Good morning, it's Paul here.

Apologies - I had a brainstorm, and totally forgot about the placeholder article that I set up last night, which has no content, but does have reader comments. Sorry about that. I was watching the Red Bull Soapbox Challenge on TV at the same time as writing this report. So in all the hilarity of splintering plywood, and wheels falling off on impact with hay bales, and go-karts jettisoning their human cargo, I totally forgot about the placeholder article put up last night. Anyway, I'll rename the 2 reports part 1 & part 2.

As usual for this time of year, it's very quiet for the announcements that we report on here (small caps trading updates & results statements). However, there seems to be plenty of reader appetite for SCVRs, judging by yesterday's reader count, and thumbs ups. So I have resisted the urge to stay in bed until lunchtime!

This is probably my last SCVR of the year. It's been another fantastic year for most of us. As Chris Boxall of Fundamental Asset Management quipped - "If you didn't make money in 2017, you probably shouldn't be in this game!". Chris's roundup for the end of 2017 is on a video here, and is very interesting. I know him well, and he's one of the top small caps fund managers out there, a walking encyclopedia on small caps, and a thoroughly decent chap, so is well worth listening to.

My own portfolio had a sparkling year too, with BMUS (a distilled version of my real portfolio) up 62.7% on the year, and up 221.3% over 2 years. Obviously I'm delighted with that, but can't promise to repeat those returns in future - I think the last 2 years really does need to be seen as something of a one-off.

My performance in the UK Stock Challenge in 2017 was poor, only up 8.3% for the year. Although looking at my stock picks from a year ago, I'm scratching my head as to why I picked 3 out of 5 of them, and in real life had changed my mind & sold them by about March. So I think this demonstrates the need to regularly re-asses one's portfolio, and if the facts/outlook deteriorate, then ruthlessly ditching things before they head further south is vitally important.

Anyway, I've picked 5 new stocks for 2018 for the UK Stock Challenge, being;

Revolution Bars (LON:RBG) - cash bid at 203p from Stonegate was rebuffed by shareholders. So why is the price now at 150p? Likely to be more bids in 2018, in my view. A good quality, expanding business, at a bargain price, in my view.

Sosandar (LON:SOS) - highly speculative at this stage, but I am optimistic that this online fashion startup should grow into the valuation. I'm backing management more than anything here, who seem highly credible to me.

Wey Education (LON:WEY) - as mentioned in yesterday's SCVR. Another speculative share, on a high valuation relative to its small size & marginal profitability. However, I think it's a pioneer in online education, and is now growing at c.60% p.a.. Huge potential markets, globally. Has fresh funding to increase its sales & marketing effort.

Cloudcall (LON:CALL) - after a long gestation period, this is now growing well, and should reach profitability in 2018, and is fully funded. SaaS revenues, mostly recurring. Price has been held back recently by a forced seller, so could rebound in 2018.

Best Of The Best (LON:BOTB) - very illiquid, but I continue to see considerable latent value in this share, based on its reputation, widely known brand (the company that runs supercar competitions at airports, but it's now mainly an online business). I'd like to see more ambitious management, pushing growth up a gear.

It's always tempting to choose smaller, more speculative shares for competitions, in the hope that you get lucky with something that shoots the lights out. However, the above are all high ranking in my personal portfolio too. So fingers crossed that I don't step on any banana skins in 2018, although one always has to be prepared for the standard 30% drop on a profit warning from any share. I look at every position size, and calculate how much money a 30% drop in share price would be. If that number frightens me, then it's time to down-size the position.

The other big risk with the above list, is lack of liquidity. It can be fiendishly difficult to sell smaller, speculative shares, especially after something has gone wrong. Please bear in mind that I have a higher tolerance for risk than most investors, and more than usual, the above are certainly NOT recommendations - those shares that I like above are probably too risky for most people.

Avanti Communications (LON:AVN)

Share price: 7.9p

No. shares: 162.1m

Market cap: £12.8m

Final results - for the year ended 30 Jun 2017 - have been published in the nick of time, before the shares would have been suspended after 6 months.

