Hi, it's Paul here.

Please feel free to post your comments, and small cap requests in the comments below.

Quindell postscript

This announcement caught my eye. The audit firm which signed off Quindell's dodgy accounts for 2010/11 has been fined £700k + £90k costs by the Financial Reporting Council (FRC). This obscure body supposedly polices published accounts. However it rarely seems to take action, and when it does, is very slow.

The audit partner responsible, has also been reprimanded (big deal!) and fined £56k - which is not a material sum of money to a partner in a decent-sized accountancy firm. Also, look at the timeline - it's now 7 years from those incorrect accounts being created. Hardly a rapid response team!

As longer term readers here will remember, I was consistently very bearish on Quindell, since its accounts were fairly obviously highly suspect. Excessive debtors, excessive capitalisation into intangible assets, and a flurry of acquisitions to muddy the waters, are the usual give-aways of fake profits, so these dodgy companies are really terribly easy to spot. You can spot a highly abnormal balance sheet in just a few seconds, so it really doesn't take any particular forensic accounting skills to uncover dodgy companies with false profits. You just have to have your wits about you.

The same was true with Globo. It was amazing how much venom from deluded fools in the investing community my bearish comments attracted over these 2 dodgy companies. There was even an attempt to get me sacked from this role at Stockopedia, by Quindell/Globo shareholders cancelling their Stockopedia subscriptions! Of course, Ed put editorial integrity before short term revenues, backing me to the hilt. That I was proven correct by subsequent events, was very satisfying.

Anyway, the perpetrators of the Quindell and Globo frauds are still at large, with their ill-gotten gains, having relieved gullible UK investors of hundreds of millions of pounds. As I sadly commented to an investor friend at the weekend, white collar crime in the UK very much does pay. The action taken by the FRC, reported today, is too little, too late, in my view, to properly punish, or deter, the same sort of thing happening again.

Kudos by the way, to Tom Winnifrith, for his tireless, obsessive exposure of multiple wrongdoings at both Quindell and Globo. People may not like his style, but he's done outstanding work exposing many dodgy companies.

Having worked in audit myself, at the start of my career in the early 1990s, I can confirm that it's really very easy to pull the wool over the eyes of auditors. Their checks on the numbers are not very detailed, and a clever FD can cover up all sorts of problems. So the onus is very much on investors to do our own reasonableness-checking on published accounts. If the numbers don't look right, then it's best to steer clear.

A popular misconception is that auditors are highly paid. They're actually not. Audits are often tendered at low prices, in order to get a foot in the door, to enable more lucrative tax, and acquisition-related work to be secured.

American market boom

There seems to be an invisible force pulling the American markets relentlessly higher, with no significant pullback in a long time. This is very worrying. Some are describing it as a "melt up". This is not normal, or healthy market behaviour, in my view. Could we be heading for a crash? I don't know. Markets are meant to "climb a wall of worry", with regular corrections. This seemingly unstoppable move upwards could be the precursor to a violent correction, possibly?

Successful trader Mark Minervini recently tweeted that the only times he can remember the American market being this exuberant, were just before the 1987 crash, and just before the dot.com bubble bursting in 2000.

However, this big rise could be justified? Maybe US shares are re-rating because the big corporate tax cuts in the US will increase earnings considerably? That in turn could trigger an economic boom, of increased investment & a virtuous circle of higher growth, greater consumer spending, etc. Who knows? That's what happened under President Reagan, after all - he initially stimulated the US economy with big tax cuts, which ushered in a period of great economic success.

These things are impossible to predict, and nearly all forecasters get it so wrong that you would have expected them to pack in forecasting as a bad job. Yet strangely, people (especially the media) still treat their forecasts with quite unjustified reverence. Economics is still very much in its infancy, and has barely scratched the surface, in terms of being able to accurately predict what the economy will do in practice.

So I think it's best to accept that we haven't got a clue what the future holds. Despite this, I'm increasingly nervous about this market melt-up, so have opened some short positions on the US markets. That's proving expensive so far, but I don't mind losses on hedges. They're an insurance policy, and insurance costs money.

