Good morning, it's Paul here. Apologies, I forgot to put up the placeholder article last night.

So far, the following have caught my eye;

Carpetright (LON:CPR) - CVA & fundraising proposals

QUIZ (LON:QUIZ) - trading update

There's still no news on who has bought the big block of GAME Digital (LON:GMD) shares. Having had a ponder overnight, I jumped the gun by suggesting that the buyer might be Sports Direct. It still could be, triggering a bid for the whole company. On balance though, I'm more persuaded by Gromley's suggestion that the overhang was probably placed with various institutional buyers. Anyway, the overhang is gone, which is good news.

EDIT: all has now been revealed in subsequent "holding in company" RNSs. I was correct that Elliott Advisors (Duodi) has sold out completely, its 36.5% stake in GMD. However, my theory that Sports Direct might have bought the overhang, and launch a bid, was wrong. Gromley's theory was correct - that the overhang has been placed with institutions.

There are some excellent new names on the GMD major shareholder list, in particular I very much like that Gervais Williams' outfit, Miton, has taken 13.1% of the company at 35p. Canaccord has taken 11.8% for discretionary clients (possibly something to do with Hargreave Hale, I wonder?), and J O Hambro has taken 5.1%. The balance I suppose would probably have been distributed to under 3% holders, hence not requiring an RNS.

All in all, whilst falling short of my hopes for a takeover bid, this is a very pleasing outcome. A huge overhang of GMD shares has been eliminated in one fell swoop. We also have some big name institutions coming on board at 35p, which very much reinforces the bull case for the new strategy of developing "BELONG" format stores, both standalone, and within Sports Direct shops.

End of EDIT

Escalating tensions in the Middle East, and President Trump's unique & bizarre way of handling things, is certainly introducing fresh nerves into the market. It sounds as if the USA is about to launch missile strikes on the Assad regime again, and Russia is threatening to shoot them down. All rather worrying, and not helpful to markets.

On the positive side, apparently warm weather is on the way for next week, which should provide a much-needed boost to retailers & pubs.

Carpetright (LON:CPR)

Share price: 38.6p (down 8.0% today, at 10:48)

No. shares: 71.3m + dilution from imminent fundraising

Market cap: £27.5m

CVA proposal & Equity capital raise update

Today's update follows on from the major news on 21 Mar 2018, which I covered here, that a big shareholder was providing a bridging loan to keep the company afloat, and that it was exploring the possibility of doing a CVA.

Sector Background

This section is my commentary, not from CarpetRight.

A CVA is a form of restructuring, which allows troubled companies to ditch some of their liabilities (usually property leases), without having to go through a full insolvency process. It's a surprisingly under-used process, which I suspect may become much more common over the next few years. JJB Sports used this process, I think twice. In that case it just delayed the inevitable collapse. In some cases though, a strong business can emerge, once loss-making sites are jettisoned via a CVA. It's less painful for creditors than controversial pre-pack Administrations, for example.

The underlying problem is that the UK's commercial property system is no longer fit for purpose. The old model of 15-25 year leases, with fixed rents, on upward-only rent reviews every 5-years, is now broken. Internet competition is taking business away from the High Streets & shopping malls. Increased costs & over-capacity too, which we've discussed here many times before, are decimating profits at many retailers & hospitality companies. So many retail sites are now on excessive, unaffordable rents, with no flexibility to reduce those rents.

The only thing that can give, is rents - which have to come down, big time. Next (LON:NXT) (in which I hold a long position) indicated recently that it is achieving about 28% reductions in rents on lease renewals. Plus it is also securing reverse premiums (i.e. cash bungs) from landlords, to refit those shops. New leases are on average only 7 years.

Despite this, profits from Next's stores network are falling rapidly, and Next has openly and publicly modelled the entire closure of all its stores. Although I don't see that happening in reality. The company just wanted to demonstrate that it has plans to deal with the worst-case scenario, and that the outcome wouldn't be too bad at all, in terms of losses.

Retailers which are financially weak don't have the luxury which Next (LON:NXT) has, in terms of being able to wait until leases expire, then walk away from them. Looking at Mothercare (LON:MTC) , shareholders stumped up £100m in a rights issue in 2014. That money has effectively been squandered, trying to solvently scale down the business, and slowly exit from its loss-making shops. With hindsight, it would have been better off doing a CVA back then. I reckon a CVA at Mothercare now is looking highly likely. After all, why should shareholders take all the pain, and landlords continue to be paid uneconomically high rents, under existing arrangements? It wouldn't surprise me if Debenhams (LON:DEB) and Laura Ashley Holdings (LON:ALY) (in which I have a long position) have to go down the same route at some point, to exit their onerous long leases.

