Hi, it's Paul here!

This is the placeholder article for Tuesday morning.

Tracsis (LON:TRCS) Interview

Early notice, for Tracsis results which will be published this Weds morning.

As is traditional now, I will be recording an audio interview over the phone with John McArthur, CEO of Tracsis. The interview will be recorded & published this Thu.

So if you have any questions to put to John, then please email them on Weds to both me and John, using these email addresses:

Me: QSCquestions@gmail.com

CEO of Tracsis: J.McArthur@tracsis.com

We're trying out this email method, to save me having to spend ages preparing for the interview.

See you in the morning!

Intercede (LON:IGP)

Share price: 34p (down 9.3% today)

No. shares: 50.5m

Market cap: £17.2m

Trading update (profit warning) - this announcement came out yesterday at 1:58 pm. This is most inconvenient, and unfair for investors. It gives city traders an advantage, in that they can sell quickly, before private investors (many of whom will be busy with their day jobs) have a chance to react. All trading updates should come out at 7am. Companies need to ensure that Board meetings (to decide whether to issue a profit warning) are only be held after the market has closed. Then the RNS can go out at 7am. This would comply with the stock exchange rules about issuing bad news without delay.

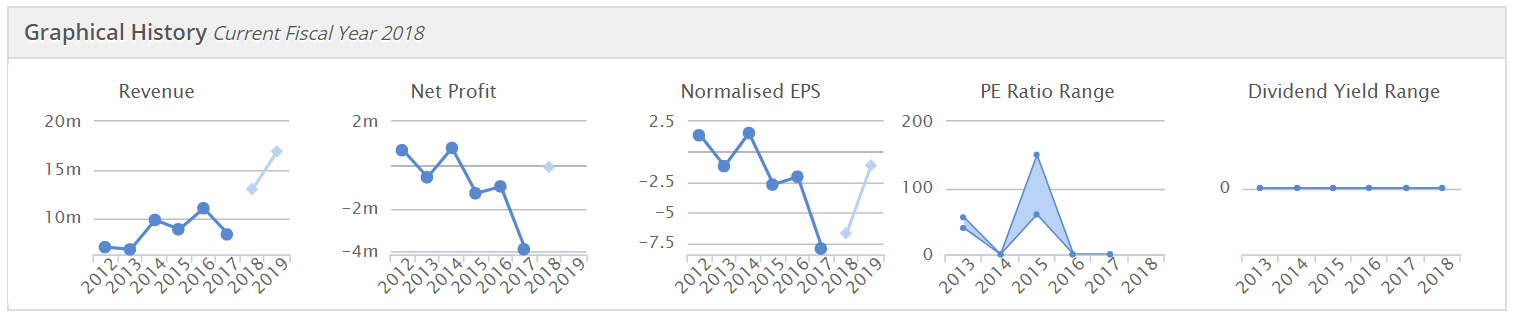

About this company - the description below sounds quite interesting, but unfortunately its financial performance in recent years has been considerably less impressive than the narrative (see Stockopedia graphical history below);

Intercede is a software and service company specializing in identity, credential management and secure mobility. Its solutions create a foundation of trust between connected people, devices and apps and combine expertise with innovation to provide world-class cybersecurity.

Intercede has been delivering solutions to high profile customers, from the US and UK governments to some of the world's largest corporations, telecommunications providers and information technology firms, for over 20 years.

There was a profit warning in Oct 2016, which I reported on here, concluding that the company was too difficult to value, due to erratic financial performance.

Profit warning - the reasons given today are similar to what caused the profit warning in Oct 2016 - delays in contract wins, of large, lumpy orders. The company admits that forecasting is "extremely challenging";

Further to the trading update of 5 October 2017, Intercede has experienced a slower market than expected and a number of large enterprise awards anticipated for this quarter have so far failed to materialise in spite of customer commitments to the contrary. This suggests a tightening of fiscal controls inside the customer base over which Intercede has no control.

While these orders are expected to be awarded eventually, customer delays are making accurate forecasting for the financial year extremely challenging.

Clearly that also makes it extremely challenging for us to calculate what the right share price should be!

More detail is given on one large deferred order;

Specifically, Intercede was informed in writing on 3 November 2017 that a significant order of over $2m from an existing customer that was forecast to be received in the current financial year ending 31 March 2018, will not now be raised until the first quarter of the next financial year.

