Good morning!

Thanks for the early comments.

I'm planning to cover Cerillion (LON:CER), Ramsdens Holdings (LON:RFX), Zoo Digital (LON:ZOO) and Patisserie Holdings (LON:CAKE), and will then see what I have time for after that.

Regards,

Graham

Cerillion (LON:CER)

- Share price: 124.5p (+4%)

- No. of shares: 29.5 million

- Market cap: £37 million

I've just finished an interview with the CEO & CFO of this company, which I hope to publish in the next day or so.

It provides charging, billing and customer relationship management software, historically to the telco space but now to a range of other industries as well.

These are nice results, which are in line with expectations: revenues are up 8% to £16 million, although the large majority of revenue comes from abroad so I expect there were some currency tailwinds. Recurring revenue and the back order book both increased materially and without any acquisitions having taken place.

The company has net cash and is run by a heavily-invested management team who have been with Cerillion for many years. It was spun out from Logica in 1999.

According to Stockopedia metrics, it qualifies for the Neglected Firms screen. Digging into that screen, it means the company doesn't have much broker coverage, and hasn't seen much EPS growth (at least not until today), but does also satisfy a wide range of attractive criteria.

For example, to qualify for the "Neglected Firms" screen, you need a PE ratio less than the industry median, and net margin greater than the industry median. Cerillion's PE ratio is c. 14x - 15x, depending on when you measure it, while the operating profit margin in 2017 was c. 16%. Both pretty reasonable!

The shares are up about 50% since the March 2016 IPO, though they have been drifting lower this year.

Outlook for the future remains "very positive" as the company pursues a "strong pipeline" of prospective international customers.

My opinion

Overall, I think this deserves a bit more attention from investors than it has received so far. As is always the case with contract-driven, B2B work, there is that element of risk from the fact that relatively few customers are responsible for the bulk of the revenues each year. But with Cerillion (LON:CER) you also get a net cash position, an experienced management team, an international customer base, and products which are essential for customers and are difficult to replace, helping to mitigate that risk.

Worth reviewing in greater detail, I suspect.

Ramsdens Holdings (LON:RFX)

- Share price: 189p (+3%)

- No. of shares: 30.8 million

- Market cap: £58 million

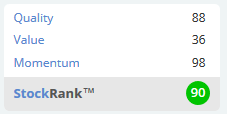

This is another IPO which has worked out quite well for investors so far. Very well, in fact! The shares have approximately doubled since listing earlier this year. Momentum Rank is a sparkling 98.

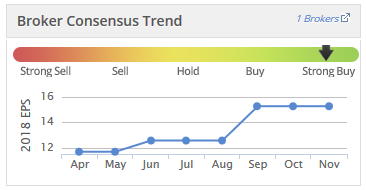

Earnings upgrades have been helpful:

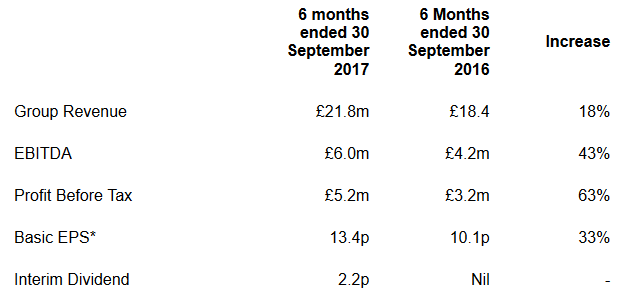

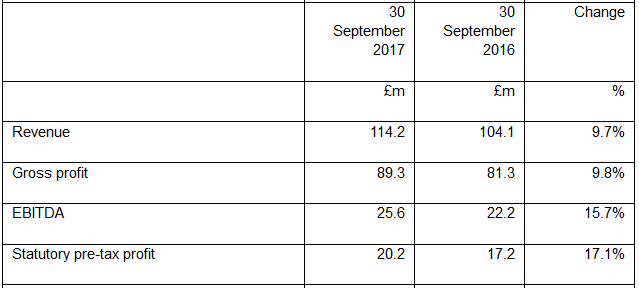

And these results are indeed highly encouraging:

Ramsdens describes itself as a "diversified financial services provider". Indeed, it has a much lower weighting in pawnbroking than rival H & T (LON:HAT) (in which I hold a long position).

At its most recent interim results, H&T's pawnbroking pledge book was £43 million, that size being roughly 88% of six-month sales. Ramsdens' pawnbroking book is £6 million, or about 28% of six-month sales.