It might become the case that shareholders force struggling retailers down the CVA route in future. I wouldn't want to refinance a retailer, to line the pockets of its landlords. Would you?

- CarpetRight update today - key points;

- Confirms it is going ahead with the previously mooted CVA

- 92 sites to be closed (almost a quarter of the 418 UK stores total mentioned in the most recent interim accounts), and 113 sites proposed for rent reduction and revised lease terms (presumably that means shorter leases, maybe introducing break clauses, etc.)

- Only landlords are being asked to take a haircut - other creditors (e.g. suppliers) are not affected - therefore the business should continue trading as a going concern, if landlords agree the CVA. If they don't agree it, then presumably Administration would be the only alternative.

- CVA proposal document to be published later today.

- Meetings - most importantly, creditors have to approve the CVA, on 26 Apr 2018. Then shareholders on 30 Apr 2018.

- Equity fundraising of net proceeds of £60m (at upper end of previously indicated £40-60m range) - placing and open offer. Good to see an open offer included. No indication given on price though - so dilution will be anywhere between large, and massive.

- Fundraising won't be done unless/until meetings grant approval for CVA - makes sense, as nobody will want to stump up fresh equity without first being sure that the landlords have agreed to take the hit via CVA.

- Current trading conditions remain difficult, but company reiterates it expects a small underlying pre-tax loss for y/e 28 Apr 2018.

- A legal matter has arisen - technical breach of borrowing powers in Articles of Association. This will be corrected on 30 Apr 2018 meeting. Doesn't look a big issue - probably the least of their worries right now.

Management comments

"These tough but necessary actions will enable us to address the burden of a legacy UK property estate consisting of too many poorly located stores on unsustainable rents and are essential if we are to restore our profitability and deliver a successful turnaround. Carpetright has engaged fully with the British Property Federation on the detail of the CVA Proposal and we thank them for their constructive approach.

"Completion of the CVA and equity financing will enable us to establish an appropriately-sized estate of modernised stores, on economic rents, complemented with a compelling online offer, enabling Carpetright to address the competitive threat from a position of strength.

"We will remain in close contact with all colleagues to keep them fully informed as we move through this process."

This sounds like it's being handled well - by co-operating with the landlord's body, they're more likely to get landlords onside.

British Property Federation comments

"These situations are never easy as landlords need to take into consideration the impact on their investors, including those protecting pensioners' savings, as they vote on the CVA proposal.

Carpetright and Deloitte, however, have demonstrated best practice, constructively engaging with the BPF early in the process and ensuring landlords' interests have been properly taken into account.

Ultimately, it will be for individual landlords to decide how they will vote on the CVA, but the proposal has sought to find a solution that works for all parties."

That sounds like a fairly strong endorsement, tacitly encouraging landlords to support the CVA, in my view.

I wonder if the landlords will be given some of the enlarged equity, as a sweetener to accept the deal? That might make more sense than offering them cash. After all, since landlords are giving up money they are entitled to under leases, and in some cases, being landed with empty & difficult-to-let warehouses, surely they should be compensated with some of the upside from the slimmed-down Carpetright's future success?

My opinion - the quandary here is that CarpetRight should be an excellent business, if the CVA proposals go through. Being able to jettison all your problem properties in one fell swoop, and just retain the profitable sites, gives the company a fantastic & totally unfair advantage over its competitors, which have to soldier on with the usual tail of loss-making sites which most retailers have.

Is it worth buying the shares now? Quite possibly, if you're a punter who is prepared to risk a 100% loss if landlords reject the CVA proposals (which seems unlikely, judging by the positive comments from the BPF, quoted above)

The big problem however, is what the price of equity fundraising will be at. Whilst an open offer is included, there are very unhelpful EU regulations which limit open offers to just 5m Euros (£4.3m), otherwise above that a prospectus is required. There probably isn't the time, nor the inclination, to produce a prospectus here, hence I imagine the open offer would end up only being £4.3m / £63m (allowing £3m for costs, to arrive at £60m net), which is only 6.8% of the total money being raised.

