Good morning! Today we have announcements from:

- Trakm8 Holdings (LON:TRAK) - final results

- Plastics Capital (LON:PLA) - final results

- Zoo Digital (LON:ZOO) - final results

- Kromek (LON:KMK) - final results

- Avation (LON:AVAP) - interim statement

- Plus500 (LON:PLUS) - trading update

- Quartix Holdings (LON:QTX) - trading statement

- Filtronic (LON:FTC) - trading update

It's a lot of news - let's see how I get along covering it.

4.30pm: I made it as far as Plus500. The Quartix statement was in line with expectations while Filtronic was "broadly in line", i.e. a slight miss. So it's not worth reporting on them today.

Trakm8 Holdings (LON:TRAK)

- Share price: 94p (-10.5%)

- No. of shares: 35.9 million

- Market cap: £34 million

This company has previously proven to be controversial, due to the rather high rating it enjoyed, compared to its limited cash generation.

Most of the optimism has by now been squeezed out of the share price.

Back in late 2015, it was trading almost at 400p:

Recently, I used the Stocko comparison tool to show a side-by-side comparison of Trakm8 with Quartix, another telematics stock. Quartix has consistently been the more impressive of the two, from a quantitative point of view.

Another resource worth mentioning is today's article by "blondeamon", who owns shares in Trakm8 and is bullish on the stock.

I've read both positive and negative reactions to today's results already.

Let's have a look at what they actually say.

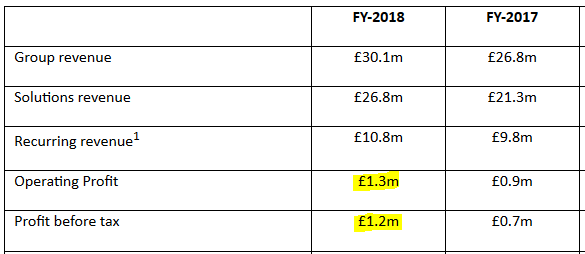

Financial highlights:

So it's a healthy upward move in many of the headline numbers.

Net debt has reduced by £0.5 million to £3.3 million, while cash generated from operations is up very significantly to £4.7 million.

Certain overhead expenses have been reduced while R&D spending is maintained and sales and marketing spend is increased. Manufacturing and distribution facilities are being expanded.

Outlook

First sentence of the outlook statement:

Due to customer inventory build-up in Q4-FY2018 and the terminated CEM activities, revenue and profit for the first half of FY-2019 is expected to be below the figure reported at H1-2018; although the full year result is anticipated to be in line with market expectations and higher than FY-2018

Customer inventory build-up: what does this mean - that customers have received more units than they need, so orders will be slower in the short-term? I'm not sure why this is better than a normal sales warning.

That, plus the planned exit from Contract Electronics Manufacturing ("CEM") leaves investors facing an H2-weighting already.

We are used to seeing forecast H2-weightings result in profit warnings, and the Trakm8 share price today appears to have priced in a profit warning for later in the year.

Balance sheet

Most of the equity on the balance sheet can be attributed to goodwill of £10.4 million and capitalised development costs of £5.3 million. So to me, the balance sheet at first glance neither looks distressed nor does it offer much in terms of anchor value.

Cash flow

The company generated £4.7 million of net cash from operations, and spent £3.7 million on investing activities, so the free cash flow generated is £1 million.

That's not a bad conversion of profits to cash flow.

But there are some weird things happening in cash.

For example, the company benefited from £1.6 million in R&D-related tax credits. Without that, free cash flow would have been negative.

There were also some large movements in the components of working capital, although they netted out at about even.

Creating and amortising intangible assets

The company amortised £1.5 million of intangible assets to calculate its net income, while capitalising £3.4 million of development costs and including £236k of purchased software as an investing activity (rather than expensing these two items items and putting them through the income statement).

It clearly believes that it is creating value with these expenditures, but the income statement would have shown an operating loss if it was not for this creation and amortisation of intangible assets.

Bulls might argue that I am ignoring the "exceptional costs" of £1.4 million. These exceptional costs freed up £2 million of overhead to be spent on other things.

Conclusion

I think your view of this company's performance depends a lot on how you view its R&D spend. If you think it's creating more value than its using up, then you can use the numbers presented by the company with confidence.

If you're not sure about how much value is being created by R&D spend (admittedly, I am in this position), then you are looking at a company which does not appear to be generating much cash, at least not without the help of tax credits.

