Good morning!

Not a very busy day on the RNS feed for small-caps so I might devote some time to ASOS (LON:ASC), which is up 15% with its final results.

Other stories to mention:

- Fishing Republic (LON:FISH) - suspended, out of funds, new CEO won't be joining.

- Tristel (LON:TSTL) - final results.

Fishing Republic (LON:FISH)

- Share price: 5.25p (suspended)

- No. of shares: 52 million

- Market cap: £3 million

Statement re Appointment of CEO

I mentioned this last month at its interim results, arguing that the c. £2 million market cap was "about right", and that it was a delisting risk.

The delisting has happened faster than expected, although it's yet to be made official.

For now, the shares are merely suspended. According to an RNS yesterday:

Group sales have been significantly affected by strong competitive pressures. This difficult trading environment has continued and the Board has been informed that certain major shareholders are no longer willing to provide further short-term financial assistance to the Group.

It's the end of the road for the business in its current form (and possibly any form?)

An inconvenience for the new CEO, who was supposed to join today! His appointment has been cancelled.

There was a point in time when I thought this might have turned out ok for shareholders, but it become clear soon enough that the offering was not competitive and that its financial characteristics were too ugly (e.g. massive inventory requirements) for it to earn a good return on capital.

We still have Angling Direct (LON:ANG) as a publicly-listed contender in the fishing space, although it's very highly rated and I'm not sure how its own rating is justified. The Stocko algorithms aren't sure either, assigning it a very weak Value Rank. So I wouldn't be in a rush to buy shares in that one either!

Tristel (LON:TSTL)

- Share price: 257p (-8%)

- No. of shares: 44 million

- Market cap: £112 million

Tristel plc (AIM: TSTL), the manufacturer of infection prevention and contamination control products, announces its audited results for the year ended 30 June 2018.

Readers have brought to my attention the idea that Tristel's share-based payments might be excessive, and that management incentives might be skewed excessively toward the share price.

It's usually straightforward to investigate this, as the relevant disclosures have to be made in a company's annual report. You may have to dig into the small print of the remuneration report to get all of the details, but you can usually find them.

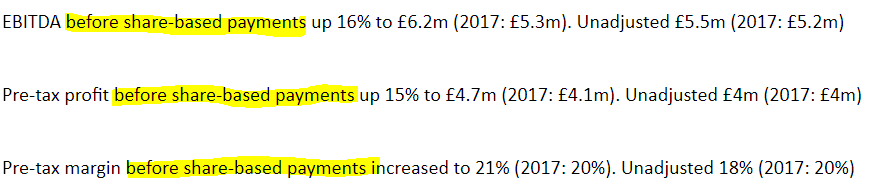

There are also red flags, such as when a company focuses on results before share-based payments (SBP):

For 2018, Tristel's SBP had a value of £665k, versus operating profit of £4 million.

So approximately 14% of the operating profit was spent on SBP.

I don't consider that to be ludicrously large as a management bonus, for a small company, but it is a bit larger than I'm comfortable with for a medium-sized company such as this.

Share Options vs Physical Shares

I've pulled out the annual report from the company's website. The total compensation package for the Board adds up to £950k in 2018, up from £885k in 2017. Again, we can compare this figure with £4 million of operating profit.

Additionally, the Directors have 2.5 million share options outstanding, up from 1.7 million a year ago. These can be exercised at very favourable share prices (all of them less than 100p), and about half of them can be exercised at 1p, i.e. almost for free.

It means dilution of c. 5-6% for existing shareholders, when all of these are exercised.

In contrast to heavy exposure via options, the two Executive Directors are recorded as owning only a little more than half a million physical shares between them.

Again, that isn't a huge problem for me. It's more like an amber flag - halfway between the ideal situation and a red flag.

Ideally, the executives would be more heavily weighted towards share ownership rather than exposure via options. But we should recognise that the heavy use of options in this way is common practice, even if it's not the ideal.

Incentive Schemes

This is a key factor for me - how are management incentivised? According to the annual report:

The existing Executive Directors' bonus scheme pays out upon the achievement of pre-tax profit in excess of the company's budget on an annual basis.

That's fine. Nothing too clever but it's ok. However the "Bonus" attached to this is very small, i.e. less than 20% of the Executive's base salaries in FY 2018.

Also:

In line with the Company's policy to grant Executive Directors share options with vesting conditions linked to the Company's performance, the Committee implemented a new scheme which is linked to share price performance. The scheme was approved by shareholders at the Company's 2017 AGM.

Annoyingly, the terms of the scheme aren't included in the annual report (link). All it says it that the terms were approved at the 2017 AGM.

When you go to the AGM page, you can find the "AGM summary of 2018 plans", which includes a summary of the share plan.

This is how it describes the conditions for award of the options:

So what are the performance conditions? It doesn't say!

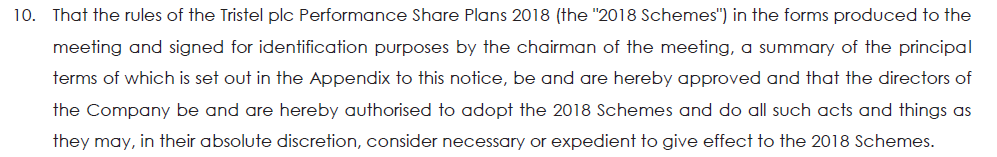

This is the resolution voted on at the AGM, to approve the share scheme:

So the rules were shown "in the forms produced to the meeting", but weren't published online? Seems a bit strange to me. Why not just show the performance conditions in the annual report like other companies do?

My investigation comes to a fruitless end, and I'm left with the conclusion that the conditions for granting the share options haven't been published online.

UPDATE: Thanks to a reader for pointing out this RNS (November 2017).

