Good morning!

After a hectic month of news, we finally get a relatively slow news day today.

Stocks crossing my radar are as follows:

- Scientific Digital Imaging (LON:SDI)

- Arena Events (LON:ARE)

- Watchstone (LON:WTG)

- Molins (LON:MLIN)

- PayPoint (LON:PAY)

Thank you for suggesting PayPoint (LON:PAY) in the comments, which updated yesterday. It's not strictly speaking within our market cap limits, but it's a stock I have followed before.

Time permitting, I will cover other requested stocks.

Thanks!

Graham

Scientific Digital Imaging (LON:SDI)

- Share price: 29.5p (+13%)

- No. of shares: 89.6 million

- Market cap: £26 million

This is an acquisitive company focused on scientific and healthcare-related technology.

We haven't covered it too frequently here. Last time, I said that I was put off by the rapidly increasing share count, which has nearly trebled since 2015. In general, I prefer organically growing companies, rather than companies which are growing through acquisition.

The SDI share price would suggest that the company's strategy is performing extremely well, so maybe I should try to have more of an open mind?

These interim results are good:

- Revenue up 34% to £6.6 million. Organic growth from two subsidiaries, plus growth from two recently acquired companies.

- PBT up over 100% to £850k, adjusted PBT up 140%.

There are now six subsidiaries, following the most recent one in August 2017.

It turns out that the two most recently-acquired subsidiaries act as supplier to a third one.

This can be a source of confusion. What happens when your PLC's subsidiaries are buying and selling things between each other?

The answer is that any transactions like this need to be completely ignored when it comes to financial reporting for the parent company PLC. It should be as if the transactions didn't take place. That is how "consolidation" works.

But it doesn't mean that no additional value is being created by the interaction of your PLC's subsidiaries. The overall margin achieved by the company improves as there is more work being done between getting in the raw materials and turning them into finished products for customers.

In terms of margin, SDI's gross profitability has been consistently improving over the past few years:

- 2014 - 57%

- 2015 - 59%

- 2016 - 61%

- 2017 - 64%

- 2018 H1 - 67%

More acquisitions are on the cards. If they are more of this supplier/customer type of acquisition, I'd expect the margins to keep improving.

With up to £5 million available in a banking facility, I wonder if the share count might stop growing so fast now? That would be an important hurdle for me to consider personally investing.

Balance sheet: Nearly all of the value is in intangible assets, as you'd expect for a company pursuing this strategy. Equity of £11.8 million is almost fully accounted for by £10.6 million of intangible assets.

My opinion: The company has some attractive characteristics. High and growing margins, niche scientific products, and a healthy bounce into profitability over the past few years.

My only concern is over the strategy. When the share count is increasing so fast, I'd be concerned that it would be difficult to keep track of what was happening and that at some point, the wheels would come off with large deals which didn't work out.

On the other hand, I'm ok with modest increases in the share count, to enable a growth strategy. Perhaps this could evolve into having a more stable share count, over time?

In the comments, a comparison has been made between SDI and Judges Scientific (LON:JDG). If you compare how their strategies have been implemented, you'll see that the Judges Scientific (LON:JDG) share count has increased by only 50% over the last ten years. That's because Judges has had modest deals funded by its own cash flow and a debt injection, as required. I much prefer this strategy.

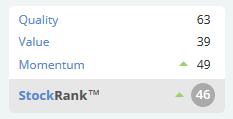

Stockopedia agrees with my lukewarm view on SDI for now. The shares look fairly valued to me.

Arena Events (LON:ARE)

- Share price: 61p (-1%)

- No. of shares: 117 million

- Market cap: £71 million

Arena listed on AIM at 55p in July last year, and this is my first time looking at it.

It's an international events business which builds temporary structures, ice rinks, seating, interiors etc. It has big-name clients in tennis and golf.

This update is in line with expectations, for the year ended December 2017.

The threat with every IPO is the "wobble" which, if it happens, is typically in the first 12-18 months, as the risks which IPO investors missed first become obvious.

So it is reassuring to hear that Arena hasn't had any wobble yet - maybe it will be one of those which doesn't have one!

A couple of big projects in H2 are mentioned: Dancing on Ice for ITV, a Koren golf tournament and an ice rink for New York.

It sounds like the cash movements have been moderately unfavourable, with increased capex and a higher working capital requirement. Net debt is £11.5 million. The current year has started "well".

