Good morning, it's Paul here.

It was a huge pleasure to meet & chat to the many Stockopedia subscribers who attended Mello London. The whole event was a terrific success. Mello has become a community of friends, and I really enjoy the gathering of the clan at each event. Congratulations to David Stredder, Georgina, and the rest of the team, for organising another excellent event.

I lost count of the number of people who thanked me & Graham in person for our work in producing these reports. It's very rewarding to receive such positive feedback, so thank you to everyone who took the trouble to speak to me. So much positive energy, I feel like a fully charged battery now!

Right, on to today's news.

OnTheBeach (LON:OTB)

Share price: 416p (up 3.5% today, at 08:06)

No. shares: 131.0m

Market cap: £545m

This is an online travel agent. It's reporting today on the year ended 30 Sept 2018.

So far, so good - the market has reacted positively this morning in early trades, share price up about 4%.

Revenues - up 24.5% to £104.1m. As disclosed in a footnote, the bulk of this increase is due to a recent acquisition (called "Classic"). The more meaningful number is that core business revenues were up 9% to £89.3m.

Marketing costs - many online businesses have marketing costs as their largest variable cost. This is a very attractive feature, since marketing spend can be dialed up or down, to suit market conditions. In a recession, it would be a major advantage over bricks & mortar competitors, which are stuck with largely fixed costs. Marketing spend here is huge, at 41.8% of revenues (down from 45.2% last year).

International - the growth in Scandinavia has stalled. Doesn't seem to be working yet, with a £2.2m EBITDA loss. Warm summer & discounting by competitors are given as reasons. To reiterate the point above about marketing spend, this was slashed to a background level.

Adjusted profit before tax - the key number for me, is £33.6m, up an impressive 17.9%. Let me check that the adjustments are sensible. Footnote 3 explains the adjustments as follows;

(3) Group adjusted profit before tax is profit before tax,

amortisation of acquired intangibles of £4.6m (FY17: £4.3m),

share based payments £1.4m (FY17: £0.5m),

exceptional costs of £0.6m (FY17: £2.7m) and

one-off property and litigation costs of £0.9m (FY17: nil)

The only big one there is reversing the amortisation of goodwill & similar, which is fine by me. I always reverse out that item anyway, as it shouldn't have any bearing on how we value any company.

The other adjustments are small in the context of £33.6m profit, so I can live with these adjustments. Share based payments is the one I grumble about usually. However, a friend pointed out that if we use fully diluted, adjusted EPS, then the potential dilution from options is already factored in.

Adjusted EPS - up an impressive 20.5% to 21.2p - giving a PER of 19.6

Dividends - for the full year total 3.3p - this is increased by 18% Y-on-Y, but seems a very low payout, yielding only 0.8%. I'm wondering why the company isn't more generous, and this steers me towards looking more closely at how cash generative (or not) it is.

Balance sheet - the key metrics for me, as usual, are these;

NAV: £117.9m, less intangibles of £88.1m, gives;

NTAV: £29.8m. That looks adequate, but not especially strong. Being an online business, it's a capex-light business model, so doesn't need a lot of net assets.

Working capital: current assets of £158.1m includes £85.7m of cash. Current liabilities total £126.4m, note this is all trade creditors - there's no bank debt. Travel companies usually receive cash up-front from customers, before having to pay suppliers, and OTB's balance sheet looks consistent with that.

I imagine that the 30 Sep 2018 year end is probably when the cash pile would be a seasonal high - companies usually choose the year end date that shows the most flattering cash position. So it's safe to work on the assumption that the cash pile could be much lower at other points in the year. This is why I see enterprise value as being quite a flawed concept. It should be based on average cash throughout the year (which of course we're not told), rather than the year end snapshot cash balance.

Cashflow statement - looks fine to me, the company seems genuinely cash generative, and has considerable scope to increase future dividends.

Note that £3.8m of development costs were capitalised. There's nothing wrong about that, but I always flag it because it renders EBITDA meaningless.

Outlook - this sounds encouraging. In the context of profit warnings from heavily indebted Thomas Cook (LON:TCG) , it's clear that OTB must be taking market share from more traditional operators.

The first quarter of our financial year (calendar Q4) is historically the quietest trading period for the Group. We are pleased to report a strong early trading performance, supported by a slightly earlier release of summer capacity by major low cost carriers, lower YOY seat prices for winter departures and a continued efficiency in marketing spend.

This current performance is in line with our expectations and the Board believes the business is well positioned for the key trading period that commences in late December and continues into Q1 2019.

Whilst the consumer environment continues to be challenging, we remain confident in the resilience and flexibility of our business model. The Board will also continue to evaluate acquisition opportunities that will both increase scale and deliver value for shareholders.

That's resolved my query about why the dividend yield is so low - the company looks to be hoarding cash for acquisitions.

My opinion - is positive. These seem to be good results & outlook, in a tough market.

The valuation strikes me as reasonable, and this is going onto my watchlist as a potential future purchase.

