Happy Friday!

Of interest today are:

- Games Workshop (LON:GAW) - trading update

- Distil (LON:DIS) - final results

- Ranger Direct Lending Fund (LON:RDL) - letters between the various parties

Turning to yesterday's announcements, I would like to catch up on:

- Impax Asset Management (LON:IPX)

- Onthemarket (LON:OTMP)

- Alliance Pharma (LON:APH)

Games Workshop (LON:GAW)

- Share price: 2900p (-5%)

- No. of shares: 32.3 million

- Market cap: £936 million

This collectible wargames designer and retailer has confirmed that sales and profit growth has continued since May:

We expect the Group's sales for the 53 weeks to 3 June 2018 to be approximately £219 million and the Group's profit before tax to be not less than £74 million.

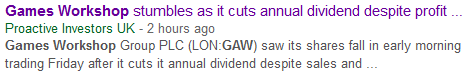

Some shareholders might have been misled by early headlines, e.g. this one:

It's easy to make mistakes when moving quickly. To be fair to the journalists involved, Games Workshop did not include any comparative figures in the RNS. That would have been helpful, and would have prevented the above mistake.

GAW has declared a 30p dividend, payable in July.

This is smaller than the March dividend (35p), but larger than the dividend paid in July 2017 (20p).

I've quickly checked the 2017 annual report. As far as I can tell, the company does not have a progressive dividend policy. Instead, it follows the principle of returning "truly surplus cash" to shareholders.

That's perfectly reasonable, and I wouldn't read too much into this 30p dividend, except that the company thinks it has 30p in spare cash per share.

It uses return on capital as a key performance indicator and has produced very attractive returns by this measure, and I am inclined to think it deserves the benefit of the doubt that it will be putting its retained earnings to good use.

Today's numbers are pretty much as were expected following the May update, so I don't think this is a major news story. The only unusual elements are the journalistic error re: the dividends, and the share price decline. It looks like some people were hoping for yet another upgrade.

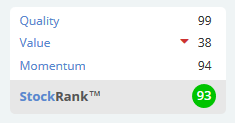

I like this stock and the StockRanks like it, too:

Distil (LON:DIS)

- Share price: 2.55p (+16%)

- No. of shares: 502 million

- Market cap: £13 million

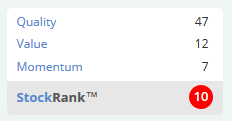

It's not very often that I pay much attention to, or have nice things to say about, those shares classified as Sucker Stocks by the Stocko algorithms:

Successful drinks companies are so profitable, however, that I think it's worth examining those which have potential in this sector.

I've written about Distil several times before - most recently in April.

It owns these drinks brands: Blackwoods Gin and Vodka, RedLeg Spiced Rum, Blavod Black Vodka, Diva Vodka and Jago's Vanilla Cream Liqueur.

These results are for the year ending March 2018.

Sales and profit growth are not as high as I originally hoped, and had been forecast by a commissioned research provider.

It's still a fine performance in percentage terms:

Turnover, supported by increased marketing investment, increases 23% to £2,014k from £1,642k

Gross profit increased 23% from £950k to £1,172k

Operating profit of £157k compared to prior year profit of £10k

With a company this small, the effects of operating leverage will be extreme, i.e. the profit figure is going to be volatile.

For example, operating profit would double from the current level if sales increased by 16% in FY 2019 (assuming margins remain stable and fixed operating expenses).

The Chairman is very happy with performance:

The Company was able to achieve its key growth objectives, particularly that of advancing the business from a breakeven position in 2017. It was an important year because we were able to demonstrate that our business can successfully grow the top line, the bottom line, invest in brands and improve cash flow.

It's a nice sector to be in at the moment, as sales of premium drinks and spirits have been outpacing beer and wine sales.

The next major piece of news flow could be in relation to US sales, where Distil is seeking a distribution partner.