So if I were to buy shares now at 39p, and the fundraising ends up being done at a deep discount, then the winners are the institutions that get in on the placing, and the losers are small investors who can probably only get a little scrap of stock in the open offer.

So as always, I'm afraid the system is rigged to favour the guys in the city, and small fry like us, could end up being shafted. What we need is reform of the system, so that fundraisings are done quickly & electronically, with minimal paperwork & fees, and are open to everyone (with first refusal going to existing holders). We should be lobbying Government to do this, because you can be sure as hell that the City won't want a cheap & simple fundraising system!

Overall then, I'm afraid it's too risky & uncertain for me right now. However, I do think that post-CVA, this share could do very well. It should restore CarpetRight to decent profitability. Therefore the lucky folk who get to participate in the placing, should make a nice profit. It remains to be seen whether small shareholders will too - we don't yet have enough information.

If (I think it's probably more a "when") this CVA is approved, I expect to see many more companies follow suit, in the troubled retailing & hospitality sectors. In a way, CarpetRight could become a model of how to do things, for troubled retailers burdened with unaffordable property leases.

Meanwhile, retailing landlords are in for probably the worst few years of their careers, or since 2008 anyway. There will also be lots of empty retail space coming to a neighbourhood near you. So this could actually become a great time for high quality start-ups and growth companies, to expand into space that they never previously would have been able to think about securing, and on deals that could also be highly advantageous.

As always, the creative destruction of capitalism causes pain for stale & old companies, but opportunities for newcomers.

QUIZ (LON:QUIZ)

Share price: 155p (up 3.3% today)

No. shares: 124.2m

Market cap: £192.5m

Quiz calls itself "the omni-channel fast fashion womenswear brand". Today's update is for the year ended 31 Mar 2018.

I find the "omni-channel" description a bit gimmicky, because these days most fashion companies sell through shops, the internet, and overseas. So it's not really anything special or unique, in my view.

Key points;

- Revenues up 30% to £116.4m, in line with expectations (36% underlying growth, excluding a one-off wholesale order)

- Spectacular online growth of +158%, to £30.6m (26.3% of total revs) - driven by increased marketing & wider product ranges.

- International expansion - new shops opened in Spain & Ireland.

- UK - strong LFL sales growth, but no figures provided.

- Gross margins in line with expectations.

- Operating costs slightly higher than planned.

Putting that all together, if sales & gross margins are in line, but costs are slightly higher than expected, then isn't that probably a small profits miss? I could be wrong, but by not explicitly stating that they've met market expectations on profit, then I see this announcement as possibly trying to gloss over a small earnings miss.

My opinion - Quiz has achieved (and is still doing) excellent growth. So it probably deserves a premium rating. However, it will still be facing the same cost pressures as everyone else, in its retail stores.

Online is highly competitive, with downward pressure on selling prices. That said, to grow its online sales by 158% year on year, is really superb. That rate will obviously slow, as the total gets bigger.

The chart appears to be showing signs of the downtrend having possibly bottomed out?

The whole retail sector has had a really tough time lately, and share prices have fallen considerably. So relatively speaking, I don't see Quiz as being any cheaper than when it was 25% more expensive - because most other similar companies have fallen in price by at least as much. Look at Footasylum (LON:FOOT) or Boohoo.Com (LON:BOO) for example.

I was beguiled by the presentation given by Quiz at it's float, but have since cooled on the company. Its fashions seem fairly ordinary. I don't see a stand-out brand here, or any particular competitive advantage - although management are clearly good rag traders and know what they're doing.

Could it be another Asos or BooHoo? Probably not, in my view, but it's possible. Overall, frustratingly, I'm on the fence with this share. It's difficult to decide whether it's worth the considerable premium (on a PER basis) to other fashion retailers. We can have another look at it when the full figures come out, on 5 Jun 2018.

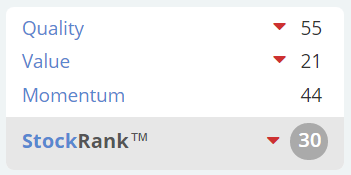

Stockopedia doesn't rate it highly at the moment. It will be interesting to see if this low StockRank improves once the 03/2018 figures are absorbed in June.

I've decided to do a few more sections re RNSs today, but will put them in a new report for Friday 13 April 2018, marked "Part 2".

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.