My only reservation is that a couple of friends bought holidays through OTB, but were not impressed. That could mean the company needs to constantly spend heavily on marketing, to attract new customers, but may not be getting repeat business as much, possibly? Therefore a key statistic I would like find out, is what level of repeat business is being achieved from active customers?

The company says repeat business is up 14%, but not what the actual level is. It also says this;

We have increased our investment to multi-skill our customer-facing staff to ensure that we can provide an even higher level of customer support for all of our valued customers and support the sale of package holidays post the implementation of the new PTRs on 1 July 2018. We are delighted to have maintained our excellent Net Promoter Scores and our repeat purchase rates have increased significantly through FY18.

I'd still like more information on this vitally important KPI of repeat customer orders.

EDIT - Many thanks to "Reacher", who added a comment below, giving a link to the company's results presentation slides (which I was not aware had been published, are here). This provides a lot of very useful additional detail.

Incidentally, I've just emailed Rob at Research Tree, to ask if they could include links to company presentations as part of their service, which would make them visible to more investors.

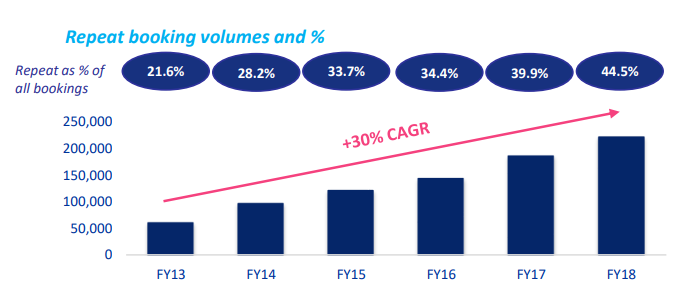

In particular, a graph shows that repeat business for OTB is building nicely, and is at a decent level;

That answers my question on repeat bookings. I don't know what the industry average is, for repeat bookings, but 44.5% seems a decent level. The trend is also positive.

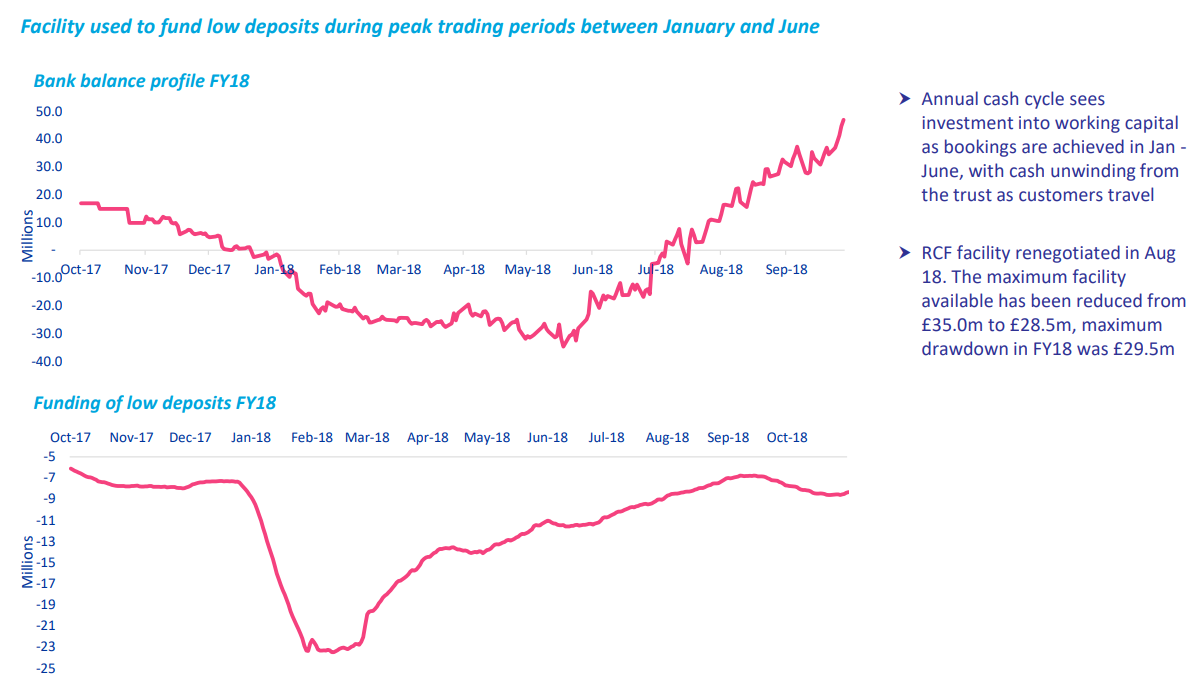

Slide 9 of the presentation discloses that;

All customer monies are paid into a trust account which isThis confirms my hunch that the year end cash figure is favourable (at a seasonal high). At other times of the year, there could be net debt (otherwise why have a RCF).

