Good morning folks,

As far as yesterday is concerned, extra sections were added late in the day by Paul to Monday’s report.

There's quite a lot that I might cover today.

- Park (LON:PARK)

- Fireangel Safety Technology (LON:FA.)

- Innovaderma (LON:IDP)

- Moss Bros (LON:MOSB)

- Ten Entertainment (LON:TEG)

- DP Poland (LON:DPP)

- Versarien (LON:VRS)

Park (LON:PARK)

- Share price: 54p (unch.)

- No. of shares: 186 million

- Market cap: £101 million

(Please note that I have a long position in PARK.)

This is one of those stocks which makes me feel a little unlucky at the moment.

My entry price was 86p in November 2017, for something like 3% of my portfolio. It was just a small position in a company which I admired.

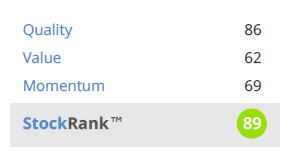

Using Stocko's look-back feature, I am able to go back in time and get a StockReport from that month, showing roughly what the share looked like when I bought it.

This is what I get:

As you can see, it had a fairly average valuation (ValueRank 62) and a super high Quality score (Quality Rank 86).

Now let's fast forward to today.

It's true that Park missed its earnings forecasts over the past two years, with a 2019 miss of over 20% compared to the forecast when I bought into the company.

That miss had a lot to do with the company moving to modern new offices in Liverpool city centre, which created a big (£1.2 million) impairment charge for FY March 2019. The new office, according to the company, will help it to attract staff and have positive benefits for its corporate culture.

In the absence of the impairment charge, Park's FY 2019 result would have been very similar to its FY 2018 result, which was only a tad short of original expectations.

So on the basis that moving offices was a one-off event with positive long-term effects, I don't think that the company has done very badly during the period in which I have held it. But the share price is down by the best part of 40%!

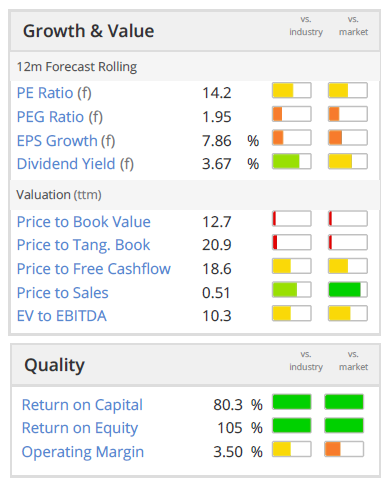

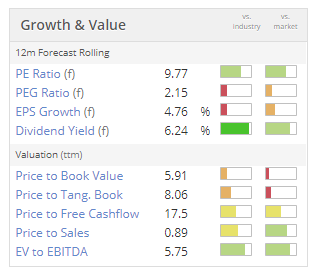

This is where we are at now in terms of valuation:

Let's compare some of the main value metrics:

- P/E ratio: 14.2x in 2017, 9.8x today.

- Dividend yield: 3.7% in 2017. 6.2% today (easily covered by earnings).

- EV/EBITDA: 10.3x in 2017, 5.75x today.

In summary, despite Park doing ok (in my opinion), its valuation has been significantly de-rated. I believe that this is a common story across UK small-caps.

So should I increase my position size? If I was interested in dividends, I might do that. But I am already fully invested and already using a little bit of leverage to gain extra exposure to the FTSE index. From a risk control point of view, I prefer being leveraged to the index rather than to individual shares (although exceptional circumstances might change that).

Anyway, let's see what Park is saying today. For those of you who aren't familiar with it, it's mostly in the business of providing gift vouchers and reward schemes, and it runs Christmas saving schemes.

- trading is in line with expectations.

- profitability to be suppressed by "strategic business plan" - new offices, technology and marketing investment. New ERP system, Microsoft Dynamics 365. This spending is not news - investors already knew this was in the works.

- H1 to be unprofitable as always, due to the high seasonality of the business, as it's geared toward Christmas.

- Name change to Appreciate Group plc to be approved at today's AGM.

- Msyterious new product, "targeting currently untapped areas of the gift voucher market", is "well underway". They will hopefully tell us the launch date for this product in H2.

My view - not much news here and I'm unsurprised that the price hasn't moved. But I do think that this is another example of a UK small-cap which has decent quality and is undervalued. But then I would say that, wouldn't I!

