Good morning!

Thanks for your suggestions.

Let's take a look at:

- Onthemarket (LON:OTMP)

- Morses Club (LON:MCL)

- Castleton Technology (LON:CTP)

- National Milk Records (OFEX:NMRP)

Onthemarket (LON:OTMP)

- Share price: 81.75p (-2%)

- No. of shares: 64 million

- Market cap: £52 million

Please note that I own shares in Rightmove (LON:RMV), so I'm not exactly disinterested when it comes to the success or failure of Onthemarket.

This update show good growth in the number of branches listed (up 28% in the year) and excellent growth in traffic, with a 75% increase in the number of site visits.

I also note that its stock of available property has improved, and its stock is now c. 64% of Rightmove's.

It generated far fewer leads per property advertised than Rightmove, but it claims that if you adjust for how much more expensive Rightmove is, that it offers twice as much value (i.e. leads per pound spent).

The rate it uses for this calculation is £331/month, which is the rate at which long-term contracts are offered to agents, for 3 or 5 years.

It also offers short-term, low-cost contracts at just £203/month.

The bit where I have a big problem is that the revenue under long-term contracts of £331/month comes at a price in terms of share issuance.

The business model is to outcompete Rightmove (which itself was founded by estate agents) by regularly giving "free" shares to estate agents, to get them on board.

That's great for the estate agents, but this regular dilution says to me that it's unlikely to be a high-grade investment.

Indeed, the need to dilute shareholders risks creating a self-fulfilling prophecy, whereby a low market cap (c. £50 million) means that ever greater numbers of shares are needed to incentivise agents to sign up, only serving to make the dilution worse.

OTM recently reported that agents weren't committing to long-term contracts at the rate expected, implying that the existing offer of free shares wasn't enough to get agents on board. Hence, the introduction of short-term, cheaper contracts.

Analysis

During H1, 1308 branches signed up for long-term contracts, receiving 1.8 million shares in return. That's about 1,400 shares per branch, with value of £1,100 (at 82p each).

That's about 3 or 4 months' worth of free advertising, in a contract which lasts for 3 or 5 years.

The idea is that this incentive, along with lower advertising rates, will help OTM grow to Rightmove's size in terms of stock availability. When OTM has a huge stock of property, and with estate agents actively preferring it thanks to the lower fees, it could pose a threat to Rightmove (and Zoopla).

My view

One possible outcome, in my view, is that Rightmove and Zoopla might charge estate agents slightly less, to see off the threat of OTM.

There is little doubt that consumers, as demonstrated by the existing traffic statistics, still have a huge preference for the big two incumbents.

Rather than let that advantage slip away to an upstart working on behalf of estate agents, I think that Rightmove and Zoopla are more likely to ease up a little on pricing, if necessary, until they have seen off this threat.

Rightmove (LON:RMV) is well-financed, reporting a cash balance in June that was equivalent to OTM's current market capitalisation. It has the lead in terms of data collection and technology, and I expect that it will continue to invest to ensure that it has the best platform. So I do not believe that there is any technological threat from OTM.

It's true that OTM are copying certain of Rightmove's products and features, but I can't see any reason why they would be able to improve on these products and features.

In order to keep the agents on side, all Rightmove needs to do is charge them rates which don't squeeze them too hard, relative to their profitability and the offer from OTM. It can always relax a bit on pricing, if necessary, and it will still have a huge operating margin.

Perhaps I'm too stuck in my thinking, but it looks to me that property portals are a natural duopoly: we have the main portal where customers go naturally, and an alternative portal which prevents the main one from draining estate agents completely dry.

While I don't think that OTM has any chance of becoming the main portal any time soon, it might pose a more significant threat to Zoopla in the race for second place.

Outlook

The outlook statement is measured:

challenging backdrop of relatively weak and highly uncertain market conditions for agents has undoubtedly slowed our progress. However, the ever-improving performance of the portal and the current level of take-up of both our long-term full-tariff contracts and our revised short-term offers provide grounds for optimism.

Current trading is in line with recent guidance.

The cash balance as of September was £8.6 million.

Given that the company has reported a loss, even on an adjusted basis, for the H1 period of nearly £7 million, and reported a loss last year of £14.5 million, I would pencil in another fundraising needed, to keep it going, if it doesn't see a lot of revenue growth very soon. Otherwise it would have to slash its marketing budget, which would be devastating.

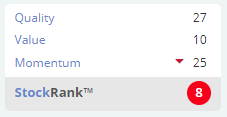

Stockopedia rates it as a Sucker Stock and it passes a short-selling screen. Statistically, most companies with this profile don't make it.