If the intangible assets already on the balance sheet don't have a lot of value, and if the intangible assets being created don't have a lot of value, then the company as a whole has not created much value and could even be interpreted to be running at an underlying loss.

That is admittedly a harsh way of looking at it. That's just what the numbers say to me.

Plastics Capital (LON:PLA)

- Share price: 109p (-1%)

- No. of shares: 39 million

- Market cap: £43 million

Paul and I have rarely had much positive to say about this group. It's a collection of niche plastics businesses - packaging, food pouches, sacks and bags, etc.

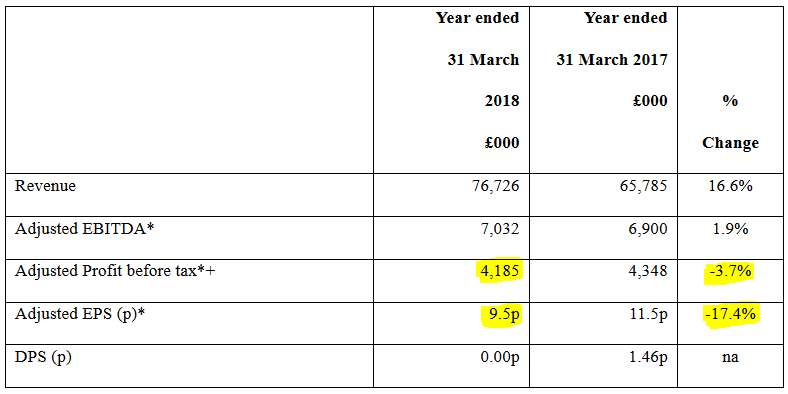

Revenues are up strongly but adjusted PBT and adjusted EPS are both down.

See how the EPS is down much worse than PBT. When I first saw this, my instinct was to check the share count for dilution. Plastics has historically carried quite a lot of debt, so I figured there might have been a placing.

My instinct were wrong. This is the company's explanation for falling EPS:

Our tax charge has increased as we now exceed 500 employees, which is the limit for attaining the maximum benefit from the government's R&D tax credit scheme. As a result, adjusted EPS decreased by 2.0p or 17.4% over the prior year.

An important similarity with Trakm8: R&D tax credits had been boosting the numbers at Plastics. As that bonus is reduced, profitability falls, too.

We need to be wary of companies benefiting in a substantial way from government subsidies or other policies - these subsidies can and do change all the time. In the case of Plastics, the policy hasn't even changed, but its own eligibility to benefit from the policy has reduced.

Another similarity with Trakm8 is the use of exceptional costs. £1.5 million is recorded in relation to the value of an acquisition, transaction costs related to an acquisition and restructuring costs.

Restructuring costs include:

"business-wide restructuring of production operations within the Industrial Divisions"

Doesn't this sound rather vague? I would welcome clarity on what this relates to. It sounds like one of those buckets that a collection of miscellaneous costs could be lumped into.

Net debt is now £15.1 million.

Balance sheet

Yet another similarity with Trakm8: most of the balance sheet equity (£31 million) can be attributed to intangible assets of £27 million. This includes goodwill of £20 million and distributor and customer relationships valued at £5 million.

My view

I don't want to delve into this in any further detail. It always seems really ugly whenever I look into it, and I wholeheartedly agree with it having a single-digit P/E ratio.

Zoo Digital (LON:ZOO)

- Share price: 94p (unch.)

- No. of shares: 73.8 million

- Market cap: £69 million

ZOO Digital Group plc, the provider of cloud-based localisation and digital distribution services for the global entertainment industry, today announces its audited financial results for the year ended 31 March 2018.

This company's share price zoomed up 10x from June last year to April this year. Well done to anybody holding it! I like to think that this company does for TV and movies (subtitling and dubbing) what Keywords Studios (LON:KWS) does for video games (localisation).

The strategy in a nutshell:

ZOO's software enables the Company to collaborate with a worldwide network of thousands of freelance workers, such as translators, voice actors and dubbing directors, and to significantly reduce the human capital requirements of service fulfilment, enabling the Company to scale its capacity efficiently as demand increases.

The numbers

The market loves a rapidly-growing top line, especially if it is organic. Zoo has delivered that with 73% growth in revenues to $28.6 million. The growth was primarily in subtitling. Dubbing services grew strongly in H2 and are set to be a bigger part of the business in future.

