Good morning!

We have plenty to digest today.

- Somero Enterprises Inc (LON:SOM) - trading update

- Ideagen (LON:IDEA) - preliminary results

- Synectics (LON:SNX) - interim results

- Cloudcall (LON:CALL) - trading update

- SimplyBiz (LON:SBIZ) - trading statement

- Bilby (LON:BILB) - preliminary results (released yesterday)

- Flowtech Fluidpower (LON:FLO) - trading update

Somero Enterprises Inc (LON:SOM)

- Share price: 405p (+2%)

- No. of shares: 56 million

- Market cap: £228 million

This is the maker of concrete leveling equipment we have covered many times before.

H1 trading is as anticipated, and guidance for the full year remains in line with market expectations

Four of Somero's six territories produced growth, including Europe and US (the most important territories).

China is down sightly, but Somero is still "encouraged" by activity levels there (I have frequently expressed doubt as to whether it will ever achieve much success in that country).

Latin America is also down. Again, the company reckons this is set to improve.

CEO comment:

The first half of the year has seen solid growth in terms of profitability and cash flow generation. The positive momentum of our business and favorable market conditions point to a positive H2 2018. In addition, we are truly excited about the significant opportunities for Somero that lie ahead derived from our continued investment in new product development, a key element to our long-term growth strategy."

My view

No change to my view on this. A good company, with limited competition, and conservative management. I expect it to continue to do very well in Europe and the US.

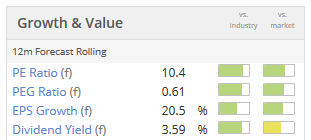

The algorithms love it. Many investors are now familiar with the story, so its rating is at a suitably high level. Quality and moment remain strong:

It is sensitive to conditions in the construction industry, as you would expect. These conditions have been favourable for a lengthy period of time. If I was going to put Somero in my portfolio, I would want to be sure that I was comfortable with that risk.

Ideagen (LON:IDEA)

- Share price: 129p (+4.5%)

- No. of shares: 203 million

- Market cap: £261 million

Ideagen PLC (AIM: IDEA), a leading supplier of Information Management software to highly regulated industries, announces its unaudited preliminary results for the year ended 30 April 2018.

An acquisitive software group. I haven't covered it before so apologies to any long-term holders.

"Underlying organic revenue growth" is 11%, assuming acquisitions had already been in the group during the previous year.

I prefer the simpler way of presenting things, when organic revenue growth was the growth of the business excluding acquisitions. But many companies seem to be doing it this new way now, instead.

Recurring revenues are up as a percentage of total, and SaaS revenues are up to £8.4 million (out of £36 million total sales).

The idea is to consolidate the risk and compliance software market. The customer list is very impressive, encompassing a wide range of blue-chip organisations:

Currently, more than 3,700 organisations use Ideagen's products including seven of the top 10 UK accounting firms, all of the top aerospace and defence companies and 75% of the world's leading pharmaceutical firms.

My view - I haven't got the time to read the entire statement in detail, unfortunately. Jumping down to the financial statements, I see we have net assets of £50 million and intangibles of £60 million.

So the balance sheet is what we've come to expect from an acquisitive strategy: loaded with intangibles, and low (in this case, negative) net tangible asset value.

As Paul noted when he covered this stock some time ago, cash generation is pretty good: there is £9.4 million of cash generated by operations in today's statement, and that's after an unfavourable working capital movement of £1.4 million.

Offsetting this, £2.2 million of development costs are capitalised, and there's a £0.5 million capex spend. (There's also all the spend on acquisition-related payments, but that goes without saying!)

Adding all of this together, I think there is about £8 million in underlying cash generation.

I wouldn't be comfortable enough with the story yet to buy it personally, but it might be worthy of some further research.

Synectics (LON:SNX)

- Share price: 216p (+1%)

- No. of shares: 18 million

- Market cap: £38 million

Synectics plc (AIM: SNX), a leader in the design, integration, control and management of advanced surveillance technology and networked security systems, reports its unaudited interim results for the six months ended 31 May 2018.

Results for the full year are expected to be in line with expectations.