As regards the UK markets, I'm seeing a lot of nervousness in small to mid caps at the moment. It feels like the days of everything going up, day after day, are now over. We've been spoiled by very buoyant market conditions, for a long time now.

There are many former momentum stars, which have sold off considerably in the last few months (e.g. Boohoo.Com (LON:BOO) (I'm long) and IQE (LON:IQE) . Investors seem to be ignoring many satisfactory, or even good updates, and banking profits instead. There certainly seems a lack of investor appetite to take small caps to new highs at the moment. That's probably quite sensible actually, as lots of small caps are now very pricey, and the UK economy seems to be in a soft patch, so there seem to be lots of profit warnings being issued.

Mind you, bargains can be found in illiquid markets, when some investors start throwing out the baby with the bath water, and/or see their stop losses triggered for no particular underlying reason. I favour such market conditions, as from time to time the market throws a bargain in my direction, as people sometimes act irrationally - scared out of good shares by erratic spikes down in price.

Anyway, let's have a look at some small cap announcements today. By the way, I apologise for any typos today - am using a small laptop, with a screen that I'm struggling to see properly.

Elecosoft (LON:ELCO)

Share price: 45.5p (up 8.3% today)

No. shares: 77.4m

Market cap: £35.2m

(at the time of writing, I hold a long position in this share)

Elecosoft plc (AIM: ELCO), the AIM-listed construction software specialist...

Clever wording makes it sounds better than it is! This is an in line update;

... is pleased to announce that Revenue and Profit before Tax trading for the year ended 31 December 2017 are both expected to be significantly higher compared with Revenue and Profit before Tax for the year ended 31 December 2016 and in line with market expectations.

Cash generation sounds good;

Elecosoft's strong conversion of operating profits into cash in the year enabled the Group to eliminate its net borrowing position at 30 June 2017 and to also improve its net cash position further as at 31 December 2017.

I love it when companies eliminate their debt through cash generation.

Other points;

- High customer renewal rates (a good sign - the product must be good)

- Emphasis on good training & support for customers (again, a good thing)

- Successful acquisition has been integrated.

- Favourable forex movements.

- Outlook - nothing specific, just says "look forward with confidence"

My opinion - I picked up a few of these shares a while back, on a positive update. Generally I'm not keen on software companies, as they're quite prone to profit warnings - often being heavily reliant on lumpy licence sales.

This share looks priced about right, in my view. It's good to have a reassuring update today under its belt.

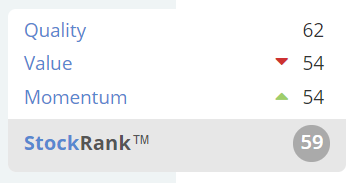

Stockopedia remains to be convinced, with a "Neutral" style, and a middling StockRank of 51. Let's hope those improve, if financial performance continues to be good.

LPA (LON:LPA)

Share price: 172,5p (up 0.9% today, at 12:51)

No. shares: 12.38m

Market cap: £21.4m

(at the time of writing, I have a long position in this share)

Final results - for the year ended 30 Sep 2017

LPA Group Plc (LPA) is a designer, manufacturer and supplier of light emitting diode (LED)-based lighting and electro-mechanical systems.

It announces today;

...record results for the year ended 30 September 2017 and a strong start to the new financial year.

This company put out a positive-sounding trading update, which I covered here on 1 Nov 2017. As often happens, the surge in share price on the day (responding to a positive update & outlook) continued, with the share price rising about another 12% today.

I won't spend long on this company, as it's too small & illiquid - I was only able to pick up a few shares. It might be of interest to readers with small portfolios, who don't have a problem with illiquid positions.

Key points;

- Revenues up 5% to £22.5m

- Pre-exceptional operating profit up 24% to £1.9m (exceptionals are negligible, so nothing to worry about there)

- Basic EPS up 17.1% to 14.4p - giving a PER of 12.0

- Dividends are modest, but growing - up from 2.5p last year, to 2.7p this year - a yield of 1.6%

- Order intake & closing order book both up nicely, so the outlook & visibility are positive.