Morses Club (LON:MCL)

- Share price: 104.5p (-%)

- No. of shares: 131 million

- Market cap: £137 million

Interim Results for the 27 weeks ended 31 Aug 2019

This is primarily a doorstep lender, one of the largest in the UK.

Most of the numbers presented here are fine, but profits are held back "by the integration of the new digital businesses".

For example: revenue is up, the loan book is up, the return on assets is up slightly (to 19.1%), the number of customers is up, and impairments as a percentage of revenue is down to 19%

(However, I note that the lower impairment charge is due to lower sales to new customers in the core division - new sales bring with them an upfront impairment charge. So there is no improvement expected for long-term impairment rates.)

Home Collected Credit

This division seems to be performing fine.

Digital lending

MCL's main online brand is dot dot loans. It also picked up loans from WageDayAdvance, which fell into administration, and it bought a business offering online current accounts.

This division produced a loss of £5 million, versus revenue of just £6.9 million.

Excluding costs which MCL says are non-recurring, the loss was £3.5m million.

Funding

MCL needs to refinance its revolving credit facility by August next year. It's working on it.

Overall leverage is modest: the company has £110 million of total assets on its balance sheet, funded by £70 million of equity.

My view

The doorstep lending division is easy enough to understand, with MCL having the second-biggest operation in the UK.

I'm not sure about the plans for the online lending division - where is it hoping to position itself? What will its competitive advantage be? The link with the existing customer base of MCL will help, but is that it?

These shares probably do offer some "value" at the current levels, but I can't get excited about the digital lending division until I understand the game plan.

Castleton Technology (LON:CTP)

- Share price: 55.2p (-41%)

- No. of shares: 82 million

- Market cap: £45 million

This is a profit warning (no surprise, with the shares down 40%). Commiserations to anyone holding this last night.

Trading in HY2019 has been behind expectations, primarily due to product and professional services revenue being lower than anticipated. The increase in recurring revenue has not been enough to offset the reduction in one-off revenue, and as a result of this, revenue, EBITDA and operating cash are lower than the strong comparable period last year.

A "material improvement" is expected in H2, but the company will still miss full-year expectations.

The CEO comment says that weakness one-off revenues are to blame for the miss, and this "highlights the importance of transitioning away from one-off revenues".

He also says:

In the first quarter of the year we reorganised the Group to streamline our sales and delivery functions. Embedding this has both taken longer and been more disruptive than we anticipated, however it positions the Group well for the longer term.

My view

I haven't covered this share since June 2019, and was neutral on it (share price 83p at the time).

At that time, I created a list of positive and negative features.

Positive features included good cash conversion, which Castleton has again highlighted today.

Negative features included the B2B nature of the work and the labour-intensive professional services/consulting element.

I've basically stopped investing in this sort of thing, because I lack the ability to predict the flow of lumpy contract work at small companies - unless you're close to the story, it's very very difficult.

I also try to avoid acquisitive companies, on the basis that most merger activity destroys value.

"Streamlining our sales and delivery functions..." has "been more disruptive than anticipated", as part of a Group reorganisation. Once again, it sounds like the costs of an acquisitive strategy have been underestimated.

This is in my "too difficult" tray. Good luck to all holders.

National Milk Records (OFEX:NMRP)

- Share price: 116.5p

- No. of shares: 21 million

- Market cap: £24 million

This is on the NEX exchange, not AIM.

As the name suggests, NMRP is "a leading supplier of dairy and livestock information services". It's the market leader in this regard.

My friend Simon is a shareholder at this company and he said he was pleased with these results.

Key points:

- Revenue up 6.5%, op. profit up 20%.

- Dividend is halved (1.25p) to allow for increased investment in "laboratories and IT".

- Net debt £1.7 million, small relative to profitability.

The company says the outlook is positive, due to dairy farmers becoming "more professional and data-driven", and consumer demand for food safety and traceability.

We get a few Brexit comments. NMRP sounds calm, while cognisant of possible short-term disruption:

I am sure the UK dairy sector will not be immune from short term issues regarding uncertainty and confusion particularly if there is a no deal Brexit. As an example, in the event of a no deal the current understanding is that the UK would not impose any tariff on cheese imported from the EU, but the EU would levy a 45% tariff on cheese imported from the UK. As another example, there are approximately 80 road tankers of raw liquid milk which move from Northern Ireland into the Republic of Ireland each day to be processed. Both examples demonstrate there is plenty of work to be done in the run up to Brexit day.

My view

I think this is interesting. I like unique businesses with control of a specific niche, and NMRP fits the bill. Worth researching in greater detail.

Out of time for today, thanks everyone.

All the best

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.