IPO - checking the flotation data, I see that the company raised net c. £57 million, of which c. £44 million was used to pay down debt, and the rest is to be used for growth.

Unusually, IPO investors walked away with well over 90% of the company's share capital. It was a sale of almost the entire company from private equity investors to a range of fund managers.

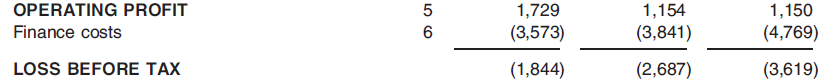

Here is an excerpt from the admission document, which shows how overly indebted the company had become. The figures are 2014-2016, from left to right:

As you can see, operating profit was decreasing while finance costs were increasing, resulting in escalating pre-tax losses.

This probably explains why the pre-IPO owners were willing to give away nearly all of Arena in exchange for money with which to pay down debt - the financial structure had become unsustainable. Shareholder loan notes were a big part of the structure, so it also meant that they got back the money they had previously lent to the company.

With over £90 million in revenue by 2016, the operating margin implied by the above figures is a bit lower than I would expect from an events business. ITE (LON:ITE), for example, achieves operating margin of >20% when things are going well. But I suppose Arena is merely contracting for events, rather than owning them.

Checking the risk factors in the admission document, the customer base does at least sound reasonably well-diversified for an events business. "Certain customers... contribute up to approximately 4% of annual revenue" - OK.

Estimates - The broker forecasts available to me suggest that 2017-2018 will prove to have been much more financially successful than 2014-2016.

Now that we have a full-year update which is "in line", does that mean the 2017 forecasts have been realised? Normally I would say yes, but I'm nervous the figures available to me might be mistaken. I can see forecasts for EBIT of £5.6 million and net income £4 million in 2017, followed by £6.5 million EBIT and £4.9 million net income in 2018.

If those forecasts are true, it makes the current valuation a bit punchy but not unreasonable. I still need more information to form a view. In particular, I need to understand why 2017 has been such a stronger year compared to 2016.

Watchstone (LON:WTG)

- Share price: 102p (1%)

- No. of shares: 46 million

- Market cap: £47 million

Paul recently wrote a post-script on Quindell (see here).

The reverberations from that saga continue as this most controversial of stocks is not dead yet - now trading under the name "Watchstone".

It has slimmed down to just two operations - pt Health and ingenie (both external links).

The first operates 230 healthcare clinics in Canada, and the second is a British telematics company.

If you're perplexed by the logic in having these businesses under the same corporate umbrella, you must not have seen how crazy Quindell was a few years ago!

At least the new managers have been tidying things up. There are now just 3 full-time staff in the central team.

The shares remain a special situation. The company has £63 million in cash, significantly more than the current market cap.

The problem is that there's not much sign of any profitability (the latest interims showed a loss, even at the "underlying EBITDA" level).

There is a further £50 million of cash being held in escrow for Slater and Gordon, the Australian legal firm which bailed out Quindell by buying most of its worthless assets.

Slater & Gordon is on the warpath, and Watchstone has increased the provision for its legal defence against S&G's accusations of deceit. The SFO is also still investigating what happened at Quindell.

For these reasons, I see the risk as being skewed to the downside here. Even in the best case scenario, the retained businesses are not exactly inspiring with their financial returns, so probably the best that can be hoped for is a return of capital.

(This section was edited after a reader spotted an error - thanks! GN)

Molins (LON:MLIN)

- Share price: 157p (unch.)

- No. of shares: 20 million

- Market cap: £32 million

Change of Name to Mpac Group plc

Just a quick note on this packaging company.

It sold its tobacco division last year, in a £30 million deal (or £27 million net of taxes and fees) which also saw the "Molins" name being sold.

Therefore, it needs to change its PLC name. From Monday, the ticker will be £MPAC.

To recap: there is a >£400 million pension fund attached to this stock, and its outcome looks at least as significant, if not more significant, then the success of the remaining operating businesses.

As such, this is another stock whose fortunes would be transformed by rising interest rates.

PayPoint (LON:PAY)

- Share price: 897p (unch.)

- No. of shares: 68 million

- Market cap: £612 million

Trading Update for the three months ended 31 December 2017

The lack of news today lets me circle back to yesterday's announcement from PayPoint.

Most people are probably familiar with the PayPoint sign attached to convenience stores - it means there is a PayPoint terminal inside, where you can pay bills and top up your mobile phone. The traditional customer is someone who doesn't have a bank current account. Some "banked" customers choose to use it too.