Performance is described as "solid".

As with Somero this morning, investors tend to interpret that word as "ok" or "pretty good". Each of SOM and SNX's share prices have nudged up slightly higher this morning on the back of this word.

You can review the Synectics product range at this link. It includes:

- command and control platforms

- recording and display systems

- surveillance cameras

I'm afraid this is not an industry I feel at home in. The difficulties at video security system provider Indigovision (LON:IND) have been discussed at length in this report, while I personally had a lucky escape in selling out of Newmark Security (LON:NWT) before things went bad.

With small security companies, like those I have just mentioned, a couple of big contracts can make or break them. I sold out of Newmark when I realised I had no real insight into their order flow (plus I had other concerns). That company's market cap has been devastated by subsequent events.

Synectics (LON:SNX) is bigger, and its customer concentration does not seem too bad. According to its 2017 annual report, there was no customer accounting for more than 10% of revenue. It also said that there were "no significant concentrations of credit risk".

That says to me that it should trade at a higher rating than smaller companies with more concentrated customer lists.

One number that jumps out at me is the receivables balance of £21 million. Might be worth a little bit of digging into that, given its size relative to sales and indeed to the market cap of the company! At least we have some evidence that the receivables are not overly concentrated.

Something else worth pointing out is that its track record is rather volatile, as demand can ebb and flow from its Oil & Gas clients. It swung to a big loss in 2014, and has been recovering since then.

It did maintain a stable share count, even through its 2014 losses.

Today it reports average net cash in the region of £5 million, and the balance sheet has tangible net assets of £20 million. So it gets a point in its favour from me in terms of financial stewardship and safety.

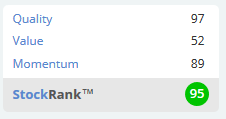

The algorithms love it, awarding a StockRank of 95 and classifying it as a Super Stock.

Purely because of the sector it's in, which I have found to be rather tricky and unpredictable, I am unlikely to add it to my personal portfolio. But I think it looks set to do reasonably well for shareholders.

It also passes a couple of quantitative screens (for its Quality and Momentum). One that is worthy of further research, then.

Cloudcall (LON:CALL)

- Share price: 138p (-11%)

- No. of shares: 24 million

- Market cap: £33 million

CloudCall (AIM: CALL), a leading cloud-based software business that integrates communications technology with Customer Relationship Management (CRM) platforms, announces the following trading update for the six months ended 30 June 2018

Paul has written positively on this stock (most recently in March), and owned the shares, attracted by its organic growth and recurring revenue model.

It provides tools that help salespeople manage customer data during live conversations, and help managers to track their team's calling activities.

Today, it reports revenue growth of 31%, to £4.1 million. The CEO says that H1 "played out largely as we expected it to".

To me, that means "broadly in line".

Last year, at the equivalent trading update for the half-year, Cloudcall reported revenue growth of 40%. Perhaps investors were expecting something slightly closer to that for H1 2018?

Full-year revenues have been forecast at £9.5 million. That would require a 32% increase in H2, compared to H1. Sounds challenging.

Cash - it has £3 million left, plus a £1.9 million facility from Barclays.

My view - I still think that raising more equity is a distinct possibility here. PBT is forecast this year to be a loss of £2.2 million, with another loss forecast for 2019. It might be happy to dip into its facility. I would guess that shareholders will want to put more money in.

As readers will appreciate, I am usually value-oriented. And I fear that everything related to "THE CLOUD" & "SAAS" has been on the receiving end of speculative interest. And I usually hate being diluted. So for all of these reasons, this share is not for me. Which is possibly a bit unfair, as it may have a very nice product.

Addendum: I've checked a broker note. Unsurprisingly, the revenue forecast for this year is reduced to £8.9 million. The negative EBITDA forecast deteriorates by £1 million to £2.9 million.

The broker thinks it doesn't need any additional funding to get to breakeven. That's a key question, and I would strongly recommend that you do your own research into that question. According to the broker's own forecasts, net cash will fall to £200k by December 2019.

