Good morning!

Football is the major story today. There's also quite a lot of stock market news:

- Swallowfield (LON:SWL) - trading update

- Orchard Funding (LON:ORCH) - application for bank licence

- Safestyle UK (LON:SFE) - trading update

- Blancco Technology (LON:BLTG) - trading update

- Sosandar (LON:SOS) - final results (this section written by Paul Scott)

10:30 AM: I have taken Alpha FX (LON:AFX) off the list, because it's an "in line with expectations" update. I've also taken Fishing Republic (LON:FISH) off the list, because its market cap is so small. Paul will be in touch soon with his thoughts on Sosandar (LON:SOS).

12:45 PM: Ditched a few more.

It's too big for this report, however one of my top holdings Burberry (LON:BRBY) released a Q1 trading statement that was in line with expectations.

Retail revenue was flat due to currency headwinds, or +3% at constant FX. "Comparable sales", which includes online sales and is measured at constant FX, was also +3%. There was no change to guidance, except that current exchange rates are more favourable. It remains on track for £100 million of cost savings.

The share price is down 4.5% as I type. Investors were evidently pricing in a little extra. There is also continued uncertainty to be faced as the company beds in a new Chief Creative Officer and responds to weak trading in the UK, Europe and the Middle East.

Personally, I continue to hold. These shares have been in my portfolio since January 2016, and I would like to keep them for the foreseeable future.

Swallowfield (LON:SWL)

- Share price: 275p (-13%)

- No. of shares: 17 million

- Market cap: £47 million

This is of particular interest to me, as I own shares in the similar company Creightons (LON:CRL). Both are engaged in the manufacture of personal care products, and manage their own brands.

Today's full-year update is broadly in line, i.e. a slight miss.

Swallowfield's two divisions, Brands and Contract Manufacturing, performed very differently this year.

Profitability in Brands is significantly ahead of expectations, reporting strong momentum, rising margins and the successful integration of a men's hair styling brand.

Revenue and operating margins in Contract Manufacturing, on the other hand, are both down compared to the previous year. Cost inflation and contract delays are to blame.

I'm inclined to think that this is not a serious profit warning. The problems in Manufacturing sound temporary to me:

Actions are underway to mitigate the material cost increases and the new contracts are now in full production and expected to contribute positively to future growth.

The occasional contract delay is to be expected in this kind of business. It's par for the course. For three major contracts to all be delayed is especially unlucky, but at the end of the day it's probably still just a case of bad luck. And anyway, most of Swallowfield's value is in its Brands division.

Investors may also be a bit concerned about the spike in net debt to £11 million. This is up from £3.6 million a year ago. Again, the company says that this is a temporary spike due to timing issues.

My view

I would like to buy this stock, at the right price. It's a type of company I like to own, particularly the Brands side of the business.

Swallowfield's enterprise value is £58 million at the latest share price, though with incoming cash receipts this will hopefully reduce by a few millions.

Brokers are guiding for £5.8 million in adjusted PBT for the current financial year.

That suggests an earnings multiple versus Swallowfield's enterprise value of 10x at the current share price, before we take the company's financial adjustments and corporate taxes into consideration.

It's a close call but I think I still have a preference for Creightons at current share prices. Swallowfield does slightly better if you run a Stocko comparison.

If Swallowfield's new CEO can go ahead and prove that the increased debt levels and the contract delays are indeed temporary issues, I do suspect that the Swallowfield share price will recover.

Orchard Funding (LON:ORCH)

- Share price: 99p (unch.)

- No. of shares: 21 million

- Market cap: £21 million

Application for Bank Licence & New Appointments

I last covered this specialist lender in a March SCVR.

Today we get confirmation that it has submitted an application for a bank licence to the PRA and FCA.

If successful, that would significantly reduce the company's cost of funds, reduce its reliance on other banks, and enable it to scale up. It anticipates receiving the licence by the end of the year.

Coinciding with this news, Orchard announces the appointment of some new Directors.

I previously wrote that I thought these shares would react positively to strong evidence that a bank licence would be granted.

It's great to have a clear timeline now for when the company thinks this could be achieved.

I wonder if it will need to raise equity, and how much, to seal the deal?

Another holding of mine, PCF (LON:PCF), had net assets of c. £25 million when it was granted a banking licence. It then raised a further £10.5 million, "to maintain the regulatory level of capital and liquidity that the Group is required to hold as agreed with the PRA and FCA".

Orchard's net assets were last reported at £13.5 million, so only about half of the level that PCF had when it got a licence. Its regulatory requirements won't be exactly the same as PCF's, naturally. But I would still be braced for an equity raise, if the application is successful.

If there is a future fundraising to provide enough capital to support a bank structure, that could be the ideal entry point. I maintain a watching brief.

Safestyle UK (LON:SFE)

- Share price:40.8p (-18%)

- No. of shares: 83 million

- Market cap: £34 million

Safestyle UK plc, the leading retailer and manufacturer of PVCu replacement windows and doors to the UK homeowner market, today issues an update on trading.

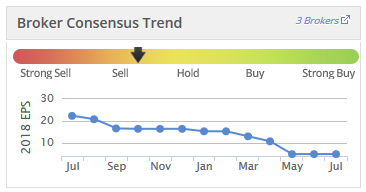

We have been watching the situation go from bad to worse with this company. See the trend in EPS guidance below. This is why momentum trading works:

Thankfully, it had a strong balance sheet before this mess erupted. Otherwise, it could easily have gone bust already.

The cash balance is forecast to be break-even at year end, with borrowing facilities in place should they be needed.

