Morning!

On the menu today we have:

- Mulberry (LON:MUL) - preliminary results

- Northern Bear (LON:NTBR) - trading update

- Connect (LON:CNCT) - trading update

- Charles Stanley (LON:CAY) - final results

5.30pm Edit: had to cut this short here, due to time constraints.

Last call for Mello South: I've been informed that the last 30 tickets for tomorrow's conference are being offered at £30.60, i.e. at a 66% discount to the full price.

Besides the speakers I've already mentioned who will be there, the event will have Leon Boros and David Stredder on a panel with two fund managers, each discussing the secrets of their own stock-picking success.

There will also be a Dragons Den event which will herald "the rebirth of Hofmeister Beer - follow the bear" (I am too young to appreciate what this is referring to).

The complete schedule can be viewed at this link. Ticket-holders will be able to view all the sessions that are filmed at their leisure afterwards and the tickets can be picked up, with the 66% discount, at this link.

CEO Interview - I'm about to do an interview with the CEO of PCF (LON:PCF) (in which I have a long position), so if you have any questions you'd like me to ask, there is some time to post them in the comments below.

11:30am: I've finished the interview with Scott Maybury at PCF. Very interesting and helpful - I should be able to publish a report on this in the next few days.

Mulberry (LON:MUL)

- Share price: 745p (-4%)

- No. of shares: 60 million

- Market cap: £447 million

I've been writing very positively in the last few days about the luxury brands Burberry (LON:BRBY) (which I hold) and Ted Baker (LON:TED) (which is on my watchlist).

Despite my belief in luxury goods as an investment space, I am still very sensitive to the valuation multiples attached to these shares. And I've failed to understand the valuation attached to luxury handbag designer Mulberry (LON:MUL) in recent years.

However, it might be starting to look at bit more attractive now. The shares have de-rated from the 1000p-1150p range for 2017 and hit a low at 600p earlier this year, before recovering to the current level.

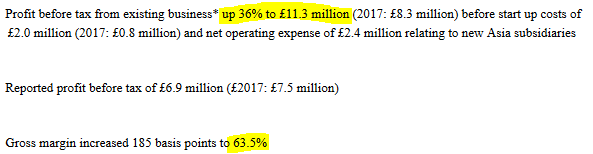

Today's results show a sharp increase in PBT, if you exclude expenses associated with expansion in Asia:

If you trust that the adjustments are reasonable, we have a historic PBT to earnings multiple of about 40x.

That's still a very rich valuation, and beyond what I'd be willing to pay, but at least the valuation is moving towards reasonable territory.

The adjusted costs are associated with opening new Mulberry entities in Mainland China, Hong Kong, Taiwan and Japan - these could have very significant growth potential.

Unfortunately, the outlook is very weak in the short-term, due to poor performance in the UK:

Retail like-for-like sales down 7% for the 10 weeks to 2 June reflecting International up 1% and UK down 9%, due to lower footfall and fewer tourists, as more widely reported

If I was to put my bullish hat on, I would point out that long-term, the UK may account for only a small percentage of Mulberry's sales. So if the UK has lower footfall and fewer tourists than expected, it's not such a huge issue in relation to the long-term value of this stock.

As the international footprint grows (and total international retail sales increased by 20% in these results), the vulnerability to UK consumer spending patterns lessens.

A 9% fall in LfL sales over the recent 10-week period is still a bit worse than might have been expected, and doesn't reflect terribly well on the brand, so on that basis I guess we could justify today's share price reaction.

Balance sheet sounds good: £25 million in cash, no debt.

Operating Margin is poor: 4% using the official numbers, or 6.5% if we add back the Asian expenses.

Operating expenses look too large: 60% of sales, or 57% if we add back the Asian expenses.

By contrast, operating expenses are 52% of sales at Burberry and 53% of sales at Ted Baker. So I'd like to know why Mulberry is suffering a 5% hit to its operating margin in expenses, compared to other high-end brands.

Anyway, this stock is out of my valuation range for now. Let's continue to monitor developments.

Northern Bear (LON:NTBR)

- Share price: 82.5p (+18%)

- No. of shares: 18.5 million

- Market cap: £15 million

There is a great comment by Luthrin (who owns NTBR shares) in the thread below (comment #22), which I would highly recommend reading.

Luthrin also made a noteworthy comment the last time I covered this stock, in February. February's trading update notified us that performance was ahead of management expectations, as does today's.

It's completely impossible for any one individual to be an expert on large numbers of shares in varying industries, which is one of the things that makes writing this report so challenging. But reader contributions make it a far more valuable project. So do check out Luthrin's comments.

Let's take a look at today's full-year update from this building services group in Northern England:

The Group's continuing operations have continued to trade strongly and ahead of management expectations over the second half of the financial year, despite the severe winter weather, particularly during the first three months of 2018.

Revenue and operating profit from continuing operations for FY 2018 will be ahead of the prior year, even after "transaction costs and amortisation of acquired intangibles associated with the H Peel acquisition".

H Peel, acquired on July 2017, will have made a contribution to operating profit. I would also be curious to see how the results would look on a like-for-like basis, excluding the contribution from H Peel.

No equity raise is foreseen, and yet shareholders can look forward to both an increased dividend and the potential for more deal activity. I agree with the company using its balance sheet in the most efficient way possible, but shareholders will need to satisfy themselves with the increased risk this entails:

Our revolving and overdraft bank facilities provide us with the resource to continue with our progressive dividend policy whilst having the financial wherewithal to look at similar acquisitions without the need to raise new equity.

Northern Bear reported PBT from continuing operations of £2.4 million in FY 2017, and £1.3 million H1 2018, including only a short period of H Peel Ownership.