I've previously bought this share on behalf of others, due to its excellent cash generation, high returns on capital, and relative immunity, as payments processor, to the vagaries of economic cycle.

Over the last year or so, PayPoint has launched an "all-in-one" platform for retailers, which looks very useful to me. You can see it on YouTube here (external link). Yesterday's update says that 7,400 retailers are operating it now.

In terms of overall performance, guidance is unchanged and everything so far is in line with expectations.

Some highlights from quarterly performance:

- UK retail services net revenue is down by 18% due to not enjoying last year's one-off benefit of a VAT recovery, and some restructuring in its click-and-collect service, Collect+. Excluding these factors, net revenue is up by 4.6%.

- UK bill and general net revenue down 3.3%. It looks like this division is in secular decline, with fewer people prepaying for energy and their mobile phone.

- Romanian division growing strongly, helped by an acquisition.

My opinion

I need to put this company back on my watchlist, and consider getting a few into my personal portfolio.

The main threat would be that over time, there are gradually fewer and fewer people without a bank account who need to use a PayPoint terminal to pay their bills.

On the other hand, I like the opportunity in providing services to retailers. That could be a great long-term earner.

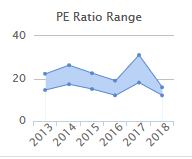

This graphic from Stockopedia says that the stock is currently trading around the low of its PE multiple in recent years. The StockRank is 81, with a Quality Rank of 95.

Harwood Wealth Management (LON:HW.)

- Share price: 147.5p (unch.)

- No. of shares: 62.5 million

- Market cap: £92 million

Scrolling back further again to Tuesday's results from this financial planning and wealth management group, based in Hampshire. It has been listed since March 2016.

These are full-year results to the end of October 2017.

Percentage growth figures are given, but they aren't interesting from a performance point of view seeing as seventeen acquisitions took place in the previous financial year, and another seven in the year which is being reported.

The acquisitions are all small however:

- FY 2016: seventeen acquisitions for aggregate consideration £11.7 million

- FY 2017: seven acquisitions for aggregate consideration £2.3 million

Headline numbers for 2017:

- Revenue £25.9 million

- Adjusted EBITDA £4.3 (a very heavily adjusted number)

- Net income £0.7 million, up from breakeven

- Period-end cash of £19 million, although another c. £2.2 million was paid out in acquisitions and dividends since period-end.

An improved final dividend is declared, reflecting strong net cash generated by operations of £3.7 million. There was no free cash flow, however, as a figure greater than that was used making investments during the year.

Digging into the cash movements, £10 million was raised in April 2017, following £10 million having been raised a year earlier, to fund the acquisition strategy. But the company has also been paying out an interim and final dividend since it listed.

This is a small source of inefficiency which I see very often - when companies are raising funds from investors but also, around the same time, paying out dividends to those same investors. If anyone can explain why such companies shouldn't stop paying dividends until they are generating free cash flow, I would love to understand!

Putting some of the key points from the statement together as bullet points:

- MiFID II has principal effect on Harwood's suppliers (fund managers), so perhaps not of great concern to shareholders in this case.

- Strategy is to aggregate smaller financial services businesses within its stable, integrate them, and benefit from improved economies of scale, as products are rolled out to an ever-widening network of advisors. In terms of organic growth, pension freedoms have opened up new opportunities to provide bespoke financial advice to customers.

- Rising equity markets are also a tailwind, as some fees are calculated as a percentage of AuM.

- Outlook statement is confident.

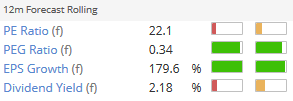

The broker to the company is forecasting adjusted PBT of £5.1 million for financial year 2018. It reckons the ex-cash PE ratio is 21x, not far off the Stockopedia non-adjusted PE ratio:

Future cash flow will be ploughed into more acquisitions, hopefully leading to compound growth.

If I can see a route for the company to generate above-average ROE, then the compound growth argument would start to look very compelling.

My impression of Harwood is that it's still very much in the mould of a professional services company, i.e. a people business. Providing bespoke advice to clients with complex challenges is labour-intensive work.

For that reason, I think it might be difficult to achieve above-average ROE here.

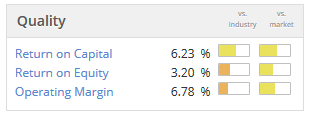

The data so far confirms this impression:

Turned out to be a long day in the end, I hope you made it this far!

Have a good weekend all.

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.