This deferral of sales revenue will have a material impact on the Group's ability to meet market expectations.

That really is very material. Total revenues last year were only £8.3m. Bear in mind also, that the gross margin is extremely high, at 98.6% - so failure to close contract wins, feeds through straight to the bottom line. This is a recipe for highly volatile & unpredictable profit/(losses).

Helpfully, some guidance is given on revenues, although this also sounds subject to some uncertainty;

Intercede is now forecasting revenue growth for the current financial year in the range of 10%-20%. This is based on the timing of receipt of a small number of large orders and Intercede's subsequent ability to deliver and recognise revenues in accordance with the Group's accounting policy.

Hmmm, that sounds like a best case scenario. So there seems to be a risk of another profit warning, if these large orders are not received or delivered by 31 Mar 2018. It all sounds very uncertain.

Cash balance - is £4.2m at 31 Oct 2017, boosted by a £1.1m R&D tax credit received in Jul 2017. Cash was £6.9m just 6 months ago, at 31 Mar 2017. So ignoring the tax credit, this appears to show that the company burned through £3.8m in H1. After the tax credit is included, cash burn seems to have been £2.7m. Therefore, at that rate of cash burn, the company would probably need to do another fundraising in 2018.

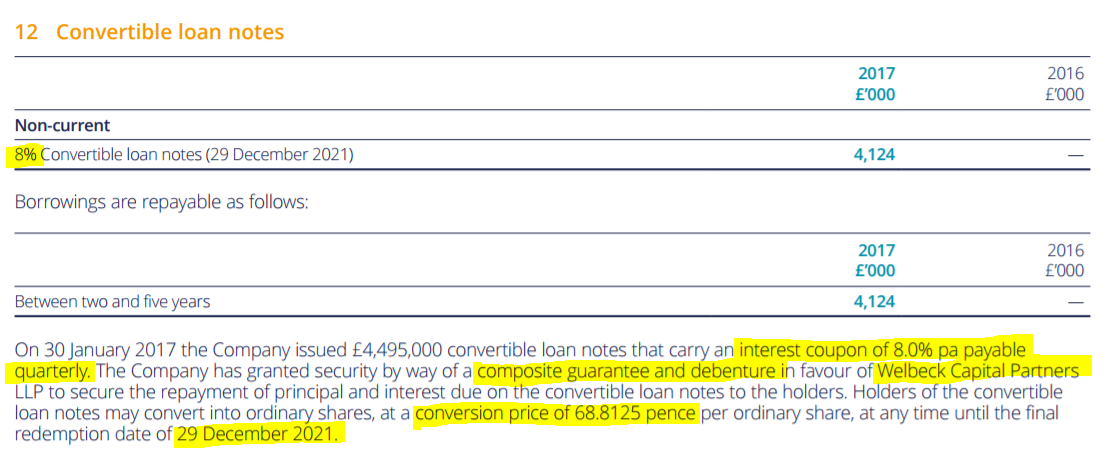

Convertible loan - this is an important point, as the last fundraising in Jan 2017 involved issuing £4.5m in covertible loans. I'm just checking the 2017 Annual Report for more details. Here we are;

- Fairly expensive borrowings then, at 8% p.a. interest. However, it's higher risk lending than a bank would normally undertake, so the cost is probably about right.

- Conversion price of 68.8125p is way out of the money, compared with the current share price of 34p. So shareholders don't have to worry about dilution unless/until the share price is above 68.8125p.

- Note that the lending is secured via a debenture - so in the event of default, then the loan note holders would take control of the company, and equity holders would be wiped out.

- Surprisingly, given the small size, these loan notes seem to have a stock market listing of their own, under the ticker INGPLCCN.

- It's not entirely clear when the capital is repayable on the loan notes, but I think it's in one lump sum, 5 years after the issue date. Interest is payable quarterly.

- I can't see any covenants relating to these loan notes. So it looks secure for now, as long as Intercede makes the interest payments.

Directorspeak - as you would expect, this is optimistic, as it has to be;

Richard Parris, Chairman and CEO, said, "the market has never been in more need of the solutions we provide, we have recently invested in a world-class sales team and we have migrated our platform to also operate in the Cloud on a subscription based model. We are poised for take-off in new mid-market enterprise and consumer oriented markets.