Given the series of "ahead of expectations" updates, I wonder what level of PBT might be reported for the full-year. I can't see any broker forecasts (unsurprising for a company of this size), but could £3 million be possible, I wonder? I don't have any solid basis for that number, I'm simply guessing.

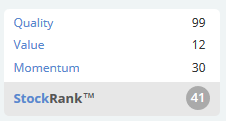

Stockopedia thinks that the forecast P/E ratio is 5.8x, and awards the stock a sparkling StockRank of 89.

So it's another micro-cap value opportunity for those willing to invest in tiddlers. It won't turn out to be the next Google or Facebook, but it is cheap. Good potential for both earnings to increase and for the valuation multiple to increase over the next two years.

Connect (LON:CNCT)

- Share price: 29.15p (-44%)

- No. of shares: 248 million

- Market cap: £72 million

A share price fall of this magnitude is often a nasty shock so commiserations to anyone holding this.

Connect is a specialist distributor, with specialties in early distribution (newspapers and magazines) and mixed freight, especially items of irregular dimensions or weight (IDW).

The wording of this update would lead you to believe that the wheels are coming off:

- "extremely disappointing" performance since May 1.

- "materially reduced" PBT forecast.

- Pass My Parcel being shut down (check out its poor reviews on trustpilot).

- CFO leaves with immediate effect (he had already resigned), CEO also set to go when a replacement is found.

Looking at Connect's various activities:

- Tuffnells (serving the irregular dimensions or weight market) full year performance to be "no better than the first half". In H1, it suffered an adjusted operating loss of £0.2 million.

I need to query some of the commentary on this. In H1, Connect said in relation to Tuffnells that:

...the underlying Irregular Dimension & Weight (IDW) market is strong and its characteristics are a good fit to the Group's capabilities.

Today, it offers the following explanation for poor performance at Tuffnells:

As reported in May 2018, the IDW market is currently volatile.

What have I missed?!

- Early distribution activities: performing worse than expected. Weaker than anticipated benefit from World Cup product. Revenue decrease of 2.9%.

Can we conclude from the above that revenues would be materially worse than 2.9% down if there had been no benefit at all from the World Cup?

My view

This is now in territory where brave (or foolhardy) value investors will be piling in.

Net income had been forecast at c. £34 million prior to today's announcement.

But the announcement doesn't quantify the new profit expectations, and I haven't done the leg work to find out what they are.

So if you are in the same position as me, you are in the dark as to official profit guidance.

I expect that the company is still profitable. We just have to hope that the wheels aren't falling off to such an extent that management lose control of the situation.

Net debt was £84 million at February 2018, with a net debt/EBITDA covenant of 1.47x.

One of the debt covenants requires this multiple to stay below 2.75x, i.e. the company would be in breach if EBITDA halved without any reduction in net debt.

It looks to me as if the shares are now pricing in an equity raise.

I am not tempted to go bottom-fishing in this situation, as it happens too often that multiple things go wrong all at the same time in a situation such as this (trading momentum stuck in a downward trend, CEO/CFO being replaced, assets being sold off and business units being wound up).

If you can take the view that trading has a good chance to stabilise and covenants are unlikely to be breached, then the risk:reward might be ok. I'll pass on this one for now.

Charles Stanley (LON:CAY)

- Share price: 345p (unch.)

- No. of shares: 50.7 million

- Market cap: £175 million

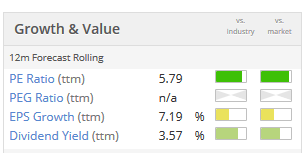

Excellent results from this investment manager.

The cash position improves to £66 million and the dividend for the year increases 33%. There's not much for a shareholder to dislike.

The video published at piworld earlier is very helpful in understanding how the CEO/CFO interpret the result. Their main financial objective (and currently their main source of frustration) is to improve the operating margin to 15%:

The focus for the 2019 financial year will be on driving top line revenue growth whilst improving operational efficiency and in turn harnessing operational gearing.

An example of where operational gearing will be important is Charles Stanley Direct. This is still loss-making on a trailing 12-month basis, but it was profitable in H2 thanks to growth in Assets under Administration.

For the overall group, what they call the "Core Business Operating Margin" improved by 160bps to 8.8%. But if you include the cost of share awards to the investment management team, the profit margin achieved was merely 7.2%.

The company is cautiously optimistic about the future:

Combined, the global and UK outlooks provide a reasonably favourable backdrop for our transformation programme and should bring growth in revenues, profits and margins if well executed, which in turn will support our progressive dividend policy and thus generate long-term shareholder value.

My view: looks good value. Management will have to go ahead now and prove they are capable of improving that profit margin. If they could do that, the shares would be really good value. I suppose I'd prefer to wait to see firmer evidence of that.

However, this is not a category of financial stock which I am interested to invest in. I prefer buying shares in fund management companies, as opposed to wealth managers.

Fund management is a much less labour-intensive activity than financial planning or discretionary stockbroking, and I think this results in better returns for investors.

Empirically, we can compare the 9% return on capital at Charles Stanley (LON:CAY) versus 22.5% at Ashmore (LON:ASHM) and 30% at Jupiter Fund Management (LON:JUP) (using Stocko data). Of course it's no coincidence that the fund managers have vastly higher operating margins, too. So I prefer to fish in the pond of fund management companies.

I was heavily distracted today, preparing for Mello and with a few other things going on. So I didn't cover as much as I wanted to, or in a very timely manner - apologies.

Tomorrow's report will be written over the course of two hours, when I arrive at Mello. Let's see how it goes!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.