The bear case on this share goes something like this: High Street retail is dead, gift vouchers are old hat, and Christmas savings schemes are just a legacy from the 20th century. So if you take a very bearish industry view, you can expect this company to achieve no growth and be a very dull investment that doesn't go anywhere.

From my point of view, it's a unique business that generates a lot of cash and doesn't need to do much to justify its current share price. So I'm sticking around for a while longer yet!

Fireangel Safety Technology (LON:FA.)

- Share price: 20p (-18%)

- No. of shares: 76 million

- Market cap: £15 million

Paul and I have covered this company for some time, and it regularly disappoints. Mentally, I wrote it off as an accident-prone stock some time ago.

It comes back today, remarkably but unsurprisingly, with another profit warning.

What's happened?

What has happened today, in a nutshell, is that the company has admitted that its capitalised development spending isn't worth what it previously assumed it was worth.

Let's get into the weeds just a little bit.

When a company capitalises its development spend, it has an asset on its balance sheet it needs to amortise (write down the value of) over time.

What I always expect is that a company will write down this value on a straight-line basis, e.g. over 5 years.

It turns out that FireAngel didn't do this with its own development spending. It adopted a "units of production" method, which "is only appropriate where demand can be measured reliably".

So it sounds like the company was expecting demand for its new "connected home" products to be of a certain strength, and it planned to write down the value of its development spending as it made these products and sold them. Today, it admits that its assumptions were overly optimistic, "given the difficulty in accurately predicting the take up of its connected home technology".

It's moving to straight-line amortisation over 7 years, which is still a bit too optimistic for me. "Connected home" technology is changing all the time. Prudence would suggest to me that development spending in this area could be obsolete after 5 years, not 7. But there you have it.

There are also exceptional charges relating to battery warranties the company is exposed to for products it sold from a 3rd-party. These are hefty at £1.4 million (10% of the market cap now!).

My view

This company has been planning a turnaround for some time. I am deeply suspicious of its pivot to an "internet of things" type of business model - it could work out, but what are the odds?

You can buy an Alexa-enabled smoke and carbon monoxide detector from Amazon right now. Is this tiny company competing directly with Amazon and other much larger organisations? If so, how on earth is it going to win?

It made an underlying operating loss in H1 and its prospects for long-term success strike me as extremely remote.

Innovaderma (LON:IDP)

- Share price: 89p (+15.6%)

- No. of shares: 14.5 million

- Market cap: £13 million

This is another one that we have covered before.

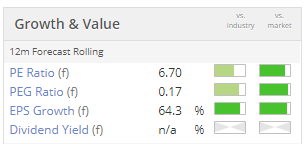

I wrote a balanced piece on it in February, having been a bit sceptical of its (overly diversified, I thought) brand portfolio. On the bright side, I noted that it could start to look really good value it it hit its earnings forecasts.

Today, it is indeed starting to look value. With a 21% revenue gain, full-year PBT has doubled to £1.4 million.

In February, I noted that the share price increased on a day when brokers actually reduced their forecasts for the company.

The same thing has happened today. The share price is up despite the FY June 2020 net income forecast being reduced from £1.7 million to £1.5 million.

FY June 2021 is pencilled in at £1.8 million, as an initial estimate.

These are after-tax numbers and suggest lots of value available at the current level.

Outlook

- The new financial year has started "very positively" and current trading is "in line with expectations", despite the earnings downgrade.

- Skinny Tan should be in Boots for the full financial year, boosting the result. Superdrug will have a limited edition range for Christmas.

- Roots to get new products and a social media campaign, and the Prolong performance should be more satisfying.

- New disruptive product launch is coming (mysterious for now).

- Like Park, it gets an ERP upgrade.

My view

I've followed this off-and-on for a while, and continue to find it interesting. With the operational and financial success of FY 2018, and with prospects sounding positive, I'm honestly surprised that it remains so cheap.

The positive relationship with Boots and Superdrug, and their support of Skinny Tan, is for me the most interesting and exciting prospect.

So I do think that this is worth researching in more detail.

Personally, I still don't quite see the logic of having skin, hair and sexual health products under the same roof. I also observe that 59% of Trustpilot reviews say that Skinny Tan is bad, and the product is rated as Poor. So I'm still reluctant to invest in this one for my personal portfolio.

Despite these question marks, it clearly remains possible that IDP could chuck out £2 million+ of PBT every year from now on. If they manage to do that, then surely investors will do well regardless of the logic and the product reviews?

Ran out of steam here, I'm afraid. Too many other things to do today.

I'll be back later in the week, so will try to catch up if things calm down.

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.