effectively a debtor to the business

Seasonal cash flow requirements are covered by a revolving

credit facility which is drawn down as required. This is not

utilised at year end

Year end cash of £85.7m is split down into its constituent parts;

Company cash: £47.3m

Trust a/c (customer cash): £38.4m

Cash profile - hoorah, another of my queries has been resolved. Slide 26 shows the average cash/debt position throughout the year, which confirms my hunch about Sept being a seasonal peak for cash. Well done to the company for being so transparent with this helpful info.;

End of edit

As an aside, one of the reasons I like Sosandar (LON:SOS) so much, is that it has cost-effective marketing to attract new customers, who then become very sticky customers - repeat orders were 43% of total orders in SOS's recent interims - which is astonishing, given how fast they are growing. It's creating a snowballing effect in revenue growth. Combine that snowballing effect with high gross margins, and the operational gearing at SOS could be astounding, in time. That's why the valuation is high.

I'm not sure whether OTB is achieving enough customer loyalty & repeat business? Although looking at reviews on feefo, they seem generally good. The danger with any holiday booking service, is that customers will leave bad reviews if something goes wrong on their holiday which is not necessarily the fault of the booking service.

The more I look at OTB, the more I like it. It seems a good GARP share, and falls into the sweet spot of what I'm looking for at the moment:

Victoria (LON:VCP)

Share price: 480p

No. shares: 125.4m

Market cap: £601.9m

Graham wrote a section yesterday here, on interim results from this floor coverings buy & build group. I met the Executive Chairman a few weeks ago, when the aborted bond issue caused a lot of confusion in the market.

As a follow-up to that report, I note today that there has been meaningful-sized Director buying, as follows;

Alexander Anton (NED): bought £243k

Andrew Harrison (NED): bought £50k

Geoff Wilding (Exec.Chmn): bought £5m (at 491p)

I tend to sit up and take notice, when Directors buy a serious size share purchase in the open market. A purchase of £5m from the Chairman does reassure me that things could be getting back on track.

Although this also needs to be seen in the context of the Chairman having banked £41.35m just 3 months ago, selling at a much higher price (827p).

Ten Lifestyle (LON:TENG)

Share price: 36p (down 42% today, at 13:04)

No. shares: 80.7m

Market cap: £29.1m

Preliminary results & trading update (profit warning)

Ten Lifestyle Group plc (AIM: TENG), a leading technology-enabled lifestyle and travel platform for the world's wealthy and mass affluent, announces its Preliminary Results for the year ended 31 August 2018 (the "Year") and provides a Trading Update for FY 2019.

It seems to be some kind of online concierge service, with some impressive sounding clients -e.g. HSBC & other banks. This share listed on AIM in Nov 2017.

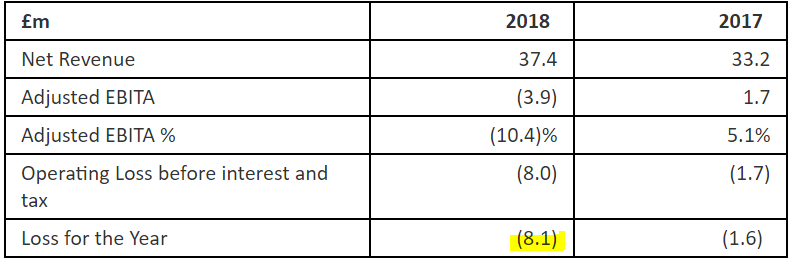

The problem is, it's not growing revenue very quickly, and is generating heavy losses;

The last trading update here on 11 Sep 2018 sounded quite upbeat.

The tone is less optimistic today;

Net Revenue for the financial year ending 31 August 2019 is expected to show continued growth, materially above the 13% growth in Net Revenue that the Group achieved in the year ending 31 August 2018, but materially below previous expectations.

Cash position - still healthy, with £20.7m net cash at 31 Aug 2018.

Looking at the cashflow statement, it burned through £8.5m cash in the year. It raised a net (after repayment of existing shareholder loans, etc) £21.3m in the IPO.

Therefore, despite under-performance, the business looks fully funded for another 2 years. At least that gives management time to attempt to turn around performance.

My opinion - it's not a startup, but has been around for 20 years, so there must be some substance to the business.

Looking at its website, membership "starts from £130 per month", and gives unlimited use of a concierge service to book restaurants, events tickets, and travel. It claims to offer special perks for members.

There are some interesting reviews from employees here at glassdoor - a good website to see what employees past and present, think (anonymously) about the company. Obviously, as with all review sites, these should be treated with a healthy dose of scepticism. It sounds as if there are cultural & management problems at this company.

Overall, this share doesn't interest me at all. Consistently loss-making businesses, that are hoping to increase sales considerably, in order to reach breakeven, are generally best avoided. The only exceptions I'll make, is where growth is stellar, and operational gearing is high.

The growth at TENG has slowed down, so for me that eliminates any reason to buy the share. Therefore, it gets a firm thumbs down for me.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.