Good morning, it's Paul here!

Pre-7 am comments

As I'm up early today, let's have a quick look at yesterday's stragglers.

I can't motivate myself to look at Nexus Infrastructure (LON:NEXS) in more detail, so have instead looked at a couple of more interesting announcements from yesterday;

Warpaint London

Share price: 102.5p

No. shares: 76.7m

Market cap: £78.6m

This company sells cosmetics.

Issued at 10:59am - not good. I understand the logic for announcing at this time - i.e. issue the update at the same time as it's being spoken at the AGM. However, for me the golden rule is to always put out trading updates at 7 am, when the market is closed. This enables everyone to digest the announcement at relative leisure, and gives a level playing field. Whereas an intra-day trading update gives a timing advantage to day-traders & city people who are glued to a screen all day, and hence can react (if needs be) first.

Trading update - sounds reasonably reassuring;

"I am pleased to report that the outlook for the Company remains in line with that reported at the time of the release of our annual results for the year ended 31 December 2018 on 10 April 2019.

"Whilst trading conditions remain challenging in the UK, we continue to see encouraging international sales growth, in particular in the EU and the US.

"The Group has a sound financial footing and we are actively implementing our strategy for growth. We look forward to the remainder of the year with cautious optimism."

Why are trading conditions challenging in the UK? Consumer demand is fine, providing companies have a decent online sales strategy, as well as selling via physical retailers. My worry is that there might be something wrong with Warpaint's products?

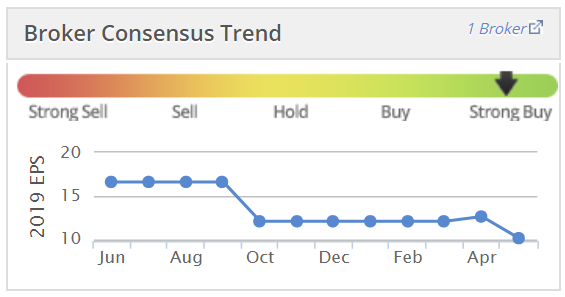

As you can see, broker consensus forecasts have been reduced over the last year, so something's obviously wrong;

Looking at the share price chart below, you can see there must have been a profit warning last Oct/Nov, and the shares have not recovered from that;

I reported here on the 29 Oct 2018 profit warning in a fair bit of detail.

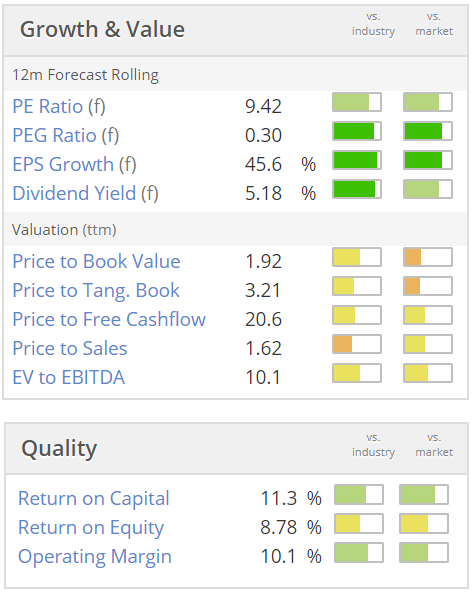

Valuation - looks quite attractive, although the company has disappointed in the past, hence why investors are likely to be more sceptical;

Note above the attractive dividend yield, which is supported by a strong balance sheet.

My opinion - this looks worth a closer look, I think. The financials look attractive. If earnings can start rising again after the problems announced last autumn, then the shares might recover. If problems continue, then there's the risk of another profit warning.

The key point to research is the product, and the competition. Does W7L have good products, which are gaining market share? If so, then the shares are cheap. However, the fact that it's struggling in the UK seems to suggest maybe that the products might not be great.

Do any readers' wives have a view on Warpaint product? It would be interesting to hear any feedback from you.

Vitec (LON:VTC)

Share price: 1160p

No. shares: 45.3m

Market cap: £525.5m

... the international provider of premium branded products and solutions to the fast moving and growing "image capture and content creation" market

It seems to be fancy cameras, and accessories, for broadcasters & photographers. There's a good 5-min introductory video here.

Accomplished investor Lord Lee told me about this company recently, saying he rates it, and owns some shares personally.