Balance sheet is fine, with almost zero liabilities and £1 million cash.

It's not enough cash to run a huge marketing campaign, but that's ok. The company has been conservative with spending: operating expenses increased by 8% this year. The advertising budget has remained under control, with a budget of c. £500k. Future earnings will be ploughed entirely into productive development and marketing.

This is still early-stage, and it might come to nothing, but I continue to believe that it has some interesting potential as a long-term hold. Having crossed the threshold of profitability, it has a clear opportunity to build some valuable brands.

Ranger Direct Lending Fund (LON:RDL)

- Share price: 792p (-1%)

- No. of shares: 16.1 million

- Market cap: £127.5 million

A war of words continues between Oaktree, the activist shareholder, and the Board of RDL (a debt investment fund, using peer-to-peer lending platforms).

Here's the timeline:

- Wednesday morning: 4th Oaktree letter to shareholders

- Wednesday evening: RDL response to 4th Oaktree letter

- Friday morning (today): New Oaktree letter to shareholders

The gist of it is that Oaktree, holding 19% of the shares, wants Board representation, to prevent shareholder value destruction.

RDL has not performed particularly well and has taken a massive hit on an investment in a US-based lending platform called Princeton. Oaktree said the following on Wednesday:

The Board’s woefully slow response to the Princeton debacle, which led to massive shareholder value loss, underscores the risk of inexperienced, slow-moving, and reactive oversight in specialty finance companies. We believe that shareholders simply cannot afford to wait for the “next Princeton” to unfold under the current Board – the Board must be strengthened immediately.

Unsurprisingly perhaps, the Board of RDL does not seem terribly keen on the idea of having Oaktree representatives trying to wind up the vehicle and return cash to shareholders (there is about 938p in NAV per share on the books).

It responded on Wednesday evening with several points, including the claim that Oaktree had engaged in a "disruptive campaign" to wind up RDL, and that its commitment to explore all strategic alternatives (including the possibility of not winding up RDL) was disingenuous,

Today, Oaktree is back with another letter, saying:

- The RDL Board has selectively engaged with those shareholders who support its views.

- There are questions around whether the RDL Board has a conflict of interest in appointing the proposed new investment manager, and whether the advisory firm that helped it select a new manager is properly incentivised to maximise shareholder value (e.g. by proposing a liquidation).

- The RDL Board may be "reneging on its commitment" to give shareholders a vote on the proposed new investment manager.

I'm still gathering information on this one. It would be great to turn 792p into 938p while taking on very little risk! But I have no idea which way the upcoming votes will go for now. Stay tuned.

Impax Asset Management (LON:IPX)

- Share price: 189.5p (+1.6%)

- No. of shares: 130.4 million

- Market cap: £247 million

Interim results to 31 March 2018

Strong results yesterday from this environmental asset manager.

AUM growth:

- March 2017: £5.7 billion

- September 2017: £7.3 billion

- March 2018: £8.1 billion PLUS £2.9 billion in the acquired US business = £11 billion.

There has been a further boost of £0.8 billion in the last two months.

So the company continues to make great progress in growing AUM, exactly what investors like to see.

Performance is a separate matter.

Impax says its investees "generally proved resilient" and that its investment strategies "delivered robust performance" in H1.

If you look at the AUM movement table, there was in fact a £243 million reduction in AUM due to "market movements, FX and performance", i.e. the assets had a negative overall return during H1.

I conclude from the text below that performance was quite average in H1:

Over the Period, most of our thematic environmental and resource efficiency strategies outperformed their sector benchmarks while slightly lagging the MSCI All Country World Index (the "ACWI"). Our global equity strategy maintained its strong performance and has on average beaten the ACWI by 300 basis points (annualised) since inception in January 2015.

The Pax World Funds have, for the most part, delivered returns within a few basis points of peers and benchmark indices, with the best performers being Large Cap, ESG Beta Quality and the Global Women's Leadership funds.

