Good evening! This is the placeholder article for tomorrow morning.

The idea is that we have an article up ready for the 7am RNS, with trading updates & results statements being the focus of the SCVRs, as usual. So readers can post any comments you wish, about the day's small caps RNSs, preferably with as much information & views as possible. We've had some absolutely smashing posts here recently from readers, which are very much welcomed. As I always say, investing is a team sport!

(I don't cover any resource sector stocks, nor blue sky, biotech, financials, property or investment trusts, etc. But I do cover about 600 other UK small caps, which is most of the rest of the small caps universe. Usual market caps we cover here are from £10m up to about £400m. We sometimes break those rules, if something topical & interesting comes up).

See you in the morning.

Good morning, it's Paul here!

Thank you for the reader comments. It's particularly helpful when people post a summary & their own views of results or trading updates. I especially like MrC's daily snapshot, so thanks for that.

There are two sharp fallers today, so I'll start with them.

System1 (LON:SYS1)

Share price: 391.4p (down 24.4% today)

No. shares: 12.5m

Market cap: £48.9m

Interim results - for the 6 months to 30 Sep 2017. The company calls itself;

the pioneering marketing services group

I'm refreshing my memory by going back through our archive. Graham covered the profit warning here on 18 Aug 2017 As you can see from the chart, that hit the share price hard. The company indicated that revenue visibility was poor, and that H1 would be "a little over break-even".

Graham called it absolutely spot-on in August, concluding that the share remained over-priced.

Graham wrote another article about the company's more recent trading update, here on 16 Oct 2017. Again he got it spot-on, concluding that the share looked "Vulnerable to a further de-rating".

Moving on to today's results, H1 produced profit before tax of £0.85m (down from £2.79 in H1 last year). Obviously that's a poor performance, but it's slightly above the £0.8m which was indicated in the last trading update. So the H1 figures don't seem to be the cause of today's 24.4% share price fall. It must be the outlook comments that are the problem. Let's have a look.

Outlook - the company says that it is hopeful of new product launches "providing a more scalable configuration", whatever that means? Also it says;

Having said that, we are in a period of change, and with our normal limited revenue visibility, we are more cautious than usual on our short-term outlook.

The encouraging signs we referred to previously continue, but trading in Q3 to date has not yet resulted in a pick-up in our order book.

Were the gross profit decline seen in H1 to be repeated in H2, then notwithstanding the lower rate of underlying overhead increase, our profit before tax (reported) for the full year would decline by 50% to 60% (2016/17: 6.3m). Normalised profit before tax (i.e. profit before tax excluding share based payments) would decline by a similar percentage.

Hmmm, that's not good is it? Previous updates were pointing towards a recovery in trading in H2, which doesn't seem to be happening, so far.

It's helpful that the company gives specific guidance on full year profit outlook - I wish all companies would do this. After all, the best people to forecast profits are the people actually running the business, not analysts or investors.

The 50-60% reduction in PBT equates to £2.5m to £3.2m range for the full year, ending 3/2018. Stockopedia is showing broker consensus net profit of £3.68m for this year. NB. remember that the net profit figures on Stockopedia are after tax. So that implies a PBT consensus of about £4.6m, assuming c.20% corporation tax. Therefore today's update is another fairly big profit shortfall compared with broker forecasts.

I haven't managed to track down any broker updates yet, but will edit this article here if I find anything. Although the company has given us specific guidance above.

Valuation - if we take the mid-point of the above range, about £2.8m, take off 20% tax, that results in earnings of £2.2m. Divide that by 12.5m shares in issue, and we arrive at EPS of just under 18p.

With the share price currently at 391p, that gives us a current year PER of 21.7 - which doesn't look cheap to me. So even after the precipitous drop in share price this year, the market is still factoring in some recovery in earnings. I'm not sure that is wise. It all depends whether you think this is a one-off bad year, or whether something more serious is happening?

Balance sheet - absolutely fine, no issues here. This is a well-funded company, which has net cash of £3.5m (that's dropped a lot though, from £7.3m a year earlier, so I'll check that out.

