Good morning, it's Paul here.

Just a quick reminder that it's the last day of the tax year. So the last chance to add up to £20k into our ISAs for the 2017/18 tax year, and any other tax planning measures that you might wish to undertake.

Airea (LON:AIEA)

Share price: 59p

No. shares: 41.4m

Market cap: 24.4m

(at the time of writing, I hold a long position in this share)

Interesting news for shareholders here. Floorcoverings distributor, James Halstead (LON:JHD) has announced that it is in the early stages of considering a bid for Airea;

James Halstead plc ("James Halstead") notes the recent movement in the share price of Airea plc ("Airea") and confirms that the Board of directors of James Halstead (the "Board") is at the very early stages of evaluating making an offer for Airea which could lead to an offer being made for the entire issued and to be issued share capital of Airea (the "Possible Offer").

As a consequence of this announcement, an "Offer Period" has commenced in respect of Airea in accordance with the rules of the City Code on Takeovers and Mergers (the "Code").

There was an excellent results statement, with lots of positives in it, which I reported on recently here, on 21 Mar 2018.

The big pension scheme (which is now quite well funded) could be an obstacle to a bid. Although in some cases, agreement can be reached with pension fund trustees whereby an acquirer injects a one-off cash sum into the pension scheme, in order to get the green light for the acquisition.

I've got mixed feelings about this. On the one hand, it's always nice to get a portfolio boost from a takeover bid, if the premium is sufficient. On the other hand, Airea has already committed to a 6p special dividend, and looks to be on a roll (geddit?!) operationally. It would be a shame to have the upside whipped away from us, before the big surge in profitability comes through (from closure of its heavily loss-making carpets business). Its commercial flooring operation is highly profitable.

Anyway, I'm writing this just before the market opens, so don't know how much the share price will rise today. My hunch is that 70p+ could be on the cards, but we'll see.

UPDATE at 09:37 - Airea (LON:AIEA) has put out a fairly standard response to the news from James Halstead (LON:JHD), as follows;

Response to statement by James Halstead plc

The Board of Airea notes the announcement released yesterday by James Halstead plc ("James Halstead") which confirms that the board of directors of James Halstead is at the very early stages of evaluating making an offer for Airea which could lead to an offer being made for the entire issued and to be issued share capital of Airea (the "Possible Offer").

Airea confirms that it has not received any approach from James Halstead regarding a possible offer by James Halstead for Airea nor has Airea had any discussions with James Halstead in relation to a potential offer.

Airea shareholders are strongly advised to take no action at this stage. There can be no certainty that any firm offer will be made nor as to the terms on which any firm offer might be made. Further announcements will be made in due course as appropriate.

The put up or shut up date, under the Takeover Code, is 5pm on 2 May 2018.

The response above seems consistent with Halstead's announcement - i.e. I would not have expected it to necessarily have yet approach Airea, as it's only in the very early stages of considering a bid - which I suppose would be desktop due diligence of the sort you & I would do.

Note that AIEA qualifies for 2 Stockopedia screens, as follows;

Tiny Titans (modelled on James O'Shaughnessy's investing approach) has a terrific track record, and I often look to see which stocks are in it. Quite often there will be some overlooked gems in there. This performance track record is strikingly good;

Airea also qualifies for inclusion in this Stockopedia screen (which I've not looked at before, but sounds interesting);

The Stockopedia screens are a great way of finding a shortlist of potentially interesting shares to research. I tend to focus on the best performing screens, and then look to see what stocks are in there. The occasional nugget of gold crops up this way!

Walker Greenbank (LON:WGB)

Share price: 126.5p (down 5.2% today, at 08:53)

No. shares: 70.9m

Market cap: £89.7m

(at the time of writing, I hold a long position in this share)

Walker Greenbank PLC (AIM: WGB), the luxury interior furnishings group, is pleased to announce its financial results for the 12 month period ended 31 January 2018.

Note that these results are flattered by the acquisition of Clarke & Clarke.

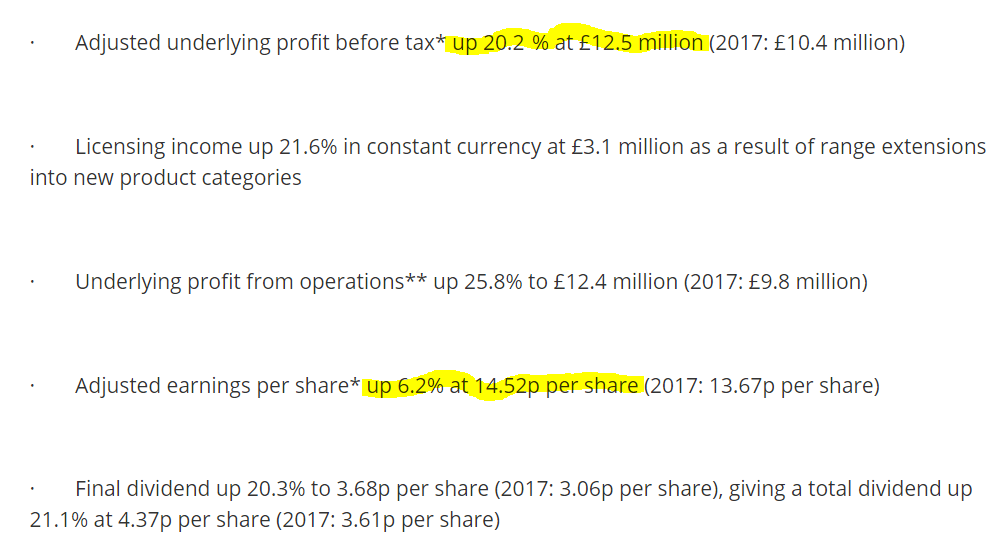

This excerpt from the highlights section shows some decent figures;

I particularly like businesses with licensing income, as it's money for old rope really. It also shows that there is considerable value in the brands being licensed - otherwise people wouldn't pay to use the brand.