Safestyle has struggled with a weaker consumer environment and an aggressive competitor who has apparently been undercutting it and stealing its staff. It is pursuing legal action against Safeglaze, which is also based in Bradford.

My view

It sounds to me as though staff are going to do well in these circumstances, at the expense of shareholders. Sales commissions and recruitment costs are up.

The Board expects margin improvement in the medium and longer term. It's not something I'm eager to bet on right now, personally. This is a cyclical and I think a commoditised industry, and I have no idea to what extent Safestyle's profitability might recover.

Blancco Technology (LON:BLTG)

- Share price: 76p (+3%)

- No. of shares: 64 million

- Market cap: £49 million

Trading Update and Notice of Results

A reasonable update from this data erasure specialist. Its performance has been troubled and its share price has collapsed over the past 18 months.

It has a new CEO and also announces a new CFO who will join later in July.

Revenues for FY 2018 (ending June) are lower than expected, while profit margins are better than expected.

Cash flow was positive in H2, reducing net debt to £2.8 million.

My view

I've just had a quick look at the interim balance sheet. Equity was £49 million, exceeded by £65.6 million of intangibles.

Meanwhile, £9 million of gross bank borrowings were drawn from a £12.4 million facility - not much headroom. So it's good that the net debt position has improved since then.

I'm not tempted to buy shares in it at this stage, due to the balance sheet and track record. But let's try to keep an open mind and wish good luck to the new brooms.

(This section is written by Paul Scott, who owns shares in Sosandar at the time of publication.)

Sosandar (LON:SOS)

- Share price: 23.2p (+9%)

- No. of shares: 107 million

- Market cap: £25 million

As promised, here is my take on the results today from Sosandar, an early-stages ladieswear eCommerce company, based in Wilmslow.

The historic figures are of little interest, because this share is all about growth. But for completeness, revenues for y/e 30 Mar 2018 were £1.35m, and the adjusted EBITDA loss was £3.1m. In this case, EBITDA is a perfectly reasonable performance measure, because the depreciation/amortisation charges are negligible (as it has hardly anything in fixed assets, as production/distribution/IT are all outsourced). There is no capitalisation of IT spend either. So EBITDA is clean.

LFL revenues are up 268% for the 6m to 03/2018. That's a strong percentage, but it's coming from a very low base. Nevertheless, to be credible, an early stage growth company should be delivering triple digit growth rates, and it is.

Forecast sales - what matters most, is how revenues can be expected to grow. Happily, I was able to work out sales & growth for Q1 of the new financial year (ending 03/2019). This is possible because the narrative today tells us that Q/e 06/2018 was up 73% sequentially on Q/e 03/2018. That's a very impressive quarterly growth rate.

We can work out that Q/e 03/2018 revenues were £492k. I've calculated this by taking full year revenue of £1,353k, and decucting the 9 month interims revenue of £861k.

If we then apply 73% sequential growth, then this arrives at my forecast of £851k revenues in Q/e 06/2018. If you multiply that by 4 to annualise it, we arrive at £3.4m revenues. However, that assumes that no sequential growth occurs, which is ridiculously pessimistic. In reality, I think this demonstrates that Sosandar is heading for perhaps £4-5m revenues this year ending 03/2019, maybe more? That's way ahead of the original plan, in the Turner Pope note from when the company floated, which forecast £3.3m revenues this year. So in a nutshell, it looks to me as if Sosandar is trading well ahead of plan, in terms of revenues.

Gross margin has improved strongly too, to 49%. That's seriously good, for such a small fashion business. It's being achieved by strong sell-through at full price, and good stock control. Or put another way, its product is in demand, and they are not having to discount much to shift it. All very encouraging.

The narrative today is dripping with positives about the outlook for the business, so I am greatly encouraged. It seems to me that we have confirmation today that this business model is going to be a success. Whereas yesterday, it was still highly speculative & uncertain.

Cash - there is £4.6m cash pile. Losses & cash burn should reduce this year, because turnover & gross profit should be rising considerably. If we take a mid point of £4.5m revenues, at 50% margin, then that's £2.25m gross profit for this year. That's up from £0.66m gross profit last year, an increase of £1.6m in gross profit - which would roughly halve the adjusted EBITDA loss this year, to about £1.6m.

In reality, I doubt that will happen, because the company will want to spend more on building its team, and other growth-related expenditure. But there's little doubt that the company has plenty of cash headroom for now. It might decide to do a top-up fundraising in 2019 or 2020, but that's of no concern to me whatsover, because it would be raising cash at a much higher share price than now - from a position of strength, since investors would probably be queuing up to put money into such a fast growth eCommerce business.

So anyone wittering on about cashflow and placings, is just scaremongering. The cash position is fine, and won't be a problem unless growth stalls. The opposite is happening, sales growth is accelerating.

Overall then, as you've probably gathered, I'm greatly encouraged by today's news. I don't know how to value this share, as it's all about future growth. In a bear market it might only be valued at £10m. In a bull market I could see it being valued at £100m+, once investors twig that the business model is working. Who knows?

I'm in this one for the long-term, so the short term price doesn't really matter. It's all about backing management, and as I've said before with Sosandar, the management team is the real deal. They're experienced, and are delivering exactly what they set out to do. I recommend reading today's narrative with the figures in full, as there are lots of very encouraging things in it.

Obviously, as a loss-making growth company, this won't appeal to value investors!

Graham here again. I think we are all done - thanks for dropping by and good luck to England tonight!

Cheers

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.