Good morning!

It’s Graham here with the Mello edition of the SCVR. I will be presenting this report on stage at 11.30.

Wish me luck.

Companies on the radar are as follows. I didn't get to cover Leeds (LON:LDSG) or AdEPT Technology (LON:ADT) before running out of time.

- Onthemarket (LON:OTMP)

- Gear4Music

Also, I'm giving a talk at 2pm today, in the PrimaryBid Room, on the subject of IFRS 16. I've spent more hours than I intended to, trying to understand this new accounting standard for leases.

That's probably the best criticism of the new rule: it's more work than simply expensing the lease payments, as companies habitually did for their operating lease payments.

But the new standard arguably presents a better (more realistic) economic picture of the company.

There will doubtless be a lot more to say on this topic in future, but for today, I hope you'll make it to the PrimaryBid Room, at 2pm.

OntheMarket

- Share price: 71.2p (+3%)

- No. of shares: 65 million

- Market cap: £46 million

Persimmon Plc and Onthemarket sign listing agreement

I've been a consistent sceptic when it comes to Onthemarket. Today's news offers some encouragement:

Under the agreement, which covers listing and additional advertising products, Persimmon Plc will list all its residential developments at OnTheMarket from both its Persimmon and Charles Church consumer brands.

Context: Persimmon is said to have sold 16,449 new homes last year. The most recently reported number of total listings at OTMP was reported to be c. 642,000.

So the boost to listings is a few percentage points - not a game changer, but still good news.

OTMP sees it as a strategic success:

"In addition to growing our agent base, a key objective for OnTheMarket is broadening our property advertiser base, with new homes developers a priority focus...

"Following the agreement with Barratt Developments PLC which we announced in September, this latest agreement further broadens our advertiser base and increases our relevance to active buyers in the market, while addressing the opportunities in the new homes market."

And it's probably a win from a PR perspective, getting a household name (is that a pun?) like Persimmon to publicly back the challenger property portal.

It was around a year ago that I invested in Rightmove (LON:RMV), and I continue to hold that share despite the 28x P/E multiple.

The way I see things playing out, Zoopla (ZPG) is the portal which is more likely to suffer from the increased competition. You may recall that ZPG itself was bought out and taken private at a 28x earnings multiple, which also helps to demonstrate the high valuation that these portals can achieve.

Onthemarket

(LON:OTMP) isn't enjoying much of that yet, and I continue to avoid it on the basis that it is not being run for the benefit its existing shareholders, instead continuing to have the ethos of a mutual organisation. But I'll keep monitoring progress - it's important to be able to change my mind!

Stockopedia hasn't changed its mind, continuing to view OTMP as a Sucker Stock with a StockRank of just 8.

Gear4music

- Share price: 221p (-9%)

- No. of shares: 21 million

- Market cap: £46 million

The market likes these H1 numbers less than I do. That may speak to the growth-oriented nature of G4M's valuation and shareholders.

This update informs us that revenue will be lower than previously forecast, but full-year EBITDA is still forecast to be in line with expectations.

The reason is that the company wants to focus on higher-margin activities, instead of reaching for growth at any price:

As we approach the Christmas trading period, we will remain focused on improving profitability rather than driving growth in market share, particularly in the UK where the market remains highly competitive.

That sounds like a reasonable approach to me. It would be nice to see the company earning some real profits with a good margin.

Indeed, my primary criticism of G4M has been that it's a box-shifter, in the same league as AO World (LON:AO.) (I was so bearish on AO a few years ago that I shorted it, but it continues to survive.)

Anyway, I'm glad to see G4M thinking about how to build a higher-margin business. It has been talking about this for a while: see my update in August and Paul's update in June. Now we know that the company is happy to walk away from lower-margin activities.

That said, if you scroll down to the KPIs, you'll see that average order value has declined 6% from H1 last year to £120. So higher margins are not necessarily associated with higher basket sizes. Higher margins can also be achieved by own-brand product sales, which are up by 43% (a big positive, in my book).