Unfortunately, short term sales in our traditional markets have been disappointing and are challenging our plans for organic growth."

My opinion - it's more of the same - jam tomorrow, and missed sales targets.

Cash burn looks high, so if things don't improve then another fundraising in 2018 looks likely - on uncertain terms.

Despite all these problems, I'm impressed with the big clients this company has secured. So its product must be half decent. If the company manages to land some big contracts, then on a 98%+ gross margin, profits could hardly be more operationally geared.

For these reasons, I'm going to take a closer look at this. However, it's one that I'd definitely categorise as very high risk. For that reason, if it does go into my personal portfolio, it would only be a smallish position size. Avoiding big losses on jam tomorrow shares is one of the best ways to improve returns, in my experience. Therefore this share can only really be considered a punt, at this stage, in my view.

Have any readers come across this company's products? If they are good, then I might have a little punt on the share. Cyber-security is certainly a topical area at the moment. The trouble is, there are so many companies operating in that field, finding a future winner is like searching for a needle in the proverbial haystack. As this company's financial performance has deteriorated in the last few years, I worry that it might be being overtaken by competitors? It's dawning on me that I don't have the expertise to invest in this sector, so maybe it's best left alone.

Fevertree Drinks (LON:FEVR)

(at the time of writing, I hold a long position in this share)

Trading update - this is just a very brief comment from me on this premium drinks (mixers) brand, which is taking the UK (and overseas) by storm.

It's released another terrific update today, saying;

Given the strong performance in the period to date, the Board anticipates that the results for the full year ending 31 December 2017 will be materially ahead of current market expectations.

Materiality is usually 10%+, so we can expect more broker upgrades.

This company is certainly growing into its high valuation.

I picked up a few recently, on a sharp sell-off, which seemed to be driven by Schweppes announcing a fightback against new competitors like FeverTree. Having seen the lamentable Schweppes TV adverts, I formed the view quite quickly that they present little threat to FEVR. I don't think there is anything that Schweppes can do, to challenge FEVR's dominance in the premium sector, because many peoples' brand loyalty has (probably permanently) switched.

What's interesting is that many traders are using trend following techniques, which have worked brilliantly in recent years. So as soon as share's chart goes wobbly, a lot of them sell out, often on stop losses. Yet quite often, those falls in share price are entirely spurious, as seems to be the case here. That's why, for me, fundamentals always trump charts.

It's interesting to note that FEVR did find buyers bang on the 200-day moving average in the last few days. So it's certainly worth taking the chart into consideration, as part of one's overall approach, in my view;

I've had my eye on this company for a while, so it was great to be able to grab some on the recent dip - probably from someone whose stop loss was triggered.

Blancco Technology (LON:BLTG)

Share price: 66p (up 21.1% today)

No. shares: 64.0m

Market cap: £42.2m

Final results - for the year ended 30 Jun 2017.

This company specialises in software for deleting data from computers, and similar electronic devices.

This company has been a big can of worms in the past. Here is our archive of articles on it.

The P&L numbers have been unreliable in the past - due to aggressive revenue recognition. The 2016 figures have been restated. Personally, I just don't want to rely on any of the P&L numbers. There are lots of adjustments. For what it's worth, the adjusted operating profit of £3.4m compares with £4.6m in the prior year.

The statutory figures show a loss before tax of -£1.7m, versus a loss of -£2.8m in the prior year.

Revenue is up 31% to £27.7m, helped by an acquisition. Organic growth of 19% looks strong - although helped somewhat by restating the prior year comps by £1.2m.

Outlook - if these numbers are achieved, then this seems to equate to roughly £3m adjusted operating profit - not madly exciting;

The business is targeting revenue growth for the 2018 financial year between 6% and 16% with an adjusted operating profit margin between 8% and 12%; this range does not include possible one-off non-recurring deals, which may or may not occur during the year and of which the market will be updated during the year should such deals materially impact results.

Chairman comments - suggest to me that there are still problems to fix;

"In the near-term, management is focused on a number of immediate priorities: cashflow and cost management; maintaining sustainable revenue growth; focusing marketing on near-term revenue generation; selectively investing in targeted product development; and embedding greater scrutiny and tighter financial controls across the business."

