Good morning!

Today, we have a couple of very welcome guest comments from Paul.

It looks surprisingly quiet on the RNS front, in relation to stocks in my universe.

Stories on the radar so far include:

- Best Of The Best (LON:BOTB) - final results

- HSS Hire (LON:HSS) - refinancing

- Footasylum (LON:FOOT) - comment on yesterday's dire announcement

- Ranger Direct Lending Fund (LON:RDL) - AGM yesterday

- Severfield (LON:SFR) - results for FY18.

- Thalassa Holdings (LON:THAL) - share buy-backs/earnings preview

Mello meeting: a quick plug for the next Mello meeting in Beckenham. It's on Monday (25th June) and will feature Sosandar (LON:SOS). All you have to pay for is your own drinks and dinner, and e-mail David in advance to say that you're going. Here's the link!

Best Of The Best (LON:BOTB)

- Share price: 295p (+7%)

- No. of shares: 10.1 million

- Market cap: £30 million

(This section is written by Paul, who owns shares in BOTB.)

Results look as expected. What's interesting is that the company (which runs a weekly competition to win supercars & other prizes) is to exit all its remaining airport sites, and become an online-only business. I think this might trigger a re-rating of the shares at some point. The decline in the airport locations (which have become too expensive to operate) has masked good online growth. Today it reports 23% underlying online growth, which is now 84% of total revenues, and set to become 100% of revenues when the 3 remaining sites are closed.R

I think the company is gradually learning which marketing expenditure works best, and this comment (below) today gives me hope that growth might accelerate. Given that each additional sale is virtually pure profit, then this process of increased growth from increased marketing could become a virtuous circle. That's what makes the shares so interesting, in my view;

All our online marketing investment is carefully tracked and constantly fine-tuned to ensure we are optimising the returns. As confidence in the returns on investment improves, we anticipate increasing our marketing budget by approximately 40% in the next financial year, across the full range of previously tested channels.

Remember that sales are international, not just UK. So the potential market size is the entire world!

Note that today's outlook statement is positive;

BOTB has delivered increased revenues and profits slightly ahead of management's expectations and remains strongly cash generative. We believe the business is well positioned for the new financial year, which has started encouragingly, and I look forward to updating shareholders on further progress in due course.

There's another special divi announced today, of 4.5p, on top of the regular 1.5p divi. There have been lots of special divis paid in recent years, and I expect more of the same.

Paul's opinion - I'm a long-term holder here. I think valuing the company on a PER basis is missing the point. The point is all about the future potential, if growth were to really accelerate. Also, the eventual outcome is likely to be a trade sale. Imagine the upside to a large betting group, if they were to buy BOTB and then ram their own customer base through their own marketing channels. With each extra sale almost pure profit, that could make the company worth multiples of the current price. You might say, couldn't a big betting group just replicate what BOTB has done instead? Yes they could, but BOTB has spent almost 20 years building up a reputation & customers. So why incur all the start-up losses from a new operation, when a big betting group could just buy BOTB and have a ready-made additional business, with good potential upside?

This share is horribly illiquid, so tricky to buy. Note that the company takes out sellers, by buying in the market. So selling would not necessarily be a problem.

HSS Hire (LON:HSS)

- Share price: 32.05p (-2%)

- No. of shares: 170.2 million

- Market cap: £55 million

HSS successfully secures refinancing

(This section is written by Paul, who does not own shares in HSS!)

HSS Hire (LON:HSS) has refinanced its debt, in what looks a terrible deal. They're paying between 700 & 800 bps over LIBOR on a new £220m facility. Plus they're having to give away 8.5m warrants too. This just shows the foolishness of running a hire company on hideously expensive debt. The whole point of operating in this sector is to finance the hire fleet on the cheapest credit available - which can only be obtained if a company also has decent equity on its balance sheet. Another example of why balance sheet strength is very important! I reckon the equity here is probably worthless. This extortionately expensive debt deal confirms that.