The conditions for the 2018 scheme were as follows:

The options will be exercisable at 1 penny per share and will vest in three equal tranches as follows:

· One-third will vest upon the achievement of a share price of £3.50;

· One-third will vest upon the achievement of a share price of £4.25;

· One-third will vest upon the achievement of a share price of £5.00.

To vest, the average share price of Tristel plc must be above the hurdle rate for a minimum three-month period

This is about as bad as a share option scheme gets: management are incentivised for the share price to reach a certain level and stay there for three months. How is that aligned with the long-term value of the business?

Additionally, the RNS says that the aggregate number of options outstanding after approval of the scheme is 4 million, 9.4% of the existing share capital at the time.

That scale of potential dilution is a real red flag to me.

The Business

The business itself appears to be doing well, making steady gains in the top line (sales). It sells primarily into hospitals and veterinary practices, places where there is a critical need to prevent cross-infection between people/animals/things.

It claims to have a distinct approach to what it does:

We are not only unique in providing chlorine dioxide as a high-performance disinfectant within hospitals, but we are also unique in our focus upon specific clinical departments within them. We target clinical departments that carry out diagnostic procedures with small heat-sensitive medical instruments.

...In these departments, we are the only simple to implement, affordable, high-performance disinfection method available. Consequently, in geographical markets in which we have been present for some time, we hold truly dominant market positions.

Sounds excellent! It has 250 patents in 36 countries. Strong IP is the hallmark of a quality company.

It is still working on its planned US roll-out. This seems to be taking a while:

Whilst no revenues have yet been generated from the United States, significant progress has been made to build a commercial platform from which to enter the market.

My View

Overall, I have a positive impression of the company. The remuneration issue does look like a legitimate concern, and some further clarity would be helpful, though I don't believe it makes the shares uninvestible.

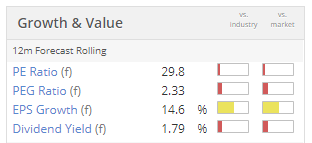

My larger concern would be the valuation, as it looks fully priced to me:

To read more about concerns relating to remuneration practices at the company, check out the comment thread below and especially post #13.

Update: Having read the November 2017 RNS, I now think that the scale of dilution from options is simply too large, and it would be enough on its own to put me off buying these shares.

But that's just me - other investors take a more relaxed view, and are happy to vote through schemes like this.

ASOS (LON:ASC)

- Share price: £57.17 (+14%)

- No, of shares: 84 million

- Market cap: £4,779 million

Let's have a quick look at these results:

- Sales up 24% at constant FX

- Gross margin up 130bps

- PBT up 28%

- basket value up 1%, order frequency +7%

FY 2019 guidance is unchanged.

Very impressive stuff, and the CEO underlines the achievement:

Our reported profit increase was achieved despite bearing material transition costs due to our investment programme.

The gains, both in the UK and elsewhere, are coming directly at the expense of traditional High Street outlets whose business models look hopelessly out of date in comparison.

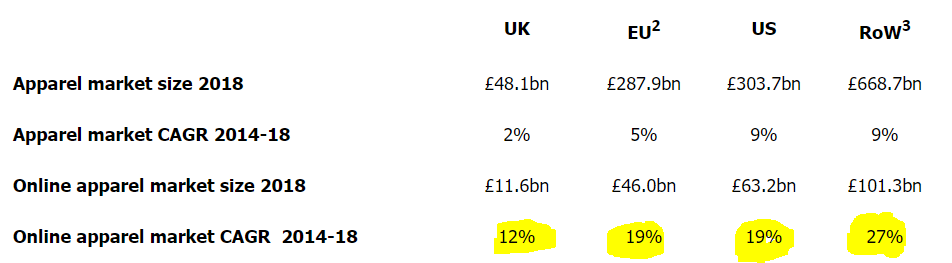

See the growth in the online apparel market from 2014-2018:

Not only is the online market growing rapidly, we have a business in ASOS which seems to be growing its market share within this market (on a global basis). That makes for an awesome combination.

Outlook - sounds great.

We remain in a period of high investment, confidently pursuing the considerable opportunity we see ahead of us. We also remain equally focussed on our core financial disciplines, reflected in our unchanged sales and EBIT margin guidance both for the current year and into the medium-term, after incorporating significant ongoing warehouse transition costs and the phased transition to US import duty.

My view - as someone who tried shorting ASOS shares a few years ago, I now have a much stronger appreciation for its achievements.

Indeed, I now think it's more interesting as a potential long idea. The valuation always looked out of whack to me, but with FY 2019 EPS forecast at 117.6p, it's currently trading at a forward P/E ratio of perhaps 49x, or a forward earnings yield of c. 2%.

Ok, it's going to take quite a long time to get your money back in dividends at this price. But still, it's good value compared to where ASOS has traded at before.

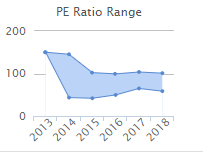

These historic P/E ratio charts from Stockopedia are very useful:

Since 2014, it has traded at a ratio of between 42x and 145x. I believe that recent prices (especially last week) compare favourably to this range.

The operating margin is admittedly weak, and is forecast to stay low at c. 4% through FY 2019.

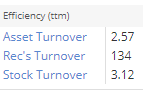

However, the company overcomes this issue by making very efficient use of its balance sheet. We can confirm this by using the "Efficiency" section of the StockReport (in the right-hand column, under "Other Ratios"):

Asset turnover of 2.6x means that ASOS is generating lots of sales relative to its asset base, and that translates to a good return on capital (ROC is 22%, according to Stocko).

So while the valuation is still a bit too rich for me, I would much rather be long than short of the stock!

That will do it for now. Cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.