So there is nothing to write home about in terms of performance during this period. But it's only a 6-month period, and client inflows remained very strong.

Outlook is positive:

As asset owners around the world become aware of the investment opportunities we have identified, our services are attracting increasing levels of attention, while our long track record and stable team provide us with a strong competitive edge. The Board is optimistic that the Company will continue to deliver good returns for our shareholders in the coming years.

Balance sheet

The company now has £11 million outstanding in loans used to help finance the US acquisition, Pax.

The large investment in Pax using the pre-existing cash balance combined with debt should, I think, help to accelerate returns for Impax shareholders over the next couple of years.

AUM has approximately doubled compared to a year ago and the acquisition has only been consolidated since mid-January 2018. So we haven't seen the full effects of the acquisition or all of this additional AUM in a complete reporting period yet.

Only 2.7 million new shares were issued in the deal, so the dilution is very small. EPS is going to rise very substantially (forecast EPS for FY 2018 is 10.2p, versus 6.2p in FY 2017).

My opinion

Momentum remains strong and I expect this to continue performing well. Long-term, I don't think that environmental strategies will outperform conventional investments but I do think they'll continue to attract AUM. So Impax is ideally positioned for further growth.

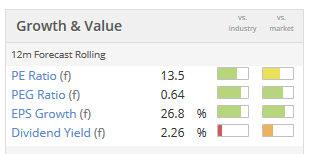

Value metrics suggest to me the market is still not giving the company all that much credit for its progress:

Onthemarket (LON:OTMP)

(Formatting is broken, so I can't put the share price here - apologies.)

This operates onthemarket.com. It's an attempt by property agents to cut out Rightmove (LON:RMV) and ZPG (LON:ZPG), two tremendously valuable and profitable companies. The stock is a fresh listing since February of this year.

It's an unusual stock. Owned by and backed by property agents, its mission is to give property agents a better deal by charging them "sustainably fair prices", rather than the price gouging some of them feel they experience from Rightmove and Zoopla.

Does it make sense? There is no doubt it could work, if all property agents chose to use it instead of the duopoly. But the duopoly is highly skilled at running property portals and customers are familiar with them, so it's not such an easy transition to make. The duopoly provides a valuable service.

I also doubt that most property agents will want to own shares in a website for the long-term. Logically, it makes sense to me that there would be a separation between property agents and the property portals.

Paul has noted previously that OTM has been offering free adverts to agents, to incentivise them to sign up.

Additionally, Investors Champion noted yesterday that free shares are given to agents who stay with OTM for long enough.

I've just had a look at the Admission Document myself. It's there in black and white:

The strategy for the Group following Admission is to increase support for an agent-backed portal further through competitive pricing for property advertisers, a premier search experience for property-seeking consumers and the targeted use of equity incentivisation.

That's fine for the agents, being given shares to incentivise them to use a product.

It makes good sense to do that in a mutual organisation, owned by its customers (OTM was previously Agents' Mutual). The purpose of a mutual organisation is only to serve its customers and redistribute its earnings to them, and that's fine.

But I'm not really very comfortable with the idea of a PLC whose mission is not to make as much money as it can from its customers (within law and ethics).

Rather like law firms who abandon the partnership structure and become listed PLCs, I can understand why it's to the benefit of the firms themselves and their former owners to sell to the public markets. But I just can't see why investors in the public markets should want to take part!

Alliance Pharma (LON:APH)

Some pleasant news. A treatment which had been in-licensed by Alliance from a Canadian firm is on the verge of regulatory approval in UK. Approval will be sought in other European territories soon.

CEO comment:

"We are delighted by this news and look forward to launching Diclectin later this year. Thereare currently no licensed treatments for nausea and vomiting of pregnancy in the UK, highlighting a clear unmet need for patients and clinicians. For Alliance, Diclectin represents a sizeable mid-term opportunity and also allows us to further leverage our European footprint."

Have a great weekend, cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.