Good morning!

A huge pile of news today. The impact on my own portfolio has been a small net positive: Volvere (LON:VLE) shares are up, while IG Group (LON:IGG) shares are down after the CEO stepped down.

Final list:

- Volvere (LON:VLE)

- Bonmarche Holdings (LON:BON)

- Mountfield (LON:MOGP)

- Zoo Digital (LON:ZOO)

- Fishing Republic (LON:FISH)

- IG Group (LON:IGG)

Volvere (LON:VLE)

- Share price: 960p (+8%)

- No. of shares: 3.7 million

- Market cap: £36 million

(Please note that I currently hold VLE shares.)

This is the largest position in my portfolio again.

As a refresher, this is the investment vehicle that finds companies in need of some restructuring. Typically, their bank debt has become too large. Volvere comes in and replaces the bank with a majority equity stake.

It has compounded NAV at a double digit percentage rate for many years. I'm a relative newcomer, only owning it since May 2016 (you can find my original write-up here).

Today's interim results are about as good as I could have reasonably hoped for. The company's key subsidiaries, of which there are only two, have both improved compared to last year.

- Impetus Automotive (website)

These are consultants to the automotive industry - clue in the name!

I wouldn't normally want to own shares in a company like this, as revenues are quite lumpy and contract-driven. However, I don't mind owning it within Volvere's portfolio, as Volvere was able to buy it at a very favourable price. It's also just a small part of the overall NAV.

Impetus revenues are up 21% to £14.8 million and PBT up 31% to £1.9 million (before intra-group charges), after picking up new business.

The statement is cautious about making further growth in the short-term, on the basis of uncertainty in the sector at the moment (including Brexit-related uncertainty).

That's ok - Impetus doesn't owe us anything. Performance has been superb! If it merely carries on at the current rate of profitability, it will be a fine result.

- Shire Foods (website)

Formerly the most profitable part of Volvere, this had been deteriorating for a few years. It makes frozen pies and pasties in Leamington Spa.

Revenues are up 15% to £7.25 million. The H1 loss reduces marginally to £170k.

Volvere attributes the difficulties at Shire to factory wages increasing and Sterling depreciation.

To counteract this, capex of nearly £1 million is planned to improve margins, grow capacity and develop new products.

It would be wonderful to see this return to growth. It's too soon to say whether that's possible but I do trust the Volvere directors to allocate capital in a prudent way (they own about 38% of the company, so they are certainly incentivised!)

For many companies of this size, capex of £1 million would be a matter of routine. For Volvere, on the other hand, £1 million of capex in Shire means £1 million that can't be spent investing in Impetus or acquiring some other more profitable business. I think VLE shareholders have a big advantage merely from the thoughtfulness which the directors bring to their capital allocation decisions.

Volvere's third subsidiary is too small to move the needle.

Future deals - as an opportunistic investor, Volvere stands ready to buy good businesses at the moment when they are most in need of refinancing.

In H1, the managers "did not identify any opportunities which we deemed worthy of investments", but they think there could be deal opportunities if the economy goes through a period of stress:

Volvere may perhaps, on balance, be one of the very few businesses to benefit from Brexit-led distress, provided it does not endure too long. We will of course assess any opportunities as they arise.

Did I mention the cash pile? At period-end, Volvere was sitting on a pile of cash and financial investments worth £20.4 million.

PBT for the Group as a whole in H1 was £1.3 million, or I estimate around £1.6 million if you focus only on Volvere's stake in Impetus (Volvere owns 83% of it).

With the Volvere enterprise value at c. £16 million, we are left with an implied mid-single-digit earnings multiple against Impetus earnings.

So I think that even if we assume Shire is worthless, Volvere's latest market cap is not very ambitious.

I doubt that Shire is worthless, and I also think that value is likely to be created by future deals (the directors have been creating value inside this vehicle since 2002). So I'm holding on!