This is a satellite operator, selling capacity to e.g. broadband companies. I've been a long time bear on this share, as regular readers will know. It's been obvious for years that this company simply doesn't have a viable business model. It's been drowning in debt for years, and doesn't generate any cashflow to repay its huge debts. Therefore a massive debt to equity swap was always the only solution to prevent Administration.

The selling price of satellite capacity is falling (which I discovered when talking to the CEO of Satellite Solutions Worldwide (LON:SAT) some time ago). This is reflected in revenues at AVN falling from $82.8m in 06/2016 to $56.6m in 06/2017. There are some noticeable bad debts provided for, including $16.8m owed by the MoD of Indonesia.

EBITDA was negative, at -$32.5m.

Depreciation & amortisation was an additional $47.2m cost, plus a write-down in valuation of its satellites of $114.1m, and $9.9m goodwill impairment, results in a humongous operating loss of $203.7m. Remember this is before accounting for the interest costs on its huge debt mountain.

Finance expense is a scarcely credible $93.2m

Note that the debt has been written down by $219.2m, which is shown as an exceptional profit

Net debt remains ridiculously, unsustainably high, at $562m

Let's not waste any more time on this crock.

Telit Communications (LON:TCM)

Share price: 155p (unchanged today)

No. shares: 130.7m

Market cap: £202.6m

(at the time of writing, I hold a short position in this share)

Bank covenant update - this troubled maker of internet of things modules, updates us today on its precarious financial position;

The Board is pleased to report that the Group's leading financing bank has granted an advance waiver for the potential breach of covenants as at 31 December 2017.

The Group and the bank remain in discussions with regard to amending its covenant package for future periods.

That's very nice, but banks are not charities. So I think it's probably the case that the banks expect TCM to repair its balance sheet through an equity fundraising in 2018. It's anybody's guess on what terms a fundraising might be done.

My opinion - this share is dripping in red flags, so I remain of the view that it's a compelling short. Having said that, compelling shorts often have a nasty habit of doing the complete opposite of what I expect.

A market cap of over £200m, for a company which doesn't generate any real cashflows, is financial distressed, and has a very nasty smell due to management and ex-management transgressions, seems pretty crackers to me.

One View (ONEV)

Share price: 12.0p (down 2% today at 11:52)

No. shares: 82.6m

Market cap: £9.9m

Interim results - for the 6 months to 30 Sep 2017. This is a cloud-based software company. I'm only really looking at it because there's nothing else reporting today.

To refresh our memories, here are my notes from Oct 2016, when it issued a profit warning. I was unimpressed, disliking the balance sheet, and losses. Good job too, as the share price has since fallen from 40p to 12p.

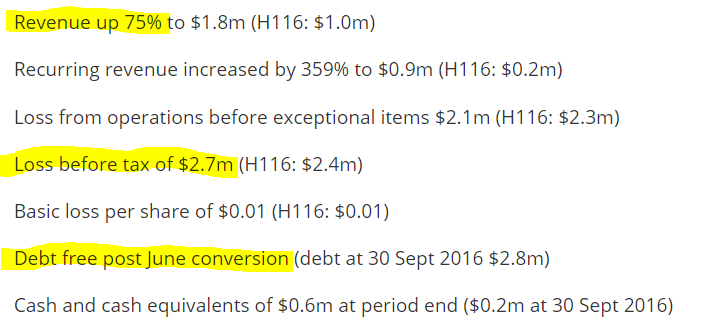

Here are today's H1 highlights;

I like the strong revenue growth.

It's still heavily loss-making though.

Conversion of debt looks interesting.

This bit seems to be saying that another fundraising is required;

Whilst the Company has limited working capital and remains reliant on continued support from its shareholders the Board views the future with cautious optimism.

My opinion - For the above reason, I'll stop there. I might revisit this company once it has completed the next fundraising, and has adequate cash in the bank to continue funding its losses. When you take into account capitalised development costs, this company has prodigious cash burn relative to its sign, so that's too early stage for me. Investors would probably do best to wait and see - the next fundraising could be at a discount, they often are with this type of share. So there's little incentive to buy the shares now, pre-fundraising, only to then see yourself diluted in a discounted placing.

I'll leave it there for now, and start replying to reader comments.

Sorry for cocking up the format today, with 2 articles.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.