Similar to H&T, Ramsdens has expanded its non-pawnbroking activities, and is pursuing and achieving excellent growth in foreign currency exchange and jewellery retail. Forex was responsible for 37% of Ramsdens' gross profit last year, versus just 25% from pawnbroking.

With respect to FX, I think it's long overdue that FX become more competitive. Banks have been making excellent margins on exchanging currencies for a long time, perhaps partly because banking itself is a rather uncompetitive industry. It's great to see new entrants in this market, and clearly there is high demand for it. Ramsdens' gross currency exchanged is up 22% vs. the same period a year ago.

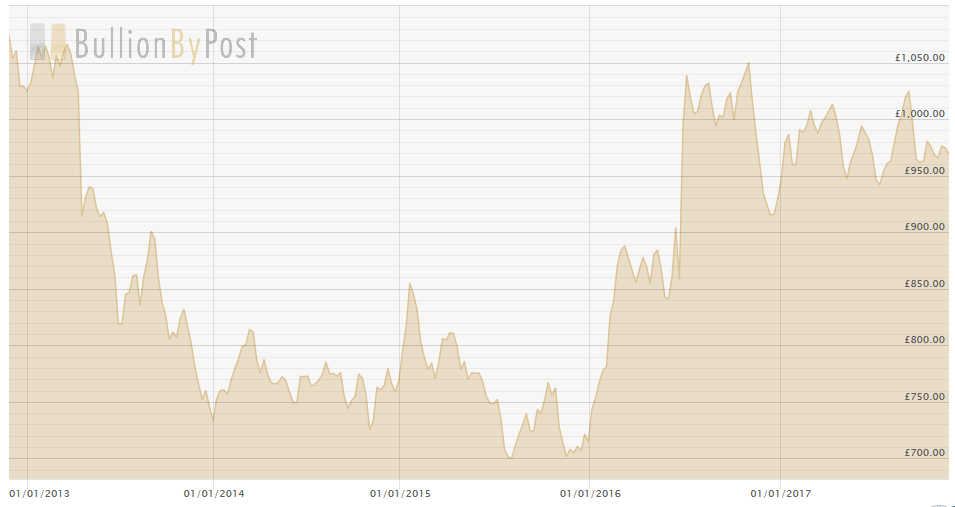

A firm POG (price of gold) has also helped. The pawnbrokers are a great investment for gold-bugs! Margins on gold purchasing activities, and the value of pawnbroking collateral, are of course inherently tied to POG.

The average price of an ounce in GBP terms has been firmer than expected in 2017, usually between £950 -£1000. It reached a medium-term low of £700 in late 2015.

Store Estate: The strong growth in the numbers has been achieved despite a lack of growth in the store estate, which is currently 123 stores. Although management have a stated intention to grow the number of stores, I'd be much happier as a shareholder to see strong growth from the existing estate than lukewarm per-store growth on an expanded estate.

Outlook remains "confident".

The Group has made a good start to the early part of the second half of the year and we have good momentum to take us into the seasonally important Christmas period for jewellery retail.

My opinion

There are no red flags here, beyond the obvious exposure to the price of gold, which no company in this sector can control.

Momentum in FX is excellent and overall capacity in the pawnbroking/alternative credit sector remains very much deflated compared to the peak reached several years ago.

I'm surprised that more competition hasn't been attracted in yet. Whenever we get that big consumer recession, I expect that is when the competition will heat up a bit more. That will be the tricky bit, where management will again need to prove their worth. But for now, everything is plain sailing.

I see these companies as mini-banks, with the opportunity to earn a much higher return on their capital than traditional banks. Ramsdens appears to be well-managed and is a leader in those parts of the country where it is concentrated, making it a sound investment in my book. That's just my opinion, of course - never advice!

Trakm8 Holdings (LON:TRAK)

- Share price: 1.38p (+0.4%)

- No. of shares: 35.7 million

- Market cap: £49 million

Readers have prodded me into covering this. Thanks for reminding me about its results today.

This is a telematics business which we have covered here many times previously. It serves business fleets and also allows for monitoring of individual driver behaviour, for insurance purposes.

The shares achieved a very rich rating by 2016, due to the popularity of the telematics concept, but are now back at a very ordinary valuation of c. 15x.

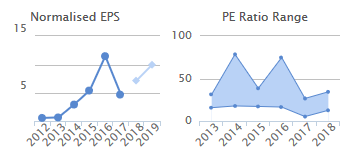

These graphics sum up what happened: EPS had grown at a rapid pace, but it eventually fell back and caused a compression in the PE rating too. The double whammy of rising earnings and a rising multiple can also work in reverse:

Onto today's results, which show an excellent improvement. They are in line with the prior expectations.

