Good morning!

A mixed bag of companies reporting today. This list is final:

- Greggs (LON:GRG)

- Duke Royalty (LON:DUKE)

- Manolete Partners (LON:MANO)

- dotDigital (LON:DOTD)

- 888 (LON:888)

- Blancco Technology (LON:BLTG)

Greggs (LON:GRG)

- Share price: £17.16 (+7%)

- No. of shares: 101 million

- Market cap: £1,734 million

Amazing share price returns at Greggs and the chart has now broken out to new all-time highs.

It reports an exceptionally strong start to 2019:

- like-for-like sales up almost 10% for the seven weeks to mid-February, total sales up 14%.

- vegan sausage roll has proven to be a hit and boosted publicity.

- versus weaker growth in H1 last year (caused by poor weather), H1 this year will be much better.

- full-year result is likely to be ahead of expectations.

My view - this company proves that it is possible to do well on the High Street. You have to get your brand/market positioning just right.

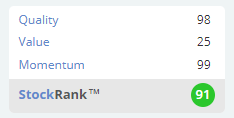

The StockRanks like it, but I'd note that the Value Rank is prety low. The P/E ratio is pushing 22x:

That same sort of earnings multiple will get you a stake in Mcdonald's ($MCD). For the same price, surely the golden arches would be a safer bet long-term?

Duke Royalty (LON:DUKE)

- Share price: 41.5p (+1%)

- No. of shares: 200 million

- Market cap: £83 million

(Please note that at the time of publication, I have a long position in DUKE.)

Apologies to those of you who were looking forward to my interview with the company - it was delayed, but was rescheduled for next week. There'll be lots to talk about now!

Duke announces a new £10 million deal with "the largest privately-owned recreational vehicle parts wholesale company in the UK".

Its website meta-description describes it as "wholesale distributors to the caravan, motorhome, boat and leisure industry." There are over 7,000 products in its online catalogue, with today's announcement saying that it provides over 15,000 parts and has "very low customer concentration risk". It generated sales of £23 million in 2018.

Key points:

- The initial yield is 13%, roughly what we would expect from a Duke deal.

- 30 year deal

- twelfth core holding for Duke (but note that some are much smaller than others, so the diversification is weaker than an equal-weighted portfolio)

- Duke is taking 12% of the diluted equity in the company

- The existing owners will "partially realise their investment".

- New financial incentives planned - equity will be used to hire "a new generation of management to take the business forward".

My view

This is not exactly the type of deal that I thought I was getting into when I invested in Duke. I did not envisage that Duke would buy equity in businesses and help business owners to sell down their stakes. This seems to me a rather fundamental point.

Having said that, we had a clue that Duke might go down this road from its recent acquisition - the investment vehicle that it acquired had purchased minority equity stakes and warrants at its investees.

So I will ask the company how much of the £10 million deal relates to Miriad's equity.

The rest of the deal will be used "to underpin the exciting growth plans that the team has identified". Providing growth capital is certainly in line with the mandate.

Portfolio

For the first time, Duke provides a complete list of its investees, including those from Capital Step (its recent acquisition).

The Capital Step investees and investment amounts are:

- Berkley Recruitment, €1.3 million

- Welltel (Ireland), €5.3 million

- Xtremepush, £2 million

- Pearl & Dean Cinemas, £2.5 million

- BHPC (Insurance brokerage), €4.6 million

- Brightwater Selection (Ireland), €1.875 million

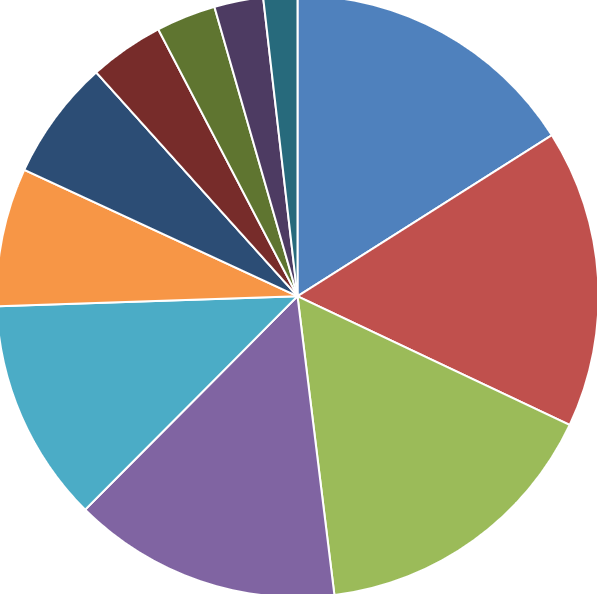

The diversification has certainly improved a lot. Here's a visual representation of the entire portfolio (my own handiwork):

Most of the Capital Step investees are the small slices in the top-left. Duke still has £8 million left to make some more investments.

Summary

I remain in "wait-and-see" mode with Duke. So far, I have the sense that the company is moving up the risk spectrum: it has bought a collection of minority equity positions and acquired a debt facility to fund its own debt investments.

Indeed, I may end up having to sell my Duke shares, if it turns out that it has moved too far up the spectrum for my own risk tolerance.

A parallel concern is that the company plans to pay out such high dividends: something like a 70% payout ratio is planned. Why not pay a much smaller dividend, keeping the funds it saves to grow the portfolio faster and to copper-fasten its own balance sheet?

