Good (Sunday) evening! It's Paul here, with a placeholder article, so that readers can post your comments here on Monday's results & trading update RNSs. We very much welcome reader comments, flagging up interesting company news, and giving your views.

Also, I had a good look at ATTRAQT (LON:ATQT) over the weekend here.

Remember that the focus here is on small caps (which we define (loosely) as market caps under £400m). We don't cover the following sectors: resources, property, blue sky, pharmas, REITS, investment trusts, etc.

See you in the morning!

Good (Monday) morning!

I'm not surprised that shares in $AMZN are marching on to new highs - completely detached from earnings, so PER has gone out of the window. Once you've signed up to Amazon Prime (which I did purely to watch Jeremy Clarkson's "Grand Tour" - which is superlative, if you like Top Gear), they've got you.

My mother yesterday lamented that Amazon doesn't pay any tax. I had to explain that's because it doesn't try to make any profit, and corporate taxes are levied on profits. Instead it's trying to kill off the competition, by eradicating their profits. How come it hasn't been nailed by competition watchdogs? Technology seems to move forward so quickly, that by the time regulators are galvanised into action, it's too late.

That got me thinking about reassuringly static technology, so my attention briefly focused on the humble bedside clock/radio. Many have tried to modernise the clock/radio, but nobody has succeeded. It remains pretty much exactly the same as when first invented in the late 1970s (from memory). There's a little wire hanging out of the back, which helps the radio find a signal. The reassuringly large, and over-geared thumbwheel, which can move from 96 right through to 108 on the FM band, with just a quarter turn, making tuning incredibly difficult. That marvellously large, and wobbly Snooze button, which you can press 10-20 times. Then of course, the smaller, less geared thumbwheel to adjust the volume of Radio 4, or Radio Luxemburg if you accidentally brushed against the unit.

The trouble is, my brain is so hard-wired to adjust the clock/radio, that I adjust it in my sleeep. So instead of moving it forward (or is it back?) by 1 hour over the weekend, to accommodate British Winter Time, I seem to have moved it forward by 9 hours. So it's a miracle that I'm awake at all.

I suppose I'd better write something about small caps. Graham is having a well-deserved week off, so you're stuck with me I'm afraid!

I've got ChipsAway coming round some time after noon, to bodge up, sorry I mean perform a seamless repair on the paintwork of my leased car. Some swine grazed the paintwork overnight a few months ago, and didn't even leave a note under the windscreen wiper to apologise & swap details. Standards are slipping in all walks of life, I'm afraid. I'm not going to replace the leased car when it expires. I only do 2k miles per annum, so it will be easier to just hire an Astra for £40 per day from Avis when I occasionally need to drive. Plus I've just been done by the plod for doing 70 in a 60 zone.

It's quiet for small cap news. I'll be looking at trading updates from £SND and Image Scan Holdings (LON:IGE) (in which I hold a long position). Is there anything else in my small caps universe that you'd like me to look at?

Sanderson (LON:SND)

Share price: 69p (down 4.0% today)

No. shares: 55.1m

Market cap: £38.0m

Trading update - I'll copy/paste, to save re-typing. Amazingly, the quote below is just one sentence, all 60 words (treating numbers as words) of it;

Sanderson Group plc ('Sanderson' or 'the Group'), the software and IT services business specialising in digital retail technology and enterprise software for businesses operating in the manufacturing, wholesale distribution and logistics sectors, issues the following trading update ahead of the announcement of its preliminary results for the year ended 30 September 2017, scheduled to be released on 28 November 2017.

Here's what the company says today, in an update which is full of facts & figures, and strikes me as being commendably clear;

The Group's unaudited revenue for the year ended 30 September 2017 is expected to be approximately 21.5million (2016: 21.32million) and operating profit, adjusted for amortisation of acquisition-related intangibles, share-based payment charges and one-off non-recurring items, is approximately 3.9million (2016: 3.69million). These non-recurring items, in the region of 0.5million, include costs relating to potential acquisitions during the year, the consolidation of office premises with internal reorganisation, as well as the costs incurred in changing the Group Finance Director. These costs are mitigated by the receipt in full of a licence fee from a former customer who had been disputing the payment relating to their access of the Group's software. Pre-contracted recurring revenues increased to over 11million (2016:10.76 million) and represent over half of total revenue. Group margins were maintained at a high level of 82% in line with the first half of the financial year.

Sales order intake totalled 13.7million (2016:12.26million). The Group order book at 30 September 2017 stood at an optimal level of 5.8million (2016:3.02million) and includes a significant order from an existing customer which is scheduled to be delivered over the course of the next two financial years.