- Recent trading - Q1 "significantly ahead" of prior year.

Balance sheet - looks fine to me, with a sound working capital position. There's a little debt, but I don't see that as a problem. Note there is a pension fund, which is in surplus on an accounting level, but may be in deficit on an actuarial basis. It's not significant, as the cashflow statement shows £100k p.a. payments by the company into the fund.

Capex looks high, but the narrative mentions relocating its factory, which is likely to have caused a spike in capex.

My opinion - based on a quick review only, I quite like the figures & outlook here. So for micro cap investors, happy to accept poor market liquidity, this might be worth a closer look. It seems soundly financed, performing well, and has a strong order book. Plus it pays modest divis. I think it would be worthwhile to do some more digging, to understand what products it makes.

The crucial consideration is whether demand is likely to continue, or whether the company is riding on the crest of a wave from one-off orders? Overall though, it's worth a closer look I think.

Note that the Stockopedia data (from Thomson Reuters) shows only 9.5p EPS expectation for 2017. So the actual of EPS of 14.4p is a long way ahead of that. Therefore, we can probably anticipate an improving StockRank, once the actual numbers flow through. So I'll wager that this middling StockRank could start to improve soon;

Boku Inc (LON:BOKU)

Share price: 85p (unchanged today)

No. shares: 213.5m

Market cap: £181.5m

Boku (AIM: BOKU), the world's leading independent direct carrier billing company, is pleased to provide the following unaudited trading update for the year ended 31 December 2017. This is the Company's first Trading Update since Admission to AIM in November 2017.

My understanding is that this company's software enables people to buy things on their mobile phones (apps, games, etc) without the need for a credit card. The cost is instead routed to their mobile phone bill, or prepaid account. This is useful in countries where credit cards are not widely used.

2017 revenues exceed $24m - up 40% on 2016 - and an Adjusted EBITDA positive second half

As we know, adjusted EBITDA can hide a multitude of sins - especially at software companies, where large amounts of overheads can be capitalised, thus flattering EBITDA.

This is impressive;

Total Processed Value (TPV)** of $1.7bn for 2017 was more than triple the 2016 amount of $554 million thanks to continued growth across all customer segments - most notably App Stores and Digital Music Subscriptions & Bundling

Although if a tripling of total processed value only results in a 40% rise in revenues, doesn't that suggest individual transactions are being done a lot more cheaply?

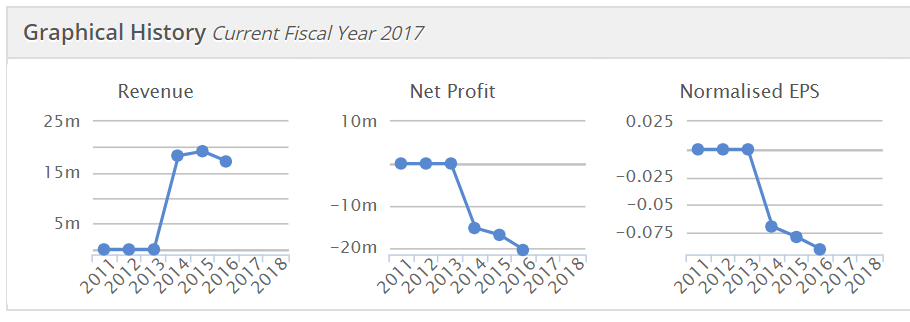

Looking on the StockReport, my first port of call for any new company is the historical graphs. These have already scared me off;

My opinion - it's clearly a jam tomorrow situation. The £181.5m market cap clearly includes some heroic assumptions about future growth. I don't tend to buy into things like that, unless I really understand the sector & the business, which is not the case here. So I think this one is really just for punters, and people who properly understand the business, and think it's likely to deliver the massive growth necessary for the current market cap (let alone a higher one).

This reminds me of Bango (LON:BGO) which looks similar, and is also relying on exponential growth to justify its extremely high (relative to historic losses) valuation.