The adjusted EPS of 14.52p is above the consensus forecast of 13.8p shown on Stockopedia. There are a couple of broker notes out this morning, both of which refer to only a slight beat on earnings, so there's a little confusion over the precise figures - but it's in the right ballpark anyway.

There was a profit warning in Nov 2017, causing a big drop in share price, which I reported on here. I've just re-read that, to refresh my memory.

Outlook - we already knew from previous updates that the UK market was soft. That continues to be the case, with another cautious update today;

Trading to date in the current financial year reflects a difficult marketplace particularly in the UK. In the first nine weeks of the current financial year, Brand sales were down 8.3 per cent in the UK and down 3.8 per cent overseas in constant currency, down 6.1 per cent in reportable currency.

The Board is focused on delivering growth-based strategic initiatives including targeted investment, cost savings where appropriate and a greater emphasis on Brand sales overseas. Additionally, our high margin licensing business is expected to continue to show strong growth.

However, trading to date in the current financial year makes us cautious about the outlook; as a consequence, the Board expects that profits for the full year will be ahead of last year's but below current Board expectations. We will provide a further update on trading at our annual general meeting in June 2018.

That's a mild profit warning. I think there was such a big reaction to the last profit warning, that more disappointing news was already baked into the share price. This is confirmed by only a c.5% drop in the share price today.

Forecasts - the above guidance from the company seems to be steering us towards about 14-15p EPS for the current year (ending 01/2019). At 126.5p per share, that equates to a current year PER of about 8.7 - which strikes me as excellent value, for a decent quality business.

Brokers are talking today about a 6-10% reduction in 01/2019 forecasts, so nothing too serious.

Balance sheet - note there is a pension deficit of £7.3m, and the recovery payments were larger than I had realised;

The Group made additional payments to the pension schemes of £1,521,000 (2017: £1,374,000) to reduce the deficit, part of the ongoing planned reduction, along with £386,000 (2017: £392,000) of pension fund scheme expenses.

So I would need to look into that in more detail before considering any additional purchase of shares here. It doesn't look a deal-breaker though, but would require some adjustment of the market cap - mind you the PER is already low, so it looks as if this issue is already in the price.

Net debt - seems fine at the year end, but note that the average monthly figure was a lot larger. I commend the company for disclosing its average monthly net debt - this is very helpful, and should be done by all companies, to give a more accurate view of the underlying cash/debt situation throughout the year (as year-end figures are often window-dressed to show an artificially favourable picture);

The Group had net debt as at 31 January 2018 of £5,263,000 (2017: £5,309,000). Average debt during the year varies due to the timing and seasonality of revenues and investment in products.

The average monthly net debt increased by £8,206,000 to £11,246,000 (2017: £3,040,000) as a result of the Group starting the financial year with net debt following the Clarke & Clarke acquisition which increased the need to utilise the bank facilities.

Total bank facilities are £22.5m, so the group seems to be in a comfortable position regarding headroom.

Overall, the balance sheet looks fine to me - I don't have any concerns.

There's a solid NTAV base of £29.8m.

Working capital looks fine, with a current ratio of 1.80 (note this includes all bank debt)

Long-term liabilities are modest. So it's absolutely fine in my view - there are no solvency worries here.

Dividends - there's quite a useful rise in the final divi, up from 3.06p last year, to 3.68p this year. There's also a small interim divi to take into account. The overall picture is this;

This brings the total dividend for the year to 4.37p per share (2017: 3.61p), an increase of 21.1%.

That suggests management are confident about the future, and happy with the financial position of the group, which I find encouraging.

My opinion - It all depends whether this is a temporary downturn in trading, or whether a more serious longer term downtrend has started. That's for each of us to figure out, and essentially guess at.

For the reasons explained yesterday, I'm leaning more towards optimism, as the squeeze on real incomes now appears to be abating in the UK. Although I imagine for luxury interior furnishings, the customer is affluent, and probably not really affected by small changes in average incomes. The UK softness is probably more linked to the slowdown in the London property market, is my guess.

It's tempting to top-up my existing position here. However, as with Topps Tiles (LON:TPT) yesterday, the question is, what's the rush? The newsflow is still negative, and nobody likes buying shares which are trending down, opening up an instant loss. There again, the muted 5% share price drop today suggests to me that the bad news is mostly in the price already - and the news wasn't actually particularly bad anyway.

Somebody might come along and bid for it, at this valuation. So I'm happy to keep this as a small position in my portfolio for now, but might top up later this year. I'll probably wait to see what the next trading update says.

Having had a major flood, and a fire, I imagine WGB's insurance broker must be under heavy sedation by now. What will the next RNS be? Stampeding wildebeest have destroyed new season's production? A swarm of locusts have eaten their inventories?

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.