Good morning, it's Paul here!

Yesterday's report ending up being a bit of a monster, covering 8 companies in total after my evening updates. So to get you started for today, here is the link to that enlarged report.

Spreadex interview

We were discussing spread betting on small caps here the other day. There seemed to be some confusion on how it works. That gave me an idea! So I contacted Spreadex (who I do most of my small caps stuff with), and asked if they would like to do an audio interview with me on QualitySmallCaps.co.uk . Anyway, they said yes. So it's the usual format - the questions come from you, and I ask them. If you would like to submit a question, here is the link to a form I've set up for this purpose. Please submit your questions using that link, asap - I need questions in today/tomorrow ideally, to give me time to prepare for the interview this Friday.

I'm not charging anything to do the interview, but am doing it because it should be an interesting discussion. It also might help people better understand the practicalities of using spread bets for small caps, clear up any misunderstandings, and reinforce the vital need for disciplined risk management.

I do want to emphasise that I am absolutely NOT recommending that people spread bet. It's potentially very dangerous, as I discovered to my cost in 2008. So I want to cover those issues in the interview, and talk about what I got so disastrously wrong in 2008, and how I'm managing the risk a lot better now. Spreadex have also improved their risk controls, so we'll cover all that.

So it should be an interesting interview/discussion.

Bitcoin

I see that Jamie Dimon has made some caustic comments about Bitcoin - he called it a fraud which will eventually blow up. I'm not sure about it being a fraud, but it's quite obviously a speculative mania, as indeed are the increasing number of copycat crypto-currencies.

If something with no intrinsic value soars to ever higher levels, in a parabolic shaped graph, then it's a bubble. Bubbles always burst. Always. So it's really just a matter of time before this blows up.

Maybe I'm just bitter, as I got stretchered out several times whilst spread betting on it, foolishly! The trouble is, the price is just so volatile, that you can be correct, but lose your shirt, as you get stopped out on the extreme volatility.

Apparently a lot of the demand comes from China, where it's seen as a good way to hide money from the authorities. There have been recent press reports that the Chinese Govt is looking at closing down some Bitcoin exchanges.

Just like the South Sea bubble, and Tulipmania, some people have become rich on Bitcoin's astonishing rise. Well done to them - let's hope they cash out before the inevitable crash.

Forex

I loosely monitor key forex rates (mainly cable - sterling-dollar) and GDP-Euro, as these have a considerable impact on earnings of UK small caps.

Just in case you hadn't noticed, I'm flagging that sterling has strengthened quite a bit against the US dollar. It is now about £1=$1.33. That's a significant move from the low in Jan 2017 of about £1=$1.20. That should ease the pain that importers (e.g. retailers) are feeling, and trying to pass on to customers in higher prices.

The Euro remains strong, but sterling has crept up against that recently, to about £1=E1.11.

I don't have any view on what forex rates are likely to do. My only interest is these movements affect earnings for UK companies in various ways. So it's worth having a think about which companies we own that have benefited from sterling weakness. That tailwind could reverse into a headwind, if sterling continues to strengthen. That might lead to some unpleasant surprises when earnings reports come out, possibly?

Focusrite (LON:TUNE)

Share price: 313p (up 1.8% today)

No. shares: 58.1m

Market cap: £181.9m

Trading update - covering the year ended 31 Aug 2017.

The company describes itself as;

Focusrite Plc (AIM: TUNE), the global music and audio products company, supplying proprietary hardware and software products used by professionals and amateurs around the world...

It's great to see such a clear description, in plain English.

Things seem to be going well;

...is pleased to report that in the second half of the financial year, revenue and profits have grown compared with the first half of the current year. This growth has been driven by a combination of factors including improved sales of product, some foreign exchange benefits and the continuing effective management of gross margin.

As a result, revenue for the financial year ending 31 August 2017, is expected to be approximately 66 million, up from 54.3 million in the same period last year. This represents an increase of around 13% on a constant currency basis.

It's also good to see the company mention the (lower) percentage rise in constant currency above of 13%. In reported currency, the revenue increase is even better, at 21.5%.

I'm looking back at the interim results to 28 Feb 2017 - which I reported on here on 3 May 2017. My feeling then was that broker forecasts looked too conservative at 12.3p EPS, with my view being that 14-15p EPS looked more likely.

Given that the company reported 7.0p adjusted EPS in H1 2017, and today says that H2 is ahead of H1, then it stands to reason that the full year does look likely to be c.15p.

The revenues split is £32m in H1, and £34m in H2, so whilst H2 is up, it's not up that much versus H1. So I'll stick with my guesstimate of 15p EPS for the full year ended 31 Aug 2017.

