Good morning, it's Paul here.

I got up early to finish yesterday's report, so a new section on Instem (LON:INS) is now up. Unfortunately, the section on Low & Bonar (LON:LWB) vanished when technical gremlins struck, so I'll reconstitute that once we've got some of today's news up in this report. Although to be honest, I don't think you're missing out much if you ignore LWB.

Please see the header for announcements which I'll cover today. Plus anything else that crops up which looks interesting.

Intercede (LON:IGP)

Share price: 23.0p (up 39% today, at 08:09)

No. shares: 50.5m

Market cap: £11.6m

(at the time of writing, I hold a long position in this share)

Today's update covers the year to 31 March 2019.

Intercede is a cybersecurity company specialising in digital identities, derived credentials and access control, enabling digital trust in a mobile world.

I was fearing a profit warning here, because the share price has been drifting down (albeit on negligible volume). However, I'm delighted to read this morning's trading update, where the company has achieved a big last-minute success, namely a major contract win on the last working day of the financial year - talk about cutting it fine!

... pleased to announce that a large US Federal Government order totaling $4.3m was received on 29 March 2019.

The order includes software licenses and annual support & maintenance; $2.05m (£1.57m) of which will be recognised in the financial year ended 31 March 2019.

As a result, revenues are now ahead of expectations;

Subject to the completion of the year end audit, revenues for the year ended 31 March 2019 are expected to be in excess of £10.0m, which is ahead of market expectations and approximately 10% higher than the previous financial year.

This reflects the impact of follow on orders from existing customers plus new contract wins via partners in the US, Europe and SE Asia.

The establishment and further development of these and other partner relationships is critical for the Group's future growth prospects.

Note that in H1 the company reported revenues of £4.17m. Therefore H2 must be over £5.83m - a 40% growth rate from H1 to H2 sequentially. Impressive stuff.

Profitability - a major turnaround (for a small company) has been achieved here. This is very significant, in my opinion;

The combined effect of increased revenues and action taken to reduce the cost base, is expected to result in a return to profitability at both operating profit level (2018: £4.5m operating loss) and after interest and tax (2018: £3.8m loss for the year).

Note that in H1, the company reported a £589k operating loss. Therefore H2 must have been a positive figure of above £589k profit. Very encouraging indeed. Does it matter that the figures were saved by a last-minute contract win? Not really, a contract's a contract. However, it does reinforce how lumpy business can be for a small company like this, dealing with big organisations, for big contracts.

I think today's major contract win demonstrates how remarkable Interecede's client base is - some of the world's largest companies, and Governments, use its software. That's astonishing, for an AIM company worth just over £10m! It says to me that there could be very substantial latent value in this company - that's the reason I own shares in it personally. High risk, but potentially very high reward. The poor track record under previous management is another reason why the market cap is so low.

Net cash - note that gross cash has risen, so the company looks fine (no need for a fundraising);

As at 31 March 2019, gross cash balances totalled £3.2m (2018: £2.3m).

Important note - the company has outstanding convertible loan notes. I gave the details on that here, in Dec 2017. In a nutshell, the debt will need to be repaid by Dec 2021. If the share price gets above 68.8125p, then holders would be more likely to convert the loans into shares (as opposed to requiring repayment in cash). It's conceivable that loan note holders might convert into equity, even if the share price were to be somewhat lower than 68.8125p, because it wouldn't be possible to buy in size in the open market for the shares. They hardly trade at all.

With the share price currently around 20p, conversion isn't an issue.

The Dec 2021 repayment date for the loan notes is sufficiently far out in the future, that it doesn't concern me at this stage. It would be more of a concern once we get to early 2021, if the company has not grown profits further from the current level.

My opinion - this company is really making good progress under new management. The market cap is peanuts, for a company with software that is being sold in multi-million deals to huge international groups & Governments.

It doesn't need to raise cash for now. It's moved into profits. Sequential growth is strong, and existing customers are placing follow-on orders. All of which suggests to me that the product must be world-class. Yet the market cap is tiny.

It's risky, because orders are so lumpy. Without the major order signed last week, we would have been looking at a profit warning today. So I'd like to buy the sales team a beer or two, for pulling off a major result, on the last day!

Bottom line, I'm a very happy holder here. If more big orders flow, then I could foresee this being a multibagger from this level. That's the uncertainty though, we have no way of knowing how future orders will pan out, good or bad. It's just educated guesswork from a shareholder perspective, as is usually the case with most investments - we're trying to predict the future, which nobody can do with certainty, for any share.

Intercede shares are extremely illiquid. On a day like today, stale bulls might use the buying interest to offload, perhaps? With the bull case starting to come good, I'll be sitting tight on mine.