Gross margin has reduced by 10%, to 35%.

Margins were low in dubbing and this is explained as follows:

...our imperative to provide clients with services of the highest quality has led to higher costs from extensive verification and quality control while the software is being refined. We fully expect these margins to improve as the software is proven and new features continue to be added.

That sounds reasonable to me. There was also a decline in gross margin in some other services provided by the group. Overall, not a great picture in gross margin but the company has expressed a lot of confidence that it will improve,

Operating expenses increased by nearly $2 million, "as we continue to build up the business".

The sales team is bigger, the R&D team is bigger, IT expenditure is up, and and marketing spend is up.

After taking all of that into account, operating profit for the year increases only marginally to $600k.

Finance costs

There were also some unusual finance costs this year. The company has a convertible loan note outstanding, convertible at 48p. Given the soaring share price, the right to convert the loan note is now worth several million dollars. That gets included on the income statement.

Finance costs such as the above are rather weird and unusual so let's put it to one side and focus on the operating profit line: £600k.

Customer concentration has reduced but the top two clients still accounted for 59% of sales. I guess this is due to the nature of the media industry and the media giants who dominate it.

Balance sheet - shows negative net tangible assets. Outstanding debt is in the form of the convertible loan note, which matures in 2020. We can presume that the note will be converted by its holders (if the share price is high enough), or else that the company will use operational cash flow or a fundraising to pay it off.

My view

The organic growth in revenues is not to be sniffed at. We also need to bear in mind that significant further growth in revenues is likely, given the H2 performance of dubbing.

I suppose the big questions are

1) how big is the growth runway in subtitling and dubbing? Is it endless, for our intents and purposes? It appears to be a fantastic space to be in, from a demand point of view. And Zoo should be able to beat its very cautious consensus revenue forecasts for FY 2019.

2) will the promised growth in margins materialise? I am inclined to believe that it will, but I suppose it can't be guaranteed.

The valuation is too racy for my investment style, so personally I would only be a buyer at much lower levels. But it's good to see a growing company which appears to be creating value and innovating in an exciting sector of the global economy.

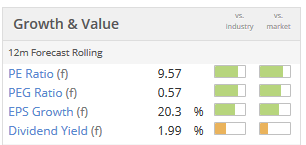

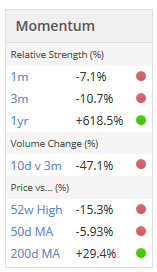

See how momentum remains very strong on a 1-year or 200-day view, bu is weak in the short-term. If I had to guess, I would see the share price waiting now for the company to grow into this valuation:

Kromek (LON:KMK)

- Share price: 24p (+1%)

- No. of shares: 260.4 million

- Market cap: £62 million

Kromek (AIM: KMK), a radiation detection technology company focusing on the medical, security screening and nuclear markets, announces its final audited results for the year ended 30 April 2018.

This is a jam-tomorrow type of share. Today it has reported its first little piece of jam: positive EBITDA.

- Revenues increased 32% to £11.8 million.

- EBITDA* was £0.5m profit (2017/2017: £1.5m loss)

The trailing price to sales valuation multiple for the stock is still in the region of 5x.

That metric doesn't look so bad if you take into account the company's net cash balance and rising sales forecast this year.

Commissioned researchers in a note this morning pointed out that the EV/Sales ratio for Kromek is cheaper than some of its peers, despite Kromek having higher forecast sales growth than the average of these companies.

A small and unprofitable business probably should be cheap, however. It's probably riskier, so it needs to be priced in such a way that if it succeeds, then investors will be richly rewarded.

With regard to the potential for future success, today's outlook statement is in line with expectations. Management are confident:

The momentum of the 2017/18 financial year has been sustained into the current financial year as Kromek's products continue to gain traction in all its business segments from the increasing adoption of CZT-based technology and other products.

(CZT is cadmium zinc telluride, the high-performance material Kromek uses.)

In FY 2018, Kromek used up £4.6 million of cash in operating activities and £5.6 million in investing activities (of which £3.5 million is capitalised development costs). The total decrease in cash, excluding an investment the company made in a money market account, was £9.1 million.

Taking into account the speed with which cash has been used up, I think we have to assume there will be another equity placing. This company had significant share issuance in FY 2016 and FY 2017. There was none in FY 2018. I would guess there will be another one before too long.