The Group cash balance at 30 September2017 was well ahead of market expectations at over 6million (30 September 2016:4.34million) and this reflects the Group's continuing strong cash generation and is after the payment of 1.38million of dividends paid to shareholders during the financial year ended 30September 2017.

Profit growth looks OK, but not sparkling.

I like the decent growth in both order book , and cash balance.

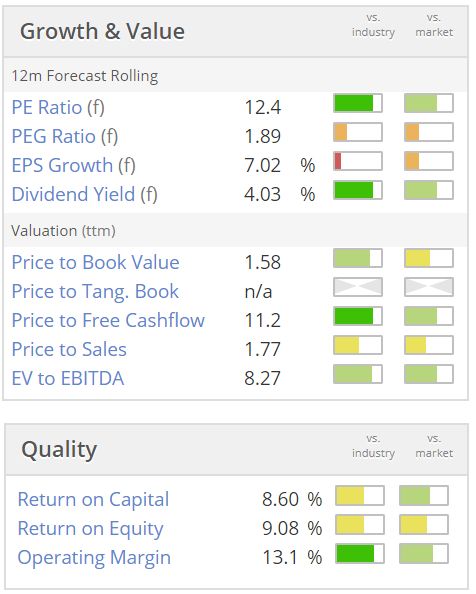

Valuation - this looks quite good value, with a low PER, and good divi yield;

Balance sheet - note there is a fairly hefty pension deficit, of £8.1m, at the last reported accounts date of 31 Mar 2017.

Outlook - the first paragraph sounds a bit hesitant, but it reverts to a more positive tone in the last paragraph;

Whilst the Group has not yet detected any major loss of confidence from either existing or from prospective customers, the Sanderson Board will continue to monitor the situation carefully.

The Board remains keen to enhance the strength of the Group by selective complementary acquisitions. Management will continue to adopt a careful and measured approach to acquisitions with the priority being very much focused on continuing to deliver shareholder value.

Sanderson has a good order book and together with a healthy balance sheet, strong reputation and good track record in its markets, the Group is well positioned to make further progress during the current year ending 30 September 2018.

My opinion - this seems reasonably priced, and hence worthy of a closer look. Do any readers have a view on this one?

Image Scan Holdings (LON:IGE)

Share price: 12.12p (up 6.6% today)

No. shares: 136.0m

Market cap: £16.5m

(at the time of writing, I hold a long position in this share)

Trading update - for background, there's a really good, recent video here of the boss, Bill Mawer, doing a presentation at Mello Beckenham, provided by my friends at PIWorld.

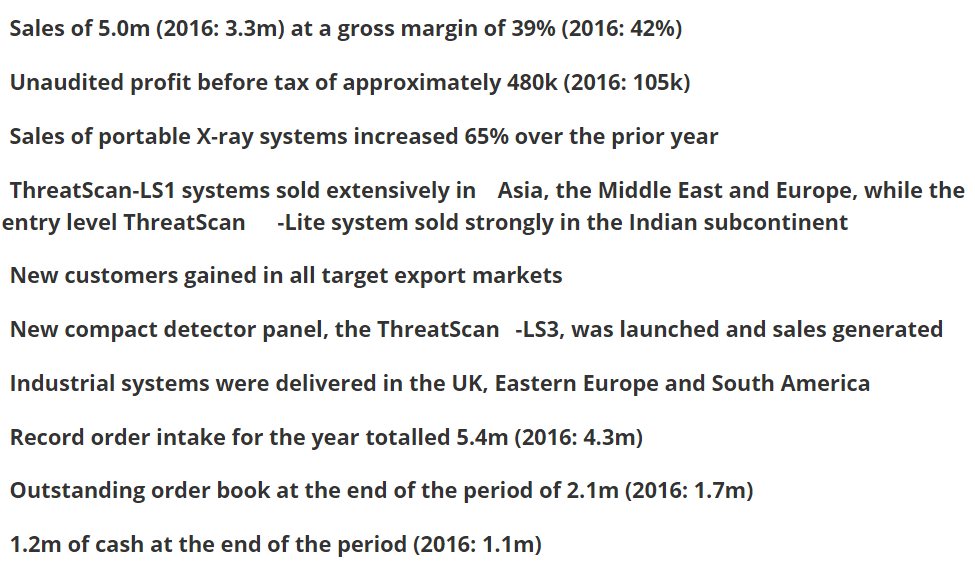

What's interesting about this little X-ray imaging (for security & industrial sectors) company, is that its new products seem to be taking off. Look at the growth (albeit from a small base) here. All key metrics are showing good progression - hence the buoyant share price;

Directorspeak - is nicely upbeat;

Image Scan's Chairman and Chief Executive, Bill Mawer, commented: "To achieve a 50% growth in sales and a five-fold increases in profit is an achievement the directors and staff are exceptionally proud of.

