different audience mix compared to Boohoo.Com (LON:BOO), then.

It sells its own-brand gear but "Global third party brands constitute the core of the Footasylum offering" - it's primarily of distributor of other brands. Half of revenues are from Nike and adidas.

Its Oxford Street store is loss-making at the EBITDA level, "but has helped to build brand awareness". Surely there are more efficient ways to advertise!

My opinion

Overall, with a few questions which will hopefully be answered in due course, it looks highly suitable for AIM. I'm looking forward to seeing news on valuation (rumoured at £150 million) and the mix of new money/old money in the IPO. Maybe we will get our next big bargain about six months after the flotation, which is set for next month.

Additional comment from Paul Scott: Many thanks to Graham for his review of FootAsylum. I had been meaning to look at this one, as my broker flagged it to me as something that fits my sector specialism.

I've only done limited research so far, but like what I've seen. It seems to be almost JD Sports mark II. So, given what a rip-roaring success JD Sports Fashion (LON:JD.) has been, it seems sensible to take seriously what FootAsylum is doing.

My main worry is that the big brands might decide to cut-out the physical retailers, and go direct to customers, and/or via Amazon. I read something over the weekend (can't remember where unfortunately) saying that footwear (especially designer trainers) is an area being specifically targeted by Amazon. So the big worry is that places like JD Sports, and FootAsylum might become expensive showrooms, with customers then making their purchases online, via Amazon (at lower selling prices). That would then kill the profits of the physical retailers.

I do like that FootAsylum is developing its own brands as well though. The big danger with just selling third party brands, is that you're very vulnerable to competition from Amazon - who as we know, are perfectly happy to just trade at or near breakeven, in order to deliberately kill off their competition. Therefore, the only online retailers which really interest me, are ones which develop their own, unique products. I think Amazon will find it a lot harder to compete with online fashion companies that are great at sourcing product (e.g. Boohoo.Com (LON:BOO) ).

I can't see from the RNS today any details about selling shareholders, although they are mentioned;

The Directors believe that the Placing will provide the Group with an appropriate capital structure to pursue its growth plans and that Admission will further raise the Company's profile and assist in attracting and retaining key employees through appropriate incentive arrangements. Admission will also enable the selling shareholders to realise, in part, their investment in the Company.

So I think it would be essential to find out how much of their shareholdings are being sold by the selling shareholders. Too many IPOs go wrong, and as Graham mentions above, problems can often emerge some time after the selling shareholders have pocketed their profits.

Overall though, from reading the RNS, and a broker note on FootAsylum, in my opinion it looks worthy of further research.

SysGroup (LON:SYS)1

- Share price: 530p (-1.4%)

- No. of shares: 12.4 million

- Market cap: £66 million

Regular readers will know that this market research / brand consultancy was previously known as Brainjuicer, and traded under the BJU ticker.

It suffered a horrible profit warning in August, when the share price fell by about a third in a single day.

I've been watching this share for several years, and never quite felt comfortable enough to buy it. The directors have always been really honest about their lack of visibility over future sales, and sales finally took a hit this year when some big one-off projects failed to repeat.

A more competitive market was cited as one of the reasons for this, along with client spending deferral.

Something else which I noticed, and which I still think is a problem, is that this company doesn't own system1.com (it's instead owned by a US firm).

Today's announcement is fairly stark:

As announced on 18 August, trading in H1 has been slower than expected, and Gross Profit (the Company's main top line performance indicator) is 9% lower than prior year (12% in constant currency), due in the main to non-recurrence of large one-off Innovation projects as a result of some significant client spending reductions and a more competitive market. Profit Before Tax in H1 is some £0.8m (prior year: £2.8m).

We remain cautious about our prospects over the remainder of the financial year due to our usual lack of revenue visibility.

It's a huge reduction in PBT despite a relatively modest reduction in gross profit, which I believe is attributable to much higher staff costs after some new hires were needed to bolster the offering.

It's the old problem with investing in consultancies - the revenue split between staff and shareholders can end up primarily favouring the latter.

I reckon this is vulnerable to further de-rating.

Bioventix (LON:BVXP)

- Share price: 2700p (-2.4%)

- No. of shares: 5.1 million

- Market cap: £138 million

This is a new one for me, so I've been trying to get up to speed with it in response to reader requests for coverage.

It's a small company (13 full-time equivalent employees) which provides sheep-derived antibodies for use in medical diagnostics.