Footasylum (LON:FOOT)

- Share price: 72.5p (-9%)

- No. of shares: 104.5 million

- Market cap: £76 million

(This section written by Paul.)

When I saw that the share was down c.50% yesterday, I quickly read the announcement, and almost bought some. However, this urge to buy immediately after profit warnings has cost me dearly in the past, as it's usually a mistake. The trouble is, I tend to "anchor" to the old share price, and hence jump to the conclusion that the share must be cheap at a 50% lower price. This is usually a mistake.

Thankfully, I managed to curb my urge to buy, and instead did some research on the revised forecasts. Or rather, I just read a broker note from N+1 Singer, which is available on Research Tree. They have reduced forecasts considerably, and are now only forecasting 4.8p EPS for the current financial year. So at 80p last night, the share is not cheap, based on the revised forecasts.

Worse still, as Graham mentioned in yesterday's report, FOOT was sold to the market on the basis of very strong organic growth in both sales and profit. That story has now almost completely collapsed. It now seems that the company is struggling to generate profit growth, despite opening loads of new shops. This really calls into question its whole business model. I've never been particularly keen on retailers which sell other peoples' products. They can be squeezed on margins too easily, and undermined by the brands selling their own products through their own websites. Why use an intermediary retailer when you really don't need to?

Overall then, I've probably got too many concerns about FOOT's business model to want to risk buying the shares, even at the new, rebased down valuation.

On the upside, it does have a decent balance sheet, so there are no solvency issues, even if trading deteriorates further. Plus, this is actaully a great time to be opening new shops on the High Street - as landlords are increasingly desperate to fill empty units, so reduced rents and generous inducements (e.g. reverse premiums to fund the fit-out, and long rent-free deals) are becoming increasingly prevalent. It might actually pay companies like FOOT to put a hold on new shop openings, and wait for even better landlord deals in the future?

I think Graham's estimate (in yesterday's SCVR) of a 60p share price, as a good potential entry point, looks about right. Who knows, the share price might even undershoot that? At 50p I would probably be a buyer.

This one joins the long list of stock market floats which were over-priced, and opportunistically timed. This reinforces my own aversion to investing in new issues. It seems safer to wait at least a year, or even 2, before considering buying into new issues.

We have a great advantage over institutions. New issues are some of the limited number of situations where instis can buy in decent size, so they naturally tend to be drawn to them. Whereas you and I can bide our time, and buy in any time we like. Furthermore, Instis are high & dry, if something goes wrong, in that it's so difficult for them to dispose of a large stake. Whereas you & I can press a button and exit instantly, if our stakes are smallish, any time we like.

The above is why I've never invested in any small cap funds. Their liquidity problems are so restrictive, that they lose a lot of the benefits of small cap investing. They have to be outstandingly good stock pickers to succeed, because they can't move in & out of small caps when they want to.

Ranger Direct Lending Fund (LON:RDL)

- Share price: 813p (unch.)

- No. of shares: 16.1 million

- Market cap: £131 million

(This section is written by Graham, who owns shares in RDL.)

A string of AGM-related notices have been released by Ranger this week. The AGM was yesterday.

To recap, this is the debt vehicle that became the target of a shareholder activist campaign by the value equity portfolio manager at Oaktree.

Oaktree is Howard Marks' firm. Marks is considered by many (including me!) to be one of the world's top value investors.

So that's what initially got me interested in the story. I checked the numbers and realised the stock was trading at a modest discount to NAV, even assuming that its large failed investment (in a lending platform called "Princeton") turned out to be worthless.

Ranger hasn't performed particularly well since inception, and so Oaktree and another institutional shareholder were both calling for it to be liquidated.

Excluding Princeton, I thought the rest of the portfolio was ok. Buying into it at a discount, with the potential for it to generate a good return and then to receive a return of capital, is the plan.

