Good morning! Thanks for your suggestions so far - they are a big help in deciding where to focus.

At the moment, I'm planning to write about the following:

- Escape Hunt (LON:ESC)

- eve Sleep (LON:EVE)

- Medica (LON:MGP)

- Seeing Machines (LON:SEE)

In big-cap news, the hostile approach by Melrose Industries (LON:MRO) for GKN (LON:GKN) has seen publication of an "increased and final offer" which is worth a look, considering the importance of these companies.

Escape Hunt (LON:ESC)

- Share price: 113.5p (unch.)

- No. of shares: 20.3 million

- Market cap: £23 million

I've been familiarising myself with this company, which offers live game experiences at various locations around the world.

The premise sounds unusual. You and your friends (or work colleagues) get locked in a room for an hour! Or as long as it takes you to escape, solving a variety of puzzles.

Some people believe that we are in a long-term trend towards consumer spending on experiences, rather than material goods. This certainly falls into the former category, so would be a good example of how invest in that trend.

This stock came into being through a company previously trading under the DAR ticker buying up the holding company Experiential Ventures Ltd for £12 million in May 2017. That was on a cash-free and debt-free basis. The Placing which took place to fund this deal raised an addition £3.6 million, more than it needed to, to help fund growth.

The Interim results to June 2017 aren't very useful considering the deal took place only two months prior. Full-year results to December 2017 will be published in April.

At the time of the deal, Escape Hunt had 214 escape rooms in 20 countries.

According to the Readmission Document, Experiential Ventures is domiciled in the Seychelles, with subsidiaries domiciled in Malaysia and Thailand. It made pre-tax profits of £115k in 2015 and £320k in 2016, from revenues of £600k and £1.1 million respectively.

Strangely, the company paid out nearly £500k of dividends in both of those years. The document says:

The declaration of dividends was based on the availability of distributable profits in the individual financial statements of the Company. These profits reflected the accounting policies of the Company at the time and applicable local laws.

I'm not sure how that works but least the company isn't short of cash any more, after 2017's placing.

Today's statement says that the first escape room has opened in Britain:

Escape Hunt plc, the global entertainment network offering unique "escape the room" adventures to the public and corporate clients, today announces the opening of its first UK owner-operated site in Bristol. This site is the first of three to open this month, alongside Birmingham and Leeds, with a further five locations to open in the coming months.

Planning issues had delayed some sites, as reported in an update a few months ago.

Today's announcement also says that the company has completed a strategic review of the marketplace and its competitors, resulting in various design and operational changes to differentiate itself from others in the space.

My opinion - I like the sound of this. It's very niche, and makes strong claims to be the leading provider of this type of entertainment. My impression is that this is indeed a very fragmented market and that a well-resourced international company could create a valuable brand.

Revenues at the interim results were up 40% against the corresponding two-month period the previous year, so I think we can be optimistic about healthy top-line growth, too. And the operating margins are excellent.

The Non-Exec Chairman is a well-known name at Watchstone (LON:WTG), Crawshaw (LON:CRAW) and Anpario (LON:ANP), previously at Booker (LON:BOK) and AO World (LON:AO.)

Can it grow into this valuation? That may take a little while. It's not in value territory yet, by any means. For that reason, I will be more inclined to keep it on my watchlist for now, rather than get involved straight away.

eve Sleep (LON:EVE)

- Share price: 126.5p (-1%)

- No. of shares: 139 million

- Market cap: £175 million

Paul covered this at the interim results to June 2017, reported in September 2017. You can read it at this link.

It's a retailer of foam mattresses. Mattresses are available for sale online and in Next (LON:NXT) (I hold), Debenhams (LON:DEB) and Fenwick. There is also some non-mattress revenue.

It won #1 Startup in 2017 from Startups 100 (external link).

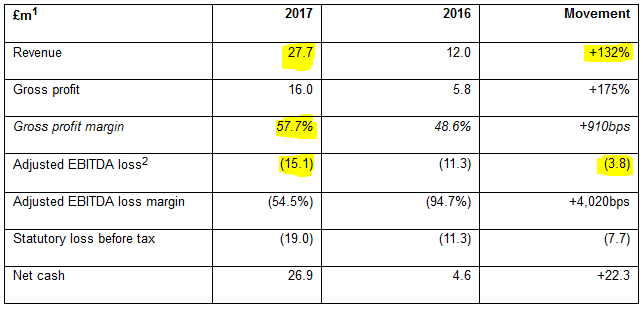

I've pasted the financial highlights below, with my own marker in yellow:

So the key points are that revenue has more than doubled and gross margin has improved, but the adjusted EBITDA loss has widened.

Cash has improved thanks to IPO proceeds received in May 2017.

Post period end - the revenue momentum has carried through at a 94% rate in year-on-year growth, for the first six weeks of 2018.

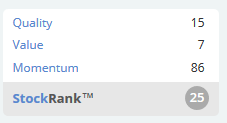

Interestingly, its StockRank has improved over the past six months, since Paul covered it. Previously it was classified as a "Sucker Stock", but now it's a "Momentum Trap", after the share price increased by more than 50%:

As far as I can discern, the company's strategy is to position itself as the most modern mattress brand, generating its pricing power primarily through this positioning. For example, it has an active instragram account with nearly twenty thousand followers, and new updates going up all the time.

The marketing spend is running at more than half of revenues, explaining the growth rate in revenues. Think about it this way: for every £1 in sales, it has spent more than 50p in advertising. And this is before it pays for the actual bed.

Given the large marketing spend, "unprompted awareness" of the brand has improved to 6.6% of the UK population.

Outlook is unchanged:

Notwithstanding the difficult consumer market in the UK, eve's trading for the current year has started strongly with sales for the first six weeks 94% above the same period last year. Although early in the year, the Company continues to target UK profitability in Q4 of 2018 and Group profitability by the end of 2019.