The royalty revenue model means that it gets a small share every time the large medical companies uses its products.

Vegpatch covered it in some depth on this website, last November. Here is the link.

Sales are abroad, mostly to the US, creating an additional layer of risk for domestic investors.

Results have been consistently sparkling, however, and these latest results (for the year ending June 2017) are no exception.

- Revenue up 31% to £7.2 million

- Profit before tax up 37% to £5.7 million

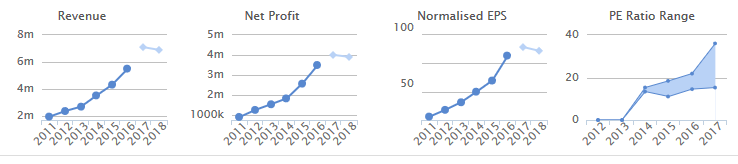

Stockopedia graphics do a neat job of summarising the company's excellent progress. They also show how the earnings multiple has become more volatile, and higher:

As you can see from the light blue dots above, (unrevised) expectations were for revenue and profits to stall in 2018.

This appears to make sense according to the latest company guidance. Though they have been overly cautious before, so perhaps we might get another pleasant surprise a year from now.

In relation to the most important vitamin D product:

Our prudent belief is that the vitamin D market will plateau in the near future. Nevertheless, we anticipate a modest further increase in vitamin D antibody sales over the next year as a limited number of smaller customers bring new vitamin D products to the market.

Furthermore, there is a specific license (in relation to a heart failure test using Brain Natriuretic Peptide, or "NT proBNP") which has been terminated, with the prospective loss of £1 million in revenue. Rather than continued growth in the short-term, it looks like merely replacing this lost revenue is the objective for now. And there is no clear-cut guarantee that this will be achieved in FY 2018.

The company explains recent developments in its industry and its overall competitive position as follows:

Within the field of antibodies, technology changes relatively slowly as new antibody technologies are validated and used... For example, we are aware that rabbit monoclonal antibody technology is established at some customers and this could have resulted in lost opportunities for our sheep monoclonal approach. However, we believe that having established our antibodies in customer products over the last ten years or so leaves our core business relatively secure due to the significant barriers to changing an antibody that works well in a diagnostic test.

"Relatively secure" - moderately safe, then!

Outlook statement includes the following:

For the financial year 2017/18, our challenge will be to make up for the approximately £1 million of lost sales mentioned above with revenues from the newly launched Siemens troponin project and modest growth from additional vitamin D antibody sales and royalties.

So they will try to replace lost revenue, but they may not.

My opinion

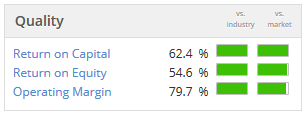

When a company has strong IP, high margins and high returns on capital, I think it's often worth paying a high multiple even when growth has slowed.

In that case, what you're paying for is the cash flow and for the strong competitive positioning.

For that reason, if I was holding this, I'd want to keep holding it. New buyers at current levels will need patience, however, because it's unlikely to see much earnings growth in the short-term, and the earnings multiple looks about as high as it can bear. It looks interesting on a 2-3 year horizon.

Spectra Systems (LON:SPSY)

- Share price: 88p (+8%)

- No. of shares: 46 million

- Market cap: £40 million

This is a somewhat mysterious (to me) security technology company, whose shares multi-bagged this year.

It has historically done a lot of work cleaning banknotes, but this year started branching out into new categories.

For example, last year it started producing specialty phosphours for a security thread manufacturer which it "believed" was working for a large Asian central bank. (Rare phosphours light up in special ways and are an important part of currency anti-counterfeiting measures.)

More recently, it announced an agreement with a US coffee system maker, so that its systems will only work for coffee cups which carry the correct signature.

So there is a lot happening to help explain why the share price has been so strong and Spectra has turned into a Super Stock.

Today we have news that ones of its key divisions has done extremely well this year:

Spectra Systems Corporation, a leader in machine-readable high speed banknote authentication and brand protection technologies, today announces that it has been informed by its covert authentication technology licensee, that royalties based on finished printed notes will reach a record level in 2017. As a result, Spectra expects that its profits for the year ending 31 December 2017 will significantly exceed market expectations.

Fantastic news, though it is tempered by an expected tapering in 2018. Next year, these royalties are projected to be "higher than average", but "not necessarily at these record levels". So there probably won't be year-on-year sequential growth.

Still, it's good news and this remains an intriguing story.