I don't include this within the "equity" portion of my personal portfolio, although I acknowledge that strictly speaking, that is what it is. For my own purposes, since the underlying assets are primarily debt obligations, I categorise this as a fixed income investment.

Anyway, what happened at the AGM?

The Ranger board at first resisted the activist campaign, but most of them (3 of 4) eventually said they intended to resign prior to the meeting.

The AGM took place yesterday, with the result that:

- one of the four existing Board members was re-elected.

- two Oaktree nominees were elected.

- one of the nominees from LIM (the other activist shareholder) was elected.

Comment by the Oaktree portfolio manager:

Oaktree is confident that the refreshed Board will have the requisite experience to oversee RDLF and ensure a smooth and successful wind-down of the Company for the benefit of stakeholders,” said Patrick M. McCaney, Managing Director and Portfolio Manager of Oaktree’s Value Equities strategy.

Sounds good.

The strategy which sounds best to me and has been proposed by LIM is to allow as much as possible for the existing portfolio to mature as normal.

The average maturity on its debt portfolio is just two years. So two years from now, half of the loans will have naturally liquidated themselves, with no unusual transaction fees. That is ideal.

Longer-term debts should be sold only if this can be done at a fair price: there is no need for a fire-sale.

I'm very confident that the new Board is well-qualified to oversee this process and maximise value for shareholders.

NAV was last reported at $183 million, for April 2018 (assuming Princeton is worthless).

Divide by the latest $1.32 exchange rate and 16.1 million shares, and I get an NAV per share estimate of 861p.

The GBPUSD exchange rate is an important risk factor.

Personally, I've been buying a lot of USD-denominated debt over the last few days. I need to think carefully about how much of this, if any, I want to hedge back to GBP or EUR.

Ranger's discount to NAV (excluding Princeton) at the latest offer price is about 4%. Unfortunately, the bid-ask spread is quite wide.

Severfield (LON:SFR)

- Share price: 85p (+4%)

- No. of shares: 302 million

- Market cap: £257 million

Results for the Year ended 31 March 2018

(This section is written by Graham.)

Quite a few reader requests for this, "the largest structural steel specialist in the UK".

Severfield is the UK's market leader in the design, fabrication and construction of structural steel, with a total capacity of c.150,000 tonnes of steel per annum, which represents c.17 per cent of UK structural steel production.

Today's results are encouraging:

- Revenue up 5% to £274.2m

- Underlying* profit before tax up 19% to £23.5m

- Special dividend of 1.7p per share

- Return on capital employed ('ROCE') of 16.5%

- "Over 100 projects undertaken during the year in key market sectors including the new stadium for Tottenham Hotspur FC, the retractable roof for Wimbledon No.1 Court and a new commercial tower at 22 Bishopsgate"

The UK order book has reduced slightly. That's the only small negative feature in today's results. As we've discovered, the relationship between the size of an order book and future revenues is not as clear-cut as we might have presumed!

It's good to see that the adjustments made to "underlying" PBT are modest. There is the amortisation of some acquired intangibles, plus movements on some currency hedging contracts.

2018 is left-hand-side, 2017 is right-hand-side:

Why do I care so much about this issue? The reason is that shareholders are nearly always paying for these adjustments. Acquired intangible assets had to be paid for with shareholder cash. They still had a cost, even if we call it "amortisation" and recognise it gradually over a period of time, instead of putting it all through the P&L on day one.

Thankfully, the accounts are Severfield are pretty clean in this regard.

Also comforting to read that the company has a ROCE target of 10% through the economic cycle.

That's not a very high target but it's comforting that the company puts so much emphasis on it. It has also been comfortably beating this target in recent years (I guess it's supposed to do that during the bullish parts of the cycle).