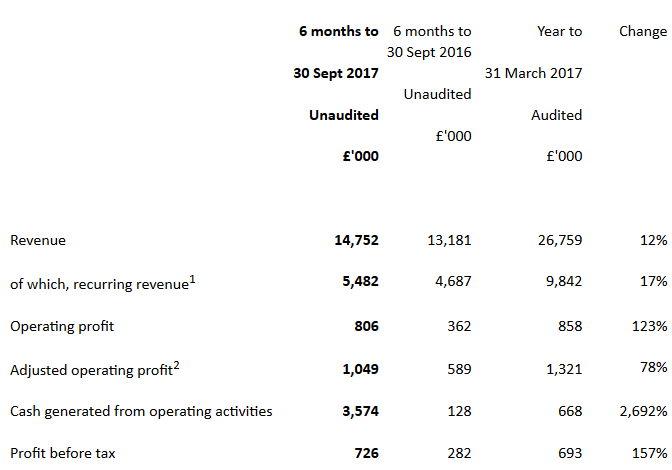

Trakm8 has been criticised for failing to generate cash. Note that it includes cash from operating activities among its financial highlights:

Net debt has reduced to £2.3 million, versus £3.9 million six months previously.

Number of telematics connections is up 14% in six months too - sounds great.

Outlook remains in line expectations. It's a little bit confusing - there is more visibility than before, but still "a level of uncertainty":

"We anticipate a stronger second half as usual. With our strong range of substantial new contracts in place, and as a result of increased sales and marketing activity, we have visibility to support our second half expectations."

"The outcome for the full year is less dependent on securing contracts from new customers than in previous years. The outcome is dependent on existing customer contracts where there is a level of uncertainty of end user demand. The Board remains confident that the market expectations will be met for the full year."

Margins

The company has a strategy to reduce low-margin hardware sales, at the cost of lower top-line growth. That sounds positive to me. Product sales are down 35%.

I would suspect that this is a challenging sector to stay ahead in. Trakm8 tells us that prices are falling for the same functionality, as you'd expect in a tech-oriented service:

There is an ongoing trend of lower service fees per unit for the same functionality. This is a necessary trend as it widens the market opportunity. Margins are protected with lower costs and overall the Gross Margin was maintained. Higher service fees are generated from the higher value added camera systems as a partial offset.

Maintaining margins will require continued technological improvement - that's what you'd expect.

With price deflation, Trakm8 is also heavily focusing on costs, and has controlled them really well in this six-month period.

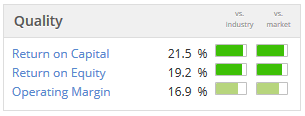

The overall operating profit margin result is 5.5%, and you probably don't need me to tell you that that's a bit on the low side.

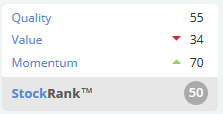

The Quality Rank incorporates measures of quality such as operating margin, and is middling, again as you might expect:

Cash Flow

The £3.6 million in operating cash flow needs to broken down a little bit.

It includes £1.6 million in R&D tax credits, and a favourable working capital movement, so that the operating cash flow before movement in working capital, a more reliable indicator, was £1.8 million.

There was about £900k in depreciation and amortisation, but the company also spent £1.75 capitalising development costs, so that there was a net increase in intangible assets on the balance sheet.

If the company didn't capitalise development costs into intangibles, then it would not have made any operating profit during this period at all.

My opinion

As you can tell, I'm not exactly sold on the investment merits here.

It sounds as if it's doing things right, and making good progress with customers.

On the other hand, margins are low, which it's attempting to maintain by controlling costs, and there is possibly some subjectivity around cash flow generation, given the high level of capitalised development spend.

I think the case that there is an economic moat or a quality business here is not yet proven.

Patisserie Holdings (LON:CAKE)

- Share price: 340p (+8%)

- No. of shares: 100 million

- Market cap: £340 million

This is a chain of cafés offering handmade cakes and ice creams, rolling out at a solid pace.

Results are solid, and kudos to the company for quickly showing the statutory pre-tax profit. Not needing or wanting to make any adjustments, even if adjustments are often justified, is a great sign:

Note there is a small dividend attached to these shares. The next final dividend is 2.4p, so the total dividend for the year is 3.6p.