Broker forecasts - Edison has put out an updated note today, which you can access either on their website, or on Research Tree. They've upped forecasts, but only to 13.9p EPS. The shortfall compared with my guesstimate of 15p seems to be due to them dropping the gross margin to 37.9% in H2, compared with 40.1% in H1. I'm not sure why that would be, as the company says that it has continued to effectively manage gross margin.

Panmures has also got a new note out today, which is on Research Tree. They're moving up to 14.1p EPS. So seeing as both brokers will have a direct line to the company, it looks like 14p-ish is the correct figure to go with.

That puts the shares on a (now historic) PER of 22.4 - quite a punchy rating, that leaves no room for any future disappointments.

Outlook - nothing is really said about the future outlook. Although the Directorspeak sounds upbeat;

"The business has had a great year, with strong sales of both our Focusrite and Novation ranges. We continue to improve and expand our portfolio of solutions to address the needs of our broad customer range and we are pleased that our efforts have been rewarded with strong demand, market acceptance and financial success."

Working capital has also been well controlled, and the business looks to be decently cash generative;

Working capital management has also been improved further in the second half and, as at 31 August 2017, net cash was 14.2 million, up from 5.6 million on 31 August 2016 and 9.4 million on 28 February 2017.

I particularly like companies with net cash. It's a sign of prudent management, and it takes away downside risk. Plus of course, it gives firepower for acquisitions, and paying bigger divis.

My opinion - I've been consistently positive on this company since it floated. The track record now is superb.

Providing the company can keep producing decent growth, then the fairly warm rating looks justified.

eve Sleep (LON:EVE)

Share price: 81p (unchaged today)

No. shares: 138.3m

Market cap: £112.0m

Half year results - for the 6 months to 30 Jun 2017.

The company calls itself;

the e-commerce focused, direct to consumer European sleep brand

So, it sells mattresses.

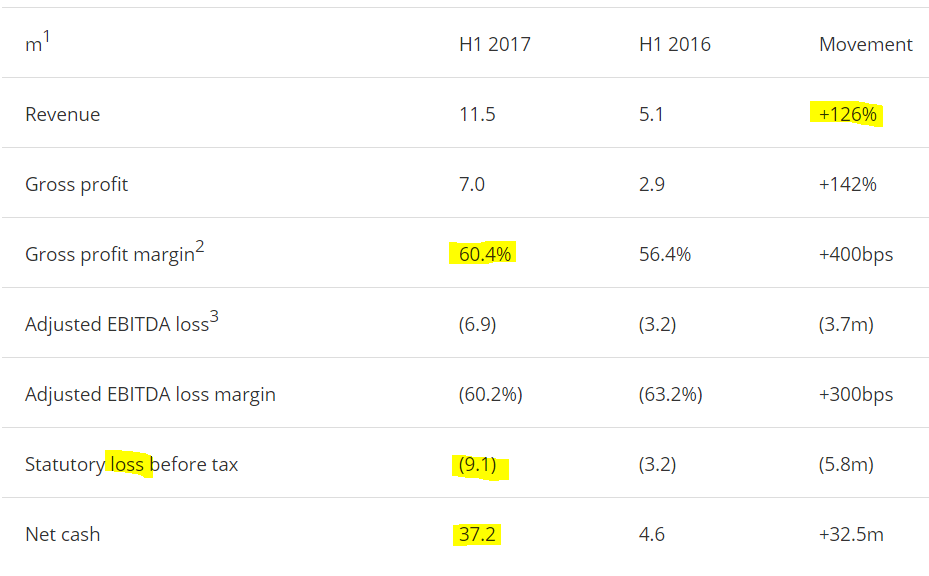

I've only looked at this company once, here on 12 Jul 2017, when the company gave a trading update for H1 2017. That indicated 126% revenue growth to £11.5m. I was sceptical about the company's claim to be trading strongly, since forecasts indicate that it's still heavily loss-making, despite the big rise in revenue.

Here are the financial highlights today;

The items I've highlighted are as follows;

- Revenue growth very strong

- Very good gross profit margin - so there's potentially good operational gearing here. Although see the footnote, which says underlying gross profit margin is lower, at 57%, not the 60.4% in the highlights table. Surely the underlying figure should have been in the table?

- However, losses have ballooned to £9.1m in 6 months - so I suspect the company must be spending heavily on marketing, to drive sales growth. Note that this loss includes £2.1 of IPO costs, so the underlying loss is £6.9m for H1.

- Net cash - there's plenty in the kitty, at £37.2m - enough to fund losses for the time being

Outlook - positive noises are made;

- Revenue growth of 129% in Jul & Aug 2017

- Brand awareness improving

- Marketing efficiency improving in Q3

- Deals done to stock Eve products in Next Home, and a 79-site German department store called Karstadt. I'd be interested to see what the gross margin split is between online, and wholesale (to retailers). The gross margin will obviously be very much lower on wholesaling, as the retailer will require most of the margin themselves.