EDIT - note that there's a single page broker update from FinnCap out this morning, available on Research Tree.

Broker update - there are some important points in today's broker update;

- Gross cash of £3.2m as at 31 Mar 2019 excludes any monies from the recent big $4.3m contract win. Therefore, the cash pile should increase further.

- All development spending is expensed through the P&L, so EBITDA is a meaningful number, unlike many software companies. I've double-checked, and there are no intangible assets on the balance sheet - confirming the very conservative accounting.

- Note that Intercede benefits from substantial UK R&D tax credits.

- Substantial upgrade in Mar 2019 estimates: EBITDA Old: negative £1.8m, New: positive £0.4m.

Taking into account all those points, it seems to me that today's 7p rise in share price doesn't come anywhere near to reflecting how positive today's news actually is.

BonMarche

Thanks to Gus, who has flagged in the comments section below, a mandatory takeover bid for this struggling womenswear chain.

Spectre Holdings (a Dubai company, owned by Philip Day, retail billionaire) has increased its holding to 52.4%, at 11.445p per share, triggering a mandatory bid at the same price.

I've not yet seen any response from the Board of BON, so it's not clear whether this is an agreed bid, or not. Frankly, they've run the company into the ground, so existing management now has zero credibility.

My opinion - it's staggering how quickly BON unravelled in the last 6 months. Prior to that, it looked well-funded, and likely to survive if not prosper. However, a bit like QUIZ (LON:QUIZ) , it seems to have run into absolutely dire trading conditions more recently. I think both chains are weak brands, and have just got the product wrong.

Sadly, we need to see a thinning out of the High Street, to allow the stronger competition to gain market share from weaker also-rans.

Graham and I have been increasingly strongly warning readers away from this share here, for a while now. Therefore I hope none of our readers got caught out on this one.

Anyway, it's game over, and I would say shareholders should count themselves lucky to be getting anything. Therefore the only logical course of action is to accept the takeover offer. Given that the bidder already owns over 50% of the company, then the chances of a higher competing offer coming along look very slim.

Hostelworld (LON:HSW)

Share price: 193p (up 5% today, at 10:56)

No. shares: 95.6m

Market cap: £184.5m

Hostelworld, the global hostel-focussed online booking platform, is pleased to announce its preliminary results for the year ended 31 December 2018.

I've had a quick skim of the results, but can't see anything much of interest here.

Internet businesses are only of interest to me, if they are generating big organic growth. The problem with HSW is that it's gone ex-growth. Its non-core businesses seem to be a dead loss, with bookings down 47% to only 0.28m in the year. The core business only managed a 4% increase in bookings, to 7.7m. The average booking is for E11.89 (up 6% in constant currency).

As HSW mentions in today's commentary, it operates in a competitive space.

On the upside, it's still a highly profitable, and cash generative business.

Cashflow statement - looks good. It generates tons of cash, and pays out most of it in divis.

Balance sheet - looks strong, no issues here.

Valuation - as the company has gone ex-growth, then it's no longer valued like an internet company, but more as a value share;

The trouble is that earnings are now declining, as are dividends.

Outlook - sounds OK;

Hostelworld is operating in a highly competitive market, which is growing. We have a very relevant brand which is trusted by a loyal and engaged customer base.

Trading in the first quarter of 2019 is in line with the Board's expectations. We remain committed to delivering value to shareholders and continue to assess our capital allocation approach in line with investment choices and priorities.

My opinion - the newish CEO (from July 2018) has done a review, and is trying various things to stimulate growth. If he succeeds, then this share could be re-rated back up to a growth stock, which would be lovely for shareholders.

On the downside, how likely is such a meaningful resumption of growth, given that there are many, some larger, competitors? The risk is that HSW could end up an also-ran, crushed by giant competitors.

On balance, I think the current share price looks about right. I don't know whether the growth strategy will work or not, hence it's not something I would invest in. If however signs of stronger growth began to percolate through in future trading updates, then I'd sit up and pay attention.

Wincanton (LON:WIN)

Share price: 230p (unchanged today)

No. shares: 123.9m

Market cap: £285.0m

Wincanton, the largest British third party logistics company, today issues the following trading update ahead of announcing its preliminary results for the year ended 31 March 2019.

- Positive H2 performance

- Substantial contract wins - but too late in the year to mitigate lost contracts

- Loss of low margin contracts

Outlook - sounds OK;

The Group's performance was further supported by a strong level of contract renewals in the second half with customers such as Asda, Valero and Marley, which together with the new business wins, positions Wincanton well to deliver revenue growth in the year ahead.

Net debt;

The Group's closing net debt is expected to be approximately £20m.

That sounds harmless, but see below.