Glancing at the StockReport, I can already see this ticks a lot of my boxes, so is worth spending some more time researching. Specifically;

- Strong operating profit margin of c.10%

- Good quality scores - all 3 are green or dark green

- Modest forward PER of 12.2

- Strong progression of revenues & profits over the last 6 years

- OK dividend yield of 3.4%, well covered (over twice)

The only slight caution that jumps out at me from the StockReport is this;

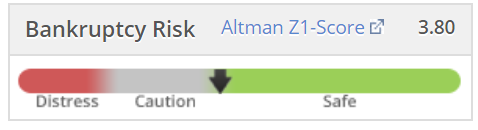

Positive NTAV, although it has some debt - that needs checking out - note the Z-score is on the cusp of "caution"

Trading update - sounds OK;

The Group's trading for the four months ended 30 April 2019 was in line with expectations

The Board's expectations for achieving progress in 2019 are unchanged

Outlook - this is interesting - a strong 2020 is expected;

"Whilst we remain mindful of geopolitical challenges, we are pleased to confirm that our outlook for the current year is unchanged, and H2 weighted as highlighted at the Full Year results. We expect a strong 2020, given the summer Olympics, US Presidential elections and the targeted growth initiatives already implemented."

There's always a risk with H2 weightings. The share could possibly have a weak patch if investors don't like the H1 2019 results, maybe?

My opinion - I rather like the look of this. At first glance, it looks a quality company, at a reasonable price. Although please bear in mind this is just my initial review, I haven't gone through the accounts yet in detail.

I'll take a closer look when the next set of results comes out.

7-8 am quick views

Here we go, the RNS is about to fire up;

Volvere (LON:VLE)

Share price: 1125p (pre-market open)

No. shares: 3.12m

Market cap: £35.1m

Final results - Graham has written about this extensively here - see the archive. So he knows a lot more about it than me. It's a turnaround investment group, run by Jonathan Lander. He buys under-performing companies. Its track record is great, in particular the sale of Impetus, bought for £1.3m in 2015, sold in 2018 for £26.1m - remarkable stuff!

The market cap is now roughly at par with the group's own net cash. So the other investments (principally Shire Foods) are thrown in for free. The trouble is, I can't see any reason to value Shire Foods at very much. Its profits are small, and falling, and it notes today upward wage cost pressure.

Another worry is that the commentary today indicates they might make further acquisitions in the food sector. I think that's a negative, as it's really not a good sector at all - facing brutal pricing squeezes from supermarkets, and rising wage costs. Yes Volvere has expertise in that sector, but I worry that management might be wasting their considerable talents on a rubbish sector. I'd much rather see them buy some more software businesses, as they did so well with Impetus.

Therefore, if the cash pile is going to be used to buy companies that maybe don't have much upside, that would detract from the share's attraction, and undermine valuation.

On the other hand, management here is a class act, and I think they can be relied upon not to do anything unwise with the cash pile. Therefore this share is really all about backing management, long-term.

The current valuation looks about right to me, as I see little value in Shire, and its other investment is tiny.

I did try to buy some shares a while back, but it was ridiculously illiquid, and has wide spread. Therefore this share is not just for Christmas, it's for life! There are no dividends.

Graham's ill at the moment, but hopefully he might be able to leave us a comment on his view of today's results from Volvere. I don't have anything further to add on VLE today.

Shareholders have almost quadrupled their money in 5 years - although selling in any size could be a problem as it's so illiquid;

Pets at Home (LON:PETS)

Thanks to the reader below who flagged up this positive-sounding announcement.

Results for 52 weeks to 28 Mar 2019.

FY19 performance ahead of expectations - underlying basic EPS is 14.1p - Stockopedia shows forecast consensus of 13.1p - that's a nice beat, but EPS is really only going sideways, if you look at the longer term trend.

Strikingly good LFL sales - up 5.1%

Underlying profit before tax up 6.1% to £89.7m - not madly exciting, but good in a tough retail environment

Divi maintained at 7.5p - attractive yield of 5.0%. Mentions possibility of special divi or buyback, in the section titled "Capital allocation"

Outlook comments - "confident about the year ahead"

Big adjustments - £40m non-underlying items, includes £18m impairment losses on receivables - would need looking into

Balance sheet - weak, with negative NTAV. £1bn in intangibles! Although not a concern, as cashflows are good enough to support the weak balance sheet, in my view

My opinion - looks quite interesting at 148p per share - a PER of 11.5, for a (mainly) retailer that's out-performing the market. 5% divi yield. Growing vets (high margin) business.

I could see the current share price recovery continuing. Probably not enough upside to get me interested though, but possibly one for traders?

I can't see anything else of interest today, so will sign off, to watch possibly Theresa May's last PMQs.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.