Good morning!

The final list:

- Elegant Hotels (LON:EHG) - half year results

- Vertu Motors (LON:VTU) - final results

- BigDish (LON:DISH) - operational update

- Argo Blockchain (LON:ARB) - operational update

- Record (LON:REC) - business update

Archaeology - a quick note regarding what I said yesterday about the "archaeologists" who inhabit financial regulatory bodies. The Financial Reporting Council has only today imposed sanctions on KPMG and one of its partners for work done on the Co-Op Bank's accounts.

So which year's accounts would these be? FY December 2009! Yet again, we see how slowly the wheels of justice turn.

I'd also like to point out that cases like the Co-Op, Autonomy and Quindell are all very high-profile. In the small-company world, dodgy accounts are much less likely to even be investigated. Tread carefully!

Elegant Hotels (LON:EHG)

- Share price: 71.5p (+4%)

- No. of shares: 89 million

- Market cap: £63 million

Elegant Hotels Group plc ("Elegant Hotels", the "Company" or the "Group"), the owner and operator of seven upscale freehold hotels and a beachfront restaurant on the island of Barbados, today announces its unaudited results for the six months ended 31 March 2019.

Paul and I have covered this share from time to time. Click here for my review of its final results in January.

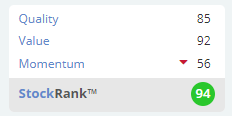

It has looked "cheap" for a while, with a very high ValueRank. It currently has a high overall StockRank:

On the other hand, it's a hotel group, so we shouldn't have very high expectations of its growth prospects. Like any property company, there are natural limits in terms of how quickly it can grow.

Today's numbers:

- Revenue +3%.

- Adjusted EBITDA up 7%, adjusted PBT up 5%, adjusted EPS up 27%.

- "Implied NAV" of 156p based on a GBP:USD exchange range of 1.3 and January 2018 property valuations by CBRE.

- "comfortable" with outlook against market expectation.

Occupancy is up but average daily rates are down. All the changes are small.

RevPar (revenue per available room) is up marginally. I believe that the local inflation rate is rising at a faster pace.

Arrivals to Barbados from the UK were up 7% in the period. Given that the UK accounts for the majority of EHG's customers, the rise in revenues and RevPar looks quite weak to me.

There is a reference to increased competition, "particularly in the all-inclusive and value segments". When consumers tighten their belts, hotels suffer.

Tax rates: Barbados has seen massive cuts in corporate taxation. The rate has been reduced from 30% to between 1% and 5.5%. Therefore, the six-month tax charge has reduced from $2 million to $0.2 million.

This helps to explain why (after-tax) EPS has increased at such a faster rate than pre-tax profits.

Net debt is $68.9 million.

My view: this looks too cheap to me. It's probably under-performing the competition in Barbados, but unless there are risks I haven't spotted yet, it still seems a bargain. The current pricing seems to imply a future deterioration in trading and/or very high currency risks. Remember that there is a GBP/USD exposure to worry about (income in GBP, expenditure in USD).

I suppose we might ask the question about whether the ultra-low tax rates in Barbados are sustainable. As a long-term investment, you need to bear in mind that these tax rates could rise again at some point.

I'm tempted to buy EHG for my own portfolio but it doesn't really fit the strategy I'm pursuing, so will instead leave it for others to research in greater detail.

Luke Johnson owns 12.5% of the shares and is currently a non-executive director.

Vertu Motors (LON:VTU)

- Share price: 36.4p (+4%)

- No. of shares: 376.6 million

- Market cap: £137 milllion

Final Results for the year ended 28 February 2019

Vertu Motors plc, the automotive retailer with a network of 123 sales and aftersales outlets across the UK, announces its final results for the year ended 28 February 2019

I will keep this brief but the bottom line is that it's trading in line with expectations in the current period.

The entire auto retailer space has been de-rated thanks to the weakness in the car market and while i do think they are too cheap as a sector, I haven't felt compelled to actually buy any of them myself! So I guess that tells a story.

Similar company Pendragon (LON:PDG) fell into a loss last year. The outgoing Chairman of Vertu remarks today that the entire sector will probably shrink and consolidate:

It is likely that over time there will continue to be a reduction in the number of franchise dealer outlets in the UK and drive further network consolidation.

Vertu generated plenty of free cash flow in FY 2019 (£21 million) and spent almost half of it on dividends and buybacks. That seems like a reasonable thing to do, when the shares are trading at a single-digit P/E multiple.

BigDish (LON:DISH)

- Share price: 2.9p (+2%)

- No. of shares: 286 million

- Market cap: £8 million

BigDish Plc (LON: DISH), a food technology company that operates a yield management platform for restaurants, is pleased to announce further progress in the UK and an expanded growth strategy.

Just a quick update here to say that it's expanding to new towns is now preparing to head for the London commuter towns.

No idea what it could be worth, but it seems like a nice concept.

Argo Blockchain (LON:ARB)

- Share price: 3.5p (+8%)

- No. of shares: 294 million

- Market cap: £10 million

I considered this to be a joke company when it first listed, offering "Mining-as-a-Service" to crypto punters.

Since then, the crypto bubble has burst and Argo has abandoned its "MaaS" strategy. Instead, it is using its crypto mining computers to generate coins for its own balance sheet. Good news.

The other good news is that Argo still has £15 million in cash (as of March 2019).

An investor holding 14% of the shares has called a general meeting with the purpose of booting out the existing managers and (presumably) giving the money back to shareholders.

Will they succeed? I have no idea. I do know that I would much prefer to have £15 million in cash than to own Argo Blockchain in its current form.

Record (LON:REC)

- Share price: 30.75p (-0.8%)

- No. of shares: 199 million

- Market cap: £61 million

(Please note that I have a long position in REC.)

This has been an unsuccessful investment for me so far, and today's update doesn't help.

We already knew that Record had put £40k into a funny little start-up whose shareholders include two directors and a shareholder of Record. A perfect example of a related party transaction.

£40k is pretty much irrelevant when we are talking about a £60 million market cap business, so I didn't care about the initial announcement.

To my dismay, the company announces today that it has put another £80k into the business.

The total investment is still less than 0.2% of Record's market cap, but the optics are terrible. Record needs to become more competitive and find new clients. This start-up sounds like a distraction from that goal.

Record says that the start-up, which runs virtual trading competitions, will help in branding and recruitment and also offer diversification from Record's existing business.

If I was going to cull anything from my portfolio, Record would be near the top of the list. Announcements like this can only make its elimination from my portfolio more likely.

That's all I can manage for today. Apologies once again for the delay.

Best wishes

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.