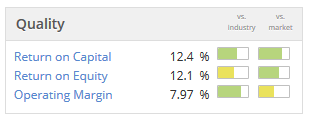

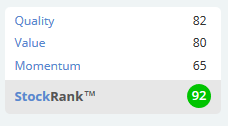

Stocko algorithms believe that the company is high Quality, estimating quality metrics as follows:

The CEO also issues a very positive outlook statement. Note the reference to the "stable" order book:

The strong performance of the Group has continued into 2018, with good revenue and profit growth supported by strong cash generation. The strategic and operational progress that we have made over recent years gives us confidence that the Group is well placed to deliver sustainable future profitable growth. With a high quality and stable order book of £237m and a strong UK pipeline of opportunities, we expect 2019 to be another year of progress in the UK.

My view

The company is doing really well, and has a fine reputation among blue-chip clients. The £50 million Google project at Kings Cross is particularly impressive.

It won't be going on my watchlist, because it doesn't tick enough of the boxes in terms of the checklist I am using these days.

- It is B2B and contract driven (note how large the Google project is relative to the order book as a whole). Four recent London projects have revenues of £20 million each. This is lumpy business.

- Like any construction business, it is cyclical. If you add up the company's net income from 2010 - 2017 (inclusive), you get a negative number. Perhaps there are particular reasons why performance was so bad during the previous cycle, which won't happen next time?

I could be missing out, but I don't believe that I can predict contract wins or time the economy, so I'd rather not play.

If things do stay rosy for a few more years, then the shares could easily turn out to have been cheap at the current level. Trailing diluted EPS is 5.97, for a fully diluted P/E ratio of 14x.

The valuation multiple is not expensive, management sounds competent, it has good market share, and the order book is stable. So there are still plenty of positives for existing shareholders.

IAS 15: A quick note for accounting nerds. Severfield reckons that the new accounting standard on revenue recognition won't affect its results in a material way.

The conclusion of this assessment is that the directors are satisfied that no material adjustments will be required on the initial application of the new standard.

Personally, I think that the new standard is very logical. It requires business contracts to be broken down into separate "performance obligations", and to recognise revenue as these performance obligations are satisfied. It makes good sense and it's reassuring that most companies have said it won't change their results very much.

Thalassa Holdings (LON:THAL)

- Share price: 84.5p (unch.)

- No. of shares: 19.1 million

- Market cap: £16 million

No real news from this one today, except for a small share buy-back.

I'm flagging it because results are due very soon - this week - for the year ended 31 December 2017.

Every value investing bone in my body is telling me to buy it, but I've resisted the temptation (so far!)

As described in my previous report on it, the company had $20.3 million cash (£15 million) as of December 2017, plus a 25% ownership stake in Local Shopping Reit (LON:LSR). That's worth about £7 million at today's share price.

So by my maths the shares are priced at a discount of almost 30% to cash plus LSR, which is a very conservative estimate of NAV.

My difficulty is that I don't know what the future investment strategy is going to look like. Thalassa has invested in everything from mining to commercial property to underwater robotics.

The Chairman is manually closing the NAV discount with these share buy-backs, so I do think that the outlook for the share price is positive, at least in the short-term. Long-term, however, I have no idea about what Thalassa might invest in. Without clarity on its strategy, it's not something I can put my own funds in.

As it says on its website:

The Company was established as a holding company with various interests across a number of industries.

If it had a clearly defined plan that was sensible, I think it would and should trade around NAV (or at least at the value of cash and property).

As I said at Mello, with balance sheet-focused value investing, you need some kind of a catalyst to unlock value. Without that catalyst, your money can get locked up fruitlessly for years.

I experienced this myself with Northamber (LON:NAR) and several others. If you are waiting three or four years for a catalyst then you could easily be destroying value, after taking the time value of money into account.

With Thalassa, that catalyst could be a focused investment strategy, more buy-backs, or a special dividend (I would favour the first two options). It would also be much better if results could be issued faster than six months after year-end. Let's see what happens - I'm still on the sidelines.

That's all for today - cheers.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.