Good morning, it's Paul here.

Right, let's get this show back on the road.

Today, I'll be looking at;

Angling Direct (LON:ANG) results

Wey Education (LON:WEY) interims

Anything else of interest.

I'm putting the finishing touches to Friday's late report here. I've covered Premier Technical Services (LON:PTSG) - and the recent shorting attack on it, and a positive update from T Clarke (LON:CTO) . So that's something to get you started today, whilst I'm looking at other announcements. I'm very sorry it was so late, due to me being unwell (am tons better today though, so hopefully that issue is now fixed).

** It's Mello week! **

I'm looking forward to catching up with many subscribers at Mello London later this week.

There are two, back-to-back, events, in London (Chiswick) as follows;

Wed 15th May - Mello Investment Trusts & Funds - excellent speakers arranged, with what should be some great insights into how top fund managers do things.

Thu & Fri, 16-17 May - Main Mello event - this was a fantastic success last year, and I'm sure will be wonderful again this year. Above all, Mello events are so friendly, they're tremendously enjoyable.

The schedule of presentations are now on the websites.

I'm booked in for the usual small caps talk on Friday, but I'll be around on both days. Graham will be speaking several times, and he seems to have been roped into doing a SCVR live at 9:00am on Friday. I refused to do any live SCVRs this year, as the stress in previous years of having to produce the material to present in about half an hour after breakfast, was just too much!

Pre-8am comments

Angling Direct (LON:ANG) -

(I have a long position in this share) - the financial highlights bullet points look really good. However, the company/advisers have been deceptive in how the results are presented - with lots of positive bullet points in the highlights, and positive commentary, but a key omission - that last year's (pre-exceptional) profit of £941k profit has fallen away to a loss of £47k in 2018.

The company does itself no favours at all, by trying to polish the proverbial. A poor result should be presented honestly, not over-PR'd in the commentary. All that does is create mistrust in investors.

Having said that, Stockopedia shows that the market was expecting a loss - with a (post-tax) forecast of a -£0.4m loss. So maybe the outcome is better (or rather, less bad) than expected? I'll have to look into that later.

I'll probably keep my (small) long position, despite regarding these results as poor, and the commentary misleading.

On the upside, the company is now very well funded, with net cash of £13.5m, following a £20m placing - so it has firepower to open more shops, and drive online growth.

Outlook & current trading sound very strong - this might have been influenced by better weather in 2019 cf.2018 possibly?

"The Company has made an excellent start to the fiscal year and, in the first two months like-for-like sales were up by 28.5% and overall sales were up by 50.7% compared to the previous year.

We will continue to build on this momentum in the year ahead, with exciting new store openings planned and continued targeted online growth. Our plans for the summer season are progressing very well and the Board is confident that the Company is on track to meet its full year targets."

My opinion - I like the strong current trading, and the online growth, especially internationally.

I dislike the fact that 2018 profit was poor, and that management have tried to gloss over this in the announcement today.

The question is whether people will sell today, due to poor figures, or whether the strong online growth will excite investors about the future potential? We'll have to wait and see what the market does once it opens.

I like online, niche, businesses. Actually, I like the mix of online, and shed-type (low rent) physical stores. Investors have to accept that they won't be profitable in the rapid growth phase, but future profits should flow once scale has been achieved, and competitors crushed.

Wey Education (LON:WEY)

(I have a long position in this share)

Big exceptionals, but a small adjusted profit. The business has genuinely been restructured, and focused on core activity of online education.

£7m market cap looks to have over-shot to the downside, in my view, hence why I bought back into this one a few weeks ago.

Strong balance sheet, with £5m cash.

This share looks cheap to me, as it's a good online service, with strong growth potential.

Main Report

Wey Education (LON:WEY)

Share price: 7.63p (up 43% today, at 11:54)

No. shares: 130.7m

Market cap: £10.0m

(at the time of writing, I hold a long position in this share)

This section looks into a bit more detail, following on from my brief earlier comments above. Now that I've had time to read the full RNS, digest the figures (and commentary). There's also an excellent short update from the house broker, which you can find on Research Tree, which contains a lot of useful points.

The key question is whether this morning's sturdy 43% share price rise is justified? Or could it be a short-term spike? Here are my notes & comments;

Impressive revenue growth, of which c.35% is organic - this is good, although the actual numbers are very small still.