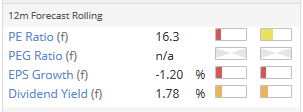

Overall, it's a bit too mysterious for me. Stockopedia really likes it though! Taking a purely quantitative approach, it looks excellent:

Thanks for reading! I think Paul will chime in with a few words on Revolution Bars (LON:RBG) if he gets a chance.

Best wishes

Graham

Revolution Bars (LON:RBG)

Share price: 187p (down 5.2% today)

No. shares: 50.0m

Market cap: £93.5m

(this section written by Paul Scott - at the time of writing, I have a long position in this share)

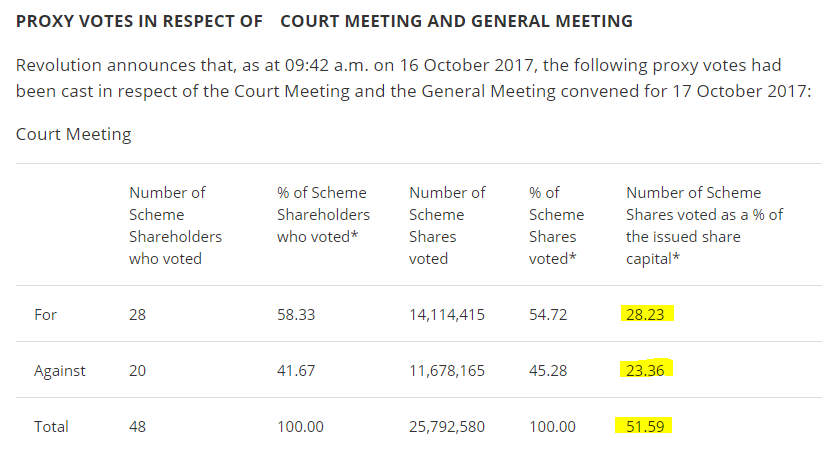

Proxy voting - this is a very important announcement. It appears that RBG shareholders are poised to reject the Stonegate 203p cash takeover offer;

As you can see from the table above, although more shareholders have voted in favour, it now seems almost impossible that the necessary 75% vote in favour could be achieved. This triggered an immediate sell-off in the share, although it bounced somewhat within a short space of time, to end the day down 5.2%, on quite heavy volume for this share - of 2.6m.

Just 7 minutes afterwards, we got a short statement from Stonegate;

Offer update (from Stonegate);

Stonegate notes the announcement by Revolution on 16 October 2017 regarding the proxy levels for the Scheme.

Stonegate is considering its options and a further announcement regarding Stonegate's intentions will be released in due course.

My opinion (Paul Scott) - who knows what happens next? There now seems to be a very real risk that the Stonegate 203p offer could fail. In a way, I think that's good, as the price is too low. Although in retrospect, it clearly would have been better for us to sell up in the market at 210p a few days ago (and then buy back in, more cheaply).

What has changed, since the lows around 105-110p earlier this year, is that we now know that two potential trade buyers (Stonegate & Deltic) both think that RBG is worth a lot more. Stonegate are prepared to pay 203p in cash - so they clearly think that RBG is worth a fair bit more than that, otherwise they wouldn't be happy to buy it at that price! Deltic confirmed that for us, repeatedly saying that the Stonegate offer undervalued RBG. Unfortunately, RBG clearly didn't have the financial firepower to mount a credible counter-offer.

I'm not familiar with all the ins & outs of the Takeover Panel rules. However, a reader here who sounded as if he knew his onions, commented recently that by stating that their 203p offer price was "final", then that apparently prohibits them from offering a higher price for RBG. I don't know whether that's true or not.

It seems to me that RBG is clearly in play, is a terrific business earning excellent returns from its existing & new sites. Although it is up against well-publicised industry & macroeconomic headwinds - weakening demand, and cost pressures.

We'll just have to wait & see what happens next. My view is that, as RBG probably now won't be sold for 203p, because RBG shareholders think that price is too low, then it's either going back to being a private company, or someone else might come along and bid for it, at a higher price.

The share price is perhaps most likely to drift down in the short term, but I see good long-term upside. Also, if many RBG shareholders are prepared to reject an immediate 203p cash offer, then you imagine they would be happy to buy in the market, if the share price remains below that level. Mind you, you can't be sure about that - because there are effectively two markets - institutions, and private investors. Its the small trades from the latter that tend to set the share price. So the price could go anywhere, on small volumes, nobody knows.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.