Good morning, it's Paul here!

Please see the header above for the companies I shall be writing about today.

Carillion & trade credit insurance

The demise of Carillion on Monday this week is clearly still a very big issue at the moment. Watching the TV news last night, I hadn't realised just how extensive the company's reach is - managing so many areas of public services, e.g. prisons, school meals, etc. I found the TV news reporting alarmist, irresponsibly so. Employees should have been reassured by the media that most jobs would almost certainly continue, under new contracts. Instead, tens of thousands of people are now (probably unnecessarily) fearing for their livelihoods.

Quite a mess. The knock-on effect for suppliers who are now facing bad debts, is likely to be serious too. Indeed it could push some smaller, and/or financially weak suppliers, and subcontractors, into insolvency too.

A keyword search produces this list of listed companies which have issued RNSs concerning their exposure to Carillion. There will be more to come, no doubt. The longer it takes a company to comment, then I'd assume the bigger the potential problem.

This is a timely reminder that sales on credit are a gift, until the cash has been paid by the customer. Hence why it's so important for investors to check (as best we can) the quality of the receivables (also known as debtors) on the balance sheet, within the current assets section.

- Are those debtors actually collectable in full?

- Is a company overly dependent on one or two big customers?

- How solvent are its biggest companies?

- Does the company insure its trade receivables? (they should do, where there is any doubt over customer solvency).

- Is debtor days reasonable (anything over 60 days is an amber flag to me, over 90 days is a red flag). For UK companies, remember to adjust for VAT - i.e. revenues excludes VAT, whereas debtors includes VAT. So I would first divide debtors by 1.2 to take it from gross to net of VAT, and then calculate debtor days (there's a link above showing how to calculate debtor days).

- Has trade credit insurance ever been withdrawn & caused disruption?

These are good questions to ask companies when we meet management. This can be an area of considerable risk, which many investors overlook. I like to hear an FD answering confidently, and in detail, when asked these sorts of questions. I want to get the feeling that the FD is really on top of the risks, and manages those risks tightly. It takes a very strong FD to stop the warehouse shipping goods because he can't get insurance cover on the customer. So I worry less about whether the FD is affable, and more about whether s(he) is strong enough to stand up to the CEO, and other people in the business. Hence why the dynamic between the CEO & FD is always interesting to observe at company meetings. A weak/submissive FD, and overly dominant CEO probably means that there could be inadequately enforced financial controls. As an aside, it was interesting to note that Globo used a highly paid, but unqualified FD. That's a red flag because such a person would be highly malleable - since the career risk of not complying with the CEOs demands would mean a large drop in salary at alternative employment.

The Carillion situation is also a reminder that, in some ways the trade credit insurance companies are just as, or sometimes even more important, than a company's bank. Very often the trade credit insurer is facing a bigger financial risk than a company's own bank. If trade credit insurance is withdrawn for a particular company, then that can often tip it over into insolvency. That was exactly what killed off the original Game Group, in March 2012. (the new incarnation, GAME Digital (LON:GMD) (in which I have a long position) is much more solidly financed, so does not face the same risk now.

This brings me nicely on to:

Begbies Traynor (LON:BEG)

Share price: 70.5p (down 0.4% today)

No. shares: 107.6m

Market cap: £75.9m

(at the time of writing, I hold a long position in this share)

Begbies is the UK's only listed insolvency practitioner. This quarterly report is always worth a read, for independent facts & figures on the health of UK companies.

It's a gloomy assessment;

493,296 businesses were experiencing 'Significant' financial distress at the end of the 2017, up 36% compared to the same period last year (Q4 2016: 361,856) and 10% higher than the previous quarter (Q3 2017: 448,011).

Reasons given are;

- Rising inflation,

- stagnant real wage growth,

- weak Pound,

- political uncertainty,

- November's rise in interest rates, and

- the ever-tightening credit environment

I would add to that list my own points: increasing online competition, wage costs rising from Living Wage & other costs (apprenticeship levy & pensions), rising business rates in some areas, increasing regulatory costs/hassle in some sectors. So there's no doubt that life is really tough at the moment for a lot of (especially smaller, private) companies.

As a result, 258,349 UK businesses ended the year in a position of negative net worth1, while a further 154,251 demonstrated a worrying increase in their working capital deficit.

Although note that financial distress is quite concentrated in 3 particular sectors;

The data shows that 'Significant' distress rose across every sector and region of the UK over the past 12 months. Support Services was the worst performing sector by volume, with 121,095 businesses showing signs of financial difficulty at the end of 2017, up 43% on last year.