We have successfully launched important new products and penetrated valuable new markets. I was also pleased with how our operations team and our supply chain handled wide variations in our manufacturing activity though the year.

We start the new year with a good order book, new products and an ambitious team, who are looking to continue the strong momentum of the Company."

The company does seem to like bold font.

My opinion - I like it, hence why I bought some shares earlier this year.

I particularly like small companies which launch new products, and then get decent sales traction, as is the case here. It remains to be seen whether this is a flash in the pan, or the start of more significant, sustainable growth?

My feeling is that, if customers in various countries, are buying new products in greater scale, then the company must be doing something right. Security concerns are obviously an ongoing threat, so portable X-ray scanners must surely be in demand for the foreseeable future.

How to value it? No idea really. Although £16.5m market cap seems reasonable to me. Stockopedia calls it a "Momentum Trap" currently, although it will be interesting to see if/when that changes, when more positive financial results are published in due course.

The chart is looking good too. I feel that the positive newsflow & improving financials, do justify this share price rise. So personally, I am minded to sit tight and see how things progress;

Seeing Machines (LON:SEE)

Share price: 4.8p (up 10.2% today)

No. shares: 1,486.5m

Market cap: £71.6m

New DMS program award with premium German auto OEM - a clumsy title for an RNS.

This company is an old favourite from years ago, which I used to own shares in. However, the long delays, and heavy cash burn eventually tried my patience too much, and I abandoned it. I'm grateful to reader "2020vision" who flags up an apparently positive contract win today. Are things starting to turn the corner, in a positive way, I wonder?

This company makes equipment which uses cameras and clever software to monitor the eye movements, and posture, of people driving vehicles. It's safety equipment, which sounds alerts if drivers nod off at the wheel, or fail to properly monitor instruments (e.g. for airline pilots).

There's never been any doubt that the product works - evidenced by Caterpillar buying it for their very expensive, heavy duty mining trucks. The big question has been whether SEE can actually become commercially viable, which to date it has failed to do.

Today the company says;

... pleased to announce a program award with a premium German Automotive OEM in conjunction with a major Tier 1 automotive partner, to provide its FOVIO Driver Monitoring System (DMS) technology into new automobile models. The awarded models are scheduled for mass production launch starting in 2020.

Whilst good news, we're looking at a wait of 2+ years for revenues.

Quantifying things, SEE says;

According to previously given guidelines, this may be considered a Medium value program (from A$10M-A$25M revenue) based on the initial included models and lifetime volume projections, with the potential to become a Large value program in time (>A$25M revenue).

It is worth noting that volume projections can change materially, up or down, and as is typical in automotive industry contracts, there are no guarantees beyond engineering milestone payments.

That's quite loosely worded. It's difficult to know what lifetime volume projections are?

The current exchange rate is 1 AUS$ = 58 pence. So the revenue projection above is £5.8m to £14.5m, spread over an unknown number of years. I assume they're probably talking about something in the region of 10 years? If that guess is right, then this contract doesn't look particularly exciting in terms of annual revenue.

What is interesting though, is that this could perhaps be the starting point for wider adoption of SEE's technology? New features on cars tend to be introduced on top end cars first, and then find their way down to mass-market, cheaper cars over time. Things we now think of as basic, e.g. central locking, aircon, and electric windows, were luxury features on top-end cars only, in the 1980s.

My opinion - this announcement has certainly piqued my interest. SEE has always been a jam tomorrow, loss-making company. However, if mass-market adoption in cars is now on the horizon, then there could be upside on this share, possibly? I'm not comfortable with the £71.6m market cap, but we're in a bull market, where people are paying up for future potential.

The company has burned through a lot of cash in the past. Looking at the last cashflow statement, it burned through about AUS$20m in y/e 30 Jun 2017. So with AUS$21.4m cash at 30 Jun 2017, it looks funded to mid-2018. Therefore I suspect another fundraising may be necessary. That's not necessarily a problem, as the newsflow is now looking good, and we are in a bull market, with plentiful funding available for technology companies with a good story.

How to value it? No idea! Overall though, I think this one is starting to look potentially interesting again. Obviously it's high risk, and speculative. You only have to look at the share count (nearly 1.5bn!) to see that early optimists have been heavily diluted.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.