Cashflow statement - this is a much-overlooked statement generally, but I'm trying to focus more on cashflow, as it can be very revealing. The stand-out item is £4,051k paid in dividends, which is responsible for most of the fall in net cash. Maybe it wasn't such a good idea, paying out a big divi?

Note 7 reveals that H1 profit before tax of £846k translated into only £365k in cash generation from operations. This is mainly due to adverse working capital movements. I'm surprised that receivables rose by £516k in H1. With revenues falling short, I would have expected receivables to fall, not rise. That could possibly indicate problems with collecting in amounts invoiced to clients?

My opinion - I really have no idea how to value this company. As it freely admits, it has little visibility of revenues. Results can be skewed by large, one-off projects. People businesses are not generally good places to invest, in my view. The trouble is that the best people often leave, to set up their own competing agencies. Plus they demand big bonuses in the good years.

I previously thought that SYS1 looked something special, and different. It had good growth record (in revenues and profits) until this year, but that's gone wrong now.

Buying the shares now would really just be a punt on the company's performance recovering. I try to make share purchases based on facts & figures, rather than just hoping that a company will perform better in future. So it's not for me. It might be worth a fresh look if & when more positive trading updates are published. For now though, I'm happy to sit on the sidelines with no position.

Peel Hotels (LON:PHO)

Share price: 95p (down 2.6% today)

No. shares: 14.0m

Market cap: £13.3m

Interim results - for the 28 weeks to 13 Aug 2017. Why 28 weeks, and not 26 weeks? Seems odd. Although the comparison figures last year H1 are also for 28 weeks.

This is a small group of hotels. It's not had a good H1.

PBT fell from £593k in H1 last year, to only £319k this year.

Note that interest costs consumed almost half operating profit last full year. Although a recent refinancing should reduce future interest costs. I hope they've got an interest rate cap on the debt.

Balance sheet - appears strong, with asset backing (PPE of £35.4m), which is partially funded with net debt of £9.2m.

Net assets are £24.2m. Given that the market cap is £13.3m, could this be an attractive value share - with the share price 45% below NTAV? I would say that the market is discounting the book value of the hotels because they're not generating much of a return.

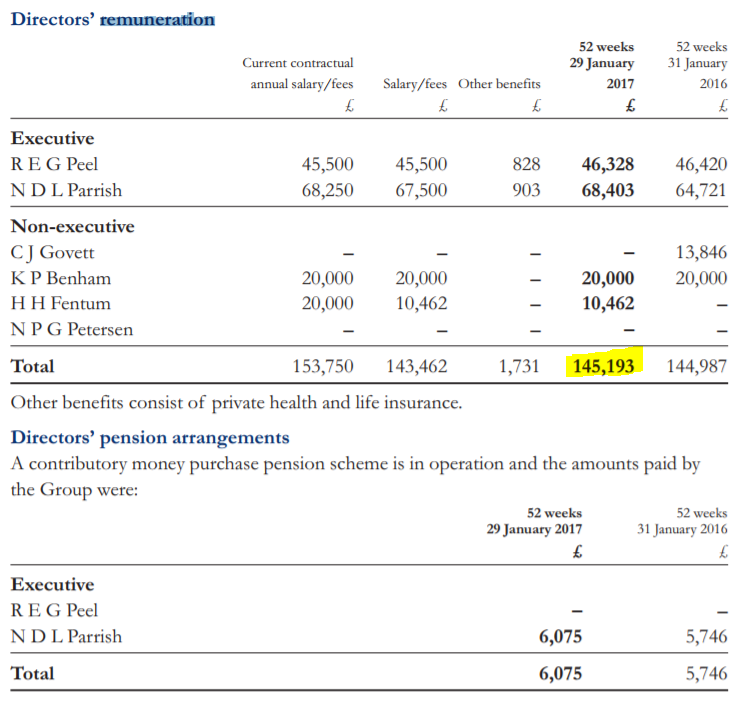

I did wonder whether this is a lifestyle business, with Directors plundering the company with inflated salaries & bonuses? On checking the Annual Report, it's actually quite the opposite - Directors draw amazingly modest salaries. These figures feels like we've gone back to 1990!