Over the same period, financial distress in the UK Construction industry grew 31% impacting 62,294 firms, while 'Significant' financial distress in the Real Estate sector increased by 46%, hitting 40,508 companies.

These three sectors alone made up 45% of all UK businesses in 'Significant' financial distress.

That's giving us a very clear steer on which sectors to treat with caution. Note also that this data was prepared pre-Carillion, so support services and construction sectors are likely to get worse in 2018.

Exporters are doing well - again something we already knew, but worth noting, so we focus our energies on stockpicking companies which have this helpful tailwind in their sales (geddit?!!);

However, there was more positive news for businesses with a strong export book who benefitted from the devaluation of the Pound, particularly within the manufacturing and engineering sector.

Very interesting stuff. As stock-pickers, I think we do need to carefully consider the macro-economic situation. It's not good enough to just pick apparently cheap stocks, whilst ignoring the industry & economic outlook. Cheap shares are usually cheap for a reason. I'm very wary of some sectors at the moment. Although there are always stars, even when the going is tough - actually that's often when star companies do best, hoovering up market share from weak & failing competitors.

Begbies shares have done well lately. Even though the forward PER has risen to 17.9, which is looking a bit toppy, I suspect that there are likely to be earnings upgrades here in future. Hence why personally, I'm not in any rush to sell my BEG shares. There's a 3.5% dividend yield. Divis have started to rise too, after being static for a long time. That's indicative of an improving outlook for earnings.

The recent spike up was caused by a newspaper tip. The trend still seems firmly upwards, which is another reason to make me want to continue holding.

Gattaca (LON:GATC)

Share price: 260p (up 6.1% today, at 10:35)

No. shares: 31.8m

Market cap: £52.7m

(at the time of writing, I hold a long position in this share)

Statement re share price movement (re Carillion)

Gattaca plc ("Gattaca" or the "Group"), the specialist Engineering and Technology (IT & Telecoms) recruitment solutions business, notes the recent share price fall.

It sounds as if the financial impact is negligible;

Whilst Gattaca has outstanding debts from the Carillion group, the vast majority of these are insured by a leading credit insurer and, at this time, we estimate our uninsured balance sheet exposure to be less than 100,000.

The impact of Carillion's liquidation on our balance sheet will therefore be minimal. Our annual Net Fee Income from the Carillion group of companies is in the order of 0.5m.

The company has not taken this opportunity to reassure on overall trading, which concerns me a little. Although it confirms that a trading update will be issued on 8 Feb 2018, for the 6 months ending 31 Jan 2018.

My opinion - I've been getting increasingly bored with holding this share, as it seems to be allergic to rising in price. Although occasionally a large dividend is received, which temporarily alleviates my negative mood.

Unfortunately, I contributed towards yesterday's sharp drop in share price. I noticed that a Director had sold some shares, and combined with worries over its possible Carillion exposure, I decided to sell some of my shares. My broker only managed to dispose of a few thousand shares, whereupon the share price began to plummet. It went into auction (triggered by a 10% fall in price apparently), and by this time it was looking like I'd have to take near to 230p to exit in any size.

At that level I decided to pull my sell order, because it suddenly dawned on me that the Carillion exposure couldn't have been bad, otherwise a Director wouldn't have risked selling, and being accused of insider dealing (i.e. selling in advance of material bad news). Admittedly, such insider dealing is fairly commonplace on AIM (e.g. Telit Communications (LON:TCM) - where I remain short), so a Director selling is not a guarantee that there won't be imminent bad news. However, my feeling is that the Directors at GATC seem reasonably straight, so I wouldn't put them down as the type that would break the rules.

That's worked out fine, as the shares have bounced a bit today. I'm concerned that the company might yet warn on profits though. Are the divis sustainable? The yield of about 9% suggests that divis might need to be cut in future. I'm on the fence about this company. Will probably hold my remaining shares, but not with any great conviction, as I suspect a profit warning could be on the cards in due course.

The problem with so many small caps is that there's so little liquidity in the market. This can cause violent share price movements. That's both a nuisance, but can also provide opportunities to make money, if you're stock-picking is good, and you're not freaked out by sudden moves down. Selectively, panic sellers can sometimes hand us bargains on a plate. I'm not sure that's necessarily the case with this share though. Performance has been lacklustre of late.