So these 2 shares could be multibaggers, if the growth gains momentum, or they could crash disastrously, if growth disappoints, and heavy losses continue - requiring further fundraises in future. High risk, potentially high reward. They're not for me - why take the risk?

Eagle Eye Solutions (LON:EYE)

Share price: 224p (down 0.9% today, at 14:19)

No. shares: 25.4m

Market cap: £56.9m

Eagle Eye, the SaaS technology company that allows businesses to create a real-time connection with their customers

Here's our archive of my 3 previous reports on this company. You can find this list of articles on any company, just by putting in the ticker, then clicking on the "Discuss" tab, at the top of the StockReport.

I don't like the company's new description of what it does, as it doesn't actually explain what the company does! Its previous description from a July 2017 announcement was much more clear;

SaaS technology company that validates and redeems digital promotions in real-time for the grocery, retail and hospitality industries

Why change something clear, to something opaque? A very odd thing to do. Clarity, and simplicity are always best.

It reports today on progress for H1 of 2017/18, being the 6 months to 31 Dec 2017. So it has a 30 June 2018 year end.

Here are the highlights, as presented by the company, and yellow highlighting from me;

There is strong growth in various KPIs there, but revenue is only up 28% - not madly exciting. I tend to prefer revenue growth of 40%+ at growth companies - because you don't need to grow at that rate compounded, for long before the figures get exciting.

Cash - the other thing that jumps out at me from this list, is that the company seems to have burned through most of its cash. Looking back through previous RNSs, the company raised £6m (before expenses) or £5.8m after expenses, in Jun 2017. So I'm rather surprised it's only got £0.8m left. Maybe there was some debt that was repaid as part of the previous fundraise? Ah yes, I've spotted a £3m facility with Barclays in the last full year accounts, which looks as if it's currently undrawn. I'm not keen on loss-making companies using bank borrowings.

Clearly the company will need to do another placing fairly soon, as it's still cash hungry. A lot of development costs are being capitalised. This is not necessarily a problem, as the company seems well-supported by investors, with a generous market cap for a loss-making company. So raising, say, another £5m would only result in c.10% dilution - unhelpful, but not a disaster.

Outlook - there's lots of commentary in today's update about customer wins, etc.

The conclusion is;

... confidence of delivering its expectations for the financial year ending 30 June 2018.

My opinion - there's definitely something interesting here, in my view. This company clearly has an interesting, innovative product, with big name customers.

However, for me the financial progress has to date been somewhat limited. It's still quite heavily loss-making.

Looking at the broker forecasts, there are big expectations for revenue growth, rising to £22.8m in 06/2019, and £32.8m in 06/2020. Yet these big increases in revenues would only just tip it into normalised profit before tax of just £0.9m in 06/2020. I'm struggling to see how that justifies a £56.9m market cap now.

This share would therefore only interest me, if I could be convinced that the company is set to smash those forecasts, and deliver much higher growth and future profitability. As things stand though, I think it looks an interesting company, with a promising-sounding product, but the financials don't look very good yet, and the price looks a bit toppy. Plus it will need to raise more equity fairly soon, so I'd rather hold fire and re-assess it once it's properly funded. I'd say a placing of £10m+ is really necessary, rather than doing repeat, smaller fundraisings. The danger of that, is that the fundraising window can easily slam shut, in a future bear market, leaving the company potentially high & dry.

The Stockopedia computers only award EYE a low StockRank of 21 - which is understandable, as early stage, loss-making companies nearly always fail to excite either the Stockopedia algorithms, or me!

Anyway, I wish the company well, and look forward to reviewing it again when the next set of numbers come out. As usual, I reserve the right to change my mind at any time, if growth accelerates and makes it a more exciting investment proposition.

Flowtech Fluidpower (LON:FLO)

Share price: 177.25p (down 3.1% today)

No. shares: 52.8m

Market cap: £93.6m

London: Tuesday 23 January 2018: AIM listed specialist technical fluid power products supplierFlowtech Fluidpower plc (LSE: symbol FLO), is pleased to announce the following unaudited update on its performance for the year ended 31 December 2017 and to the period up to this announcement...

