Good morning!

The final list turned out to be:

- Connect (LON:CNCT)

- Character (LON:CCT)

- PV Crystalox Solar (LON:PVCS)

- Arrow Global (LON:ARW)

- RM2 International (LON:RM2)

- J D Wetherspoon (LON:JDW)

- SThree (LON:STHR)

Connect (LON:CNCT)

- Share price: 34p (-8%)

- No. of shares: 248 million

- Market cap: £85 million

This distribution/logistics business has been plagued with poor performance, See our comments in June for a refresher.

Today we learn:

- Smiths News (newspaper and magazine wholesaler) - shows "resilience", newspapers holding up but magazines "weakening a little" in Q4.

- Tuffnells (delivery of awkwardly shaped objects) - H2 performance expected to be worse than H1.

Connect purchased Tuffnells in 2014 for £139 million, in a fine example of a misguided attempt by a company to diversify its operations.

There is a logic which says that a company which has diversified its activities has reduced its overall risk. I totally disagree! The way to reduce risk, in my opinion, is to improve your advantage relative to your competition. This is more easily done when you focus on one particular activity!

Glen Arnold, in his Deep Value Investments newsletter, assigned a value of zero to Tuffnells in June. Senior staff from Tuffnells have apparently found their way over to DX (Group) (LON:DX.)

- Pass My Parcel - this "Click and Collect" operation winding down faster than expected with additional operating losses in the FY 2018, but lower costs in FY 2019. Good news.

Elsewhere:

- the company is making a provision (up to £1.5 million) in relation to underpayment of the minimum wage

- new CEO from 1 September. New provisions for further restructuring costs.

- fined £1.5 million in relation to a fatality at a depot in January 2016.

- trading performance expected below expectations

My view

Despite all of the gloom, I'm not yet convinced that this company is destined to go under.

The most important part of it, Smiths News, sounds like it is doing ok. Connect also owns a distributor of newspapers and magazines to airlines, which I understand to be profitable.

The problems are being caused by all of its other parts and temporary disruptions.

But Pass My Parcel will be gone soon. Tuffnells might possibly be shut down or sold off, too. The restructuring costs, fines, etc. are one-off events.

So I think the current rating is a fair price, or possibly even cheap.

We have to bear in mind that net debt was last reported at £83.6 million (February 2018). I'm not seeing any guidance as to what it might be now.

Maybe we can draw some similarities with Conviviality (delisted: CVR) and its purchase of the drinks wholesaler Matthew Clark for £200 million in 2015. Conviviality ended up selling Matthew Clark three years later for "a nominal sum".

The problem wasn't that Matthew Clark suddenly became a bad business. The problem was that Conviviality Plc management overpaid for it and had created a corporate structure that was impossible to manage.

In the same way, it looks like Connect Group became unwieldy after it diversified from newspapers into books, click-and-collect and irregular objects.

Valuation

The core business - Smiths News - is still arguably a good business, or at least not a bad business.

It was churning out adjusted operating profit of about £40 million p.a. solidly from 2012 to 2017. It made operating profit of £17 million in H1.

Putting Smiths News on a modest multiple of earnings (given the long-term structural decline in newspaper circulation) suggests that CNCT shares are fairly priced or perhaps cheap, even allowing for the debt load.

The net debt/EBITDA covenant has a 2.75x limit, so there is an element of financial distress risk.

If debt has stayed flat since February, then EBITDA needs to be at least £30 million to stave off a breach of the covenant.

The company made £24 million of adjusted EBITDA in H1, so I am still heavily inclined to think that it will be able to pass its covenants (I could be wrong, so please make sure you do your own research!)

Maybe I could be tempted to buy this at lower levels? Let's keep an eye on it!

Character (LON:CCT)

- Share price: 536p (+7%)

- No. of shares: 21 million

- Market cap: £113 million

This toy designer and distributor had a huge sell-off last October when Toys 'R Us filed for bankruptcy protection in the US. It was a major customer for Character.

Its UK stores finally shut down in April 2018, leaving a lot of excess inventory that needed to be sold off.

Fortunately, that debacle is behind it now:

As anticipated at the time of our interim results in April 2018, the Group has witnessed a return to its previous growth pattern during the second half. With Character's UK domestic business delivering record sales, the trading results for the financial year ended 31 August 2018 will comfortably reach market expectations.

Brilliant!

There are a few other paragraphs if you are interested to read the update but the bottom line is that the company is now back to normal.

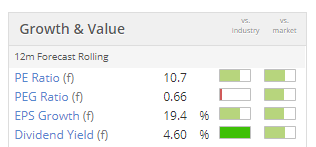

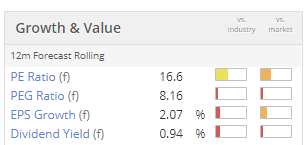

It has usually traded at a modest earnings multiple (probably because it doesn't own much of he underlying IP, it is simply designing and distributing the toys).

For it to be trading at a forward P/E of 10.7x looks higher-than-average to me, but I expect that it's a fair price to pay. The company is earning super returns on capital and nearly always has.

PV Crystalox Solar (LON:PVCS)

- Share price: 25p (+3%)

- No. of shares: 160 million

- Market cap: £40 million

This share has been a special situation for years, going through various legal disputes.