The summary is;

The Company is on-course to meet the board's full year expectations

Note that 2017 is forecast to be a thumping loss of £13.1m.

Forecasts show that the company only reaches a small profit of £1.7m in 2019, on revenues more than quadrupling from the 2017 figure, to £113.7m.

Balance sheet - looks rather bizarre, with zero fixed assets! Also it has negligible (£0.5m) inventories. So it looks as if production & delivery must all be out-sourced.

My opinion - I'm not at all convinced by this business model. People only buy a new mattress maybe every 10 years, so where's the repeat business going to come from? The company needs to quadruple sales just to reach breakeven. The only way to quadruple sales is to continue spending a fortune on marketing, to convince more & more new customers to buy the product (since there won't be repeat business from people who've already filled their bedrooms with Eve sleep mattresses).

The internet is awash with companies selling good quality memory foam mattresses for about a quarter of the cost of Eve sleep. Having bought some myself, and finding those cheaper options extremely comfortable, nothing would persuade me to shell out £600 for an Eve sleep mattress.

As an aside, I recently discovered that beds are actually superfluous. I've got the most comfortable sleeping arrangements I've ever had at the moment - no bed at all. Just a conventional mattress directly on the floor, with a thick memory foam mattress on top. It's absolutely sumptuously comfortable, and you don't have any problems about bashing your legs or feet on a bed frame, because there isn't one! So there you go - top tip - bed frames are a totally unnecessary rip-off! Also with my arrangement, I can just lift up the 2 mattresses & lean them against the wall during the day, enabling easy cleaning, and making a nice space for me to do my yoga (haha, only joking about the yoga bit!)

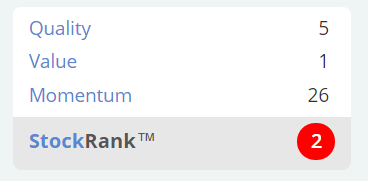

The market cap of £112m for Eve looks very optimistic to me, for an unproven, heavily loss-making business. Stockopedia's computers hate jam tomorrow stocks, so this is given a StockRank of just 2, and a "sucker stock" rating.

The bull case seems to rest on the product being superior, clever marketing, and establishing the brand as a premium thing in consumers minds. Plus there is potentially excellent operational gearing from that high gross margin. So itcould work, but why would I want to gamble on the possibility of it working out?

Generally, I find that highly cash burning growth companies usually disappoint. Then you get into the depressing cycle of a falling share price, cash running out, and discount placings. So when success is finally achieved, years later, the share price is way below the level where optimists originally funded the growth.

So far though, Eve does seem to be performing in line with the heavily loss-making forecasts. So maybe this could be a rare exception? Quadrupling sales to reach breakeven is a tall order though. So it's definitely not one for me, having been burned on things like this too many times before.

So far, the market also seems unconvinced. Although in euphoric bull markets like this, it doesn't take much to set off a speculative frenzy. So who knows, bulls could be laughing if the company starts to report better than expected numbers in future.

I'm too tired to do much more, so just a couple of very quick comments, in response to reader requests.

Ten Entertainment (LON:TEG) - I've very quickly skim-read today's results from this 10-pin bowling company. It looks potentially interesting, in my view. The balance sheet looks solid, with relatively little debt. Excellent divis. Worth a closer look, I think.

Epwin (LON:EPWN) - potentially a value share, after a recent profit warning, which Graham reported on here.

- Results today aren't good, but it remains a decently profitable business

- Interim divi is up a little on last year, at 2.23p. The forecast divi yield for the full year is 9.6% - so clearly the market is pricing-in a dividend cut at some stage.

- Outlook - slightly below expectations for full year 2017. 2018 likely to be below 2017.

- Balance sheet looks reasonable, although has net debt of £28.2m

My opinion - for me this is tainted by being the sister company of now defunct Entu, which went bust in peculiar circumstances - a highly profitable business at flotation somehow spiralled downhill and then went bust. I did wonder if profits were being hived off into Epwin? If that's the case, then Epwin profits could take a hit going forwards. Overall, there's too much of a bad smell around Entu for me to want to go anywhere near its sister company, Epwin.

EDIT: Clarification - an adviser to Epwin rang me up, and explained that it is not a sister company to Entu, but just has a common shareholder, who holds 15%.

I've fully investigated the situation, by reading the AIM Admission Documents for both companies. Both companies had the same "ultimate controlling party" at the time of admission to AIM. More details are set out in my report here of 14 Sep 2017.

So Epwin & Entu absolutely were sister companies (i.e. under common control) at the time of floating. However, due to the controlling parties having sold down some of their shares in the float, then it is probably fair to say that they are no longer sister companies - although they do still have common, large shareholders.

Right, all done for today. See you tomorrow.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.