The company may perhaps have exciting technologies, and be poised for long-term success. It is just too early-stage for me.

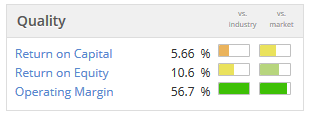

Avation (LON:AVAP)

- Share price: 230p (+2%)

- No. of shares: 62.8 million

- Market cap: £143 million

Background

We have another strong reader contribution on a stock, this time from Carcosa. Here is the link to his article, published today. It is very detailed and essential reading for anyone who is interested in this stock.

Avation is an aircraft leasing company, headquartered in Singapore.

In this case, I didn't think there is any risk in relation to the foreign headquarters. It is a real company doing real business, and Singapore is probably a great place to have the company headquarters. It just so happens to mostly have British shareholders.

Aircraft leasing is a financial activity: you deploy capital to buy planes, and then you generate yield on them by hiring them out. Your costs are mostly interest on your borrowings and the depreciation expense as the aircraft age.

Since it's a financial-type business, this share should primarily be measured against its book value.

At the half-year results, book value per share was $3.32, or 253p at today's exchange rate.

Carcosa estimates that book value per share is now 258p, excluding cash.

So the current share price likely offers a material discount to BV.

Note that balance sheet leverage was last recorded to be greater than 5x. This means that leverage is a key element determining the returns ultimately enjoyed by investors!

Interim management statement

Today's update says that things are in line with expectations. Management are growing the company's fleet with a view to diversifying its customer base. The fleet has grown by 40% and revenues by 15%.

It's an issuer of high yield (junk) bonds, recently issuing $300 million of medium-term notes.

There has been some positive movement on its credit rating, a positive omen for future borrowing costs. I suppose there must be some negative refinancing risk, too, should general borrowing conditions worsen.

My view

I retain my overall positive impression of this company.

Carcosa says today that ROE will "hopefully" remain above 10%.

For the last couple of years, it has traded between 10%-12%.

Based on continued strong execution and ROE staying within that range, I reckon that this stock should be trading around book value.

Plus500 (LON:PLUS)

- Share price: 1766p (+9%)

- No. of shares: 114 million

- Market cap: £2,011 million

4th JULY UPDATE: Plus500's PR agent, and indeed readers in the comments section, have corrected me that Plus does not make money from client losses. I am happy to accept correction on this point, and retract my statement that Plus500 directly profits from client losses.

Please see my latest commentary for updated analysis.

Plus500, a leading online service provider for trading CFDs internationally is pleased to announce that due to a strong Q2, the Board has again materially increased its expectations for the Group's financial performance for the year ending 31 December 2018.

Plus500's market cap has increased by c. £170 million today. Not bad!

Only about a week ago, it successfully transitioned away from AIM and onto the Main Market of the London Stock Exchange. That is likely to have calmed a few nerves in relation to corporate governance.

Geopolitical events have increased market volatility beyond expected levels, boosting Plus500's performance.

Trading volumes and customer acquisition, on the other hand, returned to "more normal levels".

So it's not necessarily the case that many more trades were placed with Plus500 than expected. What's more likely is that customer trades were more unprofitable than usual, because of the increased volatility. Since Plus500 is, I think, a bucket shop that takes the opposite side of customer trading, it profits directly from customer losses.

Regulatory update

Plus500 now offers some insight in relation to the upcoming ESMA restrictions on retail trading: it says 12% of EEA customers "may be eligible" for professional status, and these contribute approximately 75% of EEA revenue.

This is admittedly much better than I had expected.

I still find it hard to believe.

IG Group (LON:IGG), a rival company in which I own shares, has guided that 50% of its UK and EU revenue will be generated by professional clients.

IG tends to have sophisticated and wealthy clients who have traded for years, whereas Plus500, by my estimation, targets the most unsophisticated clients who are completely new to trading.

That is the basis on which I expected IG to generate a greater proportion of its UK and EU revenues from professional clients than Plus500.

We shall see.

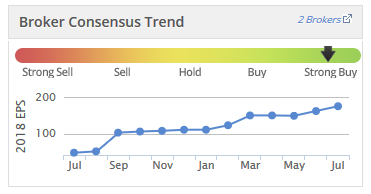

I continue to view Plus500 shares as extremely risky, and am steering far away from it. But I must admit that it does appear to have huge momentum at present. EPS estimates will be upgraded again and the StockRank is an incredible 98.

All done for today - cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.