Balance sheet - this is the deal-breaker for me - this is a stretched balance sheet, in poor shape.

NAV is £50.6m

NTAV is negative at -£15.5m

Current ratio is OK-ish at 1.15 - but trade payables looks too high - this probably includes deferred income - i.e. the other side of the double entry relating to cash paid up-front by customers.

Non-current liabilities is a hotch-potch of unusual items, which in total amount to a fairly hefty £18.7m. This includes borrowings of £9.9m - which seems odd since the company also holds cash of £11.6m - it looks to me as if that cash figure is not typical, so probably some year-end window-dressing might have occurred?

Note 12 is interesting, re the bank debt. It says;

All banking covenants have been satisfied in the year and show headroom for the foreseeable future.

Why would the company draw down £9.9m in bank debt, when it apparently didn't need to? I'm always curious when I see a big cash balance offset with a similar sized bank borrowing. That doesn't make sense to me, and is inefficient in terms of interest costs.

Development spend - note from the cashflow statement that the company capitalised £3.1m in development spend.

Dividends - the divi has been passed. That makes sense, given that the company's finances don't look great.

My opinion - it's not for me. The accounts are far too complicated, full of adjustments. The balance sheet is weak. I don't understand why it has borrowed from the bank, to leave the cash sitting there idle.

If you ignore those factors though, the company does seem to be generating revenue growth, and who knows it might actually deliver some real, unadjusted profits, at some point in the future?

It remains to be seen whether the bottom-fishers today will make a sustainable profit, or whether this is just a dead cat bounce? For me, it goes in the too difficult and I don't really trust the numbers tray.

Johnston Press (LON:JPR)

Share price: 14.4p (up 5.3% today)

No. shares: 105.9m

Market cap: £15.2m

EGM Requisition - a fascinating situation is developing at this newspaper publisher.

Custos Group AS holds 20.01% of the shares, although today's announcement mentions them as "a shareholder holding in excess of five per cent...." - being the required percentage to requisition an EGM.

Custos is trying to shake up the Board;

The Requisition proposes resolutions that Camilla Rhodes and Michael Butterworth be removed as directors of the Company, and that Alexander Salmond and Steve Auckland be appointed as non-executive directors of the Company. The Requisition also proposes that any person appointed as a director of the Company since November 6, 2017 (being the date of the Requisition) be removed as a director of the Company.

I read somewhere that there is an issue at this company, in that apparently the Bonds contain some kind of "poison pill" which could trigger immediate repayment of the bonds. If true, that could hand control of the company to the bond holders, potentially wiping out the equity holders.

Another activist shareholder, Crystal Amber Fund, holds 10.63%. I seem to recall they previously held more - so I suspect they might have realised that this is a much more difficult situation than they originally envisaged.

My opinion - this is a straightforward battle between the dominant bondholders (remember that debt ranks ahead of equity, legally), and the tiny scrap of value that is represented by the equity.

I did dabble in this share earlier this year, successfully, but in the end decided that it impossible for me to accurately predict the outcome.

Apparently the bonds are being bought by aggressive hedge funds, and the equity is being bought by activists. Maybe a clever solution will be found. The key issue is that the company won't be able to repay the bondholders, when the bonds mature. So unless an alternative is found, bondholders would end up owning the company, with equity wiped out.

I can't really see why the bondholders would want to give up that position, and allow equity holders to profit? So for me, I've decided the shares are too risky. If a favourable solution is found, the equity could spike up, which has happened a bit before.

We also have to consider that newspapers do seem to be declining, heading for ultimate oblivion. That doesn't help.

Ideagen (LON:IDEA)

Share price: 86.5p (down 2.3% today)

No. shares: 200.0m

Market cap: £173.0m

Trading update - this is an acquisitive group of software companies, mainly serving highly regulated sectors, e.g. risk & compliance software for the NHS, and other sectors.

The group has a 30 Apr 2018 year end. It is reporting today on H1 to 31 Oct 2017. I like the very prompt reporting timetable - just 7 days after the H1 period end.

This is crystal clear;

The Board is pleased to report that trading has remained strong in the first half of the financial year and expects to report revenue and adjusted EBITDA* significantly ahead of the same period last year with an underlying organic revenue growth of approximately 12%.