So I'm very cautious but what's keeping me involved is the fairly obvious upside potential if nothing goes wrong for at least a few years. Brokers are forecasting that £11.2 million of royalties and interest will be received by Duke in the year ending March 2020, resulting in £9 million of (after-tax) net cash from operating activities, or £8 million after it pays its own interest bill.

In other words, there is something approaching a 10% cash flow yield (depends on precisely how you want to measure it) at the current market cap. For now, my greed is slightly outweighing my fear.

Manolete Partners (LON:MANO)

- Share price: 289.5p (+6%)

- No. of shares: 43.6 million

- Market cap: £126 million

I covered this share before on 14 Dec and 19 Dec.

It's a mini-Burford Capital (LON:BUR), which specialises in insolvency cases.

Results for FY 2019 (ending in March) are likely to be ahead of current market expectations.

Among other positive developments, there has been an increase in the "fair value" of investments - but determining the fair value of a legal case is not terribly easy, and probably impossible for company outsiders and those who aren't legal experts.

That disclaimer out of the way, I now accept that litigation financing is an extremely lucrative activity - that's what the track record of Burford Capital (LON:BUR) (and more recently Manolete Partners (LON:MANO) ) suggests.

NAV was about £24 million after IPO, so the Price/Book multiple is something like 5x. This is in the same ballpark as Burford Capital (LON:BUR), perhaps slightly more expensive. So, a P/B of 5x looks to be the going rate for businesses in this space at the moment.

Would anybody like to start a litigation financing company with me?

dotDigital (LON:DOTD)

- Share price: 90.5p (+5%)

- No. of shares: 298 million

- Market cap: £270 million

dotdigital Group plc (AIM: DOTD), the leading 'SaaS' provider of an omnichannel marketing automation and customer engagement platform, announces its results for the six months ended 31 December 2018.

We have generally provided this company with positive coverage. It's provides deluxe marketing facililies ("like Mailchimp on steroids") for which customers pay an average of £876/month.

Organic revenue growth is moderate at 15% and I would assume is largely driven by the 16% increase in average revenue per customer. Total revenue is up 33%.

I won't go into the strategic highlights except to say that the company says it is making "strong delivery" against the three pillars of product innovation, partnership development and geographic expansion.

Things I like:

- net cash of £16.7 million, zero debt.

- confident of meeting expectations for the full year.

- operating margin is 20%.

Overall, a nice and successful business which is not too complicated - most people can understand what online marketing is all about. Dotdigital's product doesn't have the mass appeal of other products, but it does seem to have carved out a good reputation among heavy-duty users.

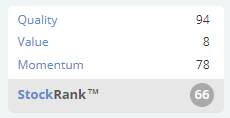

It's priced as a High Flyer, i.e. there's not much value on offer based on current metrics;

888 (LON:888)

- Share price: 172.5p (+0.3%)

- No. of shares: 364 million

- Market cap: £628 million

(Please note that at the time of publication, I have a long position in 888.)

A small-ish deal but it popped up on my alerts. 888 is spending £18 million to buy some assets from JPJ (LON:JPJ) (through subsidiaries). It is buying several online bingo brands, including Costa Bingo.

The deal gives 888 full control over more of the brands being operated on its Dragonfish platform.

Rationale sounds good, converting the brands from B2B to B2C:

Having been developed on Dragonfish, the Group's first-class B2B platform, we are confident that consolidating these brands into our existing B2C portfolio will deliver synergies and growth opportunities by applying the full extent of 888's core capabilities in product, marketing and customer relationship management to their operations."

My view

888 is a holding where my confidence has grown and I am thinking about topping up as I learn more about it.

One big difference between this Israeli PLC and Plus500 (LON:PLUS) is that I have personally used 888's poker platform, and I like it. And I know that it is highly respected in the poker community at large. Whereas, in the case of Plus500 (LON:PLUS), I don't know anyone who would recommend it.

Blancco Technology (LON:BLTG)

- Share price: 101.5p (+16%)

- No. of shares: 65 million

- Market cap: £66 million

A nice day for holders of Blancco, a company which I am heavily biased against due to the manner in which it came to be listed.

Blancco provides data erasure solutions, i.e. wiping a phone or laptop clean and verifying that it has done it.

It is listed thanks to its acquisition by the greedy former directors of Regenersis, and it would come as a huge shock to me if those directors had accidentally bought a high-quality business during their self-enrichment spree.

Today's H1 results show revenues increasing by 20% to £14.6 million, although this converts to net income of just £600k.

The company maintains the Regenersis tradition of focusing heavily on adjusted numbers, even giving us "adjusted operating cash flow".

The cash flow statement is not all that bad: I would argue there is about £1.4 million in real cash generation. My calculation would be:

- £2.1 million net cash from operating activities

- add back the £1.1 million strain from a negative working capital movement (although this might be generous, since the company had a major accounting problem in 2017 with overdue receivables and aggressive revenue recognition)

- subtract £0.4 million of share-based payments since they are a real cost to shareholders

- subtract £1.4 million of investing cash flow (excluding the acquisition of a subsidiary)

It still doesn't quite justify a £66 million market cap, but company is now very bullish on its growth prospects. It expresses confidence that it can meet full year expectations.

The balance sheet has tangible value of minus £8 million.

This gets the bargepole treatment from me, I'm afraid.

I'm out of time for today - thanks for dropping by!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.