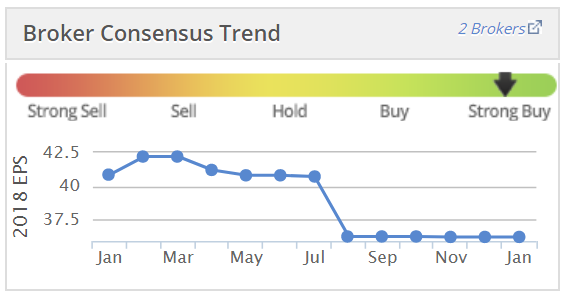

Note that earnings forecasts have already been reduced. A further reduction would not surprise me in the least. Although there are some big infrastructure projects in the pipeline, which the company has previously mentioned as giving it confidence in future earnings.

NAHL (LON:NAH)

Share price: 179p (down 2.2% today, at 12:00)

No. shares: 46.1m

Market cap: £82.5m

NAHL, the leading UK consumer marketing business focused on the UK legal services market, today provides a trading update for the year ended 31 December 2017.

I absolutely loathe this sector, due to previous awful experiences with ambulance-chasing type companies, involved in compensation, or legal stuff. Accident Exchange and Fairpoint were both disasters. However, readers have asked me to look at this, so I will. Also, some friends whose judgement I respect, have told me that this company is OK.

2017 trading - is in line at the underlying trading level;

The Group has continued to trade well and is expected to deliver underlying operating profit in line with the Board's expectations. Our finance charge has come in at a lower level due to prudent capital allocation and our balance sheet remains strong. Consequently, underlying earnings per share for FY17 are expected to be ahead of Board expectations.

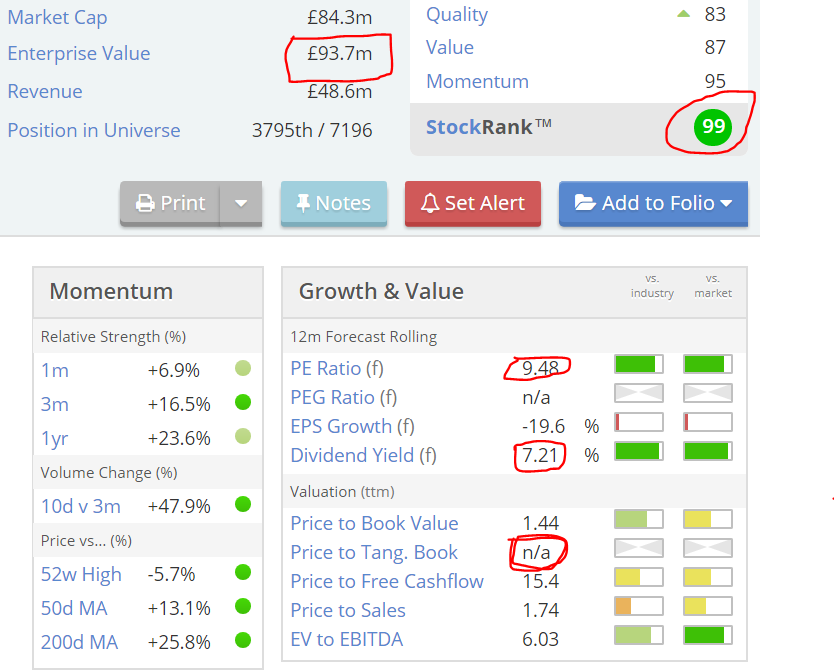

First warning sign - claiming to have a strong balance sheet is to me an amber flag. Often I find that the opposite is true. Let's have a look. The top RHS section of the StockReport throws up some interesting initial pointers, which I have ringed in a wobbly red pen;

- Enterprise Value at £93.7m is higher than Market Cap of £84.3m. Deducting one from the other, this tells me that the company had £9.4m of net debt in the last accounts.

- StockRank of 99 suggests that the Stockopedia computers really like this share. So that makes me sit up and take notice, then form my own view (which usually coincides with the StockRanks). Also note (not shown in the picture above) that the Stockopedia styles shows it in green, categorised as a "Super Stock". Again, that's a clear positive.

- The PER of 9.48 and divi yield of 7.21% are attractive, hence shown in green.

- Price to Tang(ible) Book (Value) is shown as n/a. This is a warning sign, because that means P/TBV is negative - reinforcing my suspicion that this company may well have a weak balance sheet.