My opinion

It's an admirable venture to try to shake up an existing market which is perceived to be out-of-date, so the founders deserve credit for that.

The investment merits don't particularly jump out at me, however. I agree with other commenters on this website who point out that there are no intellectual property rights (patents) to defend mattress design, and that most consumers will make the buying decision once every ten years or so, probably not having much loyalty for the brand they bought the previous time.

This is not one of those Terry Smith-type companies whose revenues derive from small, easily predictable transactions. Mattress-buying, by contrast, is irregular and cyclical.

I would be prepared to buy shares in this company at a reasonable price, but the £175 million valuation is about 3x 2018 sales.

Medica (LON:MGP)

- Share price: 155.6p (-1%)

- No. of shares: 111 million

- Market cap: £173 million

Preliminary Results for the Year Ended 31 Dec 2017

This is yet another new-ish company for me. It always takes some time to familiarise myself with new stocks.

For the purposes of this stock, I also have to familiarise myself with the science of "teleradiology". According to Wikipedia, this is "the transmission of radiological patient images, such as x-rays, CTs and MRIs, from one location to another for the purposes of sharing studies with other radiologists and physicians".

If I am following it correctly, the idea is that radiologists can remotely analysis scans and produce reports on-demand, meaning that emergencies can be dealt with out-of-hours or whenever a radiologist is unavailable locally. Medica has 318 radiologists under contract.

The services can be classified either as routine reporting (link) or urgent reporting (link - this service is called "Nighthawk").

Medica listed at 135p last year with a £121 million offer. These are maiden preliminary results.

And they are nice results, with sales up 18% and adjusted PBT up by almost 50%.

Net debt reduces to just £5 million, and a maiden final dividend is declared.

Outlook is unchanged, with trading in line with expectations so far in 2018.

Looking forward to 2018, the year has started well, with trading in line with the Board's expectations. The prospects for new work from existing and new clients and the pipeline for recruiting radiologists in the new financial year continues to be strong which gives me confidence in our outlook for 2018.

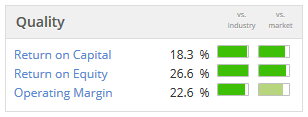

My opinion: My first impression is very positive. Cash flow conversion looks like quite good, as does the operating profit margin before exceptional items of c. 25%.

Stockopedia agrees that the quality metrics are very good:

EPS for 2017 comes out at slightly less than 4p. Looking at it instead on a forward basis, the earnings multiples are still rich but not extraordinarily so.

Both Wikipedia and the company itself today talks about pricing pressure in the industry. Radiologists are expected to do more for less now, as the technology improves:

Gross profit margin edged down from 49.8% to 48.7% as anticipated, reflecting the on-going renewal of the Group's contracts at marginally lower prices as the teleradiology market develops and outsourcing becomes normal practice. Increases in sales volume for our NHS services more than offset the reduction in average price in 2017 from anticipated pricing pressures

I suppose this is not such a bad thing, if Medica itself is at the forefront of the switch to outsourcing?

Seeing Machines (LON:SEE)

- Share price: 4.95p (unch.)

- No. of shares: 2,240 million

- Market cap: £111 million

Half Year Results to December 2017

This is another one I've not covered before, but Paul has done so many times, including as recently as last month.

It claims to offer "the world's most effective heavy vehicle driver safety system" in addition to serving various other industries. In vehicle safety, it has a system to detect driver fatigue and distraction, called "Geotab".

Revenue has taken off this year, reaching A$14.6 million in H1 2018 (H1 2017: A$4 million).

The company is based in Australia and reports in Australian dollars. 1GBP = 1.77AUD, so the latest six-month revenue figure is worth about £8.2 million.

Looking at the profit figures, all segments were unprofitable except "Off-Road".

The loss in the "Fleet" division was the same size as the total revenues in the entire group, about A$14.6 million, so that total losses were bigger than total revenues.

The company has raised large sums from investors, including over £37 million in January.

Looking at the balance sheet for December 2017, i can see A$104 million having been put into the company in total (before the January fundraising), of which A$76 million has disappeared through losses, leaving equity of A $29 million (i.e. £16 million).

My anchor valuation for an unprofitable, early-stage company such as this would be the amount of money which has been put into it so far, minus the accumulated losses which have been run up, i.e. £16 million plus the additional £37 million in January.

There have probably been losses since then, so somewhere around £50 million would be an anchor value for where it might represent "value" for me, before I start trying to work out whether or not it might succeed commercially some day.

£50 million would very likely underestimate its value if it does turn out to succeed, but in a traditional value-oriented context, I think this approach makes sense.

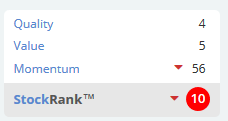

The Stockopedia algorithms are unkind to it, because statistically most companies with these characteristics do not succeed:

Checking the income statement, I see that A$10.5 million of expenses was attributable to R&D. Both this year and last year, the company still made material losses even if you add back the R&D expense.

The left-hand column is H1 2018, the right-hand column is H1 2017:

Based on the numbers above in yellow, the company has been operating at around breakeven if you ignore R&D and you also ignore customer support and marketing expenses.

The R&D and the marketing expenses have presumably been growth-oriented. So if you strip them out, and only leave in the support for existing customers, you are probably left with the company operating at a modest underlying loss.

That's the best argument I can make as to why they results aren't that bad - most of the recent losses are attributable to the company's efforts to grow.

The situation is not all that grim, when you look at it like that. After all, the gross margin is c. 45%. So my book value estimate of somewhere around the £50 million mark is where I'd start in terms of coming up with a fair market cap.

Thanks for dropping by! Paul will be with you tomorrow.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.