The Company continues to trade in line with market expectations for the full year to 30 April 2018.

Cash - has risen by £1.1m to £5.9m in the last 6 months.

Balance sheet - the company says today that it has a strong balance sheet - it doesn't (as is so often the case). The last reported balance sheet as at 30 Apr 2017 shows;

Negative NTAV of -£10.0m

Working capital - the current ratio is 0.77, which is poor. The company is financed by customers paying up-front - note the deferred income of £11.6m is almost double the reported cash of £6.2m at 30 Apr 2017. There was also a £2m creditor for short term borrowings 6m ago, although it sounds as if that has since been paid off.

Trade receivables look very high to me - I wouldn't invest here without finding out what is in there, and whether it's reasonable or not.

Having said that, the weak balance sheet here is not necessarily a deal-breaker for me, because the business looks genuinely cash generative.

Cashflow statement - note that about £2.0m development spend was capitalised last year, so that makes EBITDA meaningless. You have to account for either the capex, or the amortisation charge. You can't ignore both, which is what EBITDA does.

Note that share based payments were arguably excessive for the size of business, at £1.2m in FY2017, and £0.9m the year before.

Dividends - The reason divis are so small here, is because the company is using its cashflow to part-finance acquisitions. What's the point of a 0.3% divi yield?

Outlook - the group seems to operate in a growing niche;

...The market opportunity remains large and long term and given the Group's position as a leader in the Governance, Risk and Compliance market, the Board is optimistic about the Group's continued growth prospects."

My opinion - overall, I'd say it looks to be priced about right, on a PER of about 20.

The group's track record has been good, but I'm not keen on its weakish balance sheet, due to lots of acquisitions.

Castleton Technology (LON:CTP)

Share price: 62.5p (down 0.4% today)

No. shares: 78.7m

Market cap: £49.2m

Interim results - for the 6 months to 30 Sep 2017.

The company calls itself;

...a leading supplier of complementary software and managed services to the public and not-for-profit sectors. The Group is a 'one stop shop', providing integrated housing systems via the Cloud, working in partnership with its customers and resellers to help drive efficiencies whilst improving controls and customer service. www.castletonplc.com

P&L (or statement of comprehensive income as it's called these days - why? P&L was a far better description, so that's what I shall continue to call it) looks unremarkable - there's a bit of growth in revenue, and you have 2 main options for what you'd like profit to be;

- Adjusted EBITDA of £2.26m, or

- Profit before tax of £184k - which doesn't look very much for a £49.2m market cap company, even allowing for the fact that these are only half year numbers.

- The main difference between EBITDA and PBT is due to the £1.5m amortisation charge in H1. On closer inspection, this seems to relate to acquisitions, so is non-cash.

Cashflow statement - this is quite good. Net cashflows generated from operating activities was £1.9m in H1, and was £3.7m in the last full year.

It's not capitalising much development spend - only £340k in H1. So this looks like a genuinely cash generative business.

Balance sheet - this is where it all goes wrong for me.

NTAV is negative, at -£16.0m. That's a lot for such a small company.

Current ratio looks very weak, at only 0.47. As with Ideagen above, the business is being funded by up-front payments from its customers. Deferred income is £6.3m.

Note that non-current liabilities are also substantial for the size of business, at £11.0m. This includes £2.8m in borrowings, £2.4m in convertible loan notes, and other items.

Outlook - this sounds alright;

Castleton made significant progress during the first six months of the year and this has continued into the start of the second half.

We will continue to concentrate on driving further organic growth across the Group, whilst increasing profitability by providing more of our customers with our broader range of complementary services - and all the time building our core of repeat revenues.

The Group remains on course to meet market expectations for the full year and looks forward to continuing to build on the solid foundations in place, cementing Castleton's position as a "one stop shop" serving the social housing sector.

That sounds fine to me.

Dividends - there aren't any. Not surprising, considering the ropey balance sheet.

My opinion - I don't have a strong view either way really.

The forward PER of about 12.3 seems reasonable, but there aren't any divis, due to the weak balance sheet.