Balance sheet - is horrendous still. NTAV is negative, at -£175m as last reported on 30 Sept 2018. The main cause of this deficit, is that working capital is heavily negative - i.e. the business has hidden debt, in that it's receiving cash up-front from customers. There's a large deficit of working capital - net current assets are negative £119.6m. I don't care what anyone says, to me that is a precarious & potentially dangerous position.

Note that the apparently small pension deficit is an iceberg - i.e. only -£28.9m deficit on the balance sheet, but in reality it's a huge scheme, with over £1bn in both assets and liabilities. Deficit recovery payments are large, e.g. from the last interim report;

The Company reached an agreement with the Trustee on the 2017 triennial valuation and recovery plan in the period. The net annual deficit contributions have been agreed at £17.3m per annum increasing by RPI over the three years to March 2021 and £24.3m per annum increasing by RPI from April 2022 to March 2027...

[excerpt from RNS dated 08 Nov 2018]

Checking the cashflow statement, this means that the pension scheme is getting more cash than shareholders receive in divis.

My opinion - the PER here is low for a good reason - because a lot of the cashflow goes into funding the pension deficit, and because the balance sheet is so weak.

Also, why would anyone want to invest in a lowish margin logistics business? That said, WIN does have a great client list, and must be good at what it does, to generate fairly reliable profits in a competitive market.

There doesn't seem to be much earnings growth happening either.

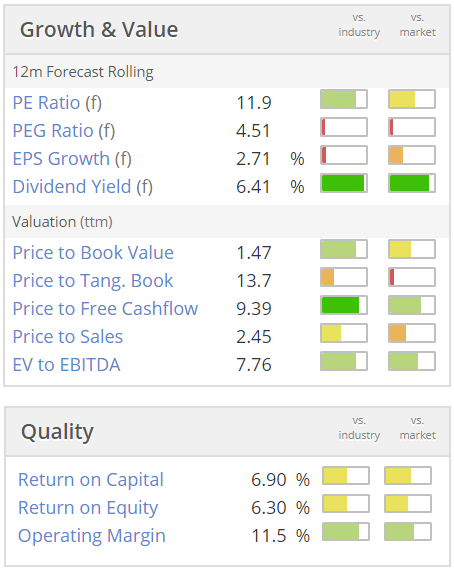

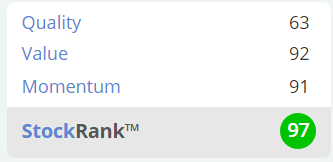

Stockopedia computers like it a lot - but I don't think they focus on pension deficits, or balance sheet strength as much as I do;

** BREAKING NEWS! **

Superdry (LON:SDRY)

The founder, Mr Dunkerton, has succeeded in his EGM to join the Board, and in time replace the existing Board.

In a vote closer than Brexit, Dunkerton achieved: For 51.15%, Against 48.85%.

As the existing (now presumably outgoing Board points out);

Peter Bamford, Chairman of Superdry, said:

"Whilst the Board was unanimous in its view that the resolutions should be rejected and 74% of shareholders other than Julian and James have voted against, there was a narrow overall majority in favour and we accept that outcome."

Therefore this cannot be seen as a vote of confidence in Mr Dunkerton - he only managed to persuade 1 in 4 outside shareholders to put him back in charge. Therefore, his winning the EGM largely on the strength of his own large shareholding, presumably is not going to be viewed positively by most outside shareholders who voted against him. Hence I suppose why the shares are currently (at 14:38 today) down 5% to 520p.

To my mind, the suits have made a mess of running this company, so bringing back the founder seems eminently sensible to me.

Gear4Music

Share price: 205p (down 5% today, at 14:32)

No. shares: 20.9m

Market cap: £42.8m

(at the time of writing, I have a long position in this share)

Gear4music (Holdings) plc ("Gear4music" or "the Group"), the largest UK based online retailer of musical instruments and music equipment, today announces a trading update for the 13 months from 1 March 2018 to 31 March 2019 ("the Period").

My initial reading of this update, first thing this morning, was quite reassuring. We already knew that the company was suffering margin pressure, which is why the share price has been smashed down from a peak of c.£7-8, to barely a quarter of that now. However, strong organic growth is continuing, and today's update explains what they're doing to fix things, and that the push for improved margins is working. That sounds fine to me.

So imagine my surprise, when my broker messaged me before 8am, to say it was indicated to open 15% down! This seemed to be because people initially focus on anything that sounds negative, and ignore the positives. That's the kind of market we're in right now for small caps - shoot first, and ask questions later.

I'm split this into positives & negatives

Bull points

Very strong organic sales growth continues (

Bear points

(Ran out of mental bandwidth, sorry - that's that)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.