Strategic review has simplified the group, to just its Interhigh & Academy21 operations. This is clearly the right strategy, and I think should allow management to focus properly on growing the main businesses.

As it operates online, Wey can grow international sales (e.g. to children of UK ex-pats) without having to establish any overseas infrastructure - so its addressable market is potentially global.

Growth plans are ambitious, and I like the upbeat tone of the whole announcement - it's not blue sky stuff, this is a (small) established business, that is trading just above breakeven. Management clearly wants to grow the business substantially ("to become the size of a Multi Academy Trust"). This is the type of growth company that I like best - with c. £5m cash in the bank, it shouldn't need to raise any more cash from shareholders.

Broker is forecasting breakeven for the FY 08/2019. Therefore £124k adjusted profit in H1 is looking good. It does note that marketing spend is being increased in H2, so leaves forecast unchanged. It does say that risk it to the upside - i.e. that Wey looks quite likely to beat current forecast - I like that.

Marketing spend - is being increased. Companies which operate online have to do that in order to grow. Therefore investors are missing the point, if they demand rapid profit growth. It's actually better to recycle profits into more marketing spend, if the company is achieving a good return from marketing spend. It sounds like Wey is not sure how to spend on marketing, and is trying out different things. To me, this is a key focus - getting value for money from its marketing. Time will tell on that one. It sounds as if marketing spend will be measured, rather than explosive growth, which is the right strategy in my view.

Gross margin is high, and showing a good sequential growth trend in the last 3 half years. At 56.4% most recently, this provides very nice operational gearing.

Profit adjustments - where these are material, they should be scrutinised. Are these genuine one-offs? Yes, I think so. The £571k restructuring costs are a genuine, big reorganisation of the business, so are one-off in nature. The narrative says that management believes there won't be any more major restructuring costs. The only item which jars a little, is the £59k equity share based awards, which to me is fundamentally payroll related, not a one-off. At this stage, they really shouldn't be paying out equity awards - let's see some profits & divis before dishing out rewards to management.

Outlook comments - overwhelmingly upbeat, with sound reasons given. Another tick in the box here then.

Any funnies in the accounts? Not that I can see, it all looks fine. Some comments from me;

- Tiny tangible assets of £187k - a very capital-light business, which I like

- Capitalising of intangibles - tiny, at only £37k in H1. So there's no skulduggery going on here, in terms of shunting costs onto the balance sheet

- Very healthy working capital. £6.45m of current assets, and £3.18m of current liabilities. That's a current ratio of 2.03 - very healthy. Also note the positive working capital structure, of clients paying up-front. Therefore growth should not require more working capital, it should actually improve the cashflow.

- Note that new provisions of £650k have appeared in current liabilities (for the exceptional provisions). This will be real cash going out of the business, so should probably be knocked off the £5.0m cash pile, when calculating enterprise value

- Cash position has benefited from favourable working capital movements

- Zero tax charge, due to brought forward tax losses

My opinion - I'm happy with all of this. It looks like a genuine recovery in performance is underway. Rapid growth, combined with high gross margins, are a lovely combination.

It's very difficult to value shares like this, as PER is irrelevant at this stage. It's all about what growth is likely to be achieved, and what size & level of profits might be generated when the business is potentially much bigger. All I can say, is that I'm comfortable with the current (after today's rise) increase in market cap to £10m. That looks about right to me, for now.

However, I think the share price could be quite strong going forwards. After last year's collapse in price, it looked like a stale bull story. I think today's announcement makes it clear that the bull cash is back on the agenda. It all depends whether there are stale bulls in the share, stranded by the lack of liquidity? It's impossible to know. That's why I don't try to anticipate short term share price movements in small caps, as it's inherently unpredictable.

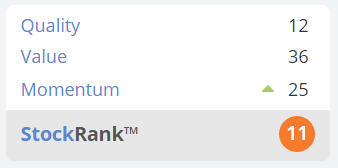

Stockopedia honks with derision at shares like this, awarding a very low StockRank. Useful as a reality check, and to flag that this is potentially high risk;

That's it for today, although I'll put a few more of today's comments into tomorrow's report, so that everyone sees them.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.