Good morning!

The following stocks have caught my eye today (edited at 3pm):

- Arbuthnot Banking (LON:ARBB) - final results

- DFS Furniture (LON:DFS) - half year results

- Inland Homes (LON:INL) - half year report

- M Winkworth (LON:WINK) - final results

Arbuthnot Banking (LON:ARBB)

- Share price: 1330p (unch.)

- No. of shares: 14.9 million

- Market cap: £198 million

We've not covered Arbuthnot before, an old name in private banking. It has offices in London, Manchester, Bristol, Exeter and Dubai, and is 55% owned by its Chairman and CEO.

To give an example of its clientele, here is a link to an article from last year, when it had a bankruptcy ruling in court against a famous former tennis player. It is probably unrelated, but there is now a repossessed property worth £2.9 million on Arbuthnot's balance sheet.

In 2016, it sold its majority stake in Secure Trust Bank (LON:STB), distributing a huge special dividend of some 300p to shareholders shortly afterwards. It retains 18.6% of STB.

It's helpful to ignore the effect of STB and focus instead on the results for its operating subsidiary, Arbuthnot Latham (the private bank).

These results are excellent, as more funds are lent out at a consistent net interest margin:

- Profit before tax £11.0m (2016: £9.1m) an increase of 21%

- Average net margin at 4.8% (2016: 4.8%)

- Customer loans exceeded £1bn increasing 38% to £1,049m (2016: £759m)

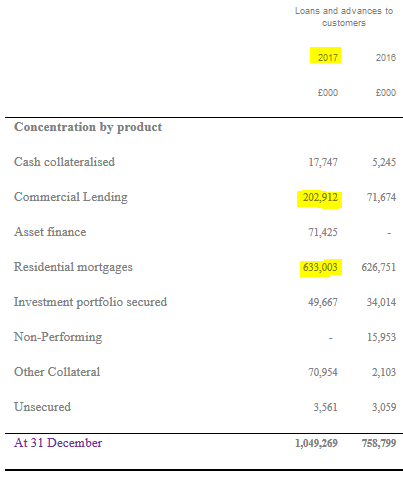

Loans and advances to customers are broken down as follows:

As you can see, the lion's share is accounted for by plain old residential mortgages and commercial lending.

Of the £1.05 billion in total lending, more than £600 million is to customers in London, the South East and South West.

The Chairman's comments are forthright, particularly on regulatory matters:

The Countercyclical Capital Buffer was reportedly introduced by the Bank of England with the intention of dampening a perceived bubble that may have been developing in the unsecured credit markets, in particular those related to credit card loans. If this was the case, would it not have made sense to apply the buffer to those institutions that actually carry out unsecured lending?

(If you scroll back to the table above, you'll see how little unsecured lending Arbuthnot does.)

My opinion

I have a positive impression so far.

- Arbuthnot's stake in STB is worth £60 million at the latest share price. Arbuthnot is carrying it at a value of £84 million on its balance sheet, but doesn't think it needs to be impaired.

- Including the STB stake at £84 million gives Arbuthnot a balance sheet net asset value of £236 million (i.e. it would be £212 million using the latest STB share price).

- Either way, Arbuthnot is trading at a small discount to net asset value.

Given return on equity in the private bank is at 10% and rising, that suggests a possible undervaluation to me. I can get higher ROE than this elsewhere, but only at a significant premium to NAV. If I only have to pay book value or less, then I'm be happy to earn a consistent 10% ROE in today's market.

The balance sheet is leveraged about 8 times, which to my mind is a modest level (for context, Lloyds Banking (LON:LLOY) is leveraged 16x). Though we also have to bear in mind that STB's leverage is not shown on Arbuthnot's balance sheet.

I'll keep this on my watchlist - I think this could be a nice share to own for the long-term.

The algorithms aren't overly impressed. There are a couple of unusual elements, like the STB share sale, which might be confusing them.

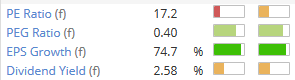

For what it's worth, here are the value metrics:

Inland Homes (LON:INL)

- Share price: 60p (-4%)

- No. of shares: 201 million

- Market cap: £120 million

Please note that I own shares in Inland Homes

This is a house-builder in the South and South-East of England. I've owned shares in it for the past couple of months.

The main thrust of my buying rationale was simple enough: it was on a nice discount to NAV. So I hoped that downside risk would be limited.

As far as upside potential was concerned, the company reported rising activity levels and has been increasing its dividend payouts. My overall portfolio yield is weak (e.g. Volvere (LON:VLE) is still my biggest holding), so I welcomed having a little bit of dividend income to play with.

Today's update from Inland shows the type of progress that i was hoping for: modest increases in NAV, and more dividends.

- 13.6% increase in Net Asset Value to £134.7 million

- EPRA NAV up 5.2% to 92.78p

NAV per share is now 63.7p, so the discount in the share price is widening. And the discount is naturally much wider against EPRA NAV, which includes the valuation uplift from unrealised gains on properties.

Since it's a much more accurate representation of value at any given moment, I think the increase in EPRA NAV is the most important performance measure for me. The ordinary NAV is affected more by the timing of property sales (e.g. in the latest period, Inland's NAV growth has been artificially boosted by the timing of sales).

The EPRA NAV increase of 5.2% over 12 months is unspectacular, but at least it is still ahead of inflation.