SimplyBiz (LON:SBIZ)

- Share price: 182p (-1.6%)

- No. of shares: 76.5 million

- Market cap: £139 million

SimplyBiz (AIM: SBIZ), the leading independent provider of compliance and business services to financial advisers and financial institutions in the UK, is today issuing a pre-close trading update for the six months ended 30 June 2018.

Trading is in line with expectations.

This is a new stock, and everything has gone smoothly since IPO (at least according to the share price). I covered it at its Intention to Float announcement (link).

Looking back at my previous article, I see that SimplyBiz had £8.8 million of operating profit in 2017, before taking into account some rather large finance costs.

Trading Highlights - revenues are up by 13.7%. Most of this growth is due to an acquisition. Organic growth looks to be around 5.5%.

Net cash is now £1.2 million, versus a large debt pile prior to IPO. So the finance costs should be all but eliminated.

My view - happy to keep an eye on this one and learn more about it.

Bilby (LON:BILB)

- Share price: 123.5p (+3.3%)

- No. of shares: 40 million

- Market cap: £50 million

This produced results at 1.25pm yesterday afternoon. Very strange!

Bilby "is an award-winning leading provider of gas, electrical and building services to over 300,000 local authority and housing associations in London and the South East".

It is running a "targeted buy and build strategy", arguing that scale enables it to bid for larger contracts.

Performance looks great for FY 2018 and the outlook is strong. Chairman comment:

Our strict cost disciplines and geographic focus continues to ensure that we can deliver industry leading margins. Our core markets in London and the South East remain buoyant and present significant opportunities for all the companies in the Bilby Group. We look forward with confidence.

Interestingly, the company claims that its central overhead costs are "considerably lower than comparable AIM listed companies".

Frugality is a wonderful trait (think of Jeff Bezos using doors for desks when he started $AMZN!)

I wonder how Bilby has managed to shave so much off its overhead? I note that it has changed its Nomad twice since its 2015 IPO.

Acquisitions - It made no acquisition in FY 2018. In the previous year, it acquired two businesses at a cost of up to £12.7 million.

These deals (DCB and Spokemead) took place at the start of the 2017 financial year. So I think when you are doing a comparison of 2018 versus 2017, it's a pretty fair comparison. The reported growth should not have been overly affected by the acquisitions.

That means there is lot to celebrate with revenue growth of 23% and an improvement in PBT to £4.3 million.

On an "underlying" basis, Bilby calculates that PBT improved from £3.3 million to £5.8 million.

My view - the market cap of £50 million looks rich enough to me, considering the services provided by this company.

I do like certain aspects of what I have learned about the group. I like the reported cost discipline, the lack of acquisitions over the past year as it beds in those from 2017, and the operational KPIs (e.g. customer satisfaction).

Personally, I don't think these services should attract an above-average earnings multiple. But I've got this stock wrong before. I saw little attraction in it when the share price was 42.5p. So I missed out on the share price trebling.

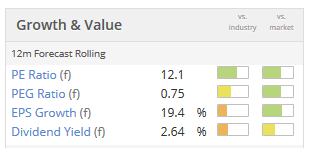

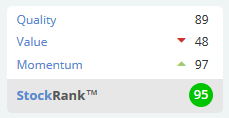

The StockRank continues to view it favourably:

Flowtech Fluidpower (LON:FLO)

- Share price: 186p (+6%)

- No. of shares: 61 million

- Market cap: £113 million

AIM listed specialist technical fluid power products supplier Flowtech Fluidpower (LSE: FLO) ispleased to announce the following unaudited trading update on its performance for the six-month financial reporting period ended 30 June 2018We have organic revenue growth of 9%, versus total revenue growth of 66%. Lots of acquisitions.

Net debt is higher than expected, at £17.5 million, and is forecast to reduce.

The plan for the rest of the year is for synergies to be targeted ("inter-company procurement and stockholding benefits") along with some more organic growth.

I do think that if the acquisitions turn out to be handled well, with some efficiencies discovered between its new subsidiaries, things could get very interesting from a shareholder point of view.

This looks like a cheap rating for a group of niche businesses that are collectively performing well.

A fairly long list today, but I just about got there in the end! Thanks for dropping by.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.