Therefore, gross margin improves to 25.2%, from 22.7%.

Another KPI which I think is interesting:

The number of subscribers on our email database decreased by 9% to 717,000, due to an initial overly strict application of the GDPR legislation, and a cleansing exercise to maintain the database's relevance and quality.

Hmm. So the company didn't understand GDPR at first (it is very complicated), and also did a clean-up job on its list. A good reminder that all mailing lists aren't created equal - what matters is engagement. We shouldn't value any mailing list purely on the basis of its size, without also having some idea about its engagement statistics.

I wonder if G4M has cleaned up its list enough, or if another "writedown" might be necessary in a while?

Another important KPI is about conversion. It's a feature of the internet that mobile hits are less profitable than desktop hits. I can guess what the reasons for this might be: people browsing on mobile are more likely to be on the move and are less likely to pull out their credit card and buy something. I've seen this first-hand: some websites which have completely different financial structures, depending on whether hits are generated for mobile or desktop.

G4M says:

Conversion rates have declined for the first time from 3.2% in FY19 H1 to 3.0%, principally due to the increasing proportion of mobile traffic. Mobile conversion remained flat at 2.0% which holds back the average and this was especially relevant in Europe in the Period

Note that they do not say whether desktop conversion rates improved or deteriorated, so I would assume that they deteriorated, although probably not to the same extent as mobile conversation rates. You need the mindset of an interrogator when reading RNS statements!

Financial Results

I suppose I should say something about the profit numbers.

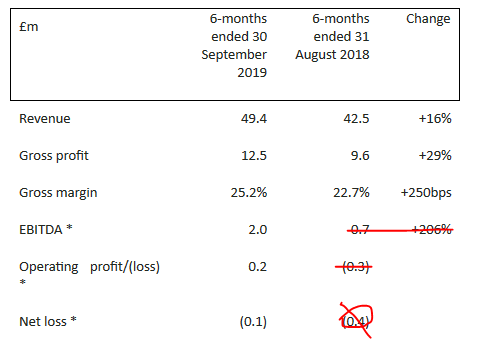

Unfortunately, the table at the top of the RNS includes some useless data:

Why are the numbers in red irrelevant?

If you follow the asterisk, you see:

FY20 H1 profit figures reported on an IFRS16 basis; comparative FY19 H1 figures remain unchanged. FY20 H1 EBITDA, operating profit and net loss on a pre-IFRS16 basis are £1.3m, £0.1m and £0.2m respectively. See Note 1.2 to the Financial Information for detail.

There is no point in comparing a pre-IFRS 16 number to a post-IFRS 16 number. So the 206% improvement in EBITDA that is shown above is meaningless.

It would be more reasonable to compare everything on a pre-IFRS 16 basis:

- EBITDA: improves from £0.7 million last year to £1.3 million

- Operating profit: improves from (£0.3 million) last year to £0.1 million.

- Net loss: improves from (£0.4 million) last year to (£0.2 million).

We also have a complication arising from a change in accounting reference date, so the H1 numbers last year don't end in the same month as the H1 numbers this year. What a mess!

One other thing that I'd like to mention about the above table is that the EBITDA number is sort of useless, too. Even for an online business like G4M, whose lease liabilities are small relative to a physical retailer, those lease which it does have will result in EBITDA inflation, post-IFRS 16.

The company disclosed that on a pre-IFRS 16 basis, EBITDA in H1 was £1.3 million - a far cry from the £2 million on a post-IFRS 16 basis. The reason is that lease payments are eliminated from operating expenses, and the charges which replace them (depreciation and amortisation) are excluded from EBITDA (the D and the A!).

So if EBITDA was viewed sceptically before IFRS 16, it should be viewed with double scepticism today.

All of that having been said, I am encouraged by G4M's strategic decisions and the overall tone of this update. I wouldn't turn bullish on it yet, but I now think it's possible that I could turn bullish on it in a year or two - if it executes!

Ok, better go to the Mello Theatre now.

Have a good day everyone.

Regards

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.