A profitable, self-funding roll-out is a fantastic place to be when it goes right. On an after-tax basis, Patisserie Holdings (LON:CAKE) generated £20.4 million in cash from operations, of which it only needed to plough £8.7 million into capex. Given the growth profile, I guess that most of this is growth-oriented capex.

Last year, it also had a very positive free cash flow profile, generating £18.6 million in cash from operations after tax, and again investing only £8.7 million of that. So the net cash position has improved dramatically over the last couple of years.

The company's main bakery is in Birmingham, and it is thinking about a new one in Manchester. That would make for considerable increase in capex in the short-term, but hopefully would generate similar returns to that which the company is currently achieving on its capital:

My opinion

This is one where I haven't spotted any red flags yet. The plan is to open 20 new stores per year, which will of course mean that the percentage growth rate will decline over time if it is achieved, but would still be a highly satisfactory outcome from an investment point of view.

At some point it will have to run out of road, but for now the runway sounds like it can last into the medium-term at least:

We continue to target new towns and cities for store openings and in the year opened in twelve new geographical locations. Many of these stores are performing ahead of expectations and reinforces the demand for the Patisserie Valerie brand.

Due to the highly cash generative nature of the business, the rollout programme is funded entirely from operating cash flows. All of our new stores were profitable from the first week of trading and we expect all of these stores to achieve the payback target of 24 months.

As you might expect, the shares are not cheap, at 20x the net income just achieved, and c. 18x on a forward basis.

But I can't imagine that will seem expensive in a few years if it executes its plans. So I'm putting Patisserie Holdings (LON:CAKE) on my watchlist for a potential purchase.

Zoo Digital (LON:ZOO)

I thought I'd help to publicise today's investor presentation by Zoo Digital over at piworld.

Zoo Digital localises entertainment for audiences around the world, using proprietary software and an outsourced army of translators. I covered its H1 results in a recent SCVR.

You can find the investor video at this link.

£BKS (new ticker)

- Share price: 47p (Placing Price: 50p)

- No. of shares: 49 million

- Market cap: £23 million

This company gets off to a quiet start on AIM as the share price dips a little from the Placing Price. It provides computing/connectivity for the algorithmic trading of forex and futures.

14 million new shares were sold, of which 9 million were "new money" for the company, and 5 million were sales by existing shareholders. A reasonable mix.

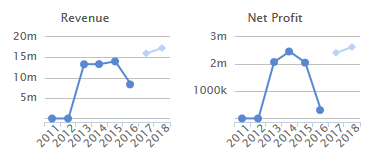

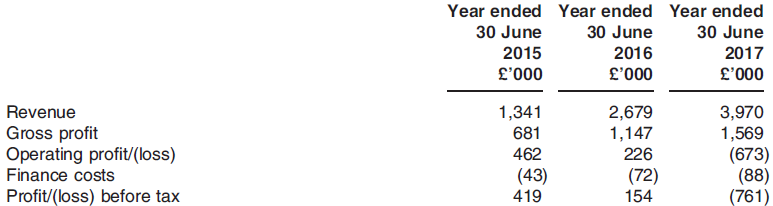

The admission document is available on the company website, here. I've managed to dig out the historical financial numbers as follows:

As anticipated, the company produces excellent gross margins, but the market cap is still looking potentially quite rich against historic figures.

The Intention to Float RNS said the company "has generated a profit¹ in each financial year since trading commenced", the profit measurement being "based on operating profit and in 2017 is pre-exceptional IPO costs."

Doing a few simple calculations, the pre-IPO costs operating profit in 2017 was less than £100k.

The decline in gross margin is explained as follows:

For the financial year to 30 June 2017, the Group experienced 48.2 per cent. revenue growth over the prior year. Revenue growth has primarily been driven by institutional client wins and additional upselling to existing clients.

In the financial year to 30 June 2017, the Group invested £1.1 million in additional operating infrastructure and capacity and, accordingly, the Group’s gross margin reduced to 39.5 per cent. (FY 2016 42.8 per cent.) and EBITDA (before exceptional items) for the year to 30 June 2017 decreased by 13.9 per cent. in comparison to the prior year.

I'm a bit lost here, because investing in infrastructure usually falls under capex and doesn't affect gross margin. Instead, it affects the operating margin in later periods as the infrastructure assets depreciate. So this explanation doesn't make sense to me, I'm afraid.

Also, operating expenses increased very significantly in 2017. Maybe that's where the new business strain fell?

Let's keep an eye on this, and hopefully all will become clear.

That's all I've got for today, cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.