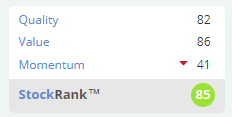

The algorithms can also see some attractive characteristics:

Bonmarche Holdings (LON:BON)

- Share price: 83.5p (-19%)

- No. of shares: 50 million

- Market cap: £42 million

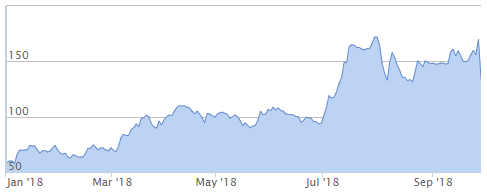

This women's fashion retailer was cheap already, before today's share price fall:

Today we have a sales warning: store sales are below expectations in Q2, after an improved Q1.

The weather is mentioned but only in passing. Bonmarche admits that the main problem is with "underlying consumer demand for the UK high street" and low footfall.

Outlook - underlying PBT for FY 2019 is now expected to be £5.5 million, versus £8 million in FY 2018.

I can see an existing FY 2019 PBT forecast for £9.2 million, so the updated forecast represents a very large percentage reduction.

Balance sheet - strong, with a forecast to have net cash of £4 million at the low point this year.

Dividend - to be maintained. It sounds as if the company will be paying out the majority of earnings this year as dividends. Quite a brave decision! I guess the balance sheet allows it to do that.

CEO comment - this leaves me scratching my head:

"Whilst it is disappointing that FY19's result is expected to be lower than originally planned, despite the challenging market, the health of the business remains strong: excluding the impact of the FX headwind, this year's underlying PBT expectation would be in line with the £8.0m achieved in FY18.

The first part of the update said that lower footfall had resulted in lower sales, and then this sentence says that profitability would have been unchanged without an FX headwind.

I think this needs a bit of clarification, to unpick how much damage can be attributed to each of these factors.

My view

In summary, the company is still profitable, is cheap on conventional metrics, but is suffering from store sales falling too quickly. The hope is that online sales continue to grow well, and at some point could be able to match the weakness in store sales.

I don't feel the need to take the risk with this share, as I already own Next (LON:NXT) and don't think there's anything better out there in terms of getting the combination of a strong online offering and a carefully managed decline in store sales, with a proactive plan to shut down stores as they become unprofitable.

I've just scrolled back to have a look at Bonmarche's most recent full-year results, and I see that the company forecast that its number of stores (325) would stay broadly flat for the foreseeable future.

Perhaps there is more detail which I've missed, but this forecast sounds complacent to me. I'd be a lot more comfortable with an active plan to reduce the portfolio as sites become increasingly unprofitable, due to the shift online. That seems like the obvious thing to do.

In summary, I won't be buying these shares as I don't need or want any more retail exposure. It could be worth a look, as a contrarian play.

Mountfield (LON:MOGP)

- Share price: 1.95p (+2.6%)

- No. of shares: 254 million

- Market cap: £5 million

This is a new one for me. We had a few reader requests so I'm happy to take a look!

It consists of three businesses that provide:

- data centre installation

- building work, employing skilled labour and subcontractors

- flooring installation

The highlights are very encouraging.

- H1 turnover up 56% to £8.9 million

- H1 PBT more than doubles to £700k

- Orders higher compared to those held at the same stage a year ago.

Drilling into the segmental analysis, the big win was in construction which went from breakeven last year to a PBT of about £450k this year, on greatly improved revenues.

The balance sheet has negative tangible net worth and a large build-up of receivables, and is partially funded by borrowings. So not too pretty.

My view - I imagine that these shares could easily re-rate higher when people have digested the earnings that are likely to be achieved in full-year 2018 and possibly in 2019. On current trends, it's probably going to look very cheap in comparison to a £5 million market cap.

While it may have individual merits, it's not for me simply because this is not a sector I want to get involved with.

Incidentally, I wonder what the long-term trend for the number of data centres is likely to be. Will they grow with demand, but then eventually shrink as less space is needed to store the same amount of data?