The update starts with an in line with expectations comment, and positive noises about further expansion;

"PBT in line with expectations, whilst the Group's heightened profile and enhanced technical skills capabilities created in both the UK and Europe has ensured that opportunities for further significant expansion have continued to be presented"

Revenues up 45% to £77.9m. Scanning through the RNS, the group seems to have made several acquisitions in 2017, which has obviously pushed up revenues. Organic growth is good, at +8%.

Net debt has risen 12% to £14.7m. Note that there has also been some dilution this year, from an equity fundraising.

This is an excellent update, with lots of useful information;

Divisional Gross margins remain broadly in line with the prior year. As a result of a weightier mix towards the generally lower margin PMC operations, a slight reduction in overall margin % is projected, therefore, the Board expects underlying* Profit before tax for the year ended 31 December 2017 will be in the range 8.6m to 8.8m, which is in line with market expectations.

I'm impressed that the group can give a fairly tight range of likely profit, 23 days after the year end. This suggests to me that it has a competent finance department, with good internal controls.

Six acquisitions were made during the year, which strikes me as perhaps being a bit too ambitious. There's a risk that this might have stretched management bandwidth a little thin?

A refurbished/redesigned shared logistics centre has also been completed, with no disruption to customer service. This management team really have been busy! Impressive stuff.

Dividends will rise 5%, giving a yield of 3.2% - not bad.

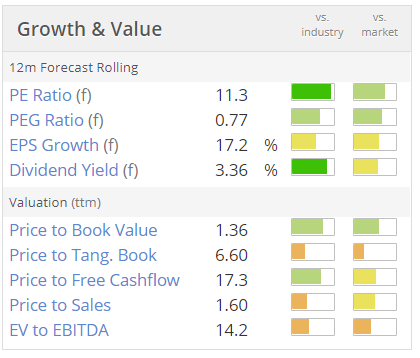

Valuation - this looks reasonably priced, on the cheap side, even when you adjust for net debt;

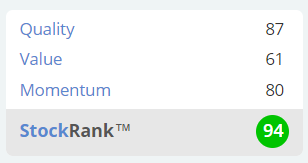

The StockRank is very high, and it is also classified as a "Super Stock";

My opinion - I like it. This is a stock we've looked at here before, and felt positive about. It strikes me as a good quality buy & build, which appears to be managed very well.

I like the decent operating profit margin - which comes from holding a wide range of niche spare parts for various machinery, and high levels of customer service, e.g. rapid delivery options, which is vital when the clients' important machines are idle, waiting on a spare part from FLO.

This share looks to me as if it could continue to be a steady riser, as more acquisitions are bolted on. So a thumbs up from me. Here's the FLO chart (geddit?!!!) - if we'd bought that dip in July 2016, we'd be 80% up, plus divis, by now. That's something to think about.

SCISYS (LON:SSY)

Share price: 128.5p (up 3.8% today, at market close)

No. shares: 29.3m

Market cap: £37.7m

SCISYS PLC (AIM: SSY), the supplier of bespoke software systems, IT-based solutions and support services to the Media & Broadcast, Space, Government, Defence and Commercial sectors, is pleased to announce a trading update for the year ended 31 December 2017 prior to entering into its close period.

This sounds good;

The Directors expect the Company's trading results will comfortably meet current market guidance, both in respect of revenues and adjusted operating profit.

That's a strange choice of words. Surely "comfortably meet" would mean beating guidance?

Additional detail also sounds positive;

The Company's overall order book is at record levels and strong across all sectors, bolstered by our 18m contract win with OHB System AG to deliver the ground-station control and communications infrastructure for the German national satellite-communications mission, Heinrich Hertz.

The Directors are pleased to note that the strong organic growth enjoyed at the end of 2017 is continuing into 2018.

The Group's cash flow is particularly healthy, with the net debt position as at 31 December 2017 better than expected, at 5.9m.

Valuation - a broker update today indicates estimated EPS of 10.2p for 2017, and a forecast of 11.2p for 2018. It sounds as if those might be conservative figures, so I'm inclined to value the company on 12p EPS - putting it on a modest PER of 10.7 - whilst that sounds cheap, this company has always been rated on a low PER of 8-10. Maybe it deserves more?