I might print off the above table, and wave it under the noses of some of the grotesquely overpaid small cap Directors at other companies. Peel Hotels is largely owned by the Directors - Charles & Robert Peel own nearly 63% of the company. So the free float is tiny - therefore I probably won't report on this company again.

Outlook - sounds reasonable, so I don't think there's any reason to panic;

The comparative shortfall in EBITDA in the first three periods will be difficult to make up by the end of the financial year however sales have now stabilised, REVPAR currently is growing (reversing the trend in the half year) and costs are under control.

The ongoing diminution of financial charges will be of great benefit to the Company and net debt will continue to decrease satisfactorily whilst leaving the Company sufficient surplus cash to continue the reinvestment in its Properties.

There lies the problem with smaller, older hotels - there is a never-ending capex requirement. So the apparently attractive cashflow doesn't tend to find its way to shareholders - divis have only been small & sporadic in recent years.

My opinion - the only upside I can see on this share, is if someone comes along and is prepared to over-pay to buy some or all of the company's properties. In an era of cheap debt, many asset prices are inflated. The trouble is, when you look at the book value of Peel's hotels, they seem greatly over-valued relative to the very small economic return they generate.

I see that 39% shareholder Robert Peel was aged 70 at the time of the publication of the last Annual Report. So maybe he might seek an exit route, through a sale of the business? He's certainly incentivised to get the best price.

Overall then, I wouldn't touch this share as a business, as it generates so little shareholder return. As a special situation, based on possible sale of the company, it might have some interest to a patient investor.

I'd be worried about possible future trading losses though. Operational gearing means that this type of business would be very vulnerable if a serious downturn in demand and pricing occurred (the two tend to happen together). So it would be worth seeing how the company managed in the serious recession of 2008-9.

It's not for me.

ATTRAQT (LON:ATQT)

Share price: 35.5p (down 18.4%)

No. shares: 106.4m

Market cap: £37.8m

Trading update (profit warning) - the company describes itself like this;

ATTRAQT Group plc specialises in onsite search, online merchandising and eCommerce personalisation with two product offerings: Freestyle Merchandising and Fredhopper. The Group's customer base is made up of over 230 client logos ranging from SMEs to global, blue-chip businesses. ATTRAQT has a strong base in the UK and Western Europe, with a presence in North America, eastern Europe and ANZ. For more information, please visit: www.attraqt.com.

So it's a niche software provider for eCommerce companies basically.

I visited the company in Mar 2015, and had a product demo & a chat with the CEO, Andre Brown. My conclusion was that the software is clearly good, and has an excellent client base (e.g. BooHoo), but that the company was too small for the stock market at the time. So it's good to see that a relatively big acquisition (called Fredhopper BV - based in Amsterdam) was made in early 2017, funded with a £27.5m Placing. Fredhopper looks to be a very similar business to Attraqt's original business. Key clients of Fredhopper include Asos, and Waitrose.

Interim results - to get myself up to speed, I'm having a quick look at the last interim results, being the 6 months to 30 Jun 2017. Fredhopper was acquired on 8 Mar 2017, so contributed almost 4 months trading to the 6 months figures.

The pre-exceptional loss in H1 was £1.1m. There was a large exceptional charge of £2.1m, which relates to the costs of acquiring Fredhopper. Can you believe that legal & professional adviser fees were almost £1.7m! It's money for old rope really - the lawyers & brokers are still ripping off clients with absurdly high fees - hence why they can afford the lavish London offices, and crazily high salaries & bonuses for staff who are generally bright, but in the real world would not be worth anything like the salaries they are paid in the City. Something that many of them will cheerfully admit, over a pint! Anyway, it's worth bearing in mind that, if you do participate in any Placings, that 5-10% of your money is going to disappear into the pockets of the advisers.