Zoo Digital (LON:ZOO)

- Share price: 134.5p (-21%)

- No. of shares: 74 million

- Market cap: £100 million

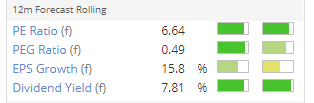

A serious percentage share price fall for an AGM statement. Long-term holders are still sitting on hefty gains:

Let's see what it says:

- H1 revenues up 17%

- full year performance in line with expectations

I'm looking for the bit that has provoked the sell-off. Maybe this is it:

Disruption has been experienced by us and other market participants in the subtitling supply chain during the transition of a major OTT operator's partner programmes, but this is easing, and we are seeing normal operations increasingly restored.

An OTT operator would be the likes of Netflix and Apple TV.

According to our report on Zoo's final results, Zoo's top two customers accounted for 59% of sales. Is the market reacting to the danger of some kind of structural shift in how one of its top clients manages its subtitling?

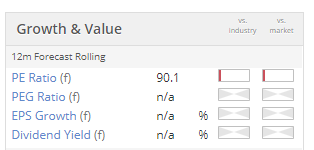

We should also bear in mind that ZOO shareholders have enjoyed massive growth in turnover over the last two years, and the P/E ratio raced up to massive levels:

H1 revenue growth of "only" 17%, even if it is technically in line with expectations, might not be what some shareholders were actually expecting. So that could be enough to explain the sell-off, given the high valuation.

I like the company, but it remains far beyond the levels where I would be willing to buy it.

Fishing Republic (LON:FISH)

- Share price: 4.65p (-17%)

- No. of shares: 52 million

- Market cap: £2.4 million

This is a rather sad market cap, given how much attention the company has received.

Lowlights:

- adjusted EBITDA loss of £1.4 million

- statutory loss of £2.5 million

- like-for-like store sales minus 22%, online sales down too

- gross margins down: too much stock and a competitive environment

Outlook - sales affected by competitive pressures, especially online. The new CEO shares the board's vision for the group to be a multi-channel retailer.

My view - the market cap seems about right to me, pricing it at a discount to book value. The business is clearly uncompetitive. Its new e-commerce website offers some hope, but it will be a big achievement if the group can make breakeven.

The stock market listing makes little sense now and I would view this as a delisting risk.

IG Group (LON:IGG)

- Share price: 648.75p (-12%)

- No. of shares: 369 million

- Market cap: £2,393 million

(Please note that I currently hold IGG shares.)

Finally, a quick note on IG. It's not particularly relevant to a small-cap report but I've mentioned the company before and had some requests on it. The CEO has stepped down.

It's an abrupt change, and a disappointing one for shareholders. What makes it worse is the lack of an explanation. All it says is that he is stepping down with immediate effect, without explaining why. So did he jump or was he pushed?

If I had to guess what had happened, I would speculate that there was some kind of boardroom disagreement, maybe a clash over strategy. There is no obvious reason for him to step down after three years in the role. As far as I could tell, he had performed fine.

It has been a difficult period as the company's business model has been threatened by ESMA regulations.

Separately to the impact of regulations, we've also had a couple of weak months of trading, both at IG and at its rival CMC Markets (LON:CMCX), which issued a warning the other day.

So in these difficult times, perhaps there was a falling-out over how to react to the company's challenges.

Today's statement says that the Board is "well advanced with its search for a new CEO", and the CFO will take the job on an interim basis.

The market is rightfully worried that the outgoing CEO might have got his forecasts wrong, that things could turn out to be much worse than he expected, and that is the real reason for his departure. That's certainly a risk.

From my perspective, I like the underlying characteristics of IG (cash generation, return on capital, etc.) to such an extent that I don't mind holding it through a period of reduced revenues.

The main thing I'm worrying about is that ESMA decides at some point that it hasn't regulated the sector enough. Could it make the regulations more onerous? Could it even go for an outright ban on leveraged trading by individuals?

I'm confident (or should I say hopeful) that the UK wouldn't stand for a ban on leveraged trading by individuals, or for more onerous regulations, especially in a post-Brexit scenario where ESMA's views should be less relevant.

So while there is a general risk hanging over the EU business, the UK business should be ok. And there are other international growth opportunities.

Putting it all together, I expect that IG will get through this. But the Board really needs to come into its own now and find a great new CEO who will be in the role for years to come.

Calling it a day there, thanks everyone for your input.

Best,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.