There's some growth, but it doesn't look madly exciting. Although I can see that software for social housing might be a good area to be in, given the urgent need for more social housing in this country - which I believe is the biggest single way to fix multiple economic & social problems - a massive housebuilding programme of new, affordable homes.

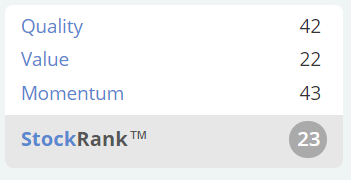

Stockopedia's computers are unimpressed, calling it "Speculative, Micro Cap, Style Neutral". The StockRank is low;

UP Global Sourcing Holdings (LON:UPGS)

Share price: 95.25p (up 8.2% today)

No. shares: 82.2m

Market cap : £78.3m

Final results - for the year ended 31 Jul 2017.

Ultimate Products, the owner, manager, designer and developer of an extensive range of value-focused consumer goods brands

This company disgraced itself by listing on the full market in Mar 2017, and then having a massive profit warning just 6 months later - which Graham reported here on 11 Sep 2017.

Results for y/e 31 Jul 2017 are good, but we already knew that. The problem is with the weak outlook, which is what caused the share price to crash in Sep 2017.

A few quick numbers for y/e 31 Jul 2017;

- Revenues up 39.1% to £110m

- Underlying PBT up 42% to £10.7m

- Net debt down 40% to £6.0m

- Underlying EPS of 10.9p (PER of 8.8)

- Full year divis of 5.115p (yield of 5.4%)

Those numbers look great, but y/e 7/2018 performance is expected to deteriorate. Therefore the outlook comments are of the most importance, not the historic numbers.

Outlook - these are the most important points;

...As previously announced, the Board therefore anticipates that revenue growth for FY 18 is unlikely. In addition, approximately £4-5 m of FY 18's revenue will now be recognised in FY 19 as a result of the move from FOB to landed arrangements with a key European customer.

However, Ultimate Products is used to managing such challenging dynamics. Current trading is in line with expectations and the Board remains confident that the business will continue to deliver sustainable, long-term growth.

The in line current trading has clearly reassured the market.

Balance sheet - looks pretty clean to me.

NAV is only £6.8m, but the company seems to operate from very little fixed assets. So it's probably just a big leased warehouse, and a bit of office furniture, in fixed assets.

Current ratio is pretty good at 1.67

There's a little debt, but nothing to worry about, in my view.

Cashflow statement - looks pretty good, although the year being reported on seems to have been a bit of a one-off good year. This does however look a decently cash generative business.

It used the bulk of the positive cashflow to pay divis, and reduce debt. That's the way it should be, so it gets a thumbs up from me.

My opinion - it's tempting to give this company the benefit of the doubt. People who bought at the IPO got stitched up basically (in my opinion). They thought they were buying a rapid growth company, which turned out to have just had a bumper year.

However, buying the shares now at less than half the price they were just 2-3 months ago, strikes me as quite interesting. My main worry is that something else might go wrong. The other worry is how much more the company might be affected by any continuing consumer downturn? BRC-KPMG retail sales figures out yesterday, for Oct 2017, were poor.

UPGS is a distributor on low margins, so it shouldn't have to worry too much about operational gearing. Therefore, I feel that it should be able to cope with a downturn, and remain profitable. My main question is why would larger retailers buy from a distributor? Could they not simply source their own product from China, instead of using an intermediary like this?

I think it might take time for confidence to return with this share, so am not sure how much shorter term upside there is. For that reason, I'll probably pass on it. However, this looks a much more attractive recovery situation than say Blancco Technology (LON:BLTG) .

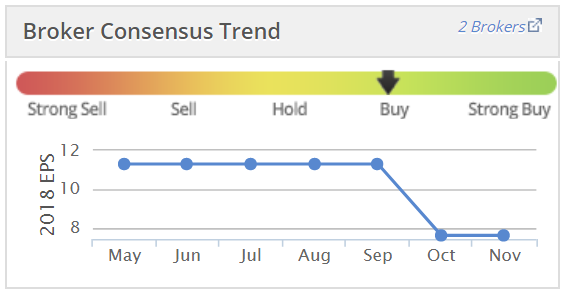

It will be interesting to keep an eye on broker forecasts. As you can see, the consensus was revised down a fair bit in Sep-Oct.

All done for today.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.