Personally, I do not expect huge returns from property investments - all I hope to achieve with them is to beat inflation. If it helps, you can consider property to be a separate asset class compared to the rest of the equity markets.

With property companies like Inland which are leveraged, it should not be too difficult for them to beat inflation, since they are earning on a bigger total asset base than simply the value of their equity.

EPRA NAV finished the year at £196 million, but the average size of the Inland balance sheet during the year was more like £265 million. Inland is using about £65 million in bank loans. That doesn't seem excessive to me.

Interim dividend is raised 30%. If the final dividend is raised by the same amount, the forward yield will be c. 3.7%.

Inland continues to grow from a small base:

Current forward order book of £38.9 million (2016: £31.8 million)

A record 560 private homes under construction with an anticipated gross development value of £144.4 million

Outlook is a bit mixed:

With the Government committed to building 300,000 new homes per annum in the UK, there are several measures in place supporting the housebuilding sector in the drive to deliver more homes, particularly at the price point at which we operate. Whilst the sector continues to be hindered by local planning difficulties and higher construction costs, we are optimistic that overall conditions for housebuilders to meet the demand for new homes will continue to be largely favourable.

My opinion

Happy to continue holding with a small-ish position size. The loss of the long-standing Group Land Director to pursue other interests was announced last month and caused me some worry, but the stock's 35% discount to EPRA NAV is more than enough to keep me interested.

M Winkworth (LON:WINK)

- Share price: 117.5p (unch.)

- No. of shares: 12.7 million

- Market cap: £15 million

Continuing with the property theme, this is a franchisor for estate agents in London.

You expect franchisors to show decent margins and returns, since their franchisees usually have to put up a lot of capital, in exchange for the right to use the franchisor's brand name and services.

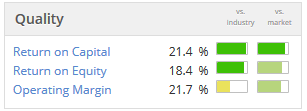

Winkworth doesn't disappoint on this front:

This is also evident in today's headline numbers. Cash generation is very nice, too:

- Revenues of £5.42 million broadly flat against prior year despite challenging market conditions

- Profit before taxation £1.38 million

- Cash generated from operations £1.70 million

The company was founded two years after Arbuthnot, in 1835. Insiders own about half the company, including the Chairman with 42%.

Personally, I like situations with well-invested managers. Even if they own controlling amounts, I think I prefer this compared to situations where managers only need to worry about their salaries.

Winkworth is managed in a conservative way, with a large cash balance relative to the size of the company (£3.6 million at year-end), and quarterly dividends.

The yield is a stunning 6.4%.

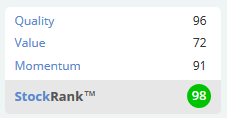

Put together high returns and a cheap valuation, and you get a huge StockRank:

I'm sorely tempted to pick up a few shares in this, but have already made a couple of purchases this month and need to manage my overall equity exposure.

Also, one of the side-effects of heavy insider ownership is that Winkworth's free float is small, worth only about £8 million at the latest middle share price. Having put in a small dummy trade, it looks like most of the official bid-ask spread might apply, which is worth about 4% of the share price.

So this is another reason for me to be cautious about getting involved. I need to think very carefully before getting hit with a big spread and taking on any new illiquid positions.

DFS Furniture (LON:DFS)

- Share price: 184p (+8%)

- No. of shares: 212 million

- Market cap: £390 million

Results from this furniture retailer are in line with expectations. Paul has already covered the trading update which foreshadowed these detailed numbers.

It looks like online sales have been replacing (some might say cannibalising) store sales, with total sales falling:

Revenue before acquisitions of £366.5m, down 3.5%, reflecting the expected challenging market environment

Contrast this with:

Double digit growth in DFS online traffic and transactions

Actually, if you scroll down and check the non-financial KPIs, the growth rate in online revenue is just 8%, not double-digits.

The financial KPI table shows a dispiriting performance in H1, e.g. showing a 7.4% decrease in underlying EBITDA before the effect of acquisitions, and a 58% decrease in pre-tax profits.

Still, the announcement was greeted with some relief by the market. The outlook is merely in-line with expectations, but does sound encouraging. We are told to expect "modest growth" in the above-mentioned EBITDA measure for this financial year, suggesting that H2 EBITDA will be much better than H1. Revenue should firm up a bit, too:

Our trading momentum has strengthened during the first half of the financial year and through into March 2018. We therefore continue to expect the second half of the financial year to demonstrate a stronger year-on-year revenue trend than the first half.

This doesn't mean that revenue will return to growth - but it will hopefully decline by less.

Also worth noting that the acquisitions are said to be doing well with £4 million of operating cost synergies being targeted over the next two years.

Balance sheet: Paul has highlighted this company's debt position several times before.

The company finished the period with net debt of £172 million, making for an enterprise value of £560 million at the current share price.

NCAV (Net Current Asset Value, or Equity minus Non-Current Assets) is a frightening minus £400 million.

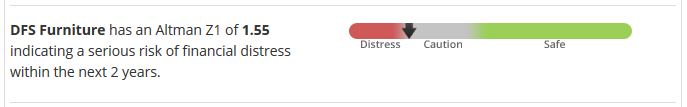

The computers agree that this is an area of concern:

Given the financial risk, this isn't a share that I'd want to hold a big position in, even if the performance and outlook are looking a bit better than I would have expected.

Tracsis (LON:TRCS) also announced today, but everything was in-line.

I've afraid I've run out of time, and didn't get to cover everything on my list. Thanks for dropping by anyway!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.