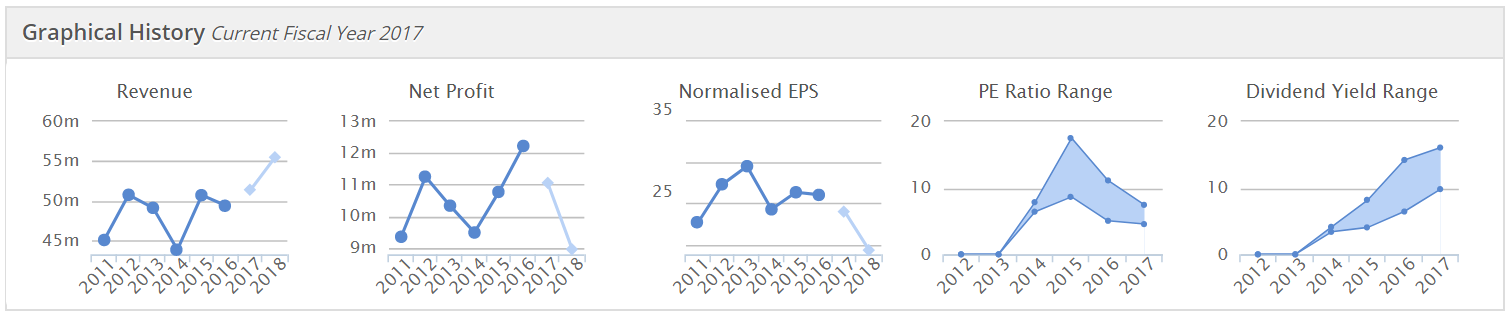

Balance sheet - with the above initial review process, I've already homed in on the balance sheet as being my main area of focus. It's easy to post big profits in this sector, but they can often be bogus. The tell-tale signs are on the balance sheet, with inflated debtors usually.

Here is a quick review of the most recent balance sheet (interims, as at 30 June 2017);

NAV is £58.4m, but this includes £60.4m goodwill and £7.8m "intangibles". Looking at note 8, the bulk of this is £6.6m described only as "contract related". A footnote says that these intangibles are related to 4 acquisitions, so I'll therefore treat this the same as goodwill, and write it off.

NTAV drops out negative, at -£9.7m. That's not good - I don't normally like to invest in companies with negative NTAV. However, if a company is highly & sustainably cash generative, and doesn't need any significant fixed assets, then I am prepared to make exceptions.

Interest-bearing debt - it has £3.7m in current liabilities, and £6.6m in creditors over 1 year, so that's £10.3m in total, less £0.8m in cash, so net debt of £9.5m. That looks a modest level of gearing, given that the company made £18.0m in underlying operating profit last year.

Debtors - this is where I'm expecting a huge, bloated, long-term & difficult-to-collect receivables book. Much to my surprised, receivables is actually fine - at £14.1m (as at 30 June 2017). For a business that's doing about £50m p.a. revenues, a £14.1m debtor book looks perfectly reasonable (especially as this sector usually has very extended debtor books).

Work-in-progress - surely there's a ton of costs held in limbo on the balance sheet as WiP? No, there's absolutely nothing! Zilch.

I hate to say it, but this balance sheet looks clean to me - if there are any bodies buried here, I can't see them!

Cashflow statement - this also looks clean to me.

Working capital movements did blunt the operating cashflow somewhat, but it still generates enough cash to pay its tax, and the generous divis were just about covered by cashflow last year: net cash from (post-tax) operating activities was £9.26m, and divis paid was £ 8.54m.

Outlook - I'm not entirely sure what this means, but this could explain why forecasts seem to be for lower profits in 2018 & 2019? Would this also absorb working capital, I wonder? Perhaps any readers who are more familiar with the company could fill in the gaps for me.

As previously guided, the opportunity to drive future growth means that the investment required to fund cases as part of the ABS' is expected to increase in 2018.

Alongside the successful relaunch of the NAH brand, these initiatives have enabled the Group to continue delivering a high quality service to its Panel Law Firm partners and the number of enquiries generated has grown 8.4% per cent year on year.

I wonder why they had to relaunch the NAH brand? That suggests something might have gone wrong previously, or some kind of regulatory changes possibly?

Ah, I've just spotted this bit - there does seem to be regulatory change underway;

Whilst there have been no specific developments regarding the previously announced regulatory changes by the Ministry of Justice, the Board expects the changes to come into effect no earlier than April 2019. The Group continues to evolve its business model to optimise the opportunity presented by the changes.

Clearly then a proper understanding of the legal & regulatory framework, and likely future developments, is going to be key in ascertaining whether this share is a good one, or not.