My opinion - I think this share could probably justify a somewhat higher rating, so it looks good value to me. On the downside, I've been frustrated with previous attempts to buy any meaningful amount of shares, because it's so thinly traded.

Eventually I suspect this company might be acquired at a premium, so patience here might pay off. There must be value in its client relationships. So a thumbs up from me, but a thumbs down for the lack of liquidity in the market, which makes it almost impossible to buy in any size, and of course the horrible bid/offer spread also has to be taken into consideration. Maybe management should make some more acquisitions, and considerably increase the size of the group, which would improve market liquidity in its shares too.

Velocity Composites (LON:VEL)

Share price: 103p (down 15.5% today, at market close)

No. shares: 35.8m

Market cap: £36.9m

Velocity Composites plc, the leading supplier of advanced composite material kits, providing engineering value-solutions for the global aerospace industry, is pleased to announce its maiden audited results as a public company for the financial year ended 31 October 2017.

This is a new share to me, which floated on AIM in May 2017. It's interesting to hear the company today state that its AIM listing has increased the company's profile within its industry;

"Our IPO has increased our profile and status significantly within the aerospace community and we have received Request for Quotations ("RFQs") by a range of large, global potential customers ahead of our anticipated timetable.

I've heard similar things from other small companies. Investors can be cynical about small companies floating on AIM, but it can bring significant spin-off benefits for companies, in terms of their credibility vis-a-vis big clients, etc.

I've reviewed the figures, and here are my notes;

- Revenues - H1 £9.3m, H2 £12.1m, full year £21.4m (up 47% on PY - pretty good)

- Underlying operating profit of £0.9m (2016: £0.3m) - a good year on year increase, but a rather slim profit margin on £21.4m revenues. Also, see note 28 - the definition of underlying excludes £446k of expenditure described as relating to future growth. That's a rather aggressive definition of underlying. Including this would reduce profits to only £450k - not much for a £36m market cap company.

- Underlying EPS of 2.39p, giving a PER of 43 - looks pricey, unless future years profits rise considerably.

- Outlook - expecting an H2 weighting for 2018 too, which might have spooked a few people into selling today, perhaps?

- Visibility for 2018 is good, at 85%

- European expansion planned

Balance sheet - is strong, following funds raised in IPO. £5.4m cash (note there is a bit of invoice discount finance within creditors). Receivables seems high - which would need looking into.

Development spend of £0.4m was capitalised - not excessive.

My opinion - these figures are a bit underwhelming. It's a small company, not really making much profits. I'd need to find out more about the company, and its market opportunity. Carbon fibre parts for aircraft sounds an interesting area to be in, but there must be any number of other companies doing similar things, at a guess?

Overall then, it hasn't really piqued my interest as yet.

LoopUp (LON:LOOP)

Share price: 373p (down 3.1% today)

No. shares: 42.07m

Market cap: £156.9m

I've had a quick look at the trading update today, but won't go into detail, as I think the market cap of £160m (at 373p per share) is now far too high, given where the company has got to.

EBITDA grew strongly to £3.5m. If you look back at the H1 results, the company did £1.6m EBITDA, which translated to £510k operating profit. Therefore this implies H2 EBITDA of £1.9m, and c.£0.8m in H2 operating profit. So I make that c.£1.3m operating profit for the full year. Does that justify £160m market cap? It seems to me that the market cap is anticipating several more years of strong growth, which may or may not happen.

It's a good product, I've tried it out. The valuation is too high in my view.

Lakehouse (LON:LAKE) - sorry I didn't get round to this one. The sector is a big avoid for me now. This type of contracting company is just best avoided in my view. Things always seem to end up going wrong - look at Carillion, ROK, Connaught, Silverdell, etc.

dotDigital (LON:DOTD) - in line update for H1 (to end Dec 2017). Spent half its cash on an acquisition. More details of operational developments.

All done, thank you for dropping by!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.