Actually, the acquisition costs are more than £1.7m, that's just what went through the P&L. There's another £1.15m in costs of the Placing, which by-passed the P&L, by being debited against the Share Premium account in reserves (i.e. a balance sheet entry). So over £2.8m in costs, for a c.£25m acquisition - that really does seem a lot.

Balance Sheet & Cashflow - the balance sheet looks a bit thin to me.

NAV at 30 Jun 2017 was £25.1m, but this is bulked up by intangibles. Removing those, gives;

NTAV of negative -£1.7m - I'm not keen on negative NTAV at the best of times, but can occasionally tolerate it where the business is highly cash generative. Because of the acquisition muddying the water, it's difficult to tell if ATQT is cash generative or not. If I've interpreted the interim figures correctly, it seems to be around cashflow breakeven, if we ignore exceptionals.

Net cash of £2.7m at 30 Jun 2017 doesn't provide much headroom, in my view. Although it's good that the balance sheet doesn't contain any interest-bearing debt.

Overall then, I wouldn't be surprised if the company were to do a smallish placing at some point, to top up its funds. That's not necessarily a problem - we're in a bull market, and investors are keen to support tech companies with decent growth.

Profit warning - right, that's got myself up to speed. Now let's look at the profit warning on 27 Oct 2017, which says;

Following Eric Dodd's appointment as Finance Director on 1 September 2017, and at the Board's request, a detailed review of the Company's forecasts has been undertaken. The review has concluded that due to inaccuracies in forecasting the timing of certain contracts and client "go-live" dates, it is necessary for the Company to revise its full year outlook.

Oh dear. This is another example of how a change in FD can be the precursor to bad news, as the new FD finds errors and/or decides to be more prudent. This issue has cropped up several times lately, so I must remember to be more suspicious when FDs leave companies.

Some guidance is given on the financial impact;

The Company now expects revenues for the full year to be circa 10% below previous expectations but still showing year on year high single digit organic growth and to be EBITDA positive in the second half of the year as well as being broadly breakeven for the year as a whole.

The lower revenue run rate at the end of 2017 will carry forward into 2018.

Capitalised development spend - in this particular case, EBITDA seems OK, as the company doesn't seem to capitalise much development spend. In the 6 months to 30 Jun 2017, it only capitalised £357k of development spend.

I presume broadly breakeven for the year as a whole means at the pre-tax profits level. It sounds alright anyway - hardly a disastrous profit warning.

My opinion - any growing software company, providing services to the booming eCommerce sector, is well worth a close look. There's a good chance that the shares could go bananas, if growth accelerates. I'm half-tempted to take a speculative long position here.

However, I have one serious reservation. This company's software is an add-on to improve the performance, and flaws in eCommerce platforms. The risk is that the product features created by ATQT are likely, over time, to be built into the latest eCommerce platforms. That would eradicate the need for eCommerce clients to use ATQT's plug ins. The company alludes to this risk in both its interim results, and the latest trading update;

The Company is working on the expectation that a significant proportion of the attrition risk relating to clients re-platforming (as discussed at the time of the interim results), will crystallise early in 2018.

The mitigating actions outlined in the interim statement, including the hiring of additional account management resource, will continue to be implemented.

In plain English, that says to me that the company is expecting to lose some big clients in early 2018.

Looking back to the interim results, published on 20 Sep 2017, this is what the company specifically said about re-platforming risk;

However, the Board has identified a temporary market change which we see as a potential risk for 2018, and which we feel it is prudent to mitigate by taking specific action now.

There is a consolidation activity occurring in the ecommerce software market, leading to some retailers reviewing their entire ecommerce platform, including the technology stack that sits on top of it.

Whilst we haven't seen much impact from this in H1, it is prudent to invest ahead of time in account management, sales and production, especially given the positive momentum the team is seeing and therefore the Board has approved an incremental spend of up to 0.5m in 2017.

I don't like the sound of that at all. It's hinting of potential trouble ahead, so for me that rules out this share.

All done.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.