Other points;

Bush, the Group's Critical Care division, experienced slightly softer trading in the fourth quarter against expectations...

Fitzalan, the Group's Residential Property division, delivered a creditable performance although trading conditions remain challenging...

The Group also made a 0.8m release from the legacy pre-LASPO ATE provision which will increase reported earnings per share.

My opinion - these figures look really good, although I note that the company seems to have flat revenues & profits. So is it cheap because it's ex-growth, I wonder? I note that the graphs below seem to show consensus profit forecasts falling, which I need to verify;

I haven't as yet seen any updated broker research today, but will edit this article if anything surfaces.

On my review of the figures, I have to say this share looks potentially interesting.

However, this just isn't a sector that I'm prepared to get involved with again. A highly profitable company like this could be vulnerable to regulatory change. We've seen this happen several times over the last 15 years or so. In some cases, companies' business models were blown to smithereens overnight by regulatory changes.

So there has to be a question mark over whether this company's bumper profits & cashflows have long-term sustainability? It's not for me, although I can see why people would find the numbers attractive. The chart also looks attractive - this looks a classic Mark Minervini stage 2 bullish phase - a long base having been formed (stage 1), followed by a rise above the moving averages. You see! Those chartists did eventually get to me!!! ;-)

Utilitywise (LON:UTW)

Share price: 39p (down 15.3% today, at 14:05)

No. shares: 78.5m

Market cap: £30.6m

Utilitywise, the leading independent utility cost management consultancy, announces a further update in respect of its full year results for the year ended 31 July 2017 ("FY17").

As a reader suggests in the comments below, it really isn't worth wasting much time on this appalling company and its dodgy accounts. We have an archive here groaning with material detailing all the ins & outs of the repeated accounting problems.

I've just been looking back at my previous articles, including 6 sceptical articles in 2013. My 2014 articles on Utilitywise are interesting, is that it seemed to be gradually dawning on me that the accounts were not right. Here in Oct 2014 I broke cover & explained why I thought the revenue recognition policy was suspect, and concluded;

Conclusion - I don't like it. There are too many red flags, the accounts look odd to me, and I'm not at all convinced that profits will be sustainable in the long run. Combined with a high valuation, that makes these shares uninvestable in my opinion. It's just an opinion, and I fully expect to get shot down in flames by existing shareholders in the company!

The share price then was 289p, so by spotting the dodgy accounts very early, as potentially nasty loss was avoided. If a humble blogger can spot dodgy accounts, why can't fund managers, is a valid question to ask?

Accounting policies - are being changed again, at the insistance of the auditors (well done them!), following the engagement of another firm of accountants, to give a second opinion;

The review, which was undertaken by a major accountancy firm, is now complete and, as a result, Group results will now reflect a change to the accounting policy of the Group regarding the estimation and recognition of revenue on contracts.

This proposed change will have no impact on the cash flows or underlying economic performance of the Group.

Whilst the bit I've highlighted is true on cashflow, it does mean that previously reported profits were over-stated.

It sounds as if there's plenty of work still needed, in order to finalise the 31 July 2017 accounts. Does this mean that there's a risk of the shares being suspended if accounts not filed by 31 Jan 2018? Quite possibly. The clock's ticking, with only a fortnight left to publish its figures.

The Group currently expects to complete its year-end audit process in respect of FY17 and announce its final results by 31 January 2018. However, due to the volume of work required there is a risk that the audit will not be complete by this date.

Impact on 2017 profits is not yet known.

Impact on 2018 profits is significant;

There is also likely to be a material impact upon the Group's reported revenue and accounting profit in the year ending 31 July 2018, with the absolute impact becoming estimable once the revised accounting policy is finalised.

The bank is being kept informed, but I wonder how much patience they have remaining? It must be tempting to just shut the business down, and collect in the run-off cash on existing contracts, from energy companies, over a number of years. Details are given about bank covenants, which might need waivers.

My opinion - it's just so messy, and with so much uncertainty, I find it impossible to value this company. We don't really know whether it's profitable at all. On the other hand, the debtors should turn into cash, over a number of years. So there could possibly be some value in the company. It has to go in the "too difficult" tray, I'm afraid. I certainly wouldn't want to be holding any share which is only 14 days away from suspension, and embroiled in a complex accounting mess. The institutions are high & dry. They can't exit, even if they want to. Whereas private investors with modest holdings can just hit the sell button any time. That gives us a big advantage.

(work-in-progress)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.