It has been in "cash conversation mode" for some time. It finally ceased production of silicon wafers this year, after that market experienced bruising levels of deflation and oversupply. Mass redundancies have been imposed.

Latest situation:

- net cash €39.6 million

- a final payment of €14.3 million due in November (from a customer who tried to back out of a contract to make purchases)

CEO comment:

Options include a return of cash to the shareholders, the acquisition of an existing business or a combination of the alternatives. The Board expects to make final decisions before the end of the year."

It has a few "small scale operations" left over in Germany, not really big enough to justify a stock market listing.

My view - this could make for an interesting speculation. The balance sheet shows net current asset value (current assets minus all liabilities) of €54 million (£48 million), mostly cash. A nice discount. I have no idea what management is going to do though!

Arrow Global (LON:ARW)

- Share price: 223p (+3%)

- No. of shares: 176 million

- Market cap: £393 million

This describes itself as an "investor and asset manager in non-performing and non-core assets". It is most well known in the UK for buying up non-performing debts from banks (e.g. credit cards) and pursuing the borrower for repayment.

I closed my long spread bet position in this soon after opening it, when I concluded that it was too complicated for me to analyse.

This RNS confirms that Arrow has completed the acquisition of "a leading originator and and manager of Italian distressed debt investments".

The due diligence required to keep track of its international acquisitions is beyond me, so I'm tempted to cease coverage of this share. I'm curious to see what happens to it, though, as 9% of shares have been sold short.

At a P/E ratio of 5x and dividend yield pushing 7%, it could be a value investment or a car crash waiting to happen.

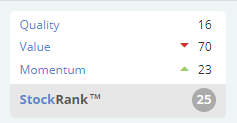

On top of the huge short position, the fact that the Stocko algorithms hate it is another red flag:

RM2 International (LON:RM2)

- Share price: 0.55p (unch.)

- No. of shares: 5 billion

- Market cap: £27.5 million

This company (in my view) should have ceased to exist already, making high-tech pallets that nobody needs.

Neil Woodford has continued to plough money in. His holding is now 64%.

H1 revenues come in at the reduced and pitiful level of $2.6 million. The operating loss is $17.1 million. The cumulative retained loss on the balance sheet is a mind-blowing $290 million.

In terms of cash, the company had an outflow of $11.3 million from operating activities during the six-month period, worse than last year. It has $13 million left.

It is hoping to raise an additional $18 million subject to the satisfaction of certain KPIs.

I can't fathom why it hasn't been put out of its misery yet. Woodford must really believe in the product!

This sums it up:

With the conversion of trials with large customers into long-term contracts taking longer than anticipated, the Company's expectation of turning EBITDA positive in 2019, as first noted on 9 March 2018, is challenging.

J D Wetherspoon (LON:JDW)

- Share price: 1264p (-1.25%)

- No. of shares: 105 million

- Market cap: £1334 million

Most of Tim Martin's opening statement concerns Brexit, where he is bullish.

The last bit is about the company's recent performance: like-for-like (LFL) sales up 5.5%. Due to rising costs, he reckons that 4% LFL growth will be required to match last year's profits. He said something very similar in last year's statement.

A bit like Warren Buffett's presentation of Berkshire Hathaway's long-term returns in every annual report, JDW shows its growth in a table going back all the way to 1984. I quite like this actually - showing a good sense of long-term stewardship.

As for the FY 2018 results:

- LFL sales up 5%

- Total sales up 2%, approaching £1.7 billion

- operating profit (before exceptionals) up 2.9% to £132 million

Exceptional items relate to pub disposals and closures, a regular occurrence.

Balance sheet - as is standard for the pub industry, net debt is significant at £726 million.

The net debt to EBITDA multiple is high but stable, and interest is covered almost five times by adjusted operating profits.

There are political overtones in the statement, not just on Brexit but also in calling for VAT equality between pubs and supermarkets and pointing out the huge tax bill paid by JDW.

We also get the following:

Wetherspoon has a significant competitive edge in governance, since all of our directors, bar one, were in situ at the time of the last financial crisis.

In contrast, most PLCs are more vulnerable, since the average tenure of CEOs and non-executives is about five years, largely as a result of governance rules. This 'institutionalising' of inexperience seems wrong.

Most corporate governance bodies disapprove of my own role as chairman, since I am not regarded as 'independent', although shareholders have not followed their advice in the past. The 'Catch-22' is that most non-executives have little option but to comply with these 'rules', since boards are criticised for non-adherence.

He makes some good points.

My view

I see this as the best pub share (you can compare it with Greene King (LON:GNK) - I think JDW comes out on top).

But this is pretty much baked into the valuation. It looks fairly priced, so I'm not motivated to add it to my portfolio. It's useful for general background info on economic and industry conditions, though - and for the forthright commentary!

SThree (LON:STHR) - Trading update

A reader requested that I comment on this one. My interest in recruitment companies has waned but I do think that this is one of the best ones, if not the best one.

The focus on STEM, the broad geographical spread and the heavy weighting toward Contract recruitment (rather than Permanent) are all big positives for me.

The balance sheet is probably fine (despite an increase in net debt) and the outlook is confident. If I had to buy a single recruitment share, it would be this one.

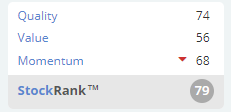

The StockRanks like it too:

Ok, that's it for